Where to invest in Q4 2025? Four experts have their say

Following a strong run of performance for various stock markets, as well as gold, our asset allocation panel are striking a more cautious tone. Jim Levi reports on whether a sell-off is on the cards before the end of 2025.

24th October 2025 08:56

by Jim Levi from interactive investor

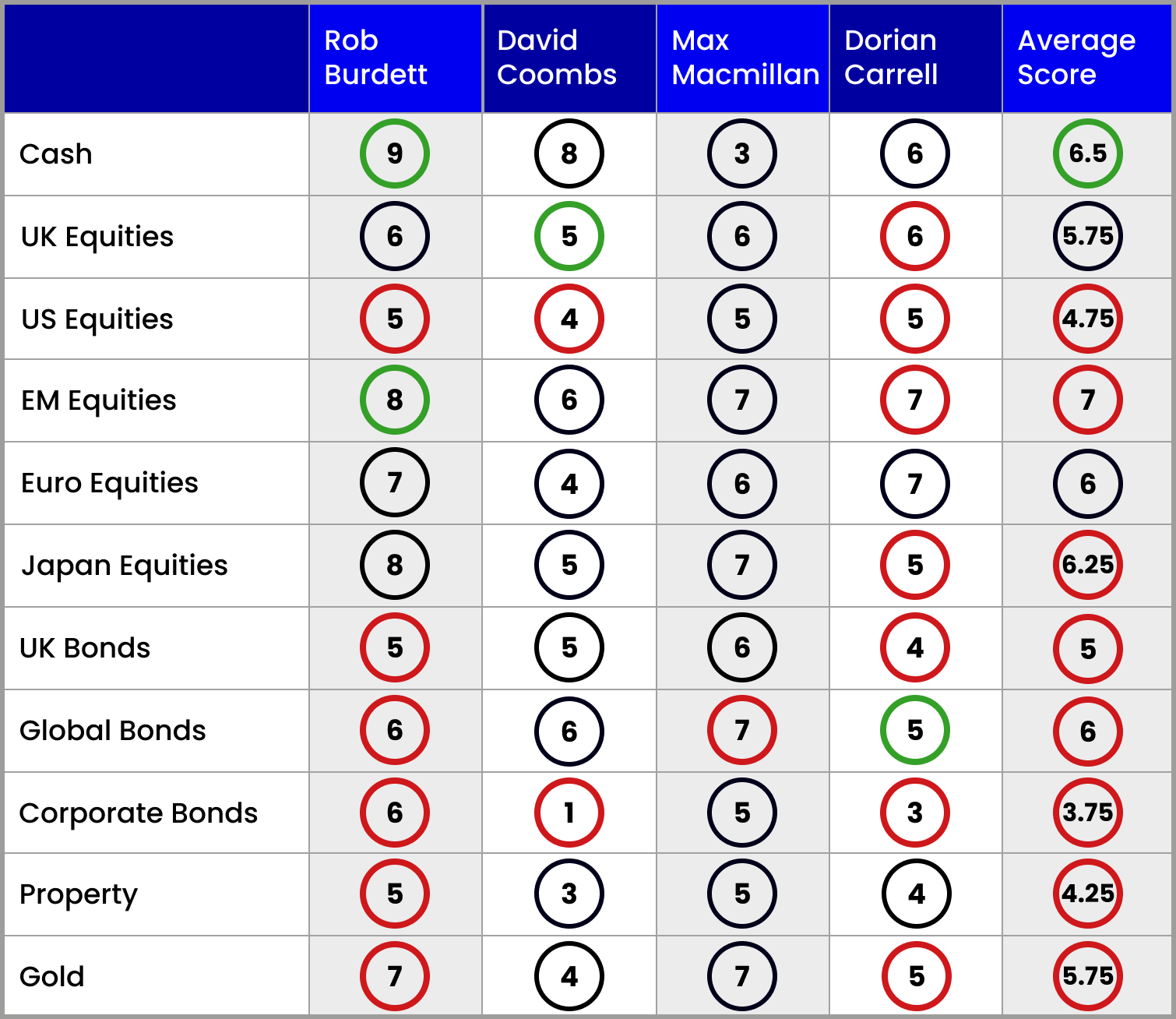

Our quarterly asset allocation article highlights the views of four professional multi-asset investors. We ask each investor to provide a score of one to nine for various assets, with five being a neutral score.

Autumn. The season of mists and mellow fruitfulness, according to the poet John Keats. But history shows that it can also be the season for financial crashes. Is such a crash pending?

Given the plethora of the gloomy warnings currently doing the rounds, investors might be forgiven for thinking it's time to be battening down the hatches.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The head of the International Monetary Fund (IMF), Kristalina Georgieva, says worries about private credit markets are giving her sleepless nights. Jamie Dimon of banking giant JP Morgan talks of “cockroaches” in the US banking system. Cockroaches certainly sound more sinister than the usual warnings from market pundits about canaries in coal mines or even elephants in the room.

Is a market sell-off on the cards?

Certainly the exuberance we saw in stock markets until early October has suddenly evaporated. Leading indices in the US, Europe and the UK have all recently hit all-time peaks. Yet the mood among our panel of asset allocators seems much more cautious.

“It is amazing how quickly the mood has changed,” admits Dorian Carrell at Schroders. “At Schroders, we now expect more volatility. But a market crash? We think that is unlikely.”

Rathbones’ David Coombs also expects choppier conditions for stock markets. He says: “There’s been too much capital chasing too few of the stocks expected to benefit from the artificial intelligence (AI) boom. I’m quite nervous and I haven’t felt like this since the dot-com bubble 25 years ago. It’s the season for crashes and there are enough warnings around. However, I think we will just get more volatility.”

