Shaky for sustainable investors in short term, but reasons to stay over long term

29th March 2023 10:52

by Jemma Jackson from interactive investor

interactive investor shares sustainable fund performance research.

interactive investor, the UK’s second-largest investment platform for private investors, today publishes new research, which delves into the performance of sustainable open-ended funds, using IA sectors as a framework. The platform also looks at sustainable indices versus wider indices.

ii’s analysis looks at performance over a short time frame (one year) and a longer-time frame (five years), and assesses the fund returns relative to market/index returns.

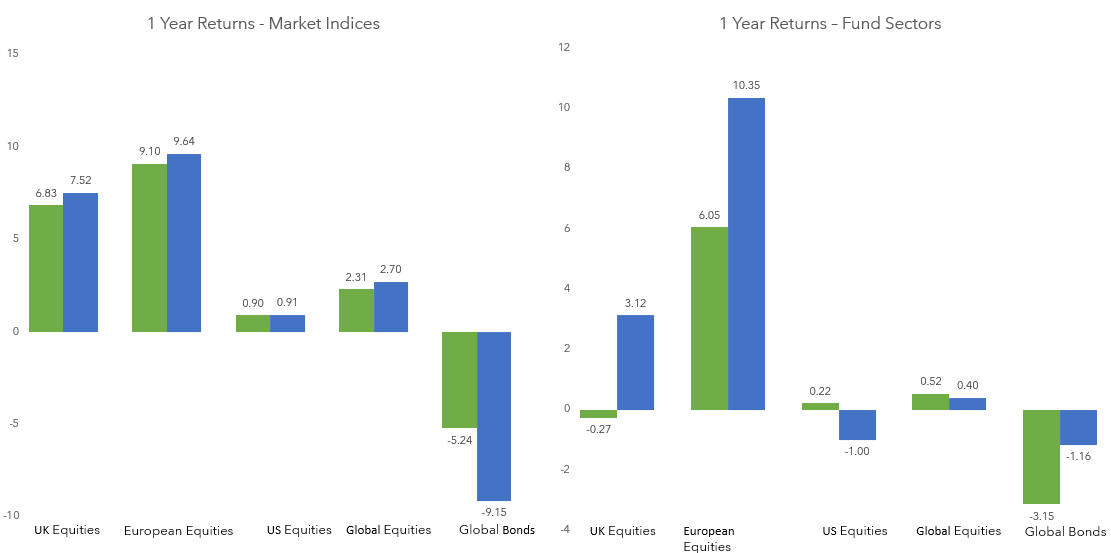

Interestingly, we can see that over the past year, sustainable market indices have broadly kept up with their conventional counterparts, suggesting more similarities than differences when it comes to index constituents. But for fund sectors, the discrepancy between the sustainable and conventional fund sectors is more significant.

Over five years, performance differences between sustainable and conventional peers is more mixed and nuanced.

It is a reminder that while the five-year performance comparisons are mixed between sustainable funds and wider peers, investing sustainably is as much about investing around a personal moral framework, and the key is to build a diversified portfolio around that.

ii’s fund research looked across several different IA sectors: UK All Companies, Europe Excluding UK, North America, Global and Global Mixed Bonds. The platform also looked at a range of stock market indices, to compare and contrast.

Data is ii using Morningstar, and classification of what constitutes sustainable funds was based on Morningstar data.

The growth of sustainable investing

Sustainable investing has become increasingly high on many investors’ agenda, and with the end of the tax year looming and ISA deadlines fast approaching, some investors will be looking at their portfolios to see if they are invested in a way that aligns with their ESG (environmental, social, governance) beliefs.

Dzmitry Lipski, Head of Funds Research at interactive investor, says: “The urgency of the climate emergency has contributed to the growth of interest in sustainable investing, as well as the growing amount of evidence that shows companies which adhere more closely to environmental, social and governance (ESG) considerations can produce better long-term returns. Nevertheless, the sustainable investing space is still growing, and can be understandably overwhelming and confusing for private investors.

“In the absence of an industry-wide framework for sustainable funds, ii wanted to help create clarity for investors interested in this space, and this is why ii’s ACE40 rated list exists.

