Share Sleuth: topping up the share I have most conviction in

8th June 2022 09:09

by Richard Beddard from interactive investor

Richard Beddard waves goodbye to a company held since 2010 to raise cash to add to a share with the perfect score.

On Tuesday 17 May, I liquidated the Share Sleuth portfolio’s entire holding of 2,261 shares in Trifast (LSE:TRI) so that I could add to its holding in Howden Joinery (LSE:HWDN).

Doubling down on Howdens

Adding more shares in fitted kitchen supplier Howdens seemed like a no-brainer. It is the only share in my Decision Engine that currently scores 9 out of 9.

I use a formula to calculate how much should be invested in each of the portfolio’s holdings. It is derived from the share’s score, so the more confident I am that a share is a good long-term investment, the bigger the portfolio’s holding should be.

A score of 9 warrants a relatively large holding, ideally about 9% of the portfolio’s total value. In contrast, a score of 5 warrants a holding of about 1% of the portfolio’s total value, which is too small to bother with.

The portfolio’s holding in Howdens was relatively modest, it was less than 6.5% of the portfolio’s total value, which meant that I could add more shares because the difference between the size of the Howdens holding and the ideal size calculated by the formula is greater than 2.5% of the portfolio’s total value.

My minimum trade size is 2.5% of the portfolio’s total value. At the time of the trade it amounted to just under £4,500.

- Share Sleuth: new addition takes number of holdings up to 30

- Shares for the future: hold fire until you see the whites of their eyes

- Read more from Richard Beddard here

I added 652 shares in Howdens at a price, quoted by a broker, of a fraction of a penny over 684p. Including £10 in lieu of broker fees, and £22 in lieu of stamp duty, the transaction cost just over £4,495.

If you read my last evaluation of Howdens, conducted in March, you will find out why I hold the company in such high regard. But you will also discover that a score of 9 out of 9 does not mean there is no risk. There are always risks.

I believe Howdens is a unique business. For a long time it has just needed to roll out more depots supplying kitchens to small builders across the UK. The problem it faces now is saturation. When most small builders can easily get to a Howdens depot, there will be no need for more, and Howdens will need to find another way to grow.

Another concern is the rising cost of living, the prospect of interest rate rises and, perhaps, recession. New kitchens are expensive and people may be put off buying them if money is tight. People tend to buy new kitchens when they move to a new house, so if confidence in the housing market evaporates it would reduce Howdens’ sales.

I have lifted the portfolio’s holding in Howdens to 7.7% of its total value despite these risks because the company’s strategy addresses them.

Howdens has been experimenting with depots in Europe for a decade or so, and it has more recently focused its efforts on France, the most promising market for expansion.

High levels of profitability and a policy not to borrow at any point during the year should allow Howdens to prosper, and perhaps perform better than competitors through difficult times.

This knowledge gives me confidence in the company’s long-term prospects, when others are perhaps spooked by what might happen along the way.

Past performance is not a guide to future performance.

This is the third time I have added shares in Howdens, and SharePad, the software I use to track the portfolio, tells me that so far it has earned Share Sleuth an annualised return of little more than 2%.

Trifast pays the price

Since the portfolio did not have enough cash to fund the Howdens trade, I had to rummage through the holdings with the lowest scores to find one to liquidate.

That share is Trifast, a manufacturer and distributor of nuts, bolts, rivets and screws (collectively, fasteners).

Its score of 6 out of 9 (last scored: July 2021) and ranks 28 of 40 shares in my Decision Engine. This means there is clear daylight between it and top ranked Howdens.

Trifast's score depends more heavily on its cheap price, and less heavily on my evaluation of the quality of the business. I have not really been able to identify its competitive advantage.

One of my goals is to fill the portfolio with high quality companies because they can produce outside returns for decades.

A re-rating of Trifast might produce higher returns in the short run, but unless it is a better company than I think it is, those returns will not be sustained.

While a product will fail if it is held together by dodgy nuts, bolts, rivets or screws, provided they are of sufficient quality, the fasteners most companies need are pretty generic.

Trifast's strategy is to achieve more scale through acquisitions. Scale makes Trifast more efficient, but since it only has about 1% of the global market it is unlikely to have a big advantage over other businesses also trying to achieve the same advantage.

To achieve scale, Trifast is acquiring rivals, but I am not convinced that past acquisitions have added much value. The company’s average ‘return on total invested capital’ is just 8%.

Liquidating Trifast is difficult because it has very experienced managers, treats staff like family and the share price is low, less than 10 times normalised profit.

But I do not think Trifast is profitable enough to satisfy shareholders as much as it does employees.

Just before I added more shares in Howdens, I liquidated 2,261 Trifast shares at a price of just over 98p, the actual price quoted by a broker. After deducting £10 in lieu of broker fees, the trade netted just under £2,214.

Share Sleuth no longer has an interest in Trifast, which brings the portfolio’s total number of holdings down to 28.

Past performance is not a guide to future performance.

Not having worked out Trifast’s competitive advantage is quite an admission since I first added the shares to the Share Sleuth portfolio in 2010.

Overall, it was a disappointing but not disastrous investment having earned the portfolio an annualised return of 7.1% according to SharePad. The initial trade was a good one, sullied by the addition of more shares at more than twice the current price in 2018.