- Is Scottish Mortgage too reliant on the AI boom?

- ii Top 50 Fund Index: most-bought funds, trusts and ETFs in Q3 2025

Max Macmillan at Aberdeen says: “It pays to believe - after three years of a bull market - that we are in the late stages of the business cycle. So, we need a portfolio of investments that’s well diversified and takes a cautious view of the outlook. We try to rebalance gradually as we go through the business cycle because we simply don’t know when the bull market will end.”

Rob Burdett at Nedgroup Investments is not predicting a crash either - at least not for the next three months. “We simply haven’t seen real euphoria in markets which usually precede a crash,” he says. “However, there are pockets of overvaluation and signs of nervousness. So, we might well see some kind of correction.”

How, then, do the panel adapt to what appears to be a change of mood in the markets? One strategy they all have in common is a cautious view of the outlook for shares on Wall Street. None of the quartet are now overweight US equities, while Coombs has lowered his score from six to four. Both Burdett and Carrell have lowered their scores for US shares from six to five. Macmillan, who also scores a five, says: “We are neutral on the US, not because we are against equities, but because that’s not where the risk/reward ratio is best.”

Of course the problem with Wall Street is the high valuations put on the so-called Magnificent Seven stocks - Apple Inc (NASDAQ:AAPL), Alphabet Inc Class A (NASDAQ:GOOGL) (Google’s parent company), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), Facebook-owner Meta Platforms Inc Class A (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA) and Tesla Inc (NASDAQ:TSLA).

- How to decide whether to take profits or run a winner

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Partly because of their connection to the AI bubble, they make up around one-third of the total value of stocks in the S&P 500 index. Of these seven - Microsoft, Amazon, Meta and Google - are forecast to spend a mind-boggling $750 billion (£562 billion) on building data centres to power their various AI models. Naturally, investors are wondering what returns - if any - these enormous capital outlays will bring.

“Wall Street is priced very aggressively and constitutes 60-70% of the total market in equities,” Dorian Carrell points out.

Emerging markets the favoured equity region

Elsewhere in equities, emerging markets is the only sector where all four panel members retain an overweight position. Although Carrell is taking some profits by reducing his score from nine to seven, he still believes it’s the most attractive area of investment opportunity.

Burdett, in contrast, has decided to increase his exposure to the sector. “Of course, if Wall Street sneezes some of the emerging markets may catch a cold, but governments of some emerging markets tend to have strong balance sheets to make them more resilient,” he argues.

At the moment, these markets are benefiting from the weakness of the dollar and this prolonged period of economic growth. Meanwhile, tariff wars are encouraging China to avoid them by exporting unfinished goods to the US via countries such as Mexico and Vietnam.

Easily the most bearish of our panel members at present, Coombs, is notable for selecting emerging markets as the only equity sector where he is currently overweight.

For Macmillan, emerging markets offer that extra element of diversification to protect his portfolio in times of uncertainty.

Moving to these shores, the panel are viewing the prospect of Rachel Reeves’ next Budget with a large dollop of trepidation. But valuations for UK equities remain modest compared with the US and so three panel members score a six, while Coombs has raised his score to a neutral five. “We think the market has already discounted a gloomy Budget,” Burdett says.

- The Autumn Budget 2025: just how painful could it be?

- Autumn Budget preview: unpacking the pension tax-free cash saga

For European equities, all four scores have remained the same since July. Carrell compliments the new German government. “They are coming out with policies that make sense,” he says.

The Japanese stock market has been an outstanding performer lately with the Nikkei 225 index breaking to new all-time highs and threatening to top the 50,000 mark. Back in early April, at the time of President Donald Trump’s launch of his new regime of tariffs, the Nikkei had sunk to a low of 31,181.

Burdett’s consistent bullishness has been vindicated by a near 60% gain in the main Tokyo index in less than seven months. He holds his score at eight. “It remains the pick of the equity markets,” he insists. In contrast, Carrell takes the view that it is time to take some profits after such a strong run. So, he’s trimming back his score from seven to five.

Cautious outlook

Enthusiasm for UK bonds (gilts) has become muted given the lack of progress in controlling the government deficit and inflation. Both Burdett and Carrell have edged their scores lower, while only Macmillan is overweight.

There’s more support for global bonds, but even here, two panel members Macmillan and Burdett have edged their scores lower although they remain overweight.

Neither Coombs nor Carrell can see much merit in corporate bonds. Coombs scores only one, while Carrell scores a three. “I’m avoiding corporate bonds altogether,” says Coombs. “The narrowing yield gap between corporate bonds and sovereign debt doesn’t compensate for the risk of defaults.”

Burdett had been the only panel member who had an overweight position in property. But even he’s now given that up.

After a surge in the gold price so far this year of more than 60%, Carrell naturally finds it hard to value the yellow metal.

- Should investors rethink gold’s safe-haven status?

- Stockwatch: take profits or buckle up for more gold upside?

“I have no idea what the price should be,” he says. As a precaution, he reluctantly settles for a score of five, down from seven. He admits that he might have been happier with no score at all. Burdett has also trimmed his score but not so drastically. “There’s continued heavy central bank buying” he says.

Uncertainty about where financial markets are heading next continues to be reflected in high cash scores for both Coombs and Burdett. But Macmillan prefers to be fully invested and his cash score remains a lowly three.

Note: the scorecard is a snapshot of views for the fourthquarter of 2025. How the panellists’ views have changed since thethird quarter of 2025: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager with Nedgroup Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at Aberdeen.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.