Time to look beyond the US trust tech winners of recent years?

There are plenty of opportunities for those looking to diversify away from mega-cap tech.

23rd April 2021 17:26

There are plenty of opportunities for those looking to diversify away from mega-cap tech.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Large-cap technology stocks have dominated global markets in recent years, especially in the US where the FAANGs (Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL)) have reigned supreme. Combined, the FAANGs and Microsoft (NASDAQ:MSFT) currently make up 12% of global equity markets while also having been among the best-performing companies globally.

Yet we think the future doesn’t look as bright for these giants, with a series of antitrust suits on the horizon and declining tailwinds from Covid-19 lockdowns. That said, these issues don’t reflect a poor outlook for the rest of the US market. In fact, we think investors have much to be excited about in the US. With substantial amounts of pending fiscal stimulus as well as strong consumer and corporate sectors, it may simply be time to look for opportunities beyond the conventional FAANG-heavy strategies.

Below, we outline the current state of the North American sectors and what they offer. We think they offer plenty of opportunities for those looking to diversify away from mega-cap tech, with some trusts having generated enviable returns over 2020 while still trading at a discount today.

The US sector in review

The North America sector remains divided between growth and value styles, with most strategies clearly falling into one camp. Even the only core strategy in the sector, JPMorgan American (LSE:JAM), is itself a blend of dedicated value and growth portfolios. The story is slightly different in the small-cap space, which is now more uniform in its growth bias given the current quality-focused portfolio of JPMorgan US Smaller Companies (LSE:JUSC), which has seen an ever increasing premium attached to it. Also Brown Advisory, the new management company of Jupiter US Smaller Companies (LSE:JUS), is implementing a quality growth strategy.

While this article outlines many promising future opportunities across a range of US equity factors, there can be no doubt which style has reigned supreme recently: growth. As can be seen from the below table, the determining factor for three-year returns has been the overall growth bias of the portfolio, with Baillie Gifford US Growth (LSE:USA)– the most growth-focused trust – far ahead of the pack in NAV total returns. Also among the best performers was the growth-orientated small-cap trust JUSC.

US-focused trusts

| Name | Growth-value score | Avg. market cap (mill. USD) | Three-year perf (%) | One-year perf (%) | YTD perf (%) | Discount/premium (%) |

|---|---|---|---|---|---|---|

| Baillie Gifford US Growth | 358.1 | 58,680 | 230.7 | 107 | 8 | 6.7 |

| Jupiter US Smaller Companies | 222.2 | 2,129.70 | 57.7 | 70.8 | 13.9 | -6.6 |

| JPMorgan US Smaller Companies | 202.1 | 4,066.70 | 59.2 | 76.7 | 11.8 | 3.6 |

| JPMorgan American* | 167.1 | 122,629 | 75.5 | 54.5 | 11.7 | -5.7 |

| Gabelli Value Plus+ Trust | 70.1 | 5,675 | 36.5 | 67.9 | 17.6 | -5.5 |

| BlackRock North American Income | 45.1 | 76,354 | 42.9 | 35.4 | 13.7 | 2.5 |

| North American Income Trust | 40.8 | 68,788 | 28.6 | 32.6 | 13.8 | -8.8 |

| iShares S&P 500 Index | 163.9 | 173,681 | 71.5 | 36.8 | 10.7 | |

| iShares NASDAQ 100 ETF | 261.6 | 342,833 | 121.4 | 44.9 | 7.9 | |

| iShares Russell 2000 ETF | 164.2 | 2,720.40 | 55.9 | 74.8 | 13.6 |

Source: Morningstar, as at 16/04/2021. All performance reflects NAV total return. *JAM saw a change in team and strategy in June 2019, though it remained invested in US large caps. Past performance is not a reliable indicator of future returns

However, despite this growth every trust is actually underweight to technology versus the S&P 500, and with the exception of Gabelli Value Plus+ (LSE:GVP) and USA, they are also underweight to communication services (which includes Alphabet, Netflix and Facebook as well).

While underweighting mega-cap tech may be attractive for diversification and potentially also future returns, any past material underweight would have been an overall detractor to performance, especially in 2020. Over 2020, the S&P 500 technology sector returned 44%, more than any other sector and 10% ahead of consumer discretionary, which includes Amazon. Moreover Apple, Amazon and Microsoft alone accounted for 53% of the S&P 500’s total return over the period. JAM has been boosted by holding large positions in all three companies and has outperformed the S&P 500 over the last year despite its circa 40% dedicated value allocation.

