Stockwatch: does AI justify this cyclical share’s growth rating?

After a sudden increase in popularity, analyst Edmond Jackson investigates whether this medium-sized company is undervalued or if there’s further upside potential.

2nd September 2025 09:53

by Edmond Jackson from interactive investor

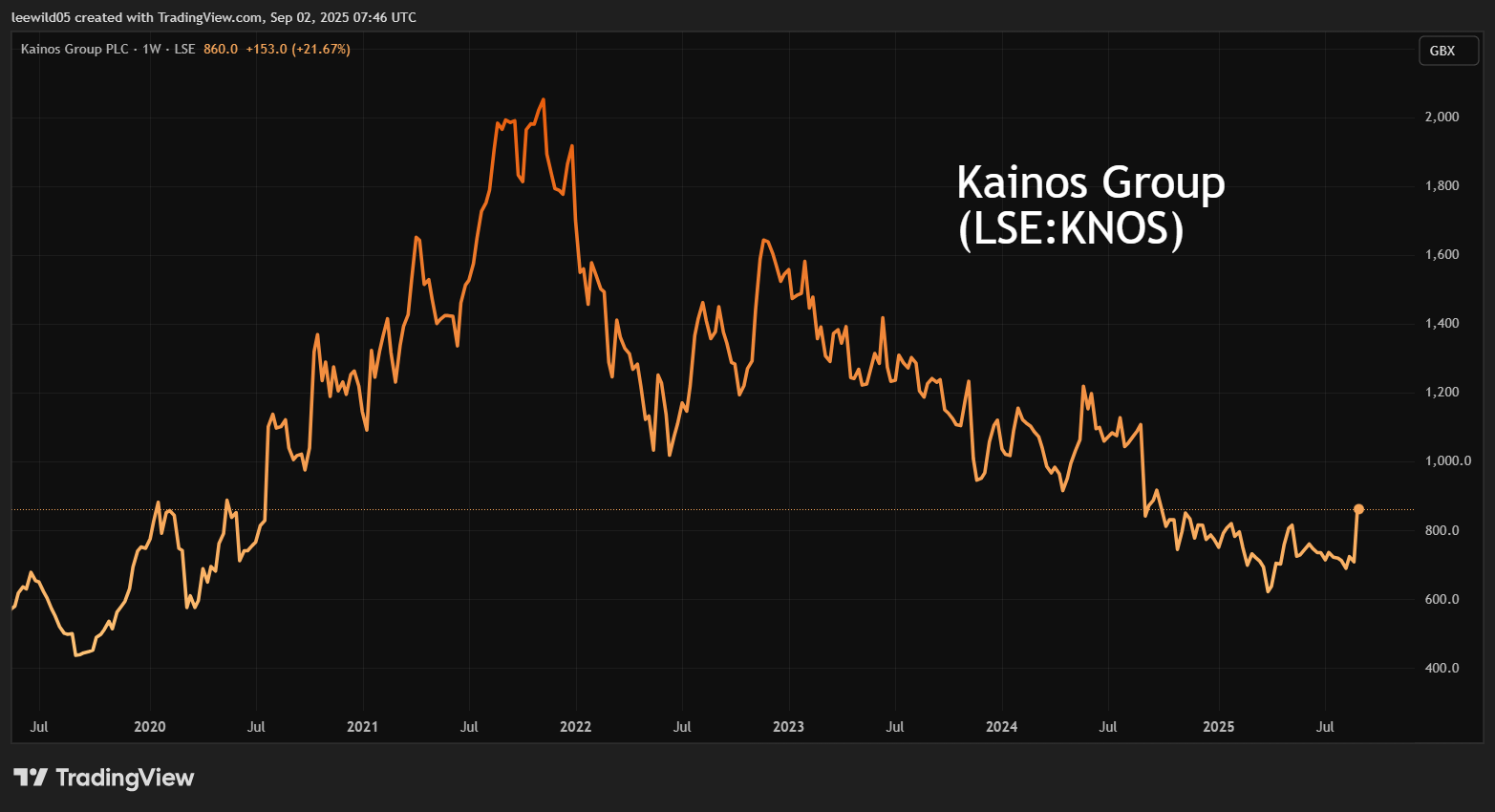

Following my recent study of Softcat (LSE:SCT) and a couple of other IT mid-caps, it is interesting to note – and with wider economic relevance – how another firm in that sector, Kainos Group (LSE:KNOS), has guided revenue to the top end of expectations for its year to 31 March 2026, its shares closing up 22.5% in response.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

This can seem like a big jump when Kainos is a mixed story on operations (like the others), yet its current price near 860p is around levels last seen in November 2024 and looks something of a break-out after a bear market from a 2,100p peak in November 2021.