I added Trifast for its recovery potential in 2010 but added more in the hope that it had become a better business in bad times as well as good in 2018. Now I am not so sure...

Performance

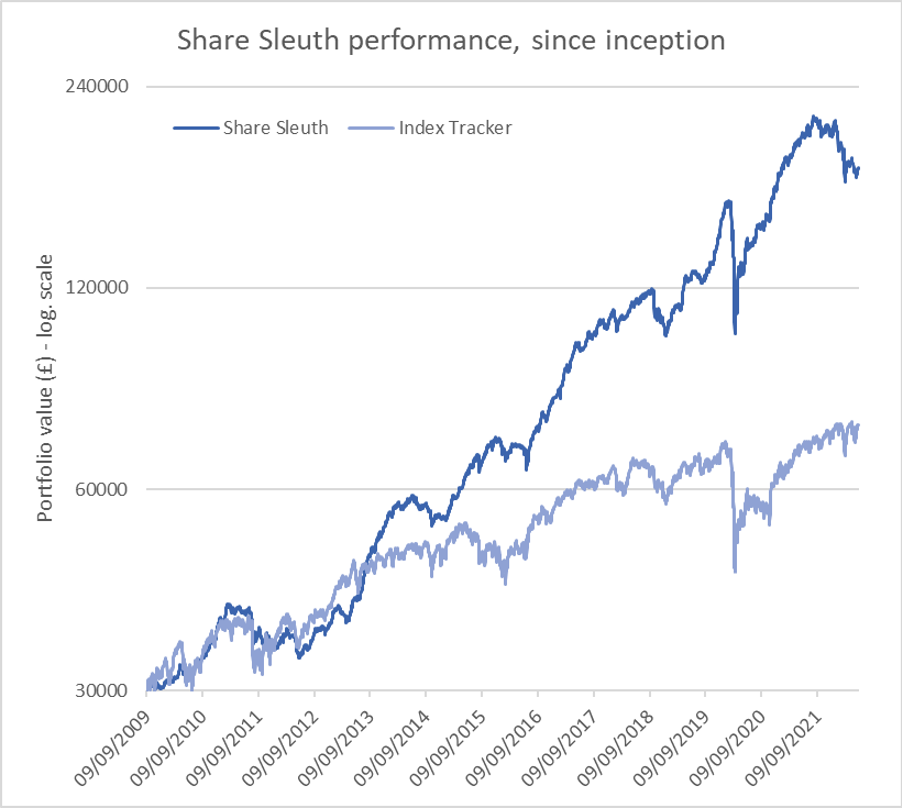

At the close on Monday 6 June, the Share Sleuth portfolio was worth £181,255, 504% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

£30,000 invested in the accumulation units of an index tracker fund would have increased in value to £74.596, which is a return of 150%.

Past performance is not a guide to future performance

The portfolio’s cash balance is £656, which includes dividends from 4imprint Group (LSE:FOUR), Howden Joinery and Porvair (LSE:PRV), all paid in the last month or so.

The cash balance is £656, which is insufficient to fund new additions at the minimum trade size of 2.5% of the portfolio’s total value (£4,500).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 656 | ||||

Shares | 180,600 | ||||

Since 9 September 2009 | 30,000 | 181,255 | 504 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,238 | 54 |

BMY | Bloomsbury | 2,676 | 8,509 | 10,704 | 26 |

BNZL | Bunzl | 201 | 4,714 | 5,586 | 19 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,021 | 11 |

CHH | Churchill China | 341 | 3,751 | 4,774 | 27 |

CHRT | Cohort | 1,600 | 3,747 | 8,368 | 123 |

D4T4 | D4t4 | 1,528 | 3,509 | 4,202 | 20 |

DWHT | Dewhurst | 532 | 1,754 | 6,650 | 279 |

FOUR | 4Imprint | 190 | 3,688 | 5,102 | 38 |

GAW | Games Workshop | 76 | 218 | 5,559 | 2,450 |

GDWN | Goodwin | 266 | 6,646 | 7,501 | 13 |

HWDN | Howden Joinery | 2,020 | 8,223 | 13,954 | 70 |

JDG | Judges Scientific | 159 | 3,825 | 13,324 | 248 |

JET2 | Jet2 | 456 | 250 | 5,155 | 1,962 |

LTHM | James Latham | 400 | 5,238 | 5,580 | 7 |

NXT | Next | 106 | 6,071 | 6,890 | 13 |

PRV | Porvair | 906 | 4,999 | 5,672 | 13 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,852 | -1 |

QTX | Quartix | 1,085 | 2,798 | 3,581 | 28 |

RSW | Renishaw | 92 | 1,739 | 3,895 | 124 |

RWS | RWS | 1,000 | 4,696 | 3,866 | -18 |

SOLI | Solid State | 986 | 2,847 | 10,698 | 276 |

TET | Treatt | 763 | 1,082 | 6,898 | 537 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,600 | 290 |

TSTL | Tristel | 750 | 268 | 2,775 | 934 |

TUNE | Focusrite | 400 | 4,530 | 4,120 | -9 |

VCT | Victrex | 292 | 6,432 | 5,163 | -20 |

XPP | XP Power | 240 | 4,589 | 7,872 | 72 |

Table notes:

May: Liquidated holding in Trifast. Added more Howden Joinery

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £181,255 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £74,956 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 6 June 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the Shares in the Share Sleuth portfolio

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.