Should I buy shares in five of the world's biggest banks?

18th January 2023 08:52

by Rodney Hobson from interactive investor

With the banking sector kicking off US reporting season last week, overseas investing expert Rodney Hobson runs through the big players and reveals whether or not he'd buy the shares.

Banks have got the US reporting season off to a very mixed start, reflecting a similarly mixed outlook for the economy in general: rising interest rates, supply chain issues, higher energy costs coupled with resilience in many sectors. Investors need to tread warily but the new year should on the whole turn out reasonably well for those who diversify into American stock markets, with banks in particular coping well with the slowing economic environment.

Substantial provisions are once again being made for potential losses caused by customers failing to meet the increased cost of borrowing. These provisions are likely to be overstated as lenders quite rightly allow for a worst-case scenario and some are likely to be written back in later years, as happened in 2021. The short-term effect, however, will be downward pressure on profits even if, as is likely, revenue rises.

- Invest with ii: US Earnings Season | Buying US Shares in UK ISA | Cashback Offers

Corporate deal making was particularly depressed during 2022. If this side of banking starts to pick up this year, as is quite possible, then it will compensate for any shortfall in consumer banking.

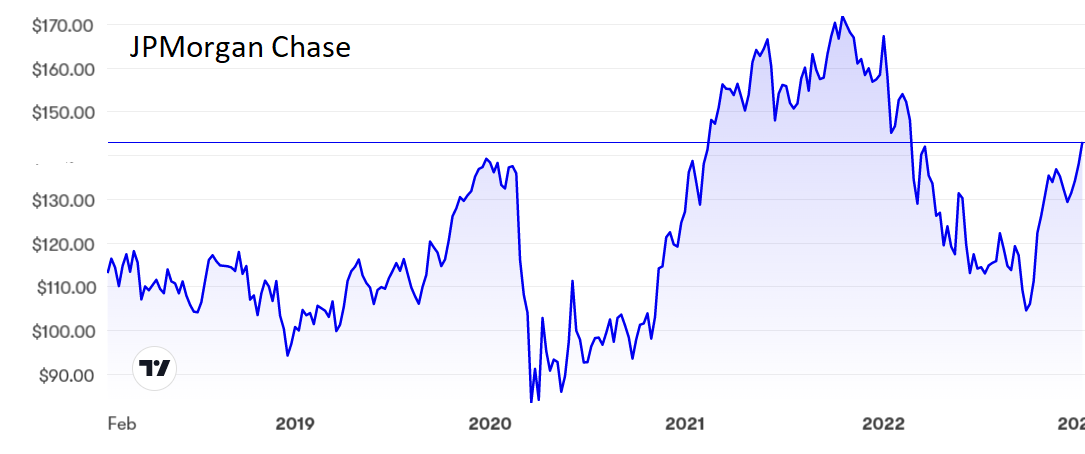

As interactive investor’s Keith Bowman reported, JPMorgan Chase & Co (NYSE:JPM) got the results season off to a strong start, but not all its competitors have kept pace.

Source: interactive investor. Past performance is not a guide to future performance.

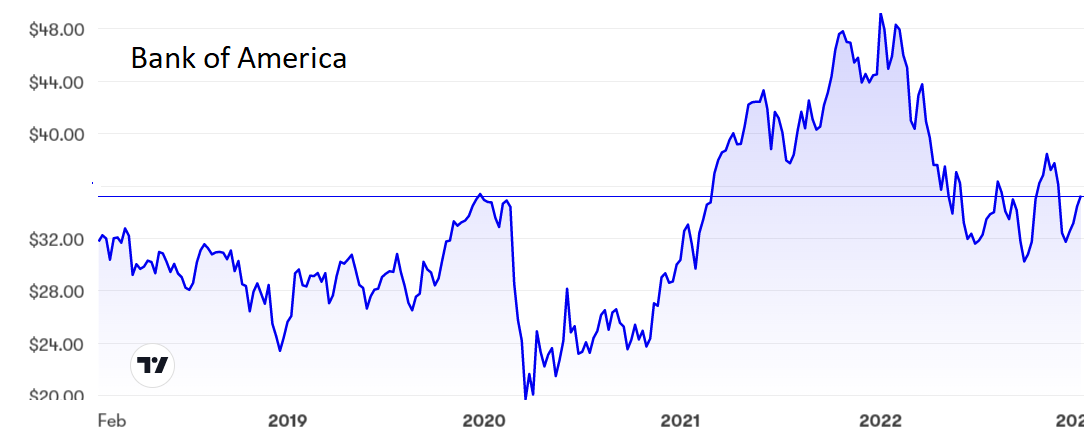

Bank of America Corp (NYSE:BAC) did manage a better fourth quarter after an underwhelming performance earlier in the year. For the final three months of 2022 it saw revenue up 11% to $24.5 billion while net income improved by an admittedly anaemic 1.7% to $7.1 billion. That still left net income down 14% for the full year at $27.5 billion despite revenue growth of 6.6% to $95 billion overall.