That reflected a pattern of broker downgrades, whereas now, unless the wider economy throws a spanner in the works, there appears to be a slight upgrade already to the consensus earnings estimate to March 2026.

Source: TradingView. Past performance is not a guide to future performance.

How durable and broad-based is this revenue surprise?

Kainos is achieving a boost as a re-seller of US Workday IT products where those Nasdaq-listed Workday Inc Class A (NASDAQ:WDAY) shares are in a sideways-volatile trend:

Source: TradingView. Past performance is not a guide to future performance.

Workday rather shows how the storming Nasdaq index is narrowly based on a few big companies, whereas its chart is more that of a classic industrial cyclical.

From Kainos’ update we learn that Workday products are continuing to deliver strong growth, which looks sustainable given that a new “pay” one is launching soon in response to the EU Pay Transparency Directive that is coming into force next June. It exemplifies how technology generally can be counter-cyclical when new items appear, especially when backed by legislation.

But is this enough to warrant a growth rating, the forward price/earnings (PE) multiple on Kainos being around 20x? We saw how Softcat at 1,624p was on 23x based on consensus for its year to 31 July 2026. However, this meant an expensive PEG ratio (PE to earnings per share (EPS) growth) of 3.4 when, ideally, you are looking for below 1.0, or at most below 1.5x.

- ii view: UK tech firm Kainos surges on bullish forecast

- Stockwatch: is this tech stock now an even better buy?

Qualitatively, Kainos’ growth from Workday represents that company’s strengths rather than much competitive advantage for Kainos beyond its shrewd judgement to partner with Workday. Likewise, it being regarded by Workday as competent.

What appears to be new from this latest update is a more upbeat tenor on its digital services side – near 81% of group revenue – compared to last May.

“Several significant programmes” have been secured in healthcare and the public sector, such as the Home Office, NHS England and the Driver and Vehicle Standards Agency. These are expected “to lead to meaningful increases in revenues for both sectors in the second half...” The US was mixed, with strong growth offset by a weaker commercial sector, which is interesting as a litmus test on the US economy, with IT spend being a classic cyclical indicator.

Strong performance in Workday services means this division will return to growth this financial year, driven by European and US markets plus Australia, New Zealand and Mexico.

In the last financial year, the UK represented 59% of group revenue, the Americas 31% and Europe 9%. It’s not as if Asia-Pacific, the Middle East or Africa can (yet) make a difference. The UK and France especially, are weighed down fiscally, hence a prospect for greater taxes on business and wealth, while the real effect of US tariffs on economic demand is yet to be seen. The geographic context here gives me reason for caution.

Improvement since the last update on 19 May

In the financial year to 31 March, Workday products saw 24% revenue growth to represent 19% of Kainos’ group total, benefiting from strong sales execution and the ongoing success of an Employee Document Management product launched in October 2023. The US company’s marketing does seem adept and has launched its pay product.

Kainos’ two service businesses experienced a tough trading environment. Digital services revenue fell 7% to 54% of total, largely affected by the UK public sector seeing digitisation policy and implementation delays after the general election. Healthcare-related revenue jumped 14% to near 14% of group total, driven by major wins with NHS England. Its ongoing momentum – said yesterday to include the NHS – seems a bit odd considering that the government announced in March that it would be abolishing NHS England and integrating its operations into the Department of Health and Social Care. Might the government’s overall priority on the NHS avoid, or at least mitigate, any disruption? A smaller commercial sector remained affected by weak economic conditions.

Workday services had a 12% revenue fall to 27% of group total, partly due to competition on price, although bookings fell 27%. Initial contracts in Australia and New Zealand offered some hope of growth, but international revenue was flat at around 40% of total.

