Interactive investor launches three-day fee-free trading offer on US shares

US earnings season investor buzz continues.

29th January 2024 11:16

by Camilla Esmund from interactive investor

- Interactive investor customers (new and existing) will not pay trading fees (usually £3.99)on buy and sell orders of US sharesfrom Wed 31 January to Fri 2 February 2024 (inclusive), as Q1 2024 US earning season gets into full swing

interactive investor (ii) the UK’s second-largest investment platform for private investors, is launching a three-day trading offer on US shares, to coincide with the busiest period of Q1 2024 US earnings.

- Invest with ii: Buy US Stocks & Shares | US Earnings Season | Interactive investor Offers

During this three-day offer, interactive investor customers (new and existing) will enjoy £0 commissionon all buy and sell orders of US shares placed via the ii website and the ii mobile app, executed from Wed 31 January to Fri 2 February 2024 (inclusive).

The offer is open to both new and existing ii customers. Not only will investors on interactive investor be benefiting from the platform’s unique flat-fee pricing, allowing them to keep more of what they accumulate over time, they’ll also be getting a unique chance to explore opportunities in the US market without paying any additional fee.

As Q1 2024 US earnings kicks off, there’s plenty of reasons for investor buzz. During interactive investor’s US trading offer period, US tech giants – Apple (NASDAQ:AAPL), Meta (NASDAQ:META), Google-owner Alphabet (NASDAQ:GOOGL), and Amazon (NASDAQ:AMZN), are all due to announce their results.

Lee Wild, Head of Equity Strategy, says:“There is real value in broadening your investment horizons, particularly from a diversification perspective. Looking overseas can help you access pockets of sometimes significant growth outside of your home market.

“Naturally, when you begin your investing journey, there are obvious advantages to sticking with what you know, and that typically means UK stocks or funds. But investors should remember that it’s a big world out there full of opportunities that are now so simple to access and research.

“Using this three-day trading offer as an example, the US is home to many of the big technology stocks that have become household names, many of which are popular with ii investors as we saw in our recent Private Investor Performance Index. It is just not possible to get exposure to this sector by investing in the UK alone.”

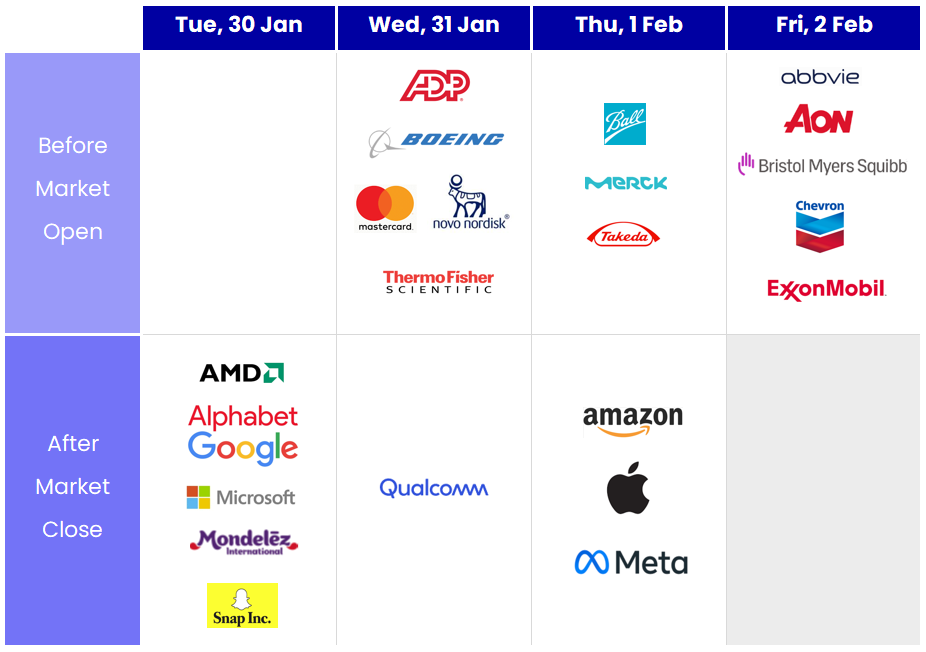

Earnings announcements: ones to watch in the coming days

Source: interactive investor

Will the ‘Magnificent Seven’ continue to rally this year? Earning season might provide some clues…

Victoria Scholar, Head of Investment, interactive investor, explains what investors should keep an eye on.

She says: “Our trading offer comes at a crescendo for US earnings and will give broader insights for investors into the strength of corporate America. After a strong annual performance for the S&P 500 and the Nasdaq in 2023, markets have got off to a shaky start this year, with earnings season a potential positive catalyst needed to revive the bullish sentiment and price action from late last year.

“Wall Street giants like JPMorgan Chase & Co (NYSE:JPM), Citigroup Inc (NYSE:C) and Bank of America Corp (NYSE:BAC) kicked off earnings season, and stocks in the financial sector have been enjoying a strong rebound since the lows last quarter. This comes after a tough year for the banks, which have been struggling with a dearth of deals and IPOs, resulting in tens of thousands of job losses in the sector. Despite this, JP Morgan still managed to record net profits for 2023 thanks to higher interest rates, which allowed them to charge more for loans.”

“Upcoming focus will be on results in the technology sector, namely the ‘Magnificent Seven’, which were responsible for much of the market gains last year. Investors should keep an eye on these. Earnings season might provide some clues into whether these stocks can continue to rally this year, or whether the uptrend is starting to fade.”

US share trading offer - terms and conditions

- A trading fee of £0 is applicable to all buy and sell orders of US shares placed via the ii website and using the interactive investor mobile apps executed between 2.30pm (GMT) on 31 January 2024 and 9pm (GMT) on 02 February 2024 (the "Offer Period")(the "Offer"). For the avoidance of any doubt, any orders placed within the Offer Period but not executed until after the Offer Period has ended will not be eligible for this Offer.

- The Offer is open to new and existing customers.

- Before you can buy US-listed shares, you need to complete the relevant IRS W-8 form. If you are a UK resident and your account is in your individual name you can complete the form online. We cannot guarantee that the process of either opening a new account and/or enabling the account for international share dealing will be completed before the Offer closes.

- These terms and conditions should be read in conjunction with the Interactive Investor Services Limited ("IISL", "ii", "we" or "our") Terms of Service and the ii SIPP Terms (together, the "Terms of Service"). In the event of a conflict between these terms and conditions and the Terms of Service, these terms shall prevail.

- After the Offer Period, the trading fee you will be required to pay will be as set out in our Rates and Charges.

- Orders placed via telephone dealing are not included in this Offer and will be subject to the charge set out in our Rates and Charges.

- All other fees set out in our Rates and Charges, (e.g. foreign exchange rates for currency conversion and Government charges), are not subject to this Offer and shall continue to apply during the Offer Period.

- Anyone who is (in our reasonable opinion) seen to be abusing the offer may be excluded at our sole discretion.

- By participating in the Offer, you agree that ii will not be liable for any costs, expenses, loss, or damage sustained or incurred with regards to the Offer.

- We reserve the right to alter, withdraw or amend this Offer and/or these terms and conditions at any time without prior notice.

- All participants to this Offer agree to be bound by these terms and conditions.

- These terms are governed by English law.

- IISL is the promoter of this Offer. IISL’s registered office is at 201 Deansgate, Manchester M3 3NW.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.