These 'hidden gem' investment trusts could be long-term core holdings

15th November 2018 10:00

by Fiona Hamilton from interactive investor

Self-managed trusts have many attributes that are appealing to investors. Fiona Hamilton examines their credentials.

Until the 1960s, almost all investment trusts were self-managed. They were standalone trusts, with boards of directors that entrusted the portfolio to one or more managers who focused solely on the trust and were therefore not distracted by other commitments.

Both boards and managers often had, or accumulated, significant shareholdings, thereby aligning their interests with those of all other shareholders. Over time some of these trusts have been taken over and broken up by other institutions. Others, such as the venerable F&C Investment Trust, formed management companies that won mandates to run other trusts or launched new ones. Over time they also diversified into running other investment products such as open-ended investment companies (OEICs) and pension funds.

Having more assets under management has enabled such management groups to enlarge investment teams – providing continuity if someone is ill, leaves or retires – and to spread the costs of administrative back-up and marketing.

The snag is that in order to pay for greater investment in staff, technology, compliance and other facilities, as well as turn a profit, asset-gathering has become a priority for many of these groups. That is especially true in an environment of downward pressure on management fees. As a result, fund managers can be diverted from their investment duties as well as being required to divide their time between a variety of portfolios.

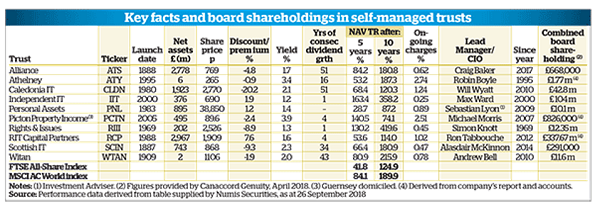

There are now less than a dozen UK-domiciled, self-managed trusts listed on the main London Stock Exchange. The table shows they vary widely in terms of age and size. Most aim to be long-term core holdings; the majority can or do invest internationally; and some, notably Personal Assets and RIT Capital Partners, put an exceptionally high emphasis on capital preservation. The latter-named trusts have tended to lag in bull markets but make up for it in setbacks.

Please click here to enlarge table for self-managed trusts key facts.

Past performance is not a guide to future performance

No institutional diversions

Despite these differences, the cohort's self-managed status gives the trusts a number of attributes in common. The ability to focus exclusively on one portfolio and to avoid 'institutional diversions' is deemed a critical advantage by the managers of trusts as diverse as the 131-year-old Scottish Investment Trust and the 18-year-old Independent Investment Trust.

This was the reason that Ian Rushbrook built a 29 % stake in Personal Assets and spun it out of Ivory & Sime in 1990, aiming to manage it expressly for private investors, free from policy restrictions. A notable result was that Personal Assets had virtually no equity exposure at the height of the 2008 crash.

It is also credited with revitalising the fortunes of Picton Property Income Trust since it was spun off from Dutch group ING in January 2012. "It is now the only thing we do, and it allowed us to create a strong alignment between staff and shareholders through a long-term incentive plan," explains chief executive Michael Morris.

The Independent investment trust was formed by several leading Edinburgh investment managers to manage large chunks of their own money. Other shareholders were courted to achieve 'a critical mass' of around £100 million. Founder manager Max Ward says that having achieved that level of support, the trust has avoided issuing any more shares, on the basis that "every extra pound under management makes it harder to manage".

Nevertheless, its subsequent success has lifted assets to over £350 million, with Ward's stake now worth around £30 million and chairman Douglas McDougall's around £60 million.

Ward and McDougall were both previously at Edinburgh-based partnership Baillie Gifford and they have continued to work closely together. "I tend to be a gullible enthusiast, whereas Douglas is more of a hardened cynic, so he acts as a great foil," Ward says.

This combination of a chairman and manager who get on well, and who both have decades of investment experience and hefty stakes, is ideal for a self-managed trust.

