Stockwatch: how CGT Budget rumour might affect share portfolios

Concerns about possible tax hikes are playing on investors’ minds ahead of the October Budget. Analyst Edmond Jackson studies potential outcomes and names a small-cap share to keep an eye on.

17th September 2024 14:24

by Edmond Jackson from interactive investor

Potential taxation changes at Chancellor Rachel Reeves’ Autumn Budget on 30 October present both a challenge and opportunity for investors.

“Levelling the playing field” is ominous in terms of capital taxes versus income, a Labour government having few ways out of a corner, having previously ruled out rises in income tax, national insurance and VAT. Yet some tweaking of VAT on relatively low-value imports would be a shot in the arm for retail stocks, which makes it currently of speculative intrigue.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

Prompt rise in capital gains tax seems likely

Due to the alleged £22 billion hole in the UK public finances, it also seems probable that any rise in capital gains tax (CGT) will apply immediately – given that capturing them would take the Treasury until 31 January 2026 to receive CGT receipts.

If taxes are equalised between capital gains and personal income, it broadly implies a doubling of CGT, from 10% to 20% for lower-rate taxpayers and 20% to 40% at the higher rate.

While this may seem like a “high-class problem” for those wealthy enough to have assets additional to those in tax wrappers – ISAs and SIPPs – in some cases sudden exposure to CGT is unavoidable.

Where substantial assets are exposed to CGT rises and are not intended to be held for the long term, a compromise might be to sell half in the weeks ahead – with a view towards better and more balanced allocation. This would simply bring forward necessary action, with the added possible benefit of mitigating a potential tax hit.

Utilising the annual exemption for CGT has, until recently, made much sense, but it has shrivelled from £12,300 in early 2023 to £3,000 now; and that was under a Conservative chancellor. Who knows if Labour will retain any allowance at all?

- How the October Budget could impact your personal finances

- Prospects for IHT under new Labour government

There is potentially a saving grace from these fears, although I doubt CGT will be left alone.

Recent data shows that 45% of the £15 billion raised from CGT in the 5 April 2024 tax year derived from large disposals generating gains above £5 million. If CGT is hiked, then people could change their behaviour over time, depleting the Treasury of what it hopes for.

For example, a “substantial shareholding exemption”, unless abolished, already offers ways to structure tax so none is paid by a company. It’s unclear whether Labour would grasp this given that it is a regular argument put forward by Conservatives, but higher taxes do tend to boost the avoidance industry.

Reeves also stated in a March 2023 interview that she had no plans to increase CGT, but that was 18 months ago. After gaining power, Labour now says the UK’s public spending deficit is far worse than previously understood and the next Budget will be “painful”.

Small-cap stocks hit hardest?

With around 90% of listed equities nowadays held by institutions which pay no tax, it is inconceivable that mid- to big-cap stocks will see any profit-taking.

The intriguing question is whether small-cap “winners” might be more prone to profit-taking ahead of any CGT regime change. A counter-balancing argument, however, is that you should not sell down your winners (unless blatantly over-valued) chiefly on tax consideration.

Say if you were sitting on a large holding in a “growth” stock – or a technology share with no earnings record – and interest rates were expected to rise, then, yes, it could make sense to lock in gains. Growth stocks are prone to rise and fall inversely with interest rates.

- The taxes Labour might hike in its first Budget

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

But the macro context is shifting from relatively higher to lower interest rates, over the next year possibly, which in principle benefits growth stocks.

Inheritance tax relief on AIM stocks might be cancelled – it is estimated this would raise around £1.1 billion – but this would affect only future long-term financial planning. It could still rather reduce demand for AIM stocks, which are more significantly owned by individuals currently. In which scenario, yes, it would mildly compromise those market values.

Might VAT on non-EU imports be introduced?

It is a loophole that’s existed for many years – in the US, back to the 1930s, it was called the “de minimis” exemption, where packages under $800 (£606) are allowed to enter without shippers paying import duties. In the UK, the exemption is at £135 and in the EU, €150 (£126).

To me, it shows how inept major governments can be. They would rather let domestic retail /industry suffer, and ultimately tax revenues. It is not “protectionist” to require equal treatment.

