Share Sleuth: halving my stake in a stock the market loves

6th July 2022 09:44

by Richard Beddard from interactive investor

Richard Beddard is taking a contrarian stance as he raises £6,000 from a company that has just risen 20%.

Like most of my trades, June’s were pre-programmed. There was still room for judgement, though.

Thu 9 Jun 2020: Reduce Judges Scientific

Judges Scientific (LSE:JDG) triggered a limit set by my trading formula, which determines how many of each share I should hold in the Share Sleuth portfolio.

The share price had enjoyed a welcome reversal from the declines experienced by much of the Share Sleuth portfolio this year, and growing small and medium sized businesses more generally.

The proximate cause of Judges Scientific’s popularity was probably the acquisition of GeoTek on 23 May, which came before a 20% rise in the share price.

My last appraisal of Judges was on 6 May, before the acquisition, and my verdict was positive.

The company, which acquires businesses that make scientific instruments and grows them, is executing a long-established strategy that has rewarded shareholders handsomely.

In terms of quality, I could not fault Judges Scientific, but I docked two points for its modestly rich share price, giving a total score of 7 out of 9.

By 8 June, when I decided to sell the shares, Judges’ normalised earnings multiple had risen to 37 times adjusted profit, enough to knock three points off the maximum possible score, reducing the total to 6.

- Shares for the future: hold fire until you see the whites of their eyes

- Shares for the future: my five best shares for long-term investment

The lower the score, the smaller the ideal holding size. My formula was telling me Share Sleuth’s holding in Judges Scientific should be worth about 4% of the portfolio’s total value (about £7,000). In fact, thanks to the rising price, it was worth 7.3% (about £13,000).

Since I could reduce the size of the holding by 2.5% of the portfolio’s total value (my minimum trade size) and it would still be bigger than the ideal size, the Decision Engine told me I should reduce the size of the holding.

On Thursday 9 June, I reduced the holding down to (roughly) the ideal size stipulated by my formula by liquidating 74 shares.

The sale price, quoted by a broker, was £82.04 per share, and, having deducted £10.00 in lieu of fees, the trade raised a fraction below £6,061.

Ambivalent about GeoTek

Despite the share price reaction, which suggests traders liked it, I am quite ambivalent about the acquisition of GeoTek.

On one hand, Judges’ past 20-odd acquisitions have been universally successful. To my knowledge it has never disposed of a prior acquisition, except for a small part of a business it did not want in the first place, and neither has it written off any of their value.

Its Return on Total Invested Capital (including acquisitions at cost) is high, so Judges Scientific has been a good acquirer.

On the other hand, GeoTek is by some margin the company’s biggest acquisition, so it may have a bigger impact on profitability. If the company has chalked up another success, this will be a good thing. If it has made a mistake, it will not.

GeoTek manufactures instruments that analyse geological cores. They are bought or rented from the company by universities and oil and gas exploration companies.

This industry may enjoy favourable conditions as governments incentivise oil and gas production to mitigate the energy crisis. Ultimately the direction of travel is probably away from fossil fuels, though.

It is also a cyclical industry, which may introduce more volatility into Judges’ results.

Finally, GeoTek provides on-site analysis for customers, a service element that brings new capabilities but increases the complexity of the group.

Tue 14 June: Add Games Workshop

In mid-June 4imprint (LSE:FOUR) and Games Workshop (LSE:GAW) were under-represented in the portfolio.

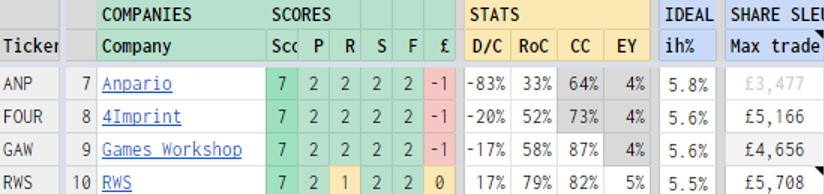

Snapshot of my Decision Engine showing the rankings of the shares discussed, the scores they are ranked by (P=profitability, R=risks, S=strategy, F=fairness, P=price) and key financial ratios (D/C=debt to capital, RoC=return on capital, CC=cash conversion, EY=earnings yield).

The last two columns show each share’s ideal holding size as a proportion of the portfolio’s total value, and the maximum trade, which is the difference between the current holding’s size and its ideal size. Anpario is greyed out because the maximum trade is less than 2.5% of the portfolio’s total value, the minimum trade size.

Their scores of 7 out of 9 were, for all intents and purposes, identical.

My instinct is to buy value when I see it (and the portfolio has enough cash). With two equally good options before me, I decided to take one of them.

Instinct is not fully explicable, but perhaps because I have known Games Workshop longer I chose it, even though I have scored 4Imprint more recently.

Games Workshop’s appraisal was in August 2021, soon after it published its annual report, but I do not expect to change my evaluation of the company’s long-term prospects again when it is time to re-score it later this summer.

On Tuesday 14 June, I added 72 more Games Workshop shares at a price of £61.92, the actual price quoted by a broker. After adding £10 in lieu of fees and just over £22 in lieu of stamp duty, the transaction cost just over £4,490.

