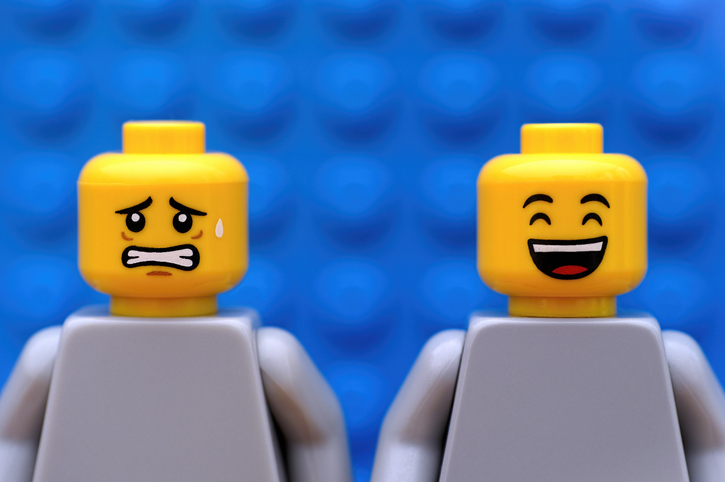

The pros name reasons for investors to be cheerful and fearful in 2023

4th January 2023 10:12

by David Prosser from interactive investor

There’s been no shortage of headwinds that have negatively impacted investor sentiment in 2022. David Prosser asks the pros to name the reasons for bull and bear points at the start of a new year.

Will 2023 be a better year for investors? 2022 was certainly a year to forget. Stock markets hit the buffers, with the MSCI World Index ending the year down just under 10%. In addition, exchanges in North America, Europe and Asia were all in the red, as was the FTSE 100, albeit marginally.

And it wasn’t just equities that disappointed; the average global corporate bond fund fell 9%. As for cash, with inflation in the UK running at 10% and most savings accounts paying less than 1%, real returns were a car crash.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

Inflation and economic outlook divides opinion

At first sight, the prospects for 2023 do not look encouraging. Headwinds from soaring inflation to the protracted war in Ukraine continue to buffet the global economy. The International Monetary Fund (IMF) forecasts global growth of just 2.7% for the year ahead – and a recession in several advanced economies. None of that is conducive to an upturn in investment returns.

However, Richard Hunter, head of markets at interactive investor, is not entirely despondent. “There are three key reasons to be cheerful, if the US Federal Reserve gets its calculations right and engineers a soft landing for the world’s largest economy,” he says.

Hunter explains: “First, the relief will filter straight through to the resumption of a risk-on approach by investors, sending shares higher.

“Second, the improved outlook would result in higher company earnings. In the UK, blue chips, which largely rely on overseas earnings, would then be able to resume full dividend growth, boosting investor returns further.

“Third, the relief factor would unleash pent-up demand from the consumer, especially in the US where consumer spending is an integral part of economic growth. In the UK, diminishing inflation would also remove some of the economic shackles.”

- Ian Cowie: UK equity income trusts are the place to be in 2023

- The biggest stock market surprises of 2022 for fund investors

- The part of the UK stock market the pros are tipping as a big winner in 2023

Still, that is definitely looking on the bright side – and many economists are not hopeful that the Federal Reserve can pull off the trick.

“The chair of the Federal Reserve has stopped talking about soft economic landings,” points out Keith Wade, chief economist and strategist at asset manager Schroders.

He cautions: “The price of taming inflation will be quite a slowdown in economic growth and an increase in unemployment.”

Anne Richards, chief executive officer of Fidelity International, is also concerned. “As central banks tighten financial conditions in response to rising wages and prices, the risk of a hard landing is increased, and could play out as an economic contraction and labour market weakness,” she warns.

Richards adds: “For equities this will be expressed in lower corporate earnings, while in debt markets we are watchful for rising default rates and downgrades.”

Moreover, it’s not just these relatively traditional economic concerns that give investors cause to be fearful. Other issues increasing the sense of fear include the panic caused by the “crypto winter”, with prices of many cryptocurrencies crashing in recent months and the high-profile collapse of FTX shocking investors.

Then there is the potential for further disruption from the Covid-19 pandemic, particularly if China continues to take such a hard line; its repeated lockdowns, albeit localised, are causing ongoing supply chain disruption.

Why global stock markets could surprise on the upside

Why, then, would anyone be cheerful? Well, first, it’s worth noting that some economists are more optimistic that Richard Hunter’s hopes for the US economy will not be dashed.

