Two stocks for the price of one

Having backed this company in the past without much luck, a major event means analyst Rodney Hobson believes this time is different. Here’s why.

10th September 2025 07:51

by Rodney Hobson from interactive investor

Economics students have for decades been taught about increasing returns to scale: the idea that bigger is better when it comes to running a business. You have the muscle to demand lower buying prices and higher selling prices while driving down costs by not duplicating effort. It also creates synergy as each partner sells to the other partner’s customers.

Alas, that does not always work, as any investor knows. Sometimes managements lose control of a sprawling empire.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

So it has proved with the merger of food groups Kraft and Heinz into The Kraft Heinz Co (NASDAQ:KHC). This joining up of two mighty businesses in 2015 to create an even mightier conglomerate has not worked out as well as expected. The fact that it was engineered by the mightiest of investors, Warren Buffett of Berkshire Hathaway Inc Class B (NYSE:BRK.B)fame, shows that no one gets it right all the time.

This year has been particularly unkind to the enlarged company. Continuing market pressures were blamed for a fall in sales and profits in the first quarter, prompting a downgrade in guidance for the full year. The continued adverse publicity against processed foods has had an effect, as has a switch by penny-pinching consumers away from expensive brands towards cheaper generic alternatives.

Price increases in recent months could not come anywhere near to offsetting declining sales, nor could improvements in efficiency fully compensate for higher procurement costs. The company admitted that organic net sales, which strip out the effect of currency movements, were set to decline by up to 3.5% during 2025 rather than grow modestly as previously hoped.

Worse was to come in the second quarter as a $9.3 billion (£6.9 billion) impairment charge plunged the company into a net loss of $7.8 billion. This led Kraft Heinz to launch a review in May to consider its options.

- Stockwatch: Amazon or Alibaba? Here’s the one I’d buy

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Why investors shouldn’t worry about weak stocks in September

The outcome is a widely expected plan to break into two parts, probably in the second half of next year, to reduce the complexity of the business. Both companies will be listed, with one concentrating on groceries and the other on sauces, seasonings and spreads.

This is not going back to the two original businesses, as some brands from both will be placed in each category, so at least some rationalisation has been achieved, albeit by a rather tortuous and expensive route.

The current chief executive Carlos Abrams-Rivera is actually going with the smaller part, groceries, with sales of about $10 billion as opposed to the $16 billion worth in sauces.

This break-up will inevitably be messy and costly. The loss of synergies will cost $300 million for a start, so investors will have to hope that handling two businesses of a more manageable size will allow the respective managements to get a tighter grip on allocating capital so that the best-performing bits are nurtured.

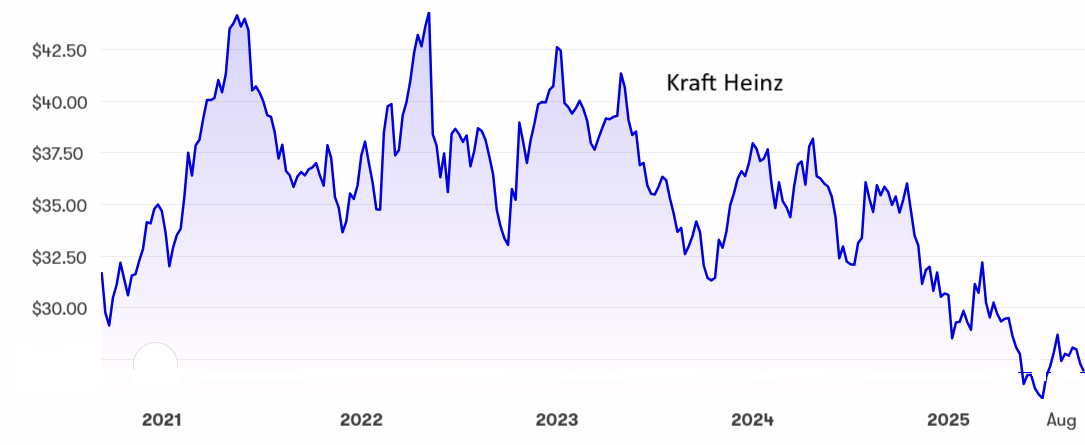

Kraft Heinz shares have fallen from a peak of $44 in May 2022 to just under $27 now, having dropped below $26 in June. At current levels the price/earnings (PE) ratio is impossible to calculate given the one-off first-half loss but there is a yield of 5.9% that anticipates a possible reduction in the dividend.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Kraft Heinz shares have been on a slide for over four years, during which there have been several dead-cat bounces, and the small pick-up since the demerger was announced could be yet another false dawn. I have previously felt that Kraft Heinz rated a buy at $40, $36 and $32, so my record on this company leaves something to be desired even though the capital loss has been partly offset by dividends.

However, the splitting of the hard-to-digest conglomerate into two bite-sized chunks looks sensible. The impairment charge will not be repeated, and the underlying business is still making a profit. Despite the clear element of risk, the shares are worth buying.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.