The bare figures are a little unfair, though. Annual profit suffered from a $2.54 billion provision for credit losses compared with the release of $4.59 billion worth of unused provisions in 2021.

The consumer banking arm, helped by the widening spread between borrowing and lending interest rates, was the star performer, producing net income up 15% to a record $3.58 billion in the fourth quarter. Despite the probably slowing pace of interest rate rises, this improvement should continue and some of the prudent provisions made last year could well be released before this year is out.

Source: interactive investor. Past performance is not a guide to future performance.

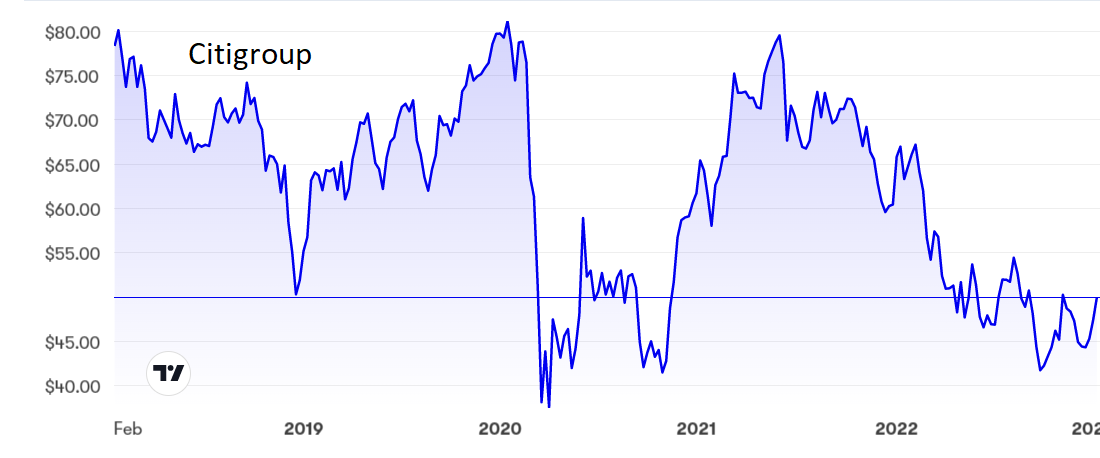

As with BoA, Citigroup Inc (NYSE:C) is having difficulty in turning rising revenue into increased profitability. Revenue in the final three months of last year rose 5.8% to $18 billion, but net income slumped 21% to $2.5 billion after $640 million worth of provisions for possible credit losses. Again, the US personal banking division was the star while investment banking struggled.

For the year as a whole, revenue rose 4.8% and net income shrank 32%, so the fourth quarter was an improvement on both counts.

Source: interactive investor. Past performance is not a guide to future performance.

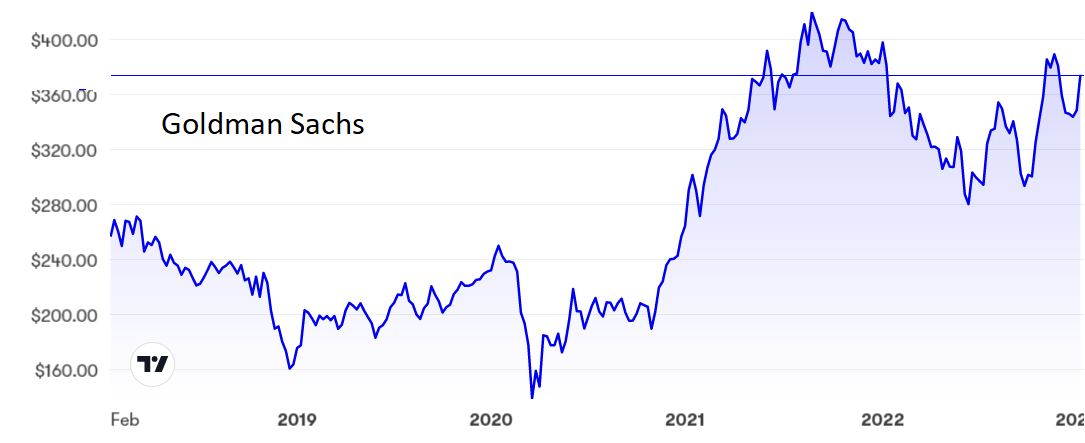

Rather more disappointing were figures from The Goldman Sachs Group Inc (NYSE:GS), which had already softened up the markets by admitting that it had lost $3 billion in its technology and consumer division in less than three years, as it tried to diversify from investment banking into more mainstream activities.

