Why we’re easing up on racy bond funds

Saltydog Investor looks at some sturdier options after a shift in market conditions.

20th October 2025 14:52

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, we help our members control the volatility of their portfolios by grouping the Investment Association (IA) sectors into our own proprietary Saltydog Groups.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

The least volatile sectors, such as Standard Money Market and Short Term Money Market, fall into our “Safe Haven” group, while more adventurous sectors, like Technology & Technology Innovation and China/Greater China, sit within our “Full Steam Ahead” groups. Between them are the “Slow Ahead” and “Steady as She Goes” groups.

Using this framework, it becomes possible to take a “core and satellite” approach to portfolio construction. This combines a relatively cautious core, which provides steady long-term returns, with smaller “satellite” holdings that aim to enhance performance or exploit specific opportunities.

The core typically makes up 60–80% of a portfolio, providing consistency and acting as an anchor during market turbulence. The satellite portion, around 20–40%, allows for more dynamic or higher-conviction positions.

In our demonstration portfolios, the core funds come predominantly from sectors in our “Slow Ahead” group. These include £ Corporate Bond, £ Strategic Bond, and £ High Yield Bond, alongside the Mixed Investment 0–35% Shares, Mixed Investment 20–60% Shares, Mixed Investment 40–85% Shares, and Targeted Absolute Return sectors.

- Funds and trusts four pros are buying and selling: Q4 2025

- ii Top 50 Fund Index: most-bought funds, trusts and ETFs in Q3 2025

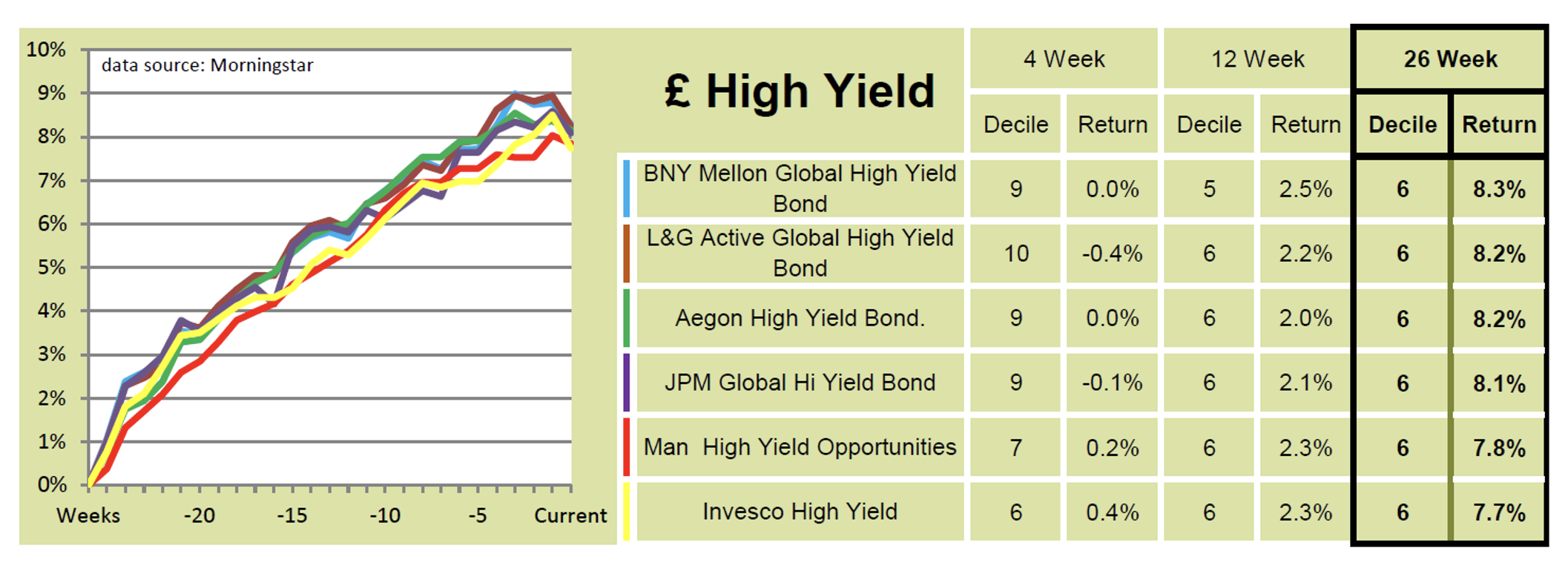

For the past couple of years, we have maintained relatively high exposure to the £ High Yield sector, with funds such as Invesco High Yield and Schroder High Yield Opportunities performing well for us. However, after a strong run earlier in the year, sterling high-yield bond funds have recently slipped behind other fixed-income and mixed-investment sectors.