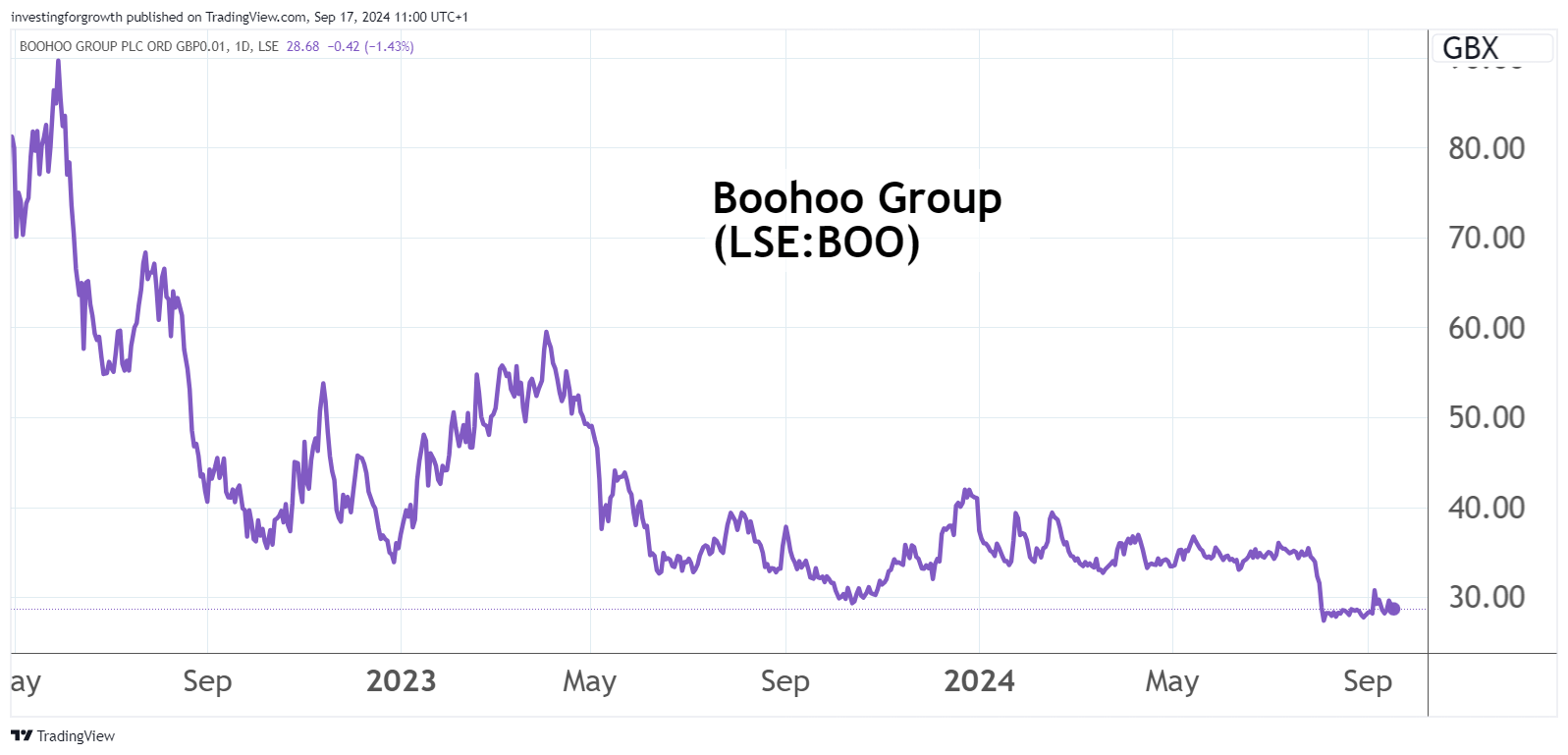

See the effects on Boohoo Group (LSE:BOO), the most prominent UK example of Chinese competition from Shein and Temu ratcheting up. The stock and its underlying profits have been decimated:

Source: TradingView. Past performance is not a guide to future performance.

