Junior ISA insights: young, increasingly passive, and building a nest egg

1st March 2023 10:08

by Jemma Jackson from interactive investor

interactive investor publishes some thought-provoking Junior ISA insights.

- Average balance of an ii JISA is £12,472, with an average age of 10

- Only half of the 10 most-held investments are ‘active’, with Fundsmith Equity rooted at the top

- Accounts of Britain’s wealthiest children have almost twice as much fund exposure as investment trusts

- Regular investing into ii Junior ISAs has soared over the past three years of ii offering free regular investing (from 12% to 18%)

A Stocks & Shares Junior ISA (JISA) is a great way of investing for children and even small regular contributions could add to a decent sum over time, tax-free.

Today, interactive investor, the UK’s second-largest investment platform for private investors, publishes some thought-provoking Junior ISA insights.

- Invest with ii: Transferring a Junior ISA | The Junior ISA Annual Allowance | ii Friends & Family

First, it seems that a growing appetite for passive funds is starting early: half the 10 most-held Junior ISA stocks are passive. That said, two active options dominate first and second place: Fundsmith Equity and Scottish Mortgage (LSE:SMT) Investment Trust.

Only three investment trusts make the top 10 most held stocks, with F&C (LSE:FCIT) and Alliance Trust (LSE:ATST) joining Scottish Mortgage. This contrasts to ii’s youngest adult customers, who tend to have a focus on investment trusts.

Traditionally the investment trust sector has been very popular when it comes to saving for children, with some great options. But competition is getting stiff from the passive sector.

Incredibly, there are 1,211 Junior ISA pots on ii worth between £50,000- £100,000*, with an average age of 13 and a half. These enormous JISA pots have almost twice as much funds' exposure as investment trusts. This is in contrast to interactive investor’s wealthiest older customer’s, where investment trusts dominate the wealthiest £1 million-plus accounts.

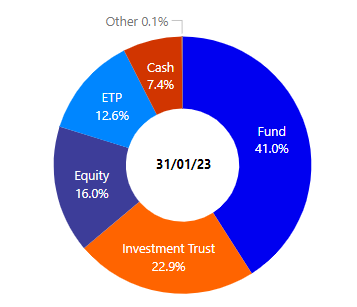

Wealthiest JISA accounts on interactive investor - £50,000-£100,000*

Junior ISA accounts overall

Overall, the average pot size of a Junior ISA on interactive investor is £12,472 and the average age is 10 years old.

Like all ii accounts, JISAs on interactive investor come with free regular investing, which has soared in recent years. The proportion of Junior ISAs on ii using regular investing has increased from 12% at the end of 2019, before ii introduced free regular investing for funds, investment trusts, ETFs and popular UK shares, through to 18% at end January 2023. Regular investing smooths out some of the highs and lows in the price of shares, removing some of the risk of market timing.

interactive investor does not offer a stand-alone Junior ISA, but it comes free with adult accounts in the Investor and Super Investor price plans. Junior ISAs are not available on ii’s Investor Essentials Plan.

Most-held Junior ISA stocks on interactive investor overall at 31 January 2023

Instrument | Stock name |

Fund | FUNDSMITH EQUITY FUND I ACC |

Investment Trust | SCOT MORTGAGE INVESTMENT TRUST ORD GBP0.05 |

Fund | INVESTEC WEATH & INV BALANCED A GBP |

Fund | VANGUARD LIFESTRATEGY 100% EQUITY ACC |

Fund | VANGUARD LIFEST 80 % EQUITY ACC |

Investment Trust | F&C INVESTMENT TRUST ORD GBP0.25 |

Investment Trust | ALLIANCE TRUST ORD GBP0.025 |

Fund | VANGUARD FTSE GLOBAL ALL CAP INDEX GBP |

Exchange traded product | ISHARES CORE FTSE100 UCITS ETF GBP |

Exchange traded product | VANGUARD FTSE ALL-WORLD UCITS ETF US |

Cash ISAs won’t cut-it long term

Myron Jobson, Senior Personal Finance Analyst, interactive investor, explains: “Cash Junior ISAs are frankly pointless other than as an option for teenagers approaching adulthood who might shortly need to use their pot and therefore want to remove the short-term risk of a sudden loss of value. Most Junior ISAs are going to be inherently very long term, because they cannot be accessed until the child is 18, there is ample time for short-term bumps in stock markets to be ironed out.

“The Junior ISA allowance stands at a generous £9,000 for each tax year but, in reality, few are fortunate enough to maximise the allowance, with the average parent saving £1,133 into these accounts in the 2020-21 tax year according to the latest HMRC figures available. But even modest investments that are given ample time to grow and benefit from compounding can yield impressive returns that could give your child a financial leg-up and then some when they reach adulthood. While stock markets can be volatile on a day-to-day basis, a glance at history shows that they have a knack of delivering inflation-beating returns over long periods of time. There are no guarantees in life – and that is something long-term investors need to be comfortable with.”

Need JISA inspiration?

Dzmitry Lipski, Head of Funds Research, interactive investor, outlines his top JISA picks.

“Montanaro Better World Fund invests in small and mid-cap companies, which aim to help solvie some of the world’s major challenges by supporting the United Nations Sustainable Development Goals. The fund has been managed by highly regarded managers Charles Montanaro and Mark Rogers since its launch in April 2018. Managers focus on six impact themes: Environmental Protection, Green Economy, Healthcare, Innovative Technology, Nutrition, and Well-being.

“Following a strict three-stage process the managers aim to establish if a company is making a good impact. This is done through a variety of screening tools and meeting company management regularly. The outcome is a concentrated portfolio of around 50 quality growth companies, benchmarked against the MSCI World SMID index. Historically mid-and small-cap funds have outperformed their larger cap counterparts over the longer term, but they’re generally considered to be more riskier investments, so should be used mainly for satellite allocation in a global well-diversified portfolio.

“Another good option is CT Sustainable Universal MAP Growth Fund. It is a one-stop, hybrid solution that incorporates actively managed multi-asset and sustainable investing with a focus on low cost. It is designed to provide consistent long-term capital growth by using a medium to high level of risk and targets an annualised return of 4% above inflation over five years.

“The fund can hold as little as 40% and as much as 80% in equities. It is part of the CT Sustainable Universal MAP range - actively managed, combining strategic and tactical asset allocation with individual security selection and integrates ESG factors within the process and reviewed by independent Responsible Investment Advisory Council. Head by highly experienced investors, Simon Holmes and Paul Niven, the CT Multi-Asset team has a successful long-term track record of producing strong risk-adjusted returns in running multi-asset ESG products.”

* Some of the largest JISA pots may have started out as Child Trust Funds.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.