Selling funds to create a solid cash buffer

7th February 2022 14:17

by Douglas Chadwick from ii contributor

January was the worst overall performance for fund sectors since March 2020. Saltydog Investor has 75% in cash, which it is waiting to put to work.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It has been a tough start to the year with most stock markets around the world losing value in January. The notable exceptions were the UK’s FTSE 100, which went up by 1.1%, and the Brazilian Ibovespa, which made 7%. At the opposite end of the spectrum were the Shanghai Composite, which fell by 7.6%, the Nasdaq, which lost 9%, and the Moscow RTSI, which went down by 10.1%.

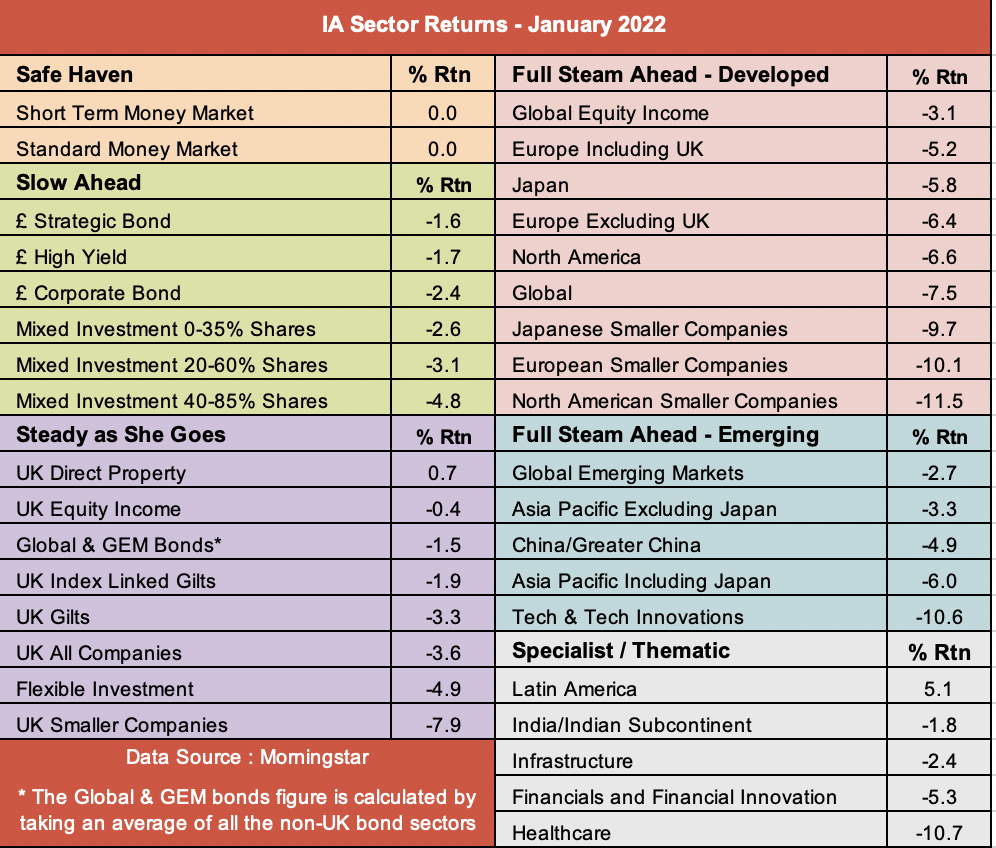

This overall downturn is reflected in our latest analysis of the Investment Association (IA) sectors. They nearly all went down in January, and it was the worst overall performance since March 2020.

Past performance is not a guide to future performance.

The worst-performing sector was North American Smaller Companies, which went down by 11.5%, and there were three other sectors that fell by more than 10%.

The UK Direct Property sector made a small gain, up 0.7%, but the star performer was Latin America, which went up by 5.1%.

In our weekly analysis, we group all the new ‘thematic’ sectors, such as Healthcare, Infrastructure, and Latin America, in with the specialist funds. There are not enough funds in these sectors for us to justify treating them separately.

When we reviewed the numbers last week, the Latin American funds were showing good returns over the previous four weeks and so one of our demonstration portfolios made a small investment in the Stewart Investors Latin America fund.

| Fund | 4 Week | 12 Week | 26 Week | ||||

| Decile | Return | Decile | Return | Decile | Return | ||

| TB Guinness Global Energy | Natural Resources | 1 | 14.3% | 1 | 10.5% | 1 | 37.0% |

| JPM Natural Resources | Natural Resources | 1 | 6.2% | 1 | 7.7% | 1 | 13.2% |

| BlackRock Natural Resources | Natural Resources | 1 | 5.9% | 1 | 8.7% | 1 | 19.3% |

| Stewart Investors Latin America | Latin America | 1 | 5.9% | 2 | 2.9% | 4 | -0.1% |

| Invesco Latin American | Latin America | 1 | 5.0% | 1 | 7.9% | 7 | -7.1% |

| ASI Latin American Equity | Latin America | 2 | 4.9% | 1 | 4.9% | 9 | -11.8% |

| Liontrust Latin America | Latin America | 2 | 4.3% | 2 | 2.9% | 10 | -15.8% |

| Threadneedle Latin America | Latin America | 2 | 0.8% | 5 | -3.9% | 10 | -21.9% |

Data source: Morningstar. Past performance is not a guide to future performance.

Much like March 2020, both portfolios are predominantly (over 75%) in cash. However, we do hold the TB Guinness Global Energy and JPM Natural Resources funds, which were at the top of last week’s specialist report, along with a couple of funds from the UK Equity Income sector.

It is always very unnerving when markets suddenly drop, but then briefly recover. Especially when nothing appears to have changed on the political and economic fronts to cause the markets to make the small rebound after the fall. This could just be a temporary rise before the downward trend continues. It is sometimes called a ‘dead cat bounce’, but I prefer the more sinister description, ‘markets tempt you back into the water with a small rise before throwing in the live toaster!’

- 12 funds for the £10,000 income challenge in 2022

- Watch our share tips here and subscribe to the ii YouTube channel for free

Many investors must be wondering whether this recent fall in the value of their investments is the beginning of a more substantial correction. Some markets have already suffered a 10% drop from last year’s highs, will this turn into 20%, 30%, or more over the coming weeks?

During the last few months, we have been selling funds to create a solid cash buffer. This means that we are relatively relaxed if there is a further substantial fall, like we saw in 2008 and 2020. Unfortunately, there may still be the pain to be endured while the value of our remaining investments continues to fall. However, nothing can match the joy to be experienced when the markets finally finish their freefall (however long that takes), and we are then able to buy back at fire sale prices and watch the gain.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.