Nestle, Nvidia, Tesla: buy, hold or sell?

After hiring its third boss in two years, analyst Rodney Hobson reveals what he thinks about goings-on at this European food giant. He also gives a view on two of the most popular US stocks.

3rd September 2025 09:01

by Rodney Hobson from interactive investor

Food group Nestle SA (SIX:NESN) is getting a little careless with its chief executives. Having ousted Mark Sneider a year ago to appoint company veteran Laurent Freixe in an attempt to halt a slide in the share price, Nestle has had to let Freixe go. Not, mercifully, due to misbehaviour of the financial sort but an undisclosed romantic liaison with a direct subordinate that amounted to a breach of Nestle’s strict code of conduct.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Results under Freixe have admittedly been a bit mixed, with lower revenue and a 10% drop in net profit in the first half of this year, though revenue and profits translated into Swiss francs have been reduced by currency movements.

However, organic sales rose 2.9%, mainly through making price rises stick, and Nestle expects a better second half despite “increased headwinds”.

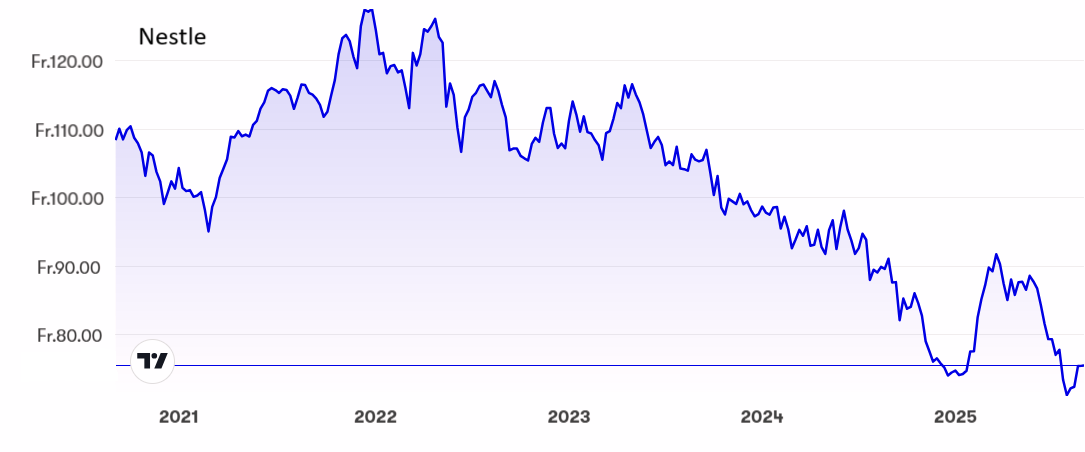

The shares have been on a long slide from SFr127 at the end of 2021, but they do seem to be bottoming out at SFr75, where the price/earnings (PE) ratio is just under 19 and there is a decent yield of 4%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Last December I said that the shares were far too cheap at SFr75 and I stick to that view. It will require patience but the buy rating remains in place.

Updates: It was a case of deciding if the pot is half full or half empty when assessing quarterly results from AI leader NVIDIA Corp (NASDAQ:NVDA). See Keith Bowman’s detailed analysis ii view: demand for Nvidia next-gen AI chip is ‘extraordinary’

Earnings once again beat expectations, but some investors fretted that extremely high growth is slowing to very high growth. Data centre sales, the main part of the business, rose a mere 56% and growth is projected to slow to 52%. Margins slipped from 78% to 72%. These figures would be staggeringly good for almost every other company but not for Nvidia, where hyper-expansion is priced into the shares.

It is worth noting that the suspension of shipments to China were to blame for the slowdown. Although China is encouraging its own chipmakers to step up production, Nvidia should resume sales there as the tariff war rhetoric cools down. Demand for Nvidia’s products continue to grow even if competitors are muscling in. The shares slipped after the results but are already picking up again at $170. They remain a buy.

- The sector Buffett’s betting on – and where to find value in it

- Stock pickers strike back as value investing returns

Meanwhile, shares in electric carmaker Tesla Inc (NASDAQ:TSLA) continue to defy gravity or common sense but at least there is now a clear sign that each recovery runs out of power somewhere between $330 and $350. An American tax incentive in favour of electric cars has ended and, given that Tesla chief Elon Musk is now firmly out of favour with the political establishment, will not be renewed.

This side of the Atlantic, sales continue to slump in Europe. For example, sales in France, a key market, halved in August in a rising market and in Sweden, where electric cars are well received, sales slumped 84% to only 210 vehicles. August figures from two other large markets, the UK and Germany, are due later this week and should make equally sad reading. Yet as recently as July Musk was claiming that “there are no issues with Tesla volumes on the European market”.

Word on Wall Street is that analysts are steadily lowering their forecasts for earnings, and Musk has tacitly acknowledged that his dream of dominating electric car sales has hit a roadblock by switching to AI and robotics, where he is playing catch-up rather than leading.

Tesla has serious problems. Those searching for solid long-term gains should look elsewhere. Investors seeking quick profits should sell anywhere above $330 and think about buying only below $280. Either way, at current share price levels Tesla is a sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.