Strange bedfellows in the market rally

Saltydog Investor looks at two fund sectors benefiting from the recent ‘plate spinning’ of optimism and fear.

27th October 2025 14:29

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

It has been a remarkable six months for global investors. After a volatile start to the year, markets have staged a broad and sustained recovery.

The “Liberation Day” tariffs announced in early April triggered sharp falls at the time but major indices have rebounded strongly. What began as a relief rally has turned into one of the most widespread, money-making opportunities seen in years.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

Between 1 May and 25 October, all the major stock markets rose.

The FTSE 100 and FTSE 250 both gained 13%, while the Dow Jones Industrial Average rose 16%. The S&P 500 climbed 22% and the Nasdaq gained 33%, driven by enthusiasm for technology and artificial intelligence (AI).

Japan’s Nikkei 225 was the strongest performer, up 37%, while China’s Hang Seng and Shanghai Composite gained 18% and 20% respectively. Even Europe and Latin America joined in, with most major indices up between 5% and 10%.

It has been a near-universal upswing, a rising tide that has lifted almost every boat.

The same picture is visible across the Investment Association (IA) sectors tracked by Saltydog Investor. Every sector has made progress over the past six months, from the cautious money market funds to the more adventurous equity-based groups.

- The funds and trusts that look beyond gold to add defensive ballast

- Two hot investment areas beyond tech

At the lower-risk end, the Mixed Investment, Flexible Investment, and UK equity sectors rose by around 10% to 15%. Among the higher-risk areas, North America, Japan, and Global funds led the developed markets, while Asia Pacific, Global Emerging Markets, and China/Greater China were strong among the emerging markets.

