The low-risk fund we’ve bought to take advantage of rate rises

24th April 2023 14:08

by Douglas Chadwick from ii contributor

These two fund sectors are the only ones that have made gains in each of the last four quarters.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last month we added the L&G Cash Trust fund, which takes our money market exposure to two funds, having invested in Royal London Short Term Money Market fund last October.

In ideal conditions, the Saltydog demonstration portfolios would be 100% invested in funds investing in stocks or the bond markets. However, economic conditions have been far from ideal for some time and so they have been holding high levels of cash.

- Invest with ii: Money Markets| Bond Yields| Tax Rules for Bonds & Gilts

If your investments are in Stocks & Shares ISAs, or a SIPP, it is still possible to hold cash, but you need to keep it on the investment platform to maintain the tax-saving benefits. You are not able to take it out and put it under your mattress.

The platform should split the money across a number of banks, to help maximise your protection from the Financial Services Compensation Scheme (FSCS), and you may earn some interest. Interactive investor pays 2.25% on balances over £10,000 in an ISA or 2.5% in a SIPP.

In terms of funds, a low-risk option are money market funds. These funds, from the Standard Money Market or Short Term Money Market fund sectors, invest in short-term debt instruments, cash, and cash equivalents. They struggled when interest rates were low and could actually lose money if the interest they were earning did not cover their costs and the management fee.

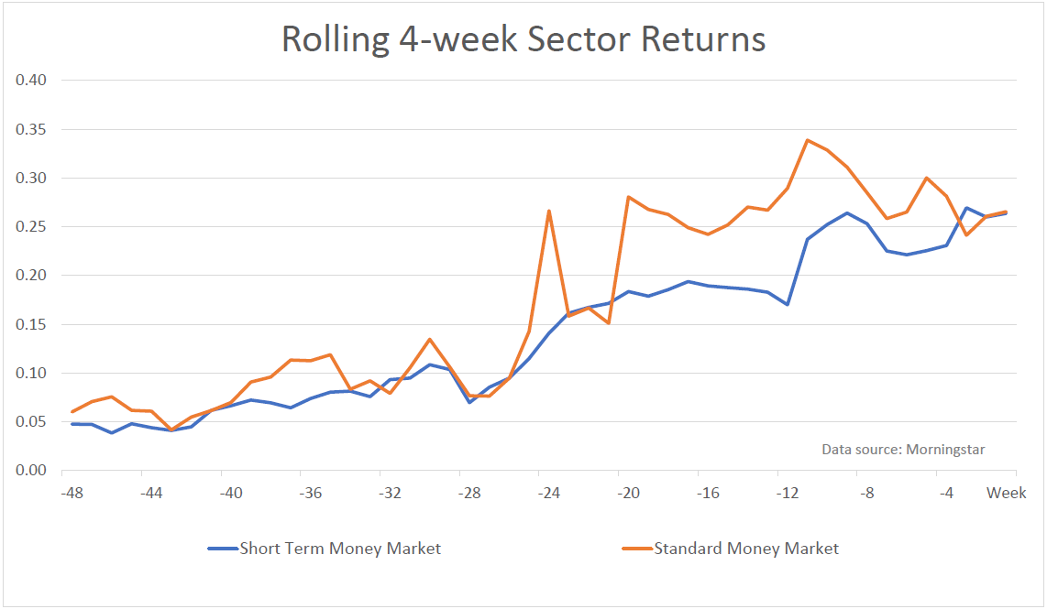

As interest rates have gone up, the returns from these funds have also risen. Here is a graph showing the rolling average four-week returns for the funds in the Standard Money Market and Short Term Money Market sectors over the past 48 weeks

Past performance is not a guide to future performance.

At the beginning of the graph, which would have been halfway through May last year, the four-week return for the Short Term Money Market sector was 0.05%, which equates to around 0.62% per year. The rate of return has been steadily rising and is now 0.26% over four weeks, which would generate an annual return of 3.48%.

Over the whole 48 weeks, the four-week average has always been positive, which shows that these funds have been steadily going up. Maybe only slowly, but consistently.

- The highest yielding money market funds to park your cash in

- Money market funds explained

- 10 things to know about money market funds versus cash savings

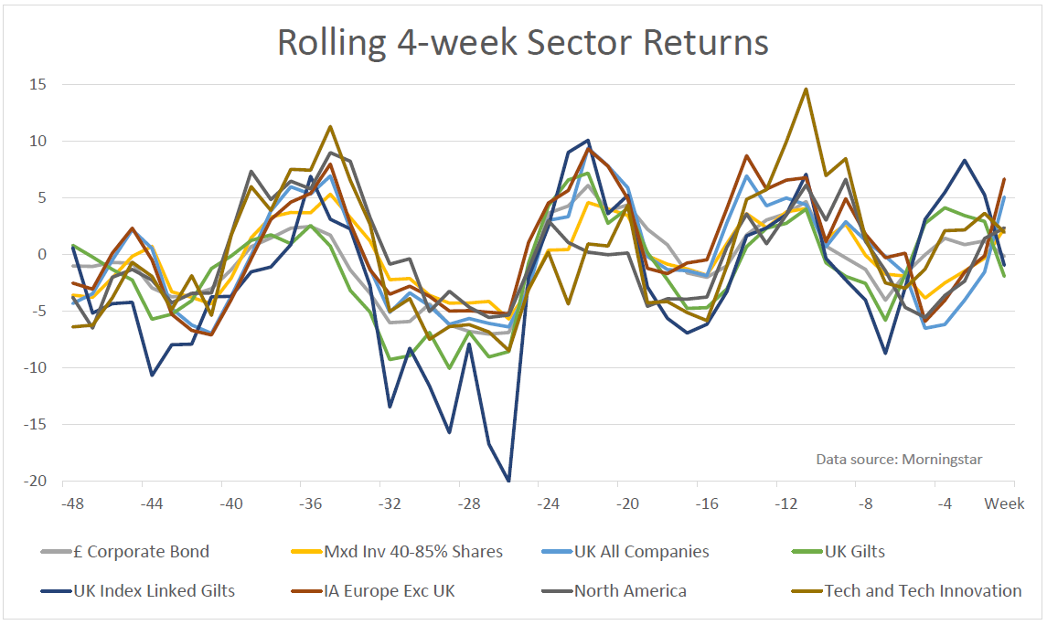

There are lots of sectors that may have done much better for one month but that have not performed so well in the months before or afterwards. For example, last month the best-performing sector was UK Index Linked Gilts with a one-month return of 7.6%. However, in February it had fallen by 5.8%. Out of more than 50 Investment Association (IA) sectors, only four went up in February and March: Europe including UK, Technology & Technology Innovations, Standard Money Market and Short Term Money Market.

Believe it or not, there are only two sectors that have gone up each month for the past four months - the Standard Money Market and Short Term Money Market sectors. They are also the only sectors that have made gains in each of the past four quarters.

The level of volatility can be seen by looking at the rolling four-week returns. It would be too confusing if I tried to show all of them on one graph, but here are a few that give a good representation of what has been going on.

Past performance is not a guide to future performance.

As you can see, not only have there been dramatic swings from one month to the next but for much of the time the sectors have been making four-week losses. Not an easy time for investors.

While there is such uncertainty in the markets, I would expect our portfolios to continue holding the money market funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.