Sector weights

| Name | Communications services (%) | Technology (%) |

|---|---|---|

| Baillie Gifford US Growth | 15.6 | 21.6 |

| Gabelli Value Plus+ Trust | 16.8 | 3.2 |

| JPMorgan American | 5.3 | 21.7 |

| Jupiter US Smaller Companies | 1.2 | 18 |

| JPMorgan US Smaller Companies | 0 | 15.7 |

| BlackRock North American Income | 6.8 | 11.7 |

| North American Income Trust | 8.6 | 4.7 |

| iShares S&P 500 Index K | 11 | 23.8 |

Source: Morningstar, as at 31/03/2021

Only one trust has been able to command a consistent premium over the last three years: Baillie Gifford US Growth. While its alpha is the primary contributor, absolute performance or thematic demand have clearly been more important, and even successful value and core equity managers who have outperformed their benchmarks still trade at a discount. However, there is another trust which has begun to trade at a premium since the start of the year: JUSC. Tailwinds supporting US smaller companies – such as the vaccination programme and the prospects for a domestic economic recovery – have translated into increased shareholder demand. However, its only peer in the North American Smaller Companies sector, JUS, still trades at a discount. We think this is likely due to the relatively poor performance under the prior manager and the uncertainty caused by his retirement. However, given the track record of outperformance from Brown Advisory’s small-cap growth strategy in the open-ended space, we think this discount is unjustified and could well close as investors become familiar with the new manager. JUS’s new portfolio should benefit from the same supportive tailwinds that have led to JUSC’s premium.

Gearing continues to remain under-utilised in this sector. While there have been cases during the pandemic where managers have increased gearing in order to buy into the market at opportunistic valuations, like with Baillie Gifford US Growth, the general trend has been towards low if any gearing over recent years. Currently only the two JPMorgan trusts are utilising any form of gearing, likely reflecting the investment style of the asset management house rather than a specific sectoral trend, as both trusts use gearing in a tactical manner rather than to increase their broader market exposure.

One of the more interesting opportunities presented by the North America sector is for income investors, not something which would immediately come to mind given the US’s traditional preference for share buybacks and the S&P 500 yielding a mere 1.45%, its lowest level in two decades. Yet there are currently three trusts in the AIC North America sector with a dividend yield of greater than 4%. Given the near-term support for the value sector, America may offer income investors the enviable combination of attractive dividend yields and strong capital appreciation.