Results a few days later showed revenue in the fourth quarter down 12.8% to $10.6 billion and pre-tax earnings off a whopping 59% to $1.5 billion. This was pretty much a continuation of similar falls over the previous 12 months.

Source: interactive investor. Past performance is not a guide to future performance.

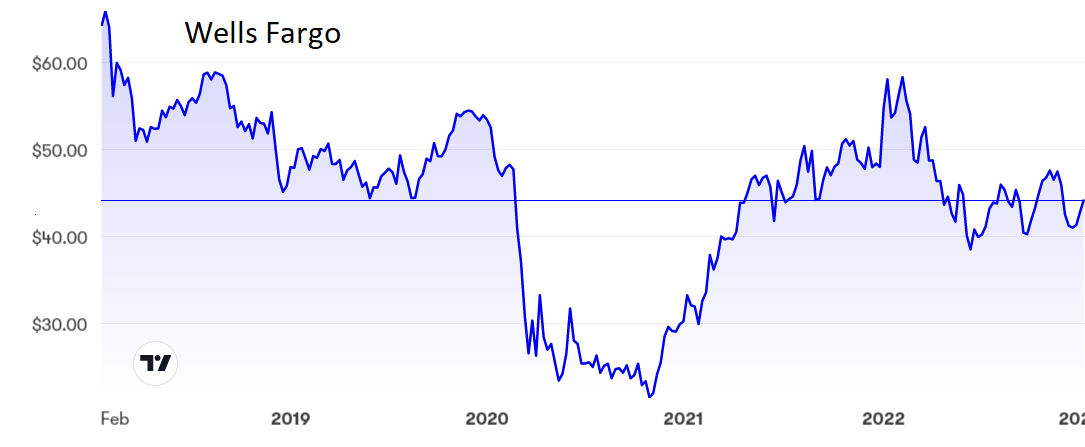

Another disappointment outlier in the sector was once again Wells Fargo & Co (NYSE:WFC), which is still having a torrid time of it. That revenue for the fourth quarter was down 5.8% to $19.7 billion was bad enough; the halving of net profits to just under $2.9 billion was pretty sickening. Losses relating to long-standing issues concerning litigation, regulation and customer compensation continue to take their toll.

In contrast to stronger rivals, the latest quarter marked a worsening profits performance compared with the first nine months, leaving net income 39% lower for the year as a whole.

Wells Fargo is going nowhere until it can resolve its historical issues, which are also distracting management from the day-to-day running of the business. That is a pity, as the bank is growing interest income quite strongly while credit defaults are rising only slowly so far.

One good sign is a settlement, costing $3.7 billion in compensation and fines, over wrongful treatment of 16 million customers that included foreclosures on mortgages. While Wells Fargo can ill afford this financial burden, it does at least draw a line under this particular legacy issue.

Source: interactive investor. Past performance is not a guide to future performance.

JPMorgan shares have performed strongly since hitting a low at $104 at the end of September and now stand at $141, where the price/earnings (PE) ratio is an undemanding 11.8 and the yield is a decent 2.8%.

Bank of America has found support at $35 and even if this breaks there is another floor at $32. The PE is also just over 11 although the yield is a little lower at 2.4%.

Citigroup shares nearly halved from just under $80 in July 2021 to $42 last September, but they have stabilised lately and now stand at $50, where the PE is a measly 7 and the yield an attractive 4.1%.

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

- 11 ways to invest your ISA like Warren Buffett

At $350, Goldman Sachs shares have not fallen as much as one might have expected from their five-year high of $420. The current PE is 9.9 and the yield 2.4%.

Wells Fargo shares have remained quite firm around $44 but the PE of 14 is more demanding than at other banks and the yield of 2.5% is not generous enough to justify this higher rating.

Hobson’s choice: JPMorgan is worth holding on to and will become a buy at anything less than $130. I would be very surprised if they dropped below $120. I rated Bank of America a buy in October at $34 on recovery hopes and that stance remains anywhere below the recent peak of $38. Too much bad news has been factored into Citigroup and investors should consider buying for further recovery, knowing the dividend is compensation should the shares slip again.

I rated Wells Fargo a sell in July but relented in October when the outlook seemed a little brighter. Fourth-quarter figures suggest that investors should indeed sell and look for better value elsewhere in the sector.

Figures from Goldman are even more alarming. The shares promptly fell 7% but it is not too late to get out before reality really sets in.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.