Investing in an old fund favourite

Saltydog Investor is beginning to dip its toes back into the stock market in its most cautious portfolio.

27th February 2024 09:38

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

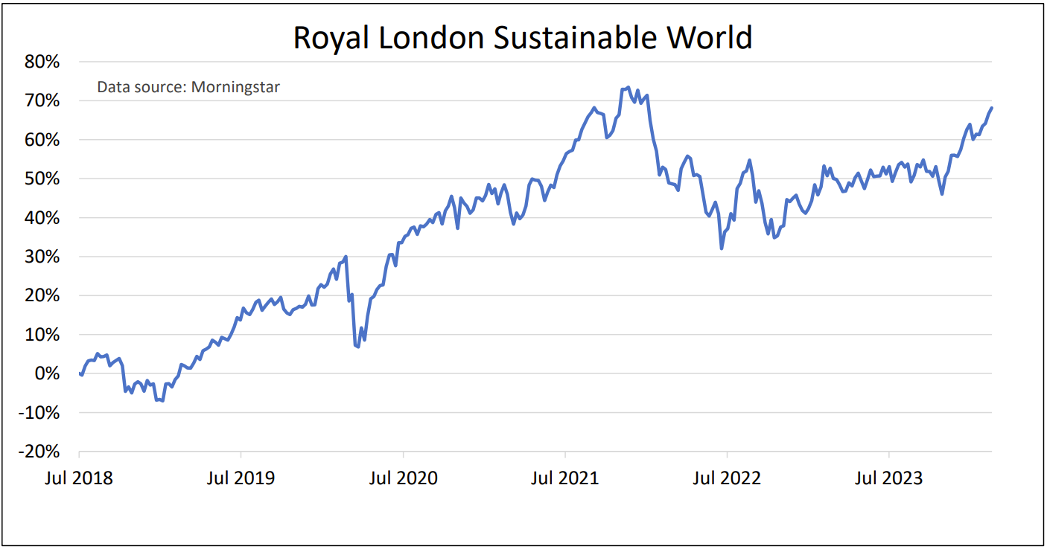

Our most cautious portfolio, the Tugboat, first invested in the Royal London Sustainable World fund in August 2018. We held it for most of 2019 and only sold it in early March 2020, when stock markets crashed because of the spread of Covid-19.

We went back into it in April 2020 and held it until May 2021. We then bought it again in July 2021 and did not sell it until February 2022. We briefly went back in again in August 2022, but sold it after a few weeks.

We have just invested in it again.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Past performance is not a guide to future performance.

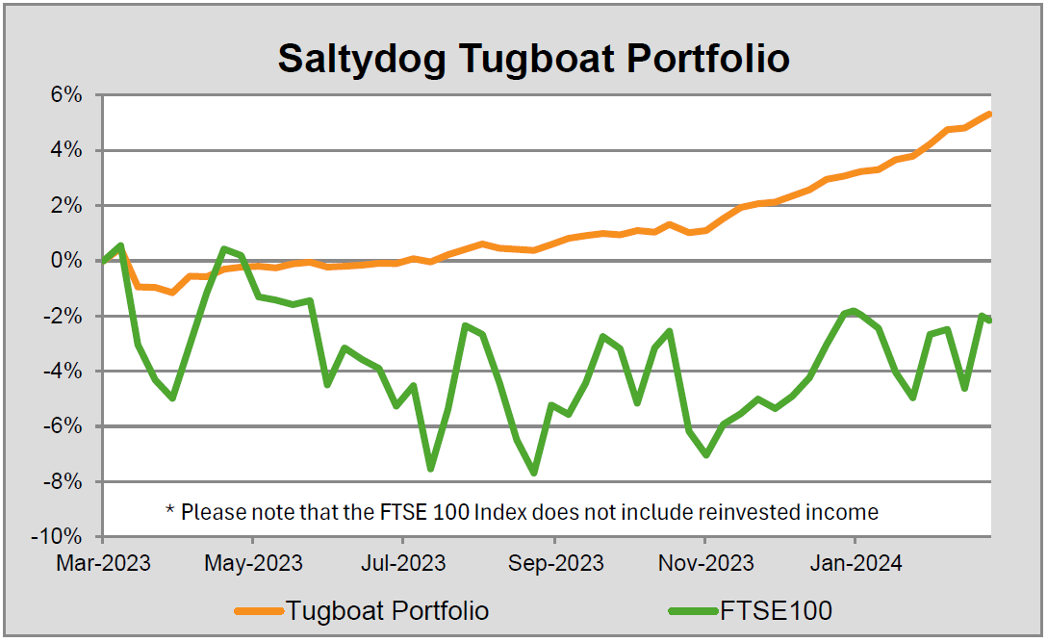

For the past four months, our Tugboat portfolio has made gains every single week. This is partly because of the large amount that we have invested in money market funds. They may not be the most exciting funds in the world, but they have provided steady gains in a volatile market.