Although Independent has the ability to invest internationally, Ward has focused its concentrated portfolio on UK equities, with the majority of its 30 or so holdings in smaller companies, because they offer the greatest opportunities for 'ten baggers' (investments that return at least 10 times the original stake).

At its last financial year end, on 30 November 2017, Independent's average annual NAV total returns since launch were 13.7%, compared to 5.4 % from the FTSE All-Share index, and exceeded even the stellar returns from Scottish Mortgage Trust, which Ward managed from 1988 to 2000.

Research has convinced Ward that running his winners is the key to success. For example, AIM-quoted Blue Prism and Fevertree Drinks represent 15 and 10% of Independent's portfolio respectively. Ward says over 90% of fund management groups would balk at this level of concentration, but Independent's self-managed status allows him to hold unusually large stakes, with the board's agreement.

Ward's dedication to unearthing 'exceptional winners', rather than worrying about benchmarks or the direction of markets, is also supported by his fellow directors. But they warn that their unusually bold approach can result in unusually poor results, as in 2008 when Independent's NAV per share suffered one of the steepest falls in the global sector. However, it bounced back exceptionally strongly in 2009, and Ward hopes returns will hold up better in any future sell-off as he now avoids companies with dodgy balance sheets.

Independent's miserly ongoing costs of just 0.25% illustrate another potential advantage of self-managed trusts. Rights & Issues IT, which has an even more concentrated portfolio of UK smaller companies, also has very low charges for its sector, as does Scottish IT.

Charges are higher for self-managed trusts that are internationally diversified but achieve this goal by adopting a multi-manager approach, either partially or fully. Caledonia Investments, RIT Capital Partners and Witan have all taken this route and were joined in 2017 by Alliance Trust.

The first three-named are all chaired by members of their founding families, which still have very substantial shareholdings, so they have the unusual appeal of offering a genuinely multi-generational approach. This implies being reasonably careful and well-diversified, as well as keeping the wider family and other shareholders happy with sustainable dividend progression.

Past performance is not a guide to future performance

Rise of the multi-manager trusts

Witan was formed in 1909 to manage the affairs of the Henderson family. Over time it became the flagship of Henderson Global Investors (now Janus Henderson). But in 2004, after several years of poor performance, it reverted to self-management because it did not want to be restricted to using the Henderson team to manage its portfolio.

Chairman Harry Henderson said at the time: "No management company can have at its disposal top managers in all markets." An independent chief executive was appointed to oversee Witan's asset allocation and to select a roster of external managers with good long-term records to manage sections of the portfolio.

Initially most of these were US-based, on the grounds that many UK managers had become overly benchmark-aware. Most were self-owned and had a lot of money in their own funds. In other words they shared many of Witan's characteristics.

With net assets approaching £1.9 billion, Witan is large enough to secure tight terms from subcontractors, so its costs are competitive for a multi-manager. Its strategy has worked much better since Andrew Bell was appointed a director and chief executive officer in 2010. Bell overhauled the roster of sub-contractors, has been prepared to make speedy adjustments to the asset allocation through index futures, and personally manages a portfolio of specialist funds accounting for up to 10% of assets.

The improvement in Witan's fortunes under Bell confirms that the quality of a lead manager of a self-invested portfolio is critical to success (and his £1.45 million shareholding should ensure his loyalty).

Bell says: "Because we are self-managed, our only consideration is the net asset value per share, not assets under management." That means Witan's board is happy to use buybacks to keep the share price close to NAV, so long as it is to the advantage of ongoing shareholders.

Alliance Trust's ongoing charge of 0.62% is even more competitive for a multimanager than Witan's 0.86%. It has made a promising start since Willis Towers Watson was put in charge of selecting its subcontractors last year, however it will take time to prove its credentials. Meanwhile it would be encouraging to see the board with more 'skin in the game': chairman Lord Smith of Kelvin's stake is worth barely more than his annual remuneration of £120,000.

Past performance is not a guide to future performance

All change at personal assets?