There is still value to be had in US value

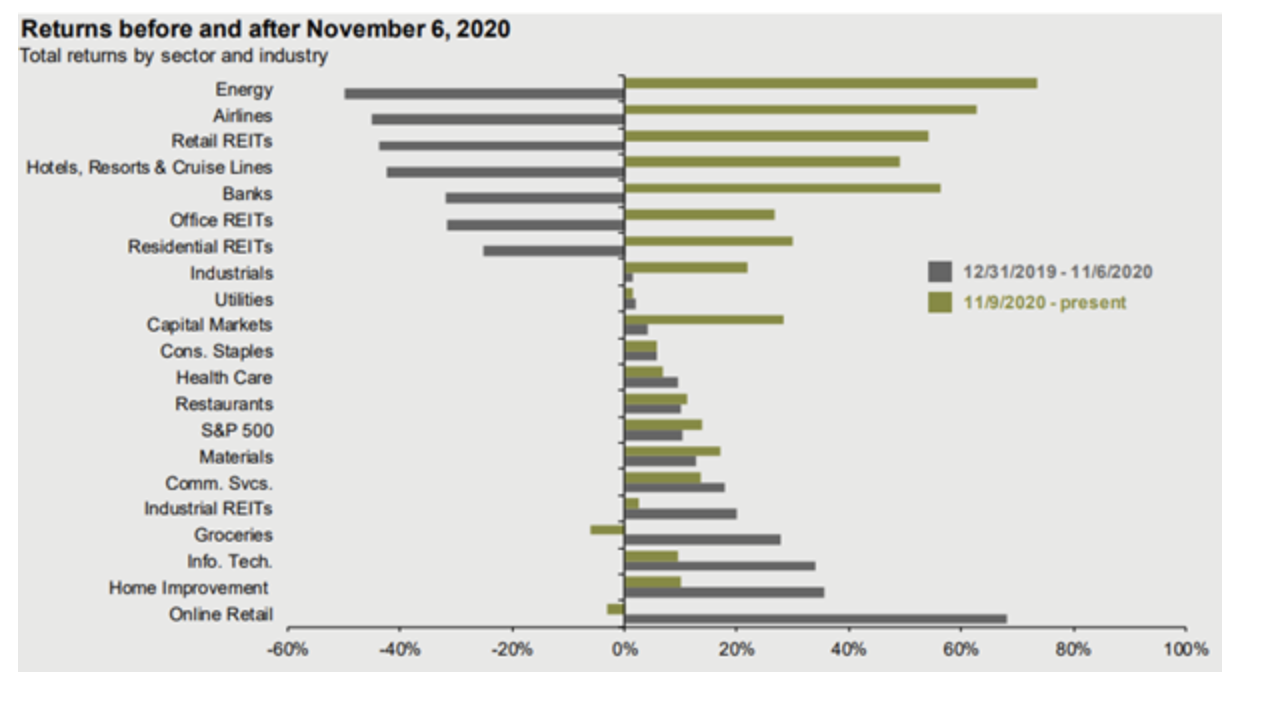

By the end of 2020 the gap between the forward P/E ratios of the cheapest and most expensive stocks in America had reached levels not seen since the dotcom bubble, the legacy of a dreadful period for US value versus growth which had in part been fuelled by valuation expansion. Over 2020 the Russell 1000 Growth Index returned 33.9% compared to the Russell 1000 Value Index’s -0.5%. Thanks to positive results from vaccine trials and now the successful roll-out of those drugs the tide has already turned, with the Russell 1000 Value having returned 13.8% YTD (Source: Morningstar, as at 116/04/2021), compared to the 7.4% of the Russell 1000 Growth. While the immediate tailwinds have come from the reversion of COVID-19 trade, where the market has rotated into the ‘COVID losers’ (the majority of which were value stocks) in anticipation of economic normalisation, the value sector is now primed to take advantage of the incoming US stimulus programme. Not only will this support the US consumer, which will help the blue-chip retailers like Walmart, but it will also be a much needed boost to financials, which composes the majority of the value sector given its sensitivity to US economic activity and the potential interest rate rises that are associated with fiscal spending.

Returns pre- and post-US vaccine roll-out

Source: JPMorgan, as at 31/03/2021

The reversal of the growth/value trade has long been expected by the managers of BlackRock North American Income (LSE:BRNA). BRNA has been unwavering in its allocation to high-quality US value stocks, split between an allocation to cyclical companies (a sector which has been a clear winner of the recovery trade) and more stable earners. While its focus on downside protection, quality bias and dedicated non-cyclical allocation has prevented it from fully benefitting from the recovery trade (which favoured the more deep-value, hardest-hit companies), it does mean the trust is well positioned to benefit from any broader value recovery, which will likely favour higher-quality value names which will see sustained growth over the recovery cycle rather than a quick post-COVID rebound.

For investors looking for a more ‘left field’ approach to value investing there is GVP, which, despite sitting in the AIC North America sector, is closer to the small-cap sector given its $5.7 billion average market cap. What makes GVP’s approach to value investing so different, other than the target market cap, is its emphasis on identifying catalysts which drive a value re-rating (as opposed to investing solely around the quality of a business). GVP’s catalysts can range from ‘hard’, such as corporate actions, financial engineering or liquidations, to ‘soft’, such as an uptick in specific economic activity. This has led GVP to have a portfolio with a 98% active share against the Russell 2000 Index, being heavily overweight to industrials, materials and communication services: an attractive feature for an investor looking to diversify away from the FAANGs and their peers. However, GVP faces a continuation vote in July following a period of disagreement between major shareholders and the board, and it may be liquidated if the vote is lost.