David Mericle, chief US economist at Goldman Sachs, says the Federal Reserve has made a good start in countering inflation without blowing up the economy. “An extended period of below-potential growth can gradually reverse labour market overheating, bring down wage growth and ultimately inflation, providing a feasible if challenging path to a soft landing,” he argues.

In which case, the global economy and corporate earnings – and therefore global stock markets – might just defy expectations in 2023.

Anyway, the Federal Reserve does not have to deliver miracles, argues William Davies, global chief investment officer of Columbia Threadneedle Investments, because even the absence of further bad news would provide a lift. “Through 2022, the market repriced for bad news,” he says. “For 2023, we may see these macro conditions continue, but as long as they don’t get significantly worse, investors may begin to feel more optimistic, and we might begin to see better market performance.”

In any case, not everything depends on the Federal Reserve. Leaving aside the US economy, many fund managers point to other reasons for investors to be more cheerful about the year to come.

Will 2023 finally be the year for UK stocks?

Laura Foll, co-manager of the Henderson Opportunities (LSE:HOT) Trust and Lowland (LSE:LWI), is one such optimist. She points out: “For anyone investing in UK stocks today there are plenty of reasons to be cheerful. Valuations are attractive in many cases – particularly, in our view, for those willing to look in the UK smaller companies area.”

Companies with good management teams tend to come through slowdowns stronger, points out Foll, and many have been prudent. “We see many companies that have trimmed unnecessary costs and focused their businesses on what they do best. When recovery comes it could fuel rapid earnings growth,” she says.

- Worst-performing fund sectors of 2022: time to buy or further pain to come?

- Why cautious funds failed to deliver in 2022

- Funds to diversify away from shares and bonds after both fell in 2022

Indeed, the UK’s lowly valuations – an underperformance that dates right back to the Brexit referendum – are a consistent theme for fund managers, many of whom argue that this is fertile ground for active investment. “The UK equity market is lowly valued and there is a wide dispersion of valuations,” says Merchants Trust (LSE:MRCH) manager Simon Gergel. He adds: “This is an excellent environment for stock picking, as we are able to identify many strong businesses that appear to be mispriced, offering attractive dividend yields and the prospect of medium-term capital growth.”

Bad news already priced into stock and bond markets?

Similarly, at a global level, Andrew Bell, manager of Witan (LSE:WTAN) Investment Trust, says that after a year of falling markets, investors are now beginning to look past the top-down economic news to focus on bottom-up stories. “2023 should see corporate earnings take over from macro gloom and multiple compression as the driver for equities,” he argues. “We expect 2023 to be a year when investors anticipate, or experience, an improvement in the economic cycle, allowing positive returns.

Nor should investors be afraid to look further afield for opportunities, argues Raheel Altaf, co-manager of the Artemis SmartGARP Global Emerging Markets Equity fund.

Normally, we think of emerging markets as adding risk to more stable developed market holdings – perhaps in 2023, the boot will be on the other foot, he suggests.

“In aggregate, emerging countries continue to have current account surpluses, largely a result of the healthy fundamentals of Asian economies,” Altaf points out.

He adds: “More broadly, emerging market stocks are trading on multi-decade valuation lows against developed markets across a range of metrics.” There are opportunities in countries including Brazil, China and Korea, he suggests.

As for bonds, Grace Le, co-manager of the Artemis Corporate Bond fund, is also in the upbeat camp, suggesting that the sell-off in 2022 may have gone too far. “Investment grade bonds are now set to deliver compelling returns over the medium term – with returns that will outstrip inflation over the coming years as inflation expectations come down,” she forecasts.

Le also points out: “Investors are currently able to buy high-quality bonds below their redemption value, giving them capital downside protection in a worst-case scenario.”

Finally, for investors unnerved by flitting between cheerful and fearful, Simon Edelsten, co-manager of the Mid Wynd International Investment Trust Ord (LSE:MWY), argues that it’s a useful exercise to give yourself pause for thought. Investors often feel there is a binary choice between positive and negative sentiment, but planning for the former while mitigating for the latter is a sensible compromise.

He says: “Each Christmas I devote some time to trying to think of all the things that can go wrong in the year ahead.

“The point of the exercise is not to depress yourself – though a stiff whisky afterwards is helpful. It encourages you to build a balanced portfolio with different elements able to benefit from or mitigate different scenarios. Too many investors forget to include some balance or protection in their portfolios.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.