Lack of board commitment has not been a problem at Personal Assets Trust, though it will be interesting to see how this develops now that changes are under way. The management approach has shifted since the August 2008 death of Ian Rushbrook, who ran the portfolio on a full-time basis but with 'all major decisions' taken collectively at weekly board meetings.

Since 2009 Sebastian Lyon of Troy Asset Management has been 'investment adviser', with responsibility for day to day decisions, and last year there were only five formal board meetings. However, Robin Angus, who has been a director since 1984 and full time executive director since 2002, and whose shareholding is worth over £1.8 million, keeps an eagle eye on any developments and can consult his colleagues whenever a decision is required.

Rushbrook's son Frank, whose family stake is worth over £5 million, is retiring from the board next year. There have been several other recent changes and Angus says that he and 73-year-old chairman Hamish Buchan will be seeking retirement 'in due course'.

The challenge is to find new directors who will maintain the board's commitment to what Buchan describes as "its long tradition of independent thought and action".

Angus says boards need to include people with a range of skills, such as law and accountancy, and ideally a good gender balance. But above all, perhaps, they need some investment specialists: "It is important to have constructive dialogue with the investment adviser not just about matters such as asset allocation, but also to test their thinking on their investment ideas. This can help them as well as us."

Angus says it is critical to find a mix of individuals who will get on with the investment adviser, as it won't work if they are at loggerheads. It is comforting to see that Lyon has a large shareholding, worth over £4.5 million.

Investment trust historian John Newlands, of Newlands Fund Research, says self-managed trusts should be able to achieve lower costs and their managers should be more focused. Ideally, he says, they need a fiercely independent chairman who is a seasoned investor and has a lot of skin in the game. 'If there is a benevolent dictator who does a good job, it can work out well,' he says.

Focus on the Scottish Investment Trust

If you are employed by a fund management group, your job is to gather assets, but with a self-managed trust your job is to focus exclusively on its success. That means working very closely with the board and agreeing on what is needed for its long-term survival. So says Alasdair McKinnon, who was promoted to lead manager of The Scottish Investment Trust in 2014.

The trust's performance prior to the change had been uninspiring and McKinnon says he and the board mutually decided that radical action was needed if it was to fend off the challenge from low-cost index trackers.

Scottish wanted to continue to invest in international equities for above-average long-term returns and dividend growth, so as to retain its claim to be a core holding for private investors, but it needed to cut costs and to establish a distinct identity and an explainable investment process.

Past performance is not a guide to future performance

McKinnon explained his philosophy to the board. Fundamentally, he said, the stockmarket is behaviourally very cyclical and over the long term there is money to be made by adopting a contrarian approach - though investors may need to be patient to benefit from it.

The board, which included a number of highly respected investment specialists, agreed.

Costs were pared back and McKinnon began to follow a high-conviction, contrarian approach. As a result the portfolio was concentrated down to 54 holdings and is now focused on companies which are out of favour and therefore relatively cheap, but which the team believe have the potential to recover and be re-rated.

To date this fresh approach has had mixed results on the capital front, but worked brilliantly for the revenue account, as the shift into higher-yielding shares has boosted the trust’s revenue sufficiently to fund a substantial increase in its dividend. This has been raised for 34 consecutive years, is amply backed by revenue reserves, and is paid quarterly.

Asked how easy it is to manage a global portfolio with a team of five (pared back from 11), McKinnon replies that it is much more cohesive now it is smaller.

"As lead fund manager you have to decide which stocks to pick, and that's much easier with a tight team that is not obsessed with internal politics."

McKinnon has watched in disbelief as companies such as Amazon and Facebook have soared in value, and could not resist a gloat when Facebook shares suffered in the summer.

"As the slide in Facebook reminds us, everything is cyclical. Companies such as [gold miners] Newcrest and Newmont offer considerable opportunities when their cycles turn – and exemplify the out-of-favour stocks that we seek out for our investors."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.