The overlooked markets that can deliver outsized returns

Which are the next frontiers for growth? A Kepler analyst suggests dimissing old-guard perspectives and exploring smaller and less familiar markets amid improving fund flows.

17th October 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

In 1519, Ferdinand Magellan set sail from Seville with five ships and just over 200 men, seeking a westward route to the Spice Islands. His fleet crossed the Atlantic, traced the eastern coasts of South America, and threaded the perilous channels that would one day bear his name, the Strait of Magellan.

From there, they pushed into the uncharted Pacific, eventually rounding Africa and returning to Europe. The journey was fraught with storms, mutiny and loss. Magellan himself did not survive the journey, yet his expedition became the first circumnavigation of the globe, opening new trade routes and revealing how deeply connected distant lands could be. It was a story of audacity, endurance and discovery beyond the edges of the known world.

Today, frontier and emerging markets occupy a similarly far-reaching map. Spanning Latin America, Africa, parts of Asia and the Middle East, and even pockets of Europe, they are diverse, fast-changing and often overlooked by mainstream investors. Their classification shifts with economic progress, political reform and market maturity, while their smaller size and lower liquidity can leave them underrepresented in global indices. Yet those same traits can foster dynamism, allowing smaller markets to respond quickly to change and deliver outsized growth from a low base.

In this article, we explore both frontier markets and, notably, the smaller end of global emerging markets (GEMs), regions that often slip below the radar, given the domination of the largest five economies being China, Taiwan, India, South Korea and Brazil, which together make up four-fifths of the index.

These smaller GEMs offer valuable diversification and untapped potential. For investors seeking exposure to these fast-growing but complex and higher risk markets, investment trusts can provide a practical route, back by experienced, locally connected teams able to uncover opportunities that might otherwise go unseen.

Understanding frontier and smaller GEM markets

Before exploring these regions, notably the ones drawing fund managers’ attention, it’s worth clarifying what we mean by frontier markets and smaller GEMs. Frontier markets occupy the space between the least developed and the more established emerging economies.

Formal definitions of what constitutes a ‘frontier market’ vary, but influential index provider MSCI defines 28 countries as frontier markets. These fall below the threshold for factors such as investability, regulation and governance required to be classified as an emerging market, but MSCI still excludes countries with extreme economic or political instability.

Frontier markets are typically less liquid, with constraints on capital flows or foreign ownership and generally weaker institutional frameworks. Yet this very underrepresentation can create space for outsized growth for investors willing to engage with their complexities.

Classic examples include Nigeria, Estonia and Pakistan, although the list evolves as economies develop and meet - or fail to meet - the criteria for market accessibility. Importantly, frontier status does not always reflect economic prosperity. Iceland, for instance, has a GDP per capita higher than the UK’s but remains classified as frontier due to the limited size and liquidity of its equity market, which hosts just 27 listed companies.

Similarly, Croatia retains frontier status despite EU and eurozone membership, reflecting low trading volumes and modest foreign participation. These cases highlight that classification depends as much on market structure, liquidity, and accessibility as on economic development.

Beyond frontier markets lies the broader emerging market universe. MSCI defines emerging markets as those with ‘significant investability’, featuring more developed market infrastructure, greater openness to foreign capital and higher regulatory standards than frontier peers, but which still fall short of developed market thresholds.

These economies tend to offer deeper equity and debt markets, improving governance, rising incomes and expanding middle classes that drive long-term consumption growth. Within this group of 24 countries, the familiar giants, China, Taiwan, India, South Korea and Brazil, dominate investor attention, yet the remaining 19%, the segment we refer to as the smaller GEMs, offers a distinct and often underappreciated opportunity set.

The lines between frontier and emerging markets can sometime be fluid, adding to their complexities. Pakistan, for instance, has shifted between the two multiple times as liquidity and accessibility have evolved, each reclassification triggering significant capital flows and short-term volatility.