- Watch our video: Polar Capital Technology: best and worst AI stocks

- Watch our video: Polar Capital Technology: AI means we’ll outperform the index

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Such an operations narrative was followed by Bytes Technology Group Ordinary Shares (LSE:BYIT) warning on 2 July of “a challenging macroeconomic environment, leading to some deferral of customer buying decisions, particularly in the corporate sector”.

So, I do not see it as irrational how shares in Kainos subsequently drifted from around 750p to near 680p by mid-August, representing a 12-month forward PE of around 16x.

Financial year-end bookings were down 10% to £382 million, hardly an encouraging forward indicator, versus the backlog (work in progress) up 3%, although bookings and the backlog did improve in the second half of the year. Management also cited last May some £8.4 million of restructuring costs and 190 job losses, as if the group was needing to adjust versus challenging markets.

Given historic numbers show a strong cash-flow profile – annual free cash flow per share ahead of EPS since the March 2021 year – you could say that over 50p per share looks achievable this year, hence a cash multiple of 16-17x.

Kainos Group - financial summary

Year end 31 Mar

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 179 | 235 | 303 | 375 | 382 | 367 |

| Operating profit (£m) | 22.8 | 50.3 | 46.0 | 52.9 | 60.8 | 42.5 |

| Net profit (£m) | 18.6 | 39.6 | 35.8 | 41.6 | 48.7 | 35.6 |

| Operating margin (%) | 12.8 | 21.4 | 15.2 | 14.1 | 15.9 | 11.6 |

| Reported earnings/share (p) | 15.1 | 32.1 | 28.5 | 33.1 | 38.6 | 28.2 |

| Normalised earnings/share (p) | 15.3 | 33.5 | 29.6 | 33.2 | 38.2 | 34.1 |

| Operational cashflow/share (p) | 19.7 | 48.6 | 35.6 | 49.3 | 54.6 | 46.6 |

| Capital expenditure/share (p) | 6.7 | 1.2 | 4.6 | 2.0 | 4.5 | 2.7 |

| Free cashflow/share (p) | 13.0 | 47.4 | 31.0 | 47.3 | 50.2 | 43.9 |

| Dividend per share (p) | 3.5 | 21.5 | 22.2 | 23.9 | 27.3 | 28.4 |

| Covered by earnings (x) | 4.3 | 1.5 | 1.3 | 1.4 | 1.4 | 1.0 |

| Return on total capital (%) | 35.6 | 54.9 | 41.4 | 40.4 | 36.7 | 29.2 |

| Cash (£m) | 40.8 | 80.9 | 77 | 108 | 126 | 134 |

| Net debt (£m) | -36.7 | -77.3 | -73.2 | -107 | -120 | -128 |

| Net assets (£m) | 59.2 | 87.6 | 108 | 129 | 157 | 138 |

| Net assets per share (p) | 48.5 | 71.4 | 86.8 | 104 | 125 | 112 |

Source: company accounts.

But with a prospective yield around 3.4% covered 1.5x by earnings or 1.8x by cash flow, the current share price near 860p looks fair enough.

Kainos has shown respectable, often mid-teens, reported operating margins which slipped below 12% last year, and there was no mention of recovery in this update. However, the restructuring should be beneficial in the medium term.

Despite a 13% fall in free cash flow per share generated last year, end-March cash rose 6% to £134 million. The income statement thus benefited from £6.1 million net financial income - there being no debt beyond £5.5 million of lease liabilities.

AI-related revenue up 61% in last financial year

The artificial intelligence (AI) boost may help justify Kainos’ share rating and is why I conclude with a “hold” stance. They are modest as yet – £41 million representing 11% of group revenue and 21% of digital services revenues – and you could say that IT is substantially going to involve AI anyway.

But since 2018, Kainos has been the fifth-largest supplier to the UK public sector and is partnered with Microsoft, which looks like a key competitive advantage. This has multi-year potential to evolve into relatively high-quality earnings.

As yet, consensus EPS expectations are for normalised growth of 17% this year and 15% to March 2027, implying a slight upgrade to this year while retaining 2027 at near 46p. Given a near 11% fall for March 2025, however, you could view the three-year trend as averaging 7%, hence a PEG ratio near three times, similar to Softcat.

Much still seems to depend on the macro environment where stagflation could compromise IT investment, Kainos being another notable example of a quest to exploit technology that can really make a difference. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.