“We don’t have all the answers, and we hope the Financial Conduct Authority (FCA) can find a better solution in the near future, following the Sustainability Disclosure Regulation (SDR) consultation, which ii responded to in January. It may well be that the sustainable world looks a little different in the not-too-distant future, but the ISA countdown clock waits for no one, and it’s worth comparing returns in the here and now. But it’s also worth remembering that performance is only one of very many factors to consider, and it certainly is not an indicator of future returns.”

The index level

Interestingly, while sustainable investments have tended to lag behind peers over the past year to 28 February 2023, at an index level the difference is relatively muted, suggesting significant crossover between ‘sustainable’ indices and conventional indices.

For example, the MSCI UK ESG Leaders is up 6.83% over one year to 28 February 2023 versus 7.52 MSCI UK All Cap. Similarly, the MSCI Europe ESG Leaders index is up 9.10% over 1 year versus 9.64% MSCI Europe index. The MSCI USA ESG Leaders and MSCI USA performed in line with each other, up just under 1%, while MSCI World ESG Leaders was up 2.31% versus 2.70% for the MSCI World.

Over five years, the sustainable investment indices have outperformed conventional indices in those Global, UK, US, and European indices, but the difference ranges from a relatively modest 2-5 percentage points. The widest outperformance compared to conventional peers came from the MSCI Europe ESG Leaders index, which beat the MSCI Europe index by 5 percentage points, followed by the MSCI USA ESG Leaders index, which beat the MSCI USA index by 4.78 percentage points.

The funds level

At the funds level, the difference in performance is more significant. Over one year to 28 February 2023, the conventional UK All Companies sector (UK equities on the table) is up 3.12%, while the sustainable equivalent funds from the sector is down -0.27%. For the Europe Excluding UK sector, the sustainable funds in that universe are up 6.05%, compared to 10.35% for conventional peers.

Sustainable Global funds and conventional peers were broadly in line over the past year, and surprisingly, when it comes to US funds, sustainable funds slightly outperformed conventional peers, but there was little in it (up 0.22% versus -1%).

Over five years to 28 February 2023, the IA North American sector (described as US Equities on the table), has seen sustainable funds outperform the most, up 70% compared to 59% for wider peers, with US growth stocks powering returns. Global funds in the sustainable space outperformed conventional peers by a more muted 3.5.

In the UK All Companies and European Excluding UK IA sectors (UK Equities and European Equities in the table), sustainable funds lagged conventional peers, sometimes substantially. For example, Europe Excluding UK IA sector returned 35.5% versus 21.59% for sustainable peers.

In all these cases, and as ever, past performance is no guide to the future.

Equivalent IA Sector |

UK All Companies |

Europe Excluding UK |

North America |

Global |

Global Mixed Bond |

It has been shaky for sustainable investors in the short term

The short-term performance of sustainable funds has been broadly disappointing over the last year. Recent market dynamics have not been kind to sustainable funds.

After all, funds with a sustainable or ESG – environmental, social, governance – focus often have more weighting to ‘growth’-oriented sectors, such as technology.

But, as the investment landscape over the last year shifted to higher interest rates and we saw greater inflationary pressures, the market has shifted in favour more traditional ‘value’ stocks, which are less common in the ESG/sustainable fund space.

In addition, sustainable funds often screen out ‘sin-stocks’/sectors such as miners and oil and gas producers, but these are areas which have seen some of the highest returns over the last year, as commodity prices have surged.

Over one year, both sustainable funds and market indices have broadly performed worse than their conventional counterparts. Within the sustainable space, funds underperformed the market indices.

Green bonds

Of all the sectors ii looked at, green bonds performed the worst over the last year.

Sam Benstead, Bond Specialist, interactive investor, explains: “Green bonds, which fund projects that aim for positive environmental and/or climate benefits, tend to have longer maturity dates, meaning that the duration is higher. Because of this, they tend to sell-off more when rates rise. We have been in a rising rate environment over the last year, so it is no surprise that sustainable bonds have struggled to keep up.”

Looking at the one-year returns for fund sectors; sustainable UK equities was the next worst-performing sector. Sustainable US equities was the third, followed by sustainable global equities. Sustainable European equities was the best-performing sustainable sector ii looked at over the last year. Though this fund sector still lagged its conventional fund sector counterpart by 4%.

Key

Sustainable = green

Conventional = blue

Source: ii and Morningstar - Total Returns to 28 February 2023. European equities are ex UK.