Vietnam provides another example. Still technically a frontier market, it has struggled to gain a promotion to emerging status, despite its rapid industrialisation, export-led growth and growing role in electronics manufacturing strengthening the case. That’s because settlement inefficiencies and foreign ownership limits have delayed progress. However, recent improvements have prompted FTSE Russell to confirm Vietnam’s expected reclassification to Secondary Emerging in September 2026, a shift that could unleash new institutional inflows.

But as we’ll come on to explore, these smaller GEMs and frontier markets form a vital but frequently overlooked part of the global investment landscape. Their complexity and diversity demand active management and local insight to navigate effectively, yet for those willing to engage, they may offer a unique proposition for genuine diversification and exposure to growth opportunities beyond the largest economies, together with returns driven by domestic rather than global drivers.

Rethinking resilience in emerging and frontier markets

Emerging and frontier markets have long carried a reputation for higher risk, sharper volatility and opaque governance, worlds apart from developed economies such as the US or UK. Yet for investors willing to look beyond the headlines, these regions can offer meaningful diversification and, at times, stronger returns than their developed peers.

So far this year, to the end of September, both frontier and emerging markets have posted strikingly strong gains despite tariff tensions and shifting global sentiment. The MSCI Frontier Emerging Market Index has risen 32.9%, while the broader MSCI Emerging Markets Index is up 27.2%, comfortably ahead of the MSCI World Index’s 15.5% advance.

Over one year, frontier markets remain ahead, although GEMs have slowed, matching developed market returns. Over five years, however, the picture reverses: developed markets have led with annualised returns of around 14%, compared with roughly 10% for frontier markets and 7% for GEMs. In essence, these markets have produced powerful bursts of performance, but sustained outperformance against developed peers has been harder to maintain.

Interestingly, volatility has not been as severe as many might assume. Over five years, the annualised standard deviation for the MSCI Frontier and MSCI EM indices, 14.5% and 16.0%, respectively, sits remarkably close to 15.5% for developed markets, hardly the gulf investors might expect.

PERFORMANCE COMPARISON

| Indices | YTD total return (%) | One-year total return (%) | Five-year total return annualised (%) | Five-Year Annualised Volatility (%) |

| MSCI World | 15.5 | 17.3 | 14.4 | 15.5 |

| MSCI EM | 27.2 | 17.3 | 7 | 16 |

| MSCI Frontier Emerging Market | 32.9 | 26.1 | 9.6 | 14.5 |

Source: Morningstar, data run to 30/09/2025. Past performance is not a reliable indicator of future results.

Both frontier and GEMs also show relatively low correlation with developed equities, offering valuable diversification for portfolios dominated by global large caps. This diversification has proved especially useful during recent US market softness: whilst the S&P Index faltered mid-year, markets such as Vietnam and China surged year-to-date, roughly 49% and 41% respectively, highlighting how local dynamics can drive returns independently of global cycles.

CORRELATION

| Investment | 1 | 2 | 3 |

| 1 MSCI EM | 1 | ||

| 2 MSCI World | 0.47 | 1 | |

| 3 MSCI Frontier Emerging Market | 0.68 | 0.54 | 1 |

Source: Morningstar.

However, accessing these benefits isn’t as simple as buying the index. Both the MSCI Frontier and GEM indices are heavily concentrated, particularly the latter, where China, India, Taiwan, Brazil and South Korea account for roughly 81% of the total. Even within those markets, performance is dominated by a handful of mega-cap names such as Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), Tencent Holdings Ltd (SEHK:700) and Samsung Electronics Co Ltd DR (LSE:SMSN), whose earnings are tied more to global tech demand than domestic conditions. TSMC, for example, manufactures chips for NVIDIA Corp (NASDAQ:NVDA), Apple Inc (NASDAQ:AAPL) and Advanced Micro Devices Inc (NASDAQ:AMD), meaning Taiwan’s market often moves in step with the US technology cycle rather than its local economy.