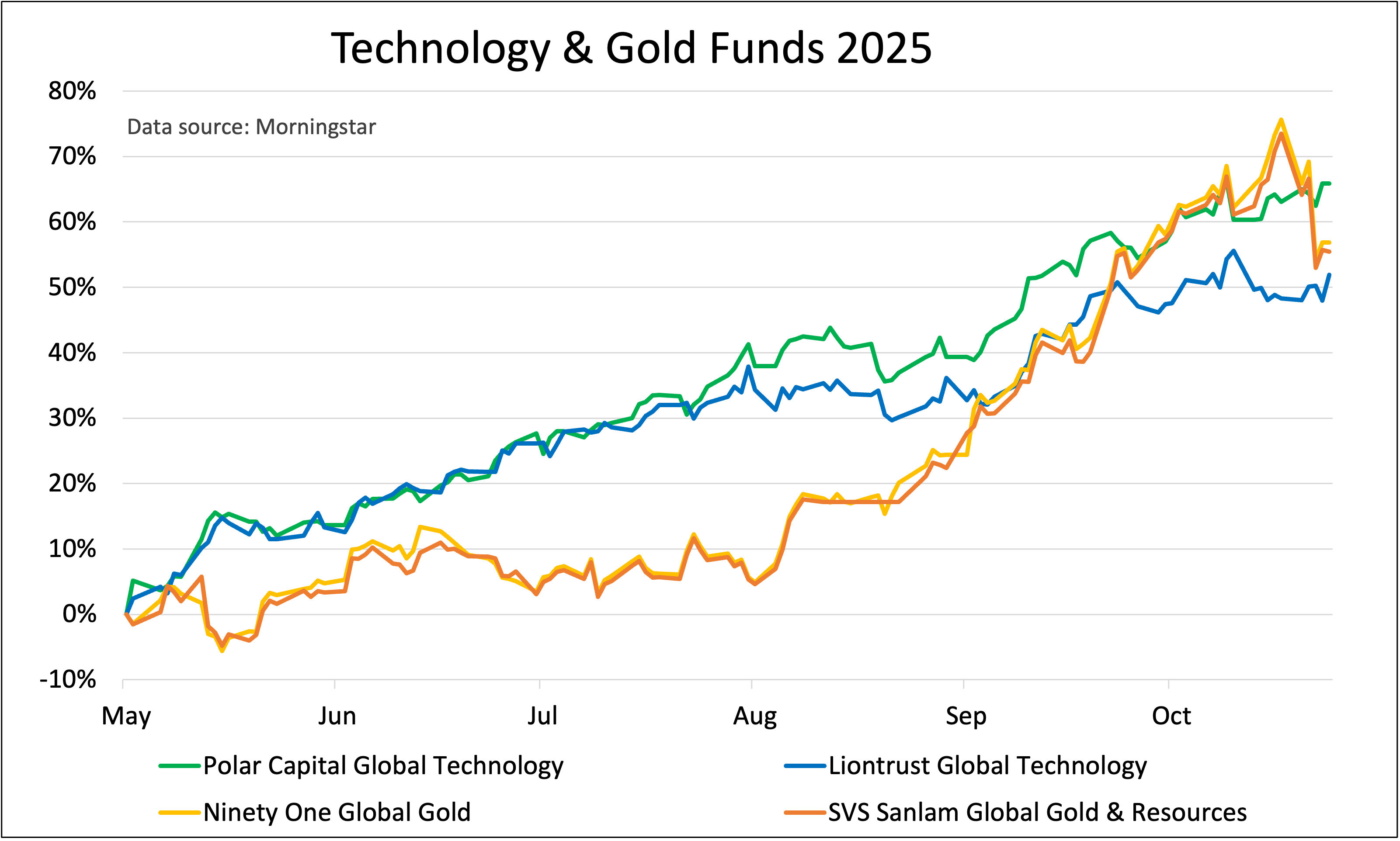

The most eye-catching performances came from the Technology & Technology Innovation sector, which up until last week was showing a 26-week return of 44%, and the specialist gold funds, which had gained an extraordinary 62%.

The gold price pulled back a little last week, in a short-term correction, but the leading funds are still in the mix with the best of the technology funds.

Past performance is not a guide to future performance.

That combination is particularly striking. It’s rare for gold and high-growth technology shares to rise together. Historically, they have tended to move in opposite directions.

Gold usually rallies when investors are anxious about inflation, war, or instability, while technology stocks thrive in periods of optimism and risk-taking. This year they have both been setting records.

Gold funds have climbed on the back of record central bank buying, persistent inflation pressures, and renewed geopolitical tensions.

- Where to invest in Q4 2025? Four experts have their say

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

At the same time, expectations of interest rate cuts have weakened the dollar, making gold more attractive to international buyers.

Technology & Technology Innovation funds have risen sharply thanks to the continued strength of the AI theme and strong earnings from the major US and Asian technology companies.

The two asset classes are being driven by different forces but share one underlying factor: uncertainty.

Investors are chasing the potential of artificial intelligence and digital transformation, while also hedging against inflation, trade disputes, and political shocks. It’s an unusual pairing and one that analysts say reflects a market “spinning two plates at once”, optimism and fear.

From 1975 until 2024, gold and the S&P 500 never reached record highs together. In 2025, it has already happened several times. It may be a sign that investors are uneasy beneath the surface. They want exposure to growth, but they also want protection.

For now, the rising tide continues to carry markets higher.

- Dividends are down, but UK funds are now beating global rivals

- Should investors rethink gold's safe-haven status?

However, when valuations become stretched and confidence overextended, it doesn’t take much to change the current.

Some analysts already warn that parts of the US technology sector are in bubble territory. Others see the simultaneous strength of gold and equities as a signal that investors are nervous, even while prices climb.

History shows that when the tide turns, the sectors that have risen the most, such as gold, technology, and emerging markets, are also the ones that tend to fall the furthest.

The past six months have been rewarding for investors but also unusual. The simultaneous strength of gold and growth stocks suggests that confidence is mixed with caution.

Inflation has eased but not vanished, and global trade remains unpredictable. For now, the trend is positive, but risks are building.

At Saltydog Investor, we will continue to monitor performance across all sectors, maintain balance between our ‘core’ and ‘satellite’ holdings, and be ready to change tack if conditions shift.

A rising tide may lift all boats, but as Warren Buffett says, it’s only when it turns that we find out who has been swimming naked.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.