To illustrate how arbitrary this decision was, I bought 4Imprint in my own (real life) portfolio because my personal holding in Games Workshop was too big to warrant a trade.

Share Sleuth performance

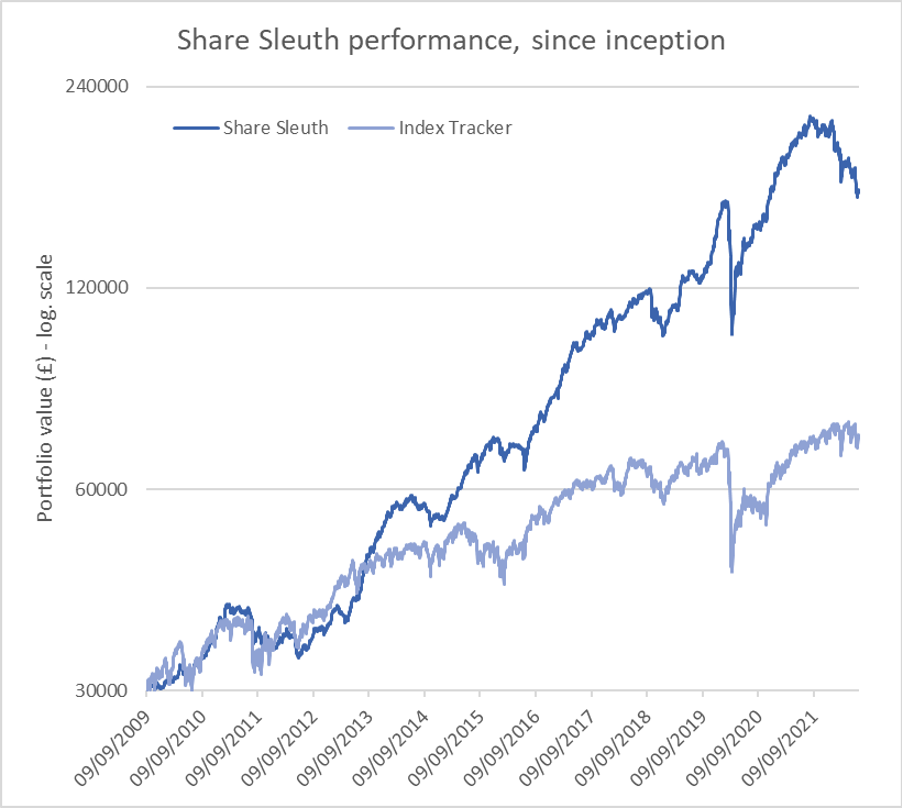

At the close on Thursday 30 June, the Share Sleuth portfolio was worth £166,326, 454% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

£30,000 invested in the accumulation units of an index tracker fund would have increased in value to £71,454 over the same period, which is a return of 138%.

The portfolio’s cash balance is £2,332, which includes dividends from Churchill China (LSE:CHH), Focusrite (LSE:TUNE) and Victrex (LSE:VCT), all paid in the last month or so.

It is not sufficient to fund new additions at the minimum trade size of 2.5% of the portfolio’s total value (£4,150).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 2,332 | ||||

Shares | 163,994 | ||||

Since 9 September 2009 | 30,000 | 166,326 | 454 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 5,732 | 41 |

BMY | Bloomsbury | 2,676 | 8,509 | 10,129 | 19 |

BNZL | Bunzl | 201 | 4,714 | 5,465 | 16 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,359 | -7 |

CHH | Churchill China | 341 | 3,751 | 4,825 | 29 |

CHRT | Cohort | 1,600 | 3,747 | 7,784 | 108 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,667 | 5 |

DWHT | Dewhurst | 532 | 1,754 | 5,719 | 226 |

FOUR | 4Imprint | 190 | 3,688 | 4,408 | 20 |

GAW | Games Workshop | 148 | 4,709 | 9,886 | 110 |

GDWN | Goodwin | 266 | 6,646 | 6,650 | 0 |

HWDN | Howden Joinery | 2,020 | 12,718 | 12,173 | -4 |

JDG | Judges Scientific | 85 | 2,082 | 6,205 | 198 |

JET2 | Jet2 | 456 | 250 | 4,130 | 1,552 |

LTHM | James Latham | 400 | 5,238 | 5,600 | 7 |

NXT | Next | 106 | 6,071 | 6,212 | 2 |

PRV | Porvair | 906 | 4,999 | 4,911 | -2 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,680 | -5 |

QTX | Quartix | 1,085 | 2,798 | 3,472 | 24 |

RSW | Renishaw | 92 | 1,739 | 3,283 | 89 |

RWS | RWS | 1,000 | 4,696 | 3,442 | -27 |

SOLI | Solid State | 986 | 2,847 | 11,093 | 290 |

TET | Treatt | 763 | 1,082 | 5,791 | 435 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,600 | 244 |

TSTL | Tristel | 750 | 268 | 2,644 | 886 |

TUNE | Focusrite | 400 | 4,530 | 4,100 | -9 |

VCT | Victrex | 292 | 6,432 | 5,195 | -19 |

XPP | XP Power | 240 | 4,589 | 6,840 | 49 |

Table notes:

June: Reduced Judges Scientific. Added more Games Workshop

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £166,326 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,454 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 30 June 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the companies in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.