Market indices used:

- MSCI UK ESG Leaders versus MSCI UK All Cap

- MSCI Europe ESG Leaders versus MSCI Europe

- MSCI USA ESG Leaders versus MSCI USA

- MSCI World ESG Leaders versus MSCI World

- Bloomberg MSCI Global Aggregate Sustainability

Longer-term performance suggests reasons to stay sustainable

Over five years, the picture becomes more positive for sustainable funds, with a number of sectors outperforming their conventional peers. Namely: (on the sustainable side) US equities, global equities, and global bonds.

However, there are some sectors ii looked at, such UK equities and European equities, where even over the longer term, sustainable funds have not been able to outperform their conventional counterparts.

Interestingly, USequities saw a great discrepancy between returns, with the sustainable index besting the conventional index by almost 5% over the five-year period and sustainable fund sector outperforming conventional fund sector by over 10% over the same time period. In the US, sustainable funds include a lot of traditional ‘growth’ sectors like technology, and Big Tech companies like Alphabet tend to score highly within ESG/sustainability metrics. These same growth stocks have also driven a lot of the US market over the last five years, before the recent shift to value which prompted a sell-off.

Dzmitry Lipski, Head of Fund Research, notes: “We must remember that when looking five years, fewer sustainable options have sufficient track record for comparison, given that much of the universe was launched or repackaged recently. Nevertheless, the data shows clear outperformance from the sustainable indexes longer-term, which gives a more encouraging outlook for sustainable investing overall.”

Source: ii and Morningstar. Total Returns to 28 February 2023

Market indices used:

- MSCI UK ESG Leaders versus MSCI UK All Cap

- MSCI Europe ESG Leaders versus MSCI Europe

- MSCI USA ESG Leaders versus MSCI USA

- MSCI World ESG Leaders versus MSCI World

- Bloomberg MSCI Global Aggregate Sustainability

There’s still support for sustainable investing but it’s sometimes difficult to action

The interest in sustainable investing continues, despite turmoil in world events and concerns about financial ‘greenwashing’.

interactive investor’s latest Great British Retirement Survey found that two in five (41%) of our general population sample think all pensions should be invested sustainably.

Of our research sample in the survey*, women were more in favour (44%), as were young people (43% of 22-to-34-year-olds). Fewer than half of those who favour all pension investments being sustainable have actually taken action to move their pensions into sustainable investments.

One in four (26%) told us they did not know the option exists, and nearly one in five (19%) told us they could not change their pension. Around three in ten (28%) respondents aged 22 to 34 are making an active change in favour of sustainability, compared with around one in 17 (6%) of people aged 56 to 65.

Have sustainable picks got the ‘green’ light for your ISA?

Dzmitry Lipski, Head of Funds Research, interactive investor, says: “Many investors will be looking for more sustainable investors for their ISAs. The CT Sustainable Universal MAP range, an ii Quick Start Fund - is a one-stop global investing shop that incorporates actively managed multi-asset and sustainable investing with a focus on low cost.

“The range is actively managed, combining strategic and tactical asset allocation with individual security selection and integrates ESG factors within the process and reviewed by independent Responsible Investment Advisory Council. Head by highly experienced investors, Simon Holmes and Paul Niven, the CT Multi-Asset team has a successful long-term track record of producing strong risk adjusted returns in running multi-asset ESG products.”

“Another sustainable ISA pick include Montanaro Better World fund – an ii ACE 40 rated list, which invests in small and mid-cap companies, which aim to help solve some of the world’s major ESG-related challenges and by supporting the United Nations Sustainable Development Goals.

“The fund has been managed by highly regarded managers Charles Montanaro and Mark Rogers since its launch in April 2018. Managers focus on six impact themes: Environmental Protection, Green Economy, Healthcare, Innovative Technology, Nutrition and Well-being.

“Following a strict three-stage process the managers aim to establish if a company is making a good impact. This is done through a variety of screening tools and meeting company management regularly. The outcome is a concentrated portfolio of around 50 quality growth companies, benchmarked against the MSCI World SMID index. Historically mid- and small-cap funds have outperformed their larger cap counterparts over the longer term, but they’re generally considered to be riskier investments, so should be used mainly for satellite allocation in a well-diversified, global portfolio.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.