Our analysis last week showed that while the leading funds in the £ High Yield sector have delivered gains of more than 8% over six months, their progress has flattened or reversed in recent weeks.

All in all, it has not been a bad place to be for the lower-risk portion of a portfolio, but returns over the past few weeks have been disappointing.

Past performance is not a guide to future performance.

The reasons lie in how different types of bonds behave and how current market conditions have shifted against them.

At the safer end of the spectrum are gilts, which are essentially loans to the UK government. They are considered virtually risk-free, so their prices mainly respond to changes in interest-rate expectations: when rates fall, gilt prices rise, and vice versa. Next come corporate bonds, issued by financially sound companies. These pay higher yields than gilts to reflect the extra risk of lending to a business rather than the government.

Strategic bond funds have greater flexibility. Their managers can adjust maturity, credit quality, and currency exposure as conditions evolve, shifting between government, investment-grade, and high-yield bonds, or holding more cash when markets look uncertain. At the riskier end are high-yield bonds, issued by companies with lower credit ratings. They offer higher income but are more vulnerable when investors turn cautious.

Bond returns are mainly driven by three factors: carry, spread, and duration. Carry is the regular income investors receive from coupon payments. High-yield bonds have the highest carry because they pay the largest coupons, which can offset small price declines but not larger ones.

Spread is the additional yield a corporate or high-yield bond offers above a gilt of the same maturity, reflecting the market’s assessment of credit risk. When confidence is high, spreads narrow and bond prices rise; when risk appetite fades, spreads widen and prices fall. High-yield bonds are particularly sensitive to changes in spreads.

- What are bonds?

- Everything you need to know about investing in gilts

- Bond Watch: a standout performer so far in 2025

Duration measures both the time element of a bond and its sensitivity to changes in interest rates. It represents the weighted average time until a bondholder receives all future cash flows, including coupons and principal. The longer the duration, the more the bond’s price will move when yields change.

For example, a duration of five means the price will fall by roughly 5% if yields rise by one percentage point. Gilts and investment-grade bonds tend to have longer durations, so they benefit more when yields fall. High-yield bonds generally have shorter durations, making them less sensitive to interest-rate changes but more exposed to credit risk.

All else being equal, high-yield bonds should outperform over time. They offer higher income, and when markets are calm, that extra yield usually translates into stronger total returns. However, when conditions become more uncertain, the picture changes. High-yield funds are driven mainly by spreads, and these can widen quickly if investors start worrying about growth or default risk. Even with their higher carry, price falls can outweigh the income advantage. Their shorter duration also means they benefit less when gilt yields decline, leaving them caught between weaker sentiment and limited rate sensitivity.

- Bond Boss: where next after 30-year gilt yields hit headlines?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Recent weeks have seen investors turn more cautious. Concerns over slowing growth, sticky inflation, and uncertainty about the timing of rate cuts have increased. Although government bond yields have eased, corporate credit spreads have stopped tightening and, in some cases, have begun to widen. That combination of lower gilt yields but wider credit spreads favours investment-grade and strategic bond funds over high-yield. The safer bonds gain from falling yields through their longer duration, while high-yield funds see little benefit and face headwinds from rising credit risk.

Valuations have added to the challenge. High-yield spreads were near multi-year lows earlier in the autumn, leaving limited upside but considerable downside if sentiment weakens. With refinancing costs for lower-rated issuers rising and default expectations edging higher, many investors have scaled back exposure to the riskier parts of the market.

At present, £ Corporate Bond funds offer a more balanced option, providing decent yields with less credit risk. £ Strategic Bond funds remain attractive for their flexibility, allowing managers to adjust positioning as conditions evolve. For a broader approach, the Mixed Investment sectors provide diversification across both equities and bonds, capturing a blend of income and growth.

In our own portfolios, we have been reducing exposure to the £ High Yield funds and increasing our holdings in the Mixed Investment sectors, particularly the Royal London Sustainable World and Liontrust Balanced funds.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.