Two top stocks for Veganuary

He succeeded with this idea before. Now our overseas investing expert thinks it’s time for another bite.

13th January 2021 10:58

by Rodney Hobson from interactive investor

He succeeded with this idea before. Now our overseas investing expert thinks it’s time for another bite.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Investors who resolved to eat less meat in the new year could consider putting their money where their mouth is. Competition among manufacturers of plant-based alternatives to meat has increased but then so has the size of the market for their products.

The latest surge in meatless “meat” is a deal under which Kellogg (NYSE:K) will supply sandwich fillings for coffee bars chain Dunkin’ – the Southwest Veggie Power Breakfast could prove quite a mouthful in more ways than one.

Nestle (SIX:NESN) and Unilever (LSE:ULVR) launched rival meatless burger patties late last year, products that together with Kellogg’s popular veggie brand MorningStar Farms could prove a threat to smaller, newer rivals that lack the firepower of a global brand. However, there is surely plenty of scope for specialists to find a lucrative niche.

- Invest with ii: Most-traded US Stocks | Sustainable Investing Ideas | Cashback Offers

Sales of plant-based proteins are set to grow 20% a year for the foreseeable future, possibly taking sales beyond $10 billion by the middle of the decade. Currently the switch from meat is being held up by the high cost of plant-based products, which can be priced at two to three times their meat-based rivals.

- US stock market outlook 2021: boom or doom?

- Use our helpful results calendar to find out when the world's largest companies report

- Want to buy and sell international shares? It’s easy to do. Here’s how

There are signs that price reductions should narrow that gap substantially, which will lend greater weight to the argument that plant-based products are more environmentally friendly and contain fewer preservatives and other potentially unhealthy additives.

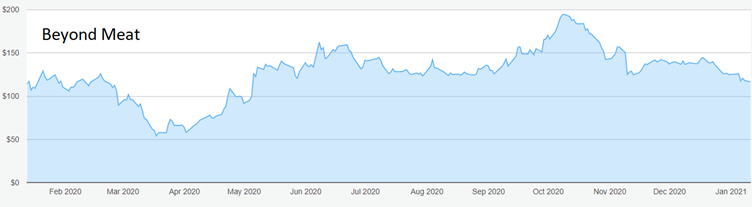

The most popular choice among a limited range of purely plant-based protein producers has probably been Beyond Meat (NASDAQ:BYND), a Californian-based company that makes burgers from plant-based protein. It doesn’t pay a dividend and is unlikely to do so in the foreseeable future, but what it lacks in payouts it makes up for in share price excitement.

It was floated at $65.75 in May 2019, nearly quadrupled to $235 in less than three months and was back to $80 three months later as realism set in. The stock has since been as low as $58 and back up to a grossly overvalued $195, but at around $120 it is more realistically priced.

Source: interactive investor. Past performance is not a guide to future performance

However, some caution is required. Third-quarter earnings were a serious disappointment as restaurant closures caused by the Covid-19 pandemic more than offset a 39% year-on-year increase in retail sales. Analysts fear that fourth-quarter figures will be equally disappointing and that lower sales may persist into 2021.

Beyond Meat has the benefit of being an early pioneer in a potentially lucrative sector and it will undoubtedly return to overall growth, assuming that various vaccines curb the pandemic. But it could be 2022 before the company turns in a profit, especially as the company has been forced to sell at discounted prices to compete with the larger rivals that have bigger marketing budgets.

- Top of the markets: US smaller companies outperform

- Most-bought US stocks in 2020

- Will 2021 be a year of RECOVERY for global stock markets?

On the positive side, the company struck a deal with McDonald's (NYSE:MCD) in November to supply the fast food chain’s new McPlant burgers. Apart from providing extra sales, the initiative is a big morale boost for Beyond Meat as McDonald’s rarely acknowledges partnerships with other brands.

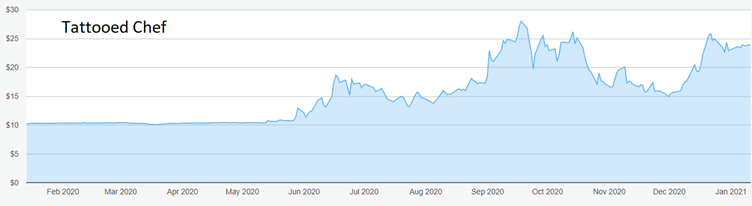

An alternative, less well known, investment is Tattooed Chef (NASDAQ:TTCF), which has suffered less in the pandemic as it sells through retail outlets.

Source: interactive investor. Past performance is not a guide to future performance

The shares hovered around $10 for more than two years before shooting up to a peak of $28. They are off their best just above $25.

- Why this $5bn stock is not just for vegans

- What Bill Ackman thinks will happen to stocks in 2021

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Hobson’s choice: Beyond Meat is still nicely up on my buy tip at up to $89 made in November 2019, though investors who got out at the recent peak did really well. I wouldn’t buy above $125 as there is likely to be resistance around that level. More cautious investors may prefer to see if the stock settles back further in the hope of buying at $110 on the way back up.

Buy Tattooed Chef up to the previous peak of $28.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.