Past performance is not a guide to future performance.

As overall market conditions have been improving, we’ve invested all the cash that we were holding in the portfolio and have now started to reduce the amount invested in money market funds.

Over the past few months, the best-performing funds have been from sectors that in the past have been the most volatile. The portfolio has benefited by holding funds such as UBS US Growth and Jupiter India. We went into the UBS fund in June last year and since then it has risen by more than 20%. The Jupiter India fund has done even better, up 29% since September.

We would obviously have done fantastically well if we had just been invested in these two funds, but that is not what our demonstration portfolios are about. We are trying to help our members gain the confidence to build their own balanced portfolios, using funds from the different Saltydog groups to control the overall volatility.

Some people might be happy having everything invested in money market funds. They would have to accept that it will limit their returns, but it should help them sleep at night. Others might prefer to go “all in” with funds from our most volatile “Full Steam Ahead” groups and are willing to accept the consequences if markets take a turn for the worse and their funds are hit the hardest. Our portfolios sit somewhere between these two extremes, but are definitely towards the more cautious end of the spectrum.

- Fund Spotlight: can Japanese stocks keep up the momentum?

- How the 10 funds to buy and hold forever have fared over the past five years

In the Tugboat portfolio, we allow a maximum of 10% to be invested in the funds from the “Full Steam Ahead” Groups and the Specialist sector.

The least-volatile funds, which are in the money markets sectors, are in our “Safe Haven” group. After the global financial crisis, when interest rates were at all-time lows, these funds struggled and sometimes could not even make enough to cover their management charges. However, as interest rates have risen, these funds have come into their own. Over the past year they have performed well, and we still hold Royal London Short Term Money Mkt, abrdn Sterling Money Market and L&G Cash Trust funds.

Next up the volatility ladder is our “Slow Ahead” group. The sectors in this group have been more volatile than those in the “Safe Haven” group, and can make losses, but when conditions are favourable they can give reasonable returns.

The top sector in this group is currently Mixed Investment 40-85% Shares. The Investment Association says: “Funds in this sector are required to have a range of different investments. However, there is scope for funds to have a high proportion in company shares (equities). The fund must have between 40% and 85% invested in company shares.

“No minimum fixed income or cash requirement. Minimum 50% investment in established market currencies (US Dollar, Sterling & Euro) of which 25% must be Sterling. Sterling requirement includes assets hedged back to Sterling.”

This used to be known as the “Balanced Managed” sector.

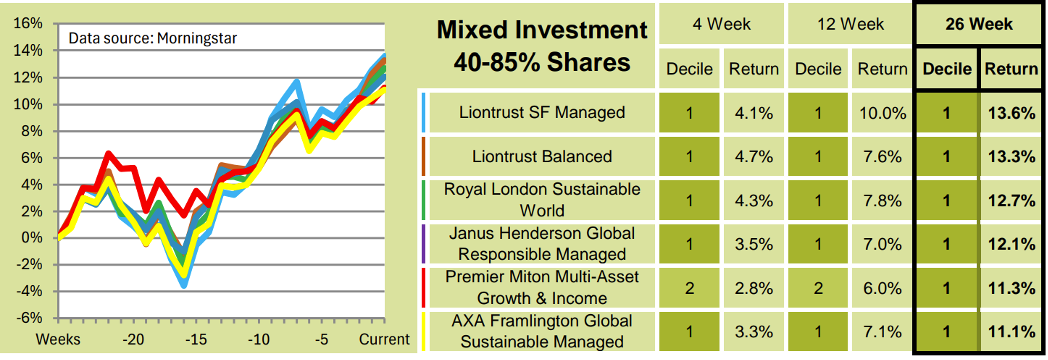

In our latest reports, these were the leading funds from this sector, based on their performance over the past 26 weeks.

Past performance is not a guide to future performance.

We already hold the Liontrust Balanced fund, which we first bought last July, and it is currently up 11.2%.

In the past, we have also held the Liontrust Sustainable Future Managed fund and the Janus Henderson Global Responsible Managed fund, but on this occasion we have gone for Royal London Sustainable World.

It invests in companies all over the world and holds both bonds and equities. Around 25% is invested in the UK and a similar amount in the rest of Europe. Nearly 35% of its holdings are in the US and its largest positions are in the technology giants Microsoft Corp (NASDAQ:MSFT) and Alphabet Inc Class A (NASDAQ:GOOGL).

If the US stock market, and the technology sector in particular, continue to perform well, then I would expect this fund to maintain its upward momentum.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.