Stock Splits

Stock splits and consolidations can be used to make a company's share price more practical and increase market liquidity.

All publicly traded companies have a specified number of outstanding shares in issue, and the value of the company at any given time (also referred to as its “market capitalisation”) can be calculated simply by multiplying this number by the current share price.

For varied reasons companies opt to split or consolidate the amount of its issued share capital. Read on to find out more, including how the process works and why our award-winning international service gives you an advantage over our competitors.

What is a stock split?

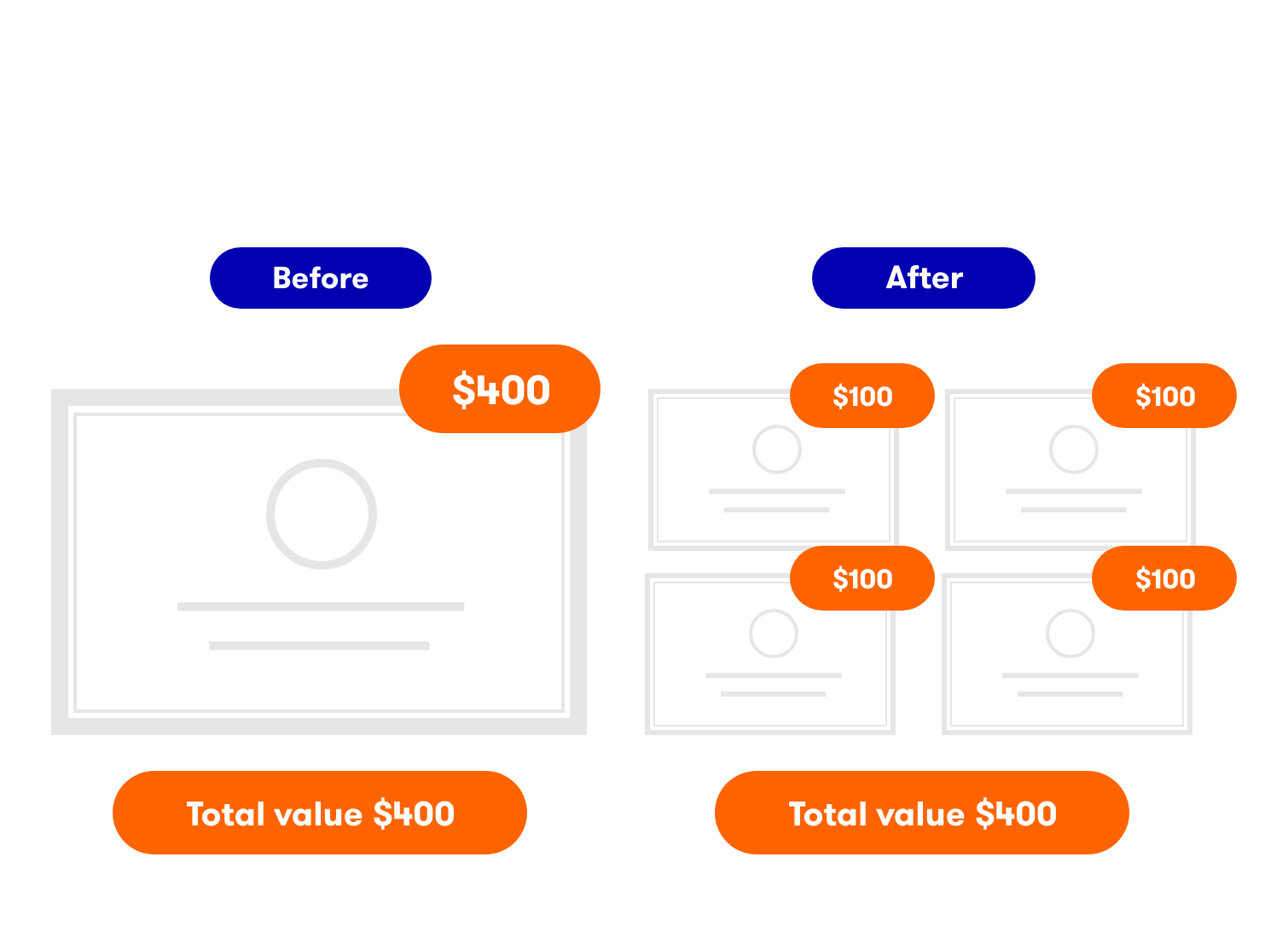

A stock split is a decision made by a company's board of directors to either increase or decrease the number of outstanding shares. Importantly, there is no net gain or loss in the company's overall market value.

For example, if a company doubles its share count by giving shareholders one additional share for every share they own, each shareholder will own twice as many shares. However, since no additional money has been paid into the company and the market capitalisation (theoretically) won't change, the share price would be expected to halve.

Split ratios

Each stock split comes with a ratio, which tells you the number of shares that will be in issue after the stock split and whether it’s a forward or a reverse stock split. If the first number is larger (as in a "10-for-1") it is a forward split. If the first number of the two is the smaller (e.g. a “1-for-3”) it indicates a reverse split.

Forward stock splits

Forward splits are the most common type of stock split. Known also as a share subdivision, they result in more outstanding shares but a lower price per share.

Pros for a forward split:

- Increase demand by making the shares affordable to more retail investors

- Maintain a desirable share price

- Easier to convert the shares into cash without affecting its market price

- To be similarly priced to other companies in the same sector

- To enable employee share incentive schemes and bonus allocations