Boohoo - financial summary

Year end 28 Feb

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 195 | 295 | 580 | 857 | 1,235 | 1,745 | 1,983 | 1,769 | 1,461 |

| Operating margin (%) | 7.7 | 10.3 | 7.4 | 6.9 | 7.4 | 7.1 | 0.5 | -4.7 | -10.1 |

| Operating profit (£m) | 15.0 | 30.3 | 42.7 | 58.7 | 90.9 | 124 | 9.4 | -82.2 | -147 |

| Net profit (£m) | 12.4 | 24.5 | 31.7 | 43.6 | 63.7 | 90.7 | -4.0 | -75.6 | -138 |

| Reported EPS (p) | 1.1 | 2.2 | 2.7 | 3.7 | 5.4 | 7.2 | -0.3 | -6.1 | -11.5 |

| Normalised EPS (p) | 1.1 | 2.1 | 2.7 | 4.2 | 5.3 | 7.6 | 0.7 | -1.8 | -1.5 |

| Earnings per share growth (%) | 33.5 | 86.8 | 32.0 | 53.3 | 26.7 | 44.0 | -90.3 | ||

| Return on total capital (%) | 20.3 | 26.4 | 19.2 | 21.1 | 25.9 | 25.3 | 1.8 | -9.3 | -19.8 |

| Operating cashflow/share (p) | 1.5 | 2.6 | 5.9 | 8.7 | 9.7 | 13.0 | 0.8 | 11.1 | 0.2 |

| Capex/share (p) | 1.2 | 2.7 | 4.0 | 4.0 | 3.8 | 9.8 | 21.2 | 7.4 | 5.4 |

| Free cashflow/share (p) | 0.3 | -0.1 | 1.9 | 4.7 | 5.9 | 3.2 | -20.4 | 3.7 | -5.2 |

| Cash (£m) | 58.3 | 70.3 | 143 | 198 | 245 | 276 | 101 | 331 | 230 |

| Net debt (£m) | -58.3 | -58.4 | -133 | -191 | -225 | -258 | 50.6 | 133 | 217 |

| Net assets/share (p) | 6.5 | 8.6 | 17.7 | 21.6 | 26.6 | 37.4 | 36.6 | 31.5 | 22.0 |

Source: historic company REFS and company accounts.

Boohoo, I think, is a particularly acute example, although the likes of Shoe Zone (LSE:SHOE), Next (LSE:NXT) and Marks & Spencer Group (LSE:MKS) are also to some extent affected. Investor sentiment in Boohoo is also jaundiced by controversy a few years ago over some of its Leicester factories, which means the stock could twitch on materially positive news.

Last Friday, the Biden administration announced plans to bar products subject to US/China tariffs from the de minimis restriction. America has been flooded with $5 T-shirts and $10 sweaters. Even if prices were to rise at least 20% - as is mooted - it would still leave Shein and Temu highly competitive, it would just take off some of the edge.

Estimates here suggest over £2 billion could be raised for the Treasury this way, and you’d think advisers to Chancellor Reeves ought to have this in their sights.

- Stockwatch: a well-timed takeover underlines appeal of gold

- Stockwatch: a FTSE 100 share worth owning for near 10% yield

- AIM’s best companies of 2024: shortlist revealed

It would be preferable to doubling CGT given that there would be some impact on business investment – not mainly wealthy people with shares. Yet this new Labour government could look to CGT rates in Scandinavian countries above 30% (Norway, the highest at 38%) as a template for the approach they want here.

Otherwise, CGT rates vary on the Continent from 10% in Romania to 15% in Hungary and 19% in Poland. Belgium is zero-rated yet France has 34% and Germany 26%.

A balanced approach would be a 50% hike in CGT combined with wider initiatives such as VAT on low-value foreign imports. Properly, multinationals such as Apple Inc (NASDAQ:AAPL), Google and Starbucks Corp (NASDAQ:SBUX) – which deftly arrange their domiciles to greatly minimise tax – should be dealt with. This would, however, need supranational co-operation rather than anything in a domestic Budget.

Aside from anyone much exposed to CGT, the 30 October Budget could therefore be well received by investors. I hesitate to rate Boohoo shares an intrinsic “buy” given that the company is expected to be loss-making as far out as its February 2026 year. As a speculation, however, experienced traders might like to consider it.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.