The standout fund sector up 40% so far in 2025

In the final weeks of the year, Douglas Chadwick assesses a sector that’s benefited from strong exposure to commodities.

15th December 2025 14:28

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Although 2025 is shaping up to be a good year for equity markets, it has not been without its challenges.

The tariff disputes early in the year triggered a sharp sell-off, as markets reacted to concerns that US President Donald Trump was prepared to pursue his policies with little regard for Wall Street. In the event, agreements were reached and a full-blown crisis was avoided, although relations with China remain fragile and could deteriorate again.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

What followed was a strong recovery, led by large technology stocks and supported by interest rate cuts. However, that rebound revived concerns that inflation was not as firmly under control as hoped, and that valuations in parts of the tech sector had become unsustainable. Those worries came to the fore in November, when markets experienced another correction.

Geopolitical tension remains high. While the situation in Gaza has eased in recent months, the Middle East remains unstable. Despite ongoing diplomatic efforts by the US and Europe’s coalition of the willing, the war in Ukraine grinds on. This underlying unease has supported the rise in demand for gold and other safe-haven assets.

Even so, and despite periods of volatility, most investment sectors have delivered positive returns so far this year. With a couple of weeks to go, only two Investment Association (IA) sectors are currently showing year-to-date losses. UK Direct Property is marginally lower, down 0.4%, while India/Indian Subcontinent has seen more substantial losses, with a fall of 9.3%.

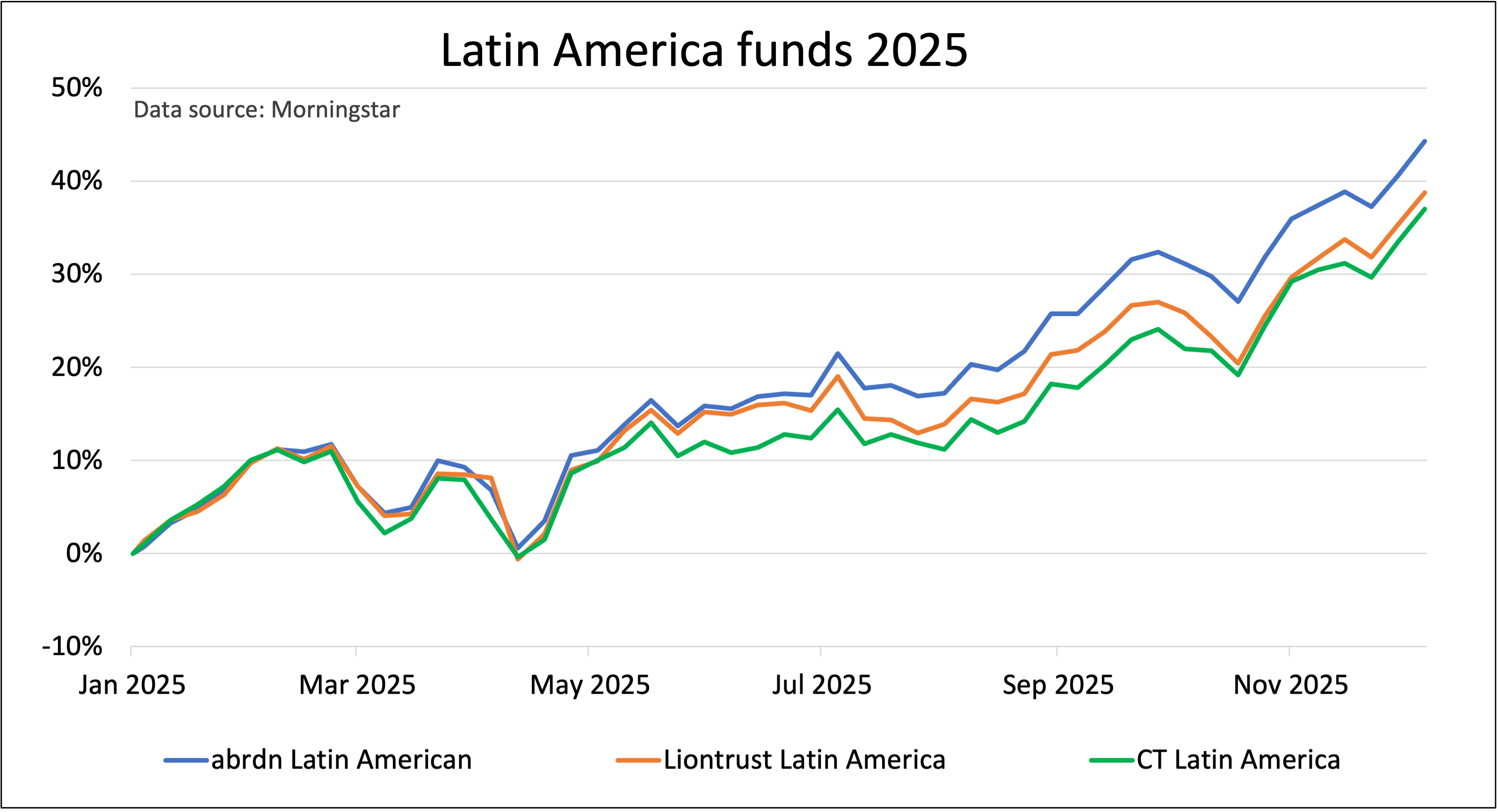

At the other end of the spectrum is the Latin America sector, which has risen by more than 40%.

Past performance is not a guide to future performance.

The Latin America sector got off to a particularly strong start to the year, gaining 11.4% in January, and has continued to make steady progress since then. For example, in the second quarter, when Technology funds were leading the way with gains of around 15%, the Latin America sector still rose by more than 8%.

China/Greater China then took the lead in the third quarter, rising by nearly 24%, but Latin America again delivered a solid three-month return of 11.4%. The final quarter of the year is still unfolding, but at present the Healthcare sector has the edge, up nearly 13%, with Latin America in second place, having gained 7.2%.

Latin America is one of the newer IA sectors, having been introduced in 2021. Before then, funds investing in the region were typically grouped within either the Specialist sector or Global Emerging Markets.

- Watch our video: ARK Invest’s Cathie Wood on performance, Nvidia and China

- Ian Cowie: the niche trust winning big this year

According to the United Nations, Latin America comprises more than 30 countries. These include around a dozen in South America, such as Brazil, Argentina, Colombia, Peru, Venezuela, and Chile; seven in Central America, namely Mexico, Guatemala, Honduras, El Salvador, Nicaragua, Costa Rica, and Panama; and a number of Caribbean nations, such as Cuba, Haiti, the Dominican Republic, and Jamaica.

From an economic perspective, the most significant are Brazil, Mexico, Argentina, Colombia, and Chile.

There are relatively few funds investing in the region, and those that do tend to be heavily weighted towards Brazil and Mexico, often with meaningful exposure to the US.

Latin America benefits from strong exposure to commodities, including oil, metals, and agricultural products, which have benefited from supply constraints and steady global demand.

- Three high-risk areas return to form in 2025: will it last?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Inflation peaked earlier in many South American economies, allowing central banks to cut interest rates sooner than in the US or Europe, which has helped support equity valuations.

Valuations were also relatively low following several years of underperformance, attracting investors looking to diversify away from more expensive developed markets. While political risks remain, much of that uncertainty was already priced in, allowing markets to recover.

Here is a graph showing the relative performance of three Latin America funds that we include in our regular weekly analysis.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.