It is not the size of the boat

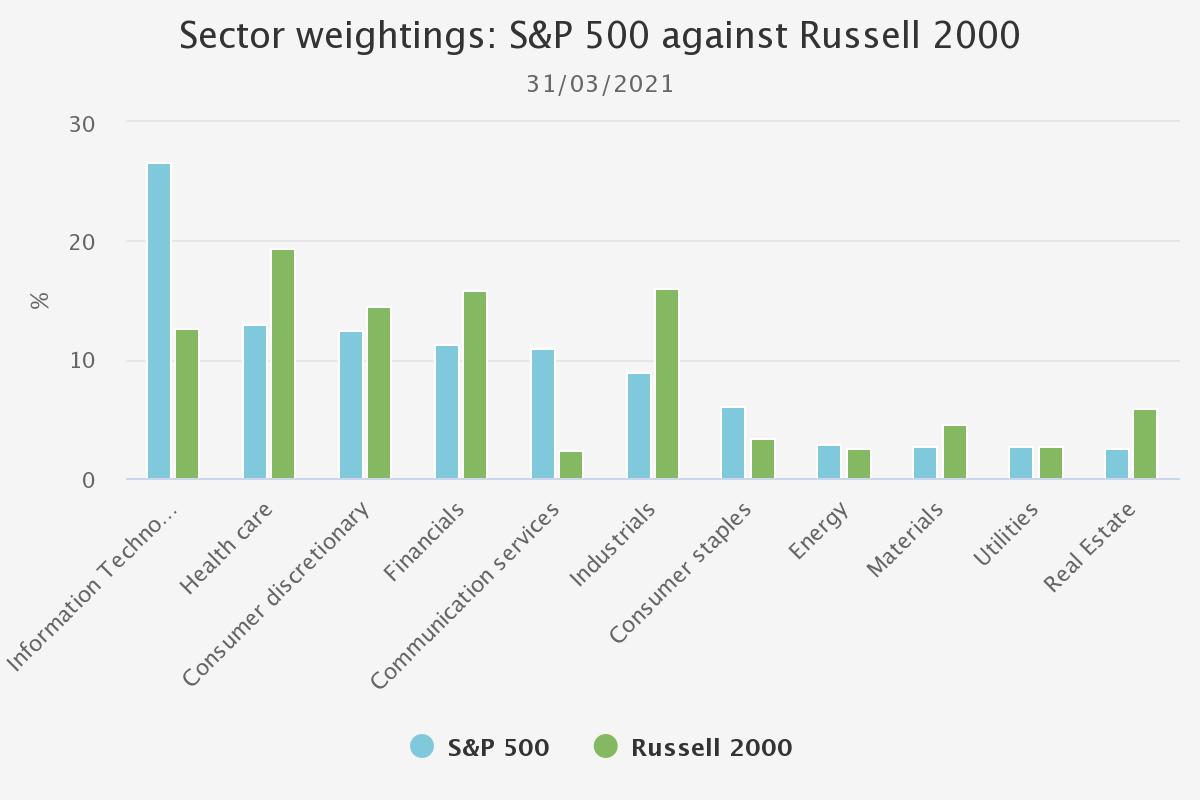

While the value sector is primed to take advantage of the anti-FAANG sentiment and the associated large-cap style rotation out of growth stocks, the small-cap sector is positioned to benefit from the domestic recovery. As was argued in our recent head-to-head article, the US consumer is looking exceptionally strong given high disposable income and a strong aggregate financial situation. This, coupled with the incoming fiscal stimulus from the Biden administration (which will eventually work its way into the average consumer’s pocket), means that small-cap companies – the vast majority of which rely on domestic demand for their services – have a host of positive tailwinds supporting them, especially with the post-lockdown surge in consumer spending.

Sector weightings of large- and small-cap US equities

Source: Standard & Poor’s, FTSE Russell, as at 31/03/2021

This is not to imply that the US small-cap sector lives or dies on the health of the US consumer, as there are plenty of companies which have risen up from the small-cap ranks based primarily on their ability to disrupt the incumbent market players and challenge the dominant large caps. This has allowed small-cap investors to capitalise on the tailwinds supporting growth stocks, while still avoiding many of issues plaguing the FAANGs. Just ask Brown Advisory, whose US small-cap team will soon take over the management of JUS, bringing with them their growth bias. Arguably the most recognisable holding of the Brown Advisory strategy has been Salesforce, which the company first purchased when it was nothing more than an obscure loss-making small-cap company. Salesforce is no longer part of the portfolio given its $215bn market cap firmly placing it in the large-cap sector, but it does act as evidence for both the stock-picking skill of Brown Advisory and the ability for US small-cap companies to challenge even the biggest players in their sector, including the FAANGs.

The opportunity set within US small caps is not relegated to the rapidly growing disruptors, for there are plenty of high-quality companies capable of sustaining strong earnings growth. This is something we outlined recently in our note on JUSC, a trust which offers its clients a portfolio of high-quality US small caps. One of the trust’s most promising holdings has been Douglas Dynamics, a manufacturer of snowplough components. While not as cutting edge as some of the (often speculative and loss-making) technology or biotech companies in the small-cap space, Douglas Dynamics offers its investors a highly sustainable business model with a well-versed management team that have been able to dominate a fragmented marketplace. Such companies are commonplace within JUSC’s portfolio, which has allowed it to generate 69.2% over the last 12 months, beating both the NASDAQ 100 and the S&P 500. The managers have observed that there has been an increasing demand for high-quality small-cap companies due to their ability to generate income even during the pandemic, as well as often being domestically sensitive companies which can best capitalise on the incoming tailwinds. This has led to an increase in the premium attached to US small-cap quality over the last 12 months.