For investors seeking a broader spread of risk and return, it’s worth looking beyond these giants to the smaller GEMs offering distinct cycles and idiosyncratic opportunities. Smaller GEMs have staged an exceptional run over the past year, with a few exceptions, reflecting improving domestic fundamentals rather than external tailwinds. Falling inflation, lower interest rates, policy normalisation and IMF-backed reforms have all helped rebuild confidence. Turkey and Egypt, for example, have pivoted to orthodox monetary policy and fiscal discipline, whilst parts of Latin America and Eastern Europe have benefited from reform momentum and cyclical recoveries.

We think it’s this strength of returns and resilience that has surprised many investors who perhaps still associate these markets with dependency on US demand or cheap-labour export models. In reality, improving local governance, domestic investment and regional trade ties are increasingly driving growth.

SMALLER GLOBAL EMERGING MARKETS

| MSCI Market | One-year return (%) | Five-Year Annualised Return (%) | Five-Year Annualised Volatility (%) |

| Chile | 27.4 | 10.7 | 26.3 |

| Colombia | 78.8 | 21.2 | 33.2 |

| Czech Republic | 61.4 | 31.5 | 22.1 |

| Egypt | 25.3 | 1.2 | 31.1 |

| Greece | 68.4 | 29.8 | 25.9 |

| Hungary | 47.7 | 22.8 | 28.2 |

| Indonesia | -21.6 | 3.9 | 19 |

| Kuwait | 25.8 | 12.8 | 12.8 |

| Malaysia | -0.6 | 3.9 | 15.1 |

| Mexico | 32.5 | 19.1 | 23.8 |

| Peru | 39.9 | 22.6 | 29.3 |

| Philippines | -16.9 | 0 | 21.7 |

| Poland | 34.8 | 14.2 | 32 |

| Qatar | 9.4 | 5.3 | 14.9 |

| Saudi Arabia | 1.1 | 9.7 | 16.6 |

| South Africa | 36.9 | 15.5 | 23.6 |

| Thailand | -8.5 | 3.7 | 22 |

| Turkey | -1.9 | 14.9 | 33.3 |

| UAE | 34 | 18.2 | 17.5 |

| MSCI EM | 17.3 | 7 | 16 |

Source: Morningstar, data run to 30/09/2025. Past performance is not a reliable indicator of future results.

Markets such as Greece, Chile and the Czech Republic further illustrate this point, showcasing how smaller economies can outpace larger developed peers but also GEMs like China and India. And this is not just over the past year, but on a five-year annualised basis too. Admittedly, timing plays a role: India’s recent pullback follows several years of exceptional performance, while China’s rebound this year has yet to erase several years of struggle. Nonetheless, the relative consistency shown by smaller economies in recent years highlights their growing importance in delivering diversification and resilience, and potential divergence from older expectations of growth drivers.

Going one step further, we can also see that frontier and smaller emerging markets tend to move less in sync with one another too, further reducing overall portfolio risk. Saudi Arabia’s market, for instance, has little in common with Indonesia’s, and developments in Vietnam bear little relation to Pakistan’s. This dispersion allows active managers to allocate dynamically across different cycles and drivers, smoothing volatility and capturing uncorrelated sources of growth.

Taken together, these dynamics explain why smaller GEMs and frontier markets have weathered global headwinds so well this year, and why their resilience may have gone underappreciated given old-guard perspectives. With that in mind, we can now look at where expert managers are finding value, and how local insight and on-the-ground expertise are helping uncover the next frontiers for growth.

Where investment trust managers are finding value

Behind the broad gains across frontier and emerging markets this year, performance has been far from uniform. Returns have largely come from economies undergoing meaningful reform, supported by credible policy cycles, re-established trade potential and renewed foreign inflows. Latin America has shown resilience amid a weaker dollar and stronger financial positions, parts of Eastern Europe have benefitted from rising defence and infrastructure spending, whilst in emerging Asia, domestic demand and supply-chain realignment have underpinned growth.

Recognising these divergent dynamics, investment trust managers have been rotating towards regions where policy credibility, economic resilience, supply-chain relevance and attractive valuations align, positioning portfolios to capture both cyclical recovery and long-term structural growth.

