Two stocks crash by a third and this FTSE 100 firm is down 10%

Three high-profile companies have had a terrible day, punished for either disappointing profits, dividend cuts, weak forecasts, or all three. ii’s head of equity strategy explains the dramatic share price plunge.

28th February 2024 12:30

by Lee Wild from interactive investor

For months now, it’s been all about the Magnificent Seven and how they’re driving not just US markets to record highs, but also spreading some of that magic pixie dust further afield. But often it feels like it’s missed the UK. We’ve had some excellent performances from the likes of Rolls-Royce Holdings (LSE:RR.), easyJet (LSE:EZJ) and InterContinental Hotels Group (LSE:IHG), true, but there have been plenty of disasters, and some big names have been dealt a brutal blow today.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Most dramatic of the three notable fallers is St James's Place (LSE:STJ). We were told last month about fund flows at the wealth manager, but the market hadn’t been prepared for a pre-tax provision of £426 million, equivalent to 9.5% of the company’s market capitalisation.

The money has been set aside to cover potential client refunds, mostly linked to a “significant increase in complaints, particularly in the latter part of 2023” regarding the delivery of ongoing servicing.

It means the FTSE 100 firm swung to a loss before tax of £4.5 million versus a profit of £504 million the year before. The after-tax loss was £9.9 million compared with a £407 million profit last time.

On top of that, the annual dividend of 23.83p was about 54% less than the 51.42p expected by analysts. That’s because the final payout has been cut to just 8p from 37.19p a year ago. Management has also cut the payout ratio to 50% from guidance of 70%, so the dividend will be fixed at just 18p a share in 2024, 2025 and 2026. Anything left over will be used for share buybacks.

Chief executive Mark FitzPatrick explained: “A combination of the provision we have established and an expected decrease in the level of profit growth in the next few years as we transition to our new charging structure, reduces our ability to invest for long-term growth in our business over the next few years.”

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- eyeQ: FTSE 100 is cheap but should you buy it?

- Stockwatch: a 9% yield and nearest example to an ‘annuity’ share

A significant negative market reaction was inevitable, and St James’s shares traded as low as 410p mid-morning, down almost 34% from last night’s closing price at 621p. Shares, which were worth 1,700p each just over two years ago, haven’t traded this low since the end of 2012.

It was a bad day at the office for Halfords Group (LSE:HFD), too; a profit warning crashing its share price almost a third lower to levels last seen in October 2022.

Writing was on the wall a month ago when the company last updated shareholders. Then, it reported sales were below expectations, and warned that the Cycling and Consumer Tyres market had been “significantly worse than anticipated” and had weakened in Q3.

Instead, investors focused on a “resilient” quarter, better-than-expected cost savings, strong start to Q4 and unchanged full-year profit guidance.

Unfortunately, that confidence was misplaced, and three of the company’s four core markets - Cycling, Retail Motoring and Consumer Tyres – have suffered “further material weakening”. A “significant” drop in like-for-like revenue growth at the retail business means group profit for the year to 31 March will likely be £35-£40 million rather than the £48-£53 million expected previously.

Halfords blamed the wet and mild weather for lower customer numbers at its shops and sales of things like winter and car cleaning products. Putting more of its bikes in the sale plus more customers buying on credit also hit margins at the cycles business.

“Looking ahead to FY25, we remain cautious on market recovery in the short-term, and the current significant volatility in market conditions means that forecasting accurately is challenging,” the company said. “Notwithstanding this, we anticipate that underlying [pre-tax profit] in FY25 will be broadly in line with that forecast in FY24.”

It was also a grim day for one of the country’s largest companies, its shares trading down at their lowest since the Covid crash in March 2020.

Reckitt Benckiser Group (LSE:RKT), owner of brands such as Nurofen, Durex and Dettol, reported lower than predicted fourth-quarter sales, a 22% slump in annual profit and downbeat forward guidance for 2024.

My colleague Keith Bowman has more news on Reckitt’s results here.

- Insider: directors get buying at BT, Rolls-Royce and BAT

- Three stocks I wouldn’t sell

- Have Boomers come around to these shares?

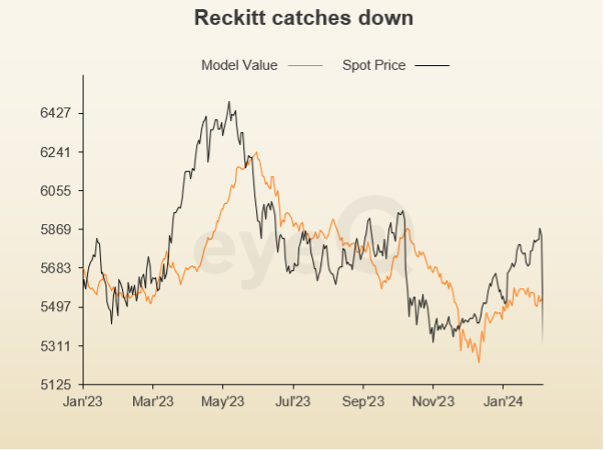

interactive investor has just teamed up with experts at eyeQ who use artificial intelligence, macro-economic factors and their own smart machine to generate actionable trading signals. Here’s what they say about Reckitt.

“Investors who follow the big picture would have known the stock was vulnerable to such news.

“Last night, shares closed at 5.3% rich to macro conditions, according to eyeQ’s smart machine. The early 2024 rally was not justified by big-picture fundamentals like economic growth, inflation and the Bank of England’s policy stance.

“After today’s sell-off, the shares are now 2.9% cheap to overall macro conditions.

“Macro relevance stands at 57%, just below our 65% threshold for macro being the dominant driver of price action. This means company news is critical right now. That could mean the hangover after poor earnings lasts a little longer until a new macro regime (the narrative that markets assign to price action) reasserts itself.”

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

Source: eyeQ. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.