Losing your FAANGs doesn’t mean losing your bite

As discussed above, the US equity market has been dominated by the mega-cap tech stocks, especially over 2020. Yet investors need to be able to differentiate between the FAANGs and the wider growth opportunities available in America. While the growth sector has been on the back burner in the first quarter of 2021, it doesn’t mean that its mid-term opportunity set has diminished: market sentiment today does not always reflect tomorrow’s earnings growth. Baillie Gifford US Growth has been an excellent example of this. While it does hold positions in the FAANGs, with an average 7% position in Amazon over the last 12 months, it is in fact underweight to the mega-cap tech names compared to the S&P 500. Its phenomenal returns have instead been driven by the more cutting-edge growth opportunities presented by the US large-cap market, be those in Shopify, Tesla, Nvidia or its unlisted holdings like SpaceX. Given Baillie Gifford US Growth’s enormous P/E ratio (Morningstar estimates its P/E to be 72), it has been the major loser in the recent value rotation, dropping from first to last place in performance over three months. Yet this recent blip may end up being a good entry point for growth investors, if one is confident that the headwinds facing the FAANGs will not spread to the wider sector and that the trust can continue its growth trajectory post-COVID-19, although that may be easier said than done.

While not explicitly in the AIC North America sectors, the same logic can also be applied to Allianz Technology Trust (LSE:ATT), which has 84% of its portfolio allocated to US technology companies. Of all the strategies mentioned in this note, ATT is most exposed to the FAANGs, holding all five stocks plus Microsoft within its portfolio. However, the team is becoming increasingly bullish on the mid-cap opportunities presented in America, which is where they now see superior earnings growth and have correspondingly increased the trust’s overall allocation. ATT demonstrates the difficulty of investing in the technology sector without having some exposure to the FAANGs, given their global dominance, but also the wider opportunity set available given the relative earnings growth perceived by ATT’s managers.

Balance in all things

While this article has outlined plenty of opportunities in the US outside of the conventional mega caps, there is a strong argument to retain some exposure to the FAANGs. One needs only to look at Microsoft, which is the elder statesman when compared to many of the large tech names but in 2001 faced its own major antitrust suit by the US government around its monopoly position (due to the restrictions it placed on operating systems and internet browsers). While the initial judgment was to have Microsoft broken up, it was eventually appealed and an antitrust fine was enforced instead. Microsoft has clearly recovered from this, given that its share price has increased eightfold since 2001.

For a US equity investor who is sceptical of the impact of antitrust, or for an investor who does not want to go all in on the recovery tailwinds supporting value and small-cap stocks, a more balanced approach may be needed, such as the one employed by JAM. JAM is a combination of two dedicated growth and value managers, allowing it to capitalise on both the recovery trade as well as the past tailwinds supporting the FAANGs. For evidence of this one needs only to look at JAM’s current top ten, which is a contrasting combination of the FAANGs and major US financials. This combined approach has allowed JAM to outperform the S&P 500 since its managers took over the trust in June 2019, a difficult feat to achieve for any balanced US strategy given that the majority of US equity fund managers have failed to beat the S&P 500 over the long term. This is a fact made famous by Warren Buffett, after he made a successful $1m bet with a hedge fund manager in 2008 that an S&P 500 tracker fund would beat a portfolio of hedge funds over ten years.

Conclusion

Mega-cap technology, and by extension growth investing, has been the dominant force in US equities over recent times, with growth investors being rewarded at the expense of their value-orientated peers. However, we think there are reasons to doubt the ability of the FAANGs to repeat their recent success, and the investment trust space offers a host of possible alternatives for investors looking to de-FAANG their portfolio. With the incoming stimulus from the Biden government supportive of small-cap companies and the various sectors which make up the value space, investors may now find attractive opportunities outside of conventional mega-cap tech. These could include BRNA, with its well established stance toward value stocks, or the quality growth portfolio of Brown Advisory, which is soon to take over JUS. These strategies and others demonstrate that there are still plenty of opportunities in US equities which do not rely on overweighting the FAANGs.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.