Emerging Europe: banking reform, fiscal support and domestic demand

Among the standout stories has been Greece, continuing to reap the rewards of post-crisis banking reform, and Hungary, where falling rates and broader European fiscal stimulus, including Germany’s increased defence and budgetary spending, have supported re-ratings in domestic equities.

Managers Nick Price and Chris Tennant of Fidelity Emerging Markets Ord (LSE:FEML) have long backed these trends, targeting high-quality financials across emerging Europe. Portfolio holdings such as Piraeus Financial in Greece and OTP Bank in Hungary combine these opportunities, alongside robust asset quality with the potential for yield and earnings growth as monetary policy eases.

JPMorgan Global Emerging Markets Inc Ord (LSE:JEMI)shares this focus on well-capitalised financials, benefiting from Greece’s improving fundamentals while also adding to Poland, where rising domestic demand supports both income and capital growth.

Elsewhere, the Czech Republic has quietly been one of the year’s strongest markets, up around 61% over 12 months. Rate cuts, strengthening domestic demand and rising real wages have buoyed sentiment, while its defensive profile has appealed amid global volatility. BlackRock Frontiers Ord (LSE:BRFI)has been a notable beneficiary here, identifying undervalued opportunities such as Moneta Money Bank, offering the trust both income and diversification away from globally sensitive large caps.

Frontier exposure: local reform momentum, easing rates and domestic resilience

BRFI’s opportunity set extends beyond the larger GEMs. By deliberately excluding giants such as China, India and South Korea, the managers focus on smaller, less-researched markets where reforms, orthodox monetary policy and improving macro stability are driving returns. Over the past year, exposure has been rebuilt in Pakistan, Kenya and Bangladesh, where easing inflation and IMF-backed reforms are restoring confidence. In Pakistan and Sri Lanka, fiscal and monetary reforms have spurred economic revival, whilst valuations remain compelling after years of neglect.

Vietnam, still classified as a frontier market pending its promotion next year, has benefitted from supply-chain diversification and robust domestic demand. Vietnam Enterprise Ord (LSE:VEIL), managed by Tuan Le, targets sectors most exposed to policy-led expansion, notably banks, real estate and consumer companies. Government reforms promoting private enterprise and foreign ownership have supported strong earnings growth, whilst domestic demand and infrastructure investment provide additional tailwinds. Valuations remain modest despite robust export growth, creating a compelling mix of growth and value within the GEM universe. This potential promotion to FTSE’s Emerging Market Index in 2026 could provide a further catalyst, with Reuters estimating $5–7 billion of inflows into Vietnam’s roughly $350 billion market as funds adjust to its inclusion.

Latin America, Africa and the Middle East: structural growth and improving quality

Utilico Emerging Markets Ord (LSE:UEM)has been increasing exposure to Chile and Colombia, where the managers see long-term potential in regulated sectors such as water, power and transport. These areas benefit from steady demand, visible cash flows and supportive policy environments, offering both resilience and growth. The trust also holds FPT (Vietnam) and Sonatel (West Africa) capturing opportunities across digital adoption and infrastructure expansion. By focusing on markets shaped by urbanisation and the energy transition, UEM is well placed to benefit from the secular themes transforming emerging and frontier economies.

Lastly, the team at Ashoka WhiteOak Emerging Markets Ord (LSE:AWEM)are finding value in less-crowded areas, targeting under-researched small- and mid-cap companies in markets with strong governance and accountable management, avoiding those dominated by state control. This has led to rising exposure in Mexico, the US’s largest trading partner under the USMCA, where nearshoring, policy stability and easing inflation have supported growth. AWEM has also added selectively in the Middle East, identifying high-quality, shareholder-friendly opportunities such as Saudi National Bank and ADNOC Drilling in the UAE. While the region remains underweight due to lower governance scores overall, there has been improvements. These positions demonstrate the team’s flexibility to not only capture structural growth themes without compromising on quality, but take advantage of improvements in the region.

Discounts and fund flows reflect growing sentiment

The strong performance of frontier and smaller emerging markets this year is reflected not only in market returns but also in investment trust discounts and fund flows. As shown in the table below, current discounts across the trusts featured in this article have narrowed meaningfully relative to both their one- and five-year averages.

