Sylvania Platinum: what next after a remarkable run?

After delivering great returns for investors, our chartist looks at potential for more at this AIM star.

13th May 2021 08:12

by Alistair Strang from Trends and Targets

After delivering great returns for investors, our chartist looks at potential for more at this AIM star.

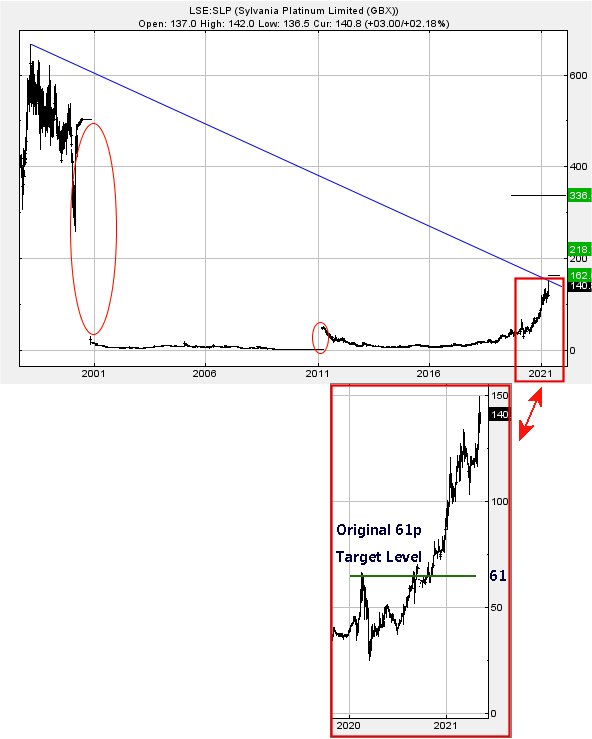

In our review of Sylvania Platinum (LSE:SLP) back in 2019, we mentioned forces were at work which allowed a lunge in the direction of 61p. This was due to price movements from six years previously.

Obviously, with the share now trading around 140p, our goal was achieved. An awkward situation now exists as we’re forced to travel back to 1999. By this method, we can try and make sense of where current price movements find their inspiration.

Once upon a time, the share was trading above 600p*, and this appears to provide the arithmetic powering current price strength, a quite extraordinary situation from our perspective. Making matters more difficult, a couple of gaps exist on the chart which circle major price adjustments where there was no trading.

Something happened at the start of the 21st century, when one morning the market awoke and decided Sylvania was no longer worth five quid a share but instead, around 33p represented fair value.

In the period since the share price exceeded 96p, we’ve little choice but to seek inspiration from the days when it was trading at 650p. From our standpoint, this is now the only thing making sense, capable of explaining the rise to current levels.

Next, above 151p should prove capable of bringing a visit to an initial 162p. If exceeded, our longer-term secondary calculates at 218p. Above such a level, things are necessarily vague, thanks to the circled gaps, and we shall prefer revisit to run the numbers again. We’ve chosen to show a long-term 336p, but the reality of such ambition almost needs guesswork.

- Why reading charts can help you become a better investor

- Check out our award-winning stocks and shares ISA

Finally, the inset below shows a textbook case of our target levels. Earlier in 2020, the share price indeed hit – and exceeded – our target of 61p. The share price then tanked, plunging to 24p. But at the start of September 2020, the price once again attained our 61p and once the prior highs were finally beaten, a state of “higher highs” existed and the rest is history with the price languishing at 140p presently. The value of the share price would need to literally halve before we’d suggest time to panic.

*At the end of 2010 Sylvania Resources announced its intention to redomicile the holding company of the group from Australia to Bermuda via a share for share exchange in which Sylvania Platinum, a company incorporated in Bermuda, would become the new holding company for the Sylvania group of companies.

Source: Trends and Targets. Past performance is not a guide to future performance

Alistair Strang has led high-profile and 'top secret' software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know 'how it worked' with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.