While the current levels themselves may not appear exceptionally wide versus the average, the pace of narrowing is telling. One-year averages remain close to five-year levels, indicating to us that a swift rebound in sentiment and performance has occurred, particularly striking given renewed tariff tensions that initially put many GEM and frontier markets in the crosshairs. Should this momentum continue, there is scope for further narrowing, which would not only add an extra kicker to investor returns but potentially indicate confidence in the asset class is returning.

TRUST DISCOUNTS

| Current discount (%) | One-year average (%) | Five-year average (%) | |

| FEML | -5.7 | -10.9 | -11.6 |

| JEMI | -8.7 | -11.5 | -10.3 |

| BRFI | -4.6 | -6.2 | -7.4 |

| VEIL | -16.6 | -20.3 | -16.8 |

| UEM | -11.2 | -16 | -14.5 |

| AWEM | 1.7 | 0.7 | -0.1 |

| Morningstar Investment Trust Global Emerging Market | -4.7 | -6 | -9.1 |

Source: Morningstar, data run to 08/10/2025.

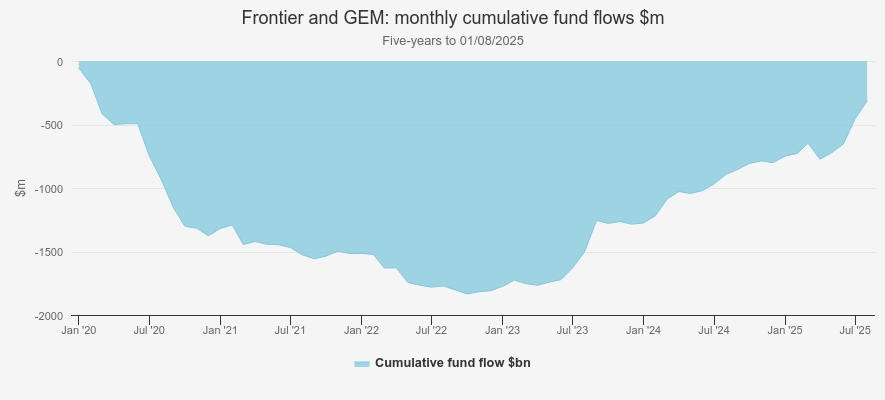

Cumulative fund flows further underscore this shift. Over the long term, flows across the asset class remain negative, reflecting years of investor caution. Yet since 2023, flows have turned sharply upward. India’s sustained strength and improving confidence in China have played a role, but the unexpected resilience of other emerging and frontier markets, from Vietnam to Central and Eastern Europe, has also been a key factor.

While some of these markets are closely linked to the US, favourable trade positions, domestic growth and lower-than-expected correlations with global factors have helped offset external headwinds. Others have benefited from internal dynamics that allow them to perform independently of broader developed market trends, illustrating the structural diversity and differentiated return drivers across these regions.

CUMULATIVE FUND FLOWS

Source: Morningstar

Taken together, these trends suggest that investor confidence in emerging and frontier markets is slowly being rebuilt. For long-term investors, current discounts could represent an appealing — and still relatively under-appreciated — way to participate in this recovery, combining exposure to regions that are resilient, diverse and increasingly differentiated from developed markets.

Conclusion

Frontier and smaller emerging markets have demonstrated surprising resilience this year, defying common expectations around dependence on the US, exports and growth being driven solely by cheap labour for manufacturing. While performance remains uneven, structural growth trends, domestic reforms, selective policy support and more stable trade than often assumed have created meaningful opportunities and diversification benefits.

Clearly, investor interest is also returning, as reflected in improving fund flows, highlighting renewed confidence in these markets. For long-term investors, success lies in looking beyond just the largest economies to the smaller, often overlooked markets that can deliver outsized returns. With diversity, renewed momentum and resilience, these markets remain a compelling, if nuanced, part of a well-diversified portfolio. For those willing to embrace their complexity and accept bouts of volatility along the way, the journey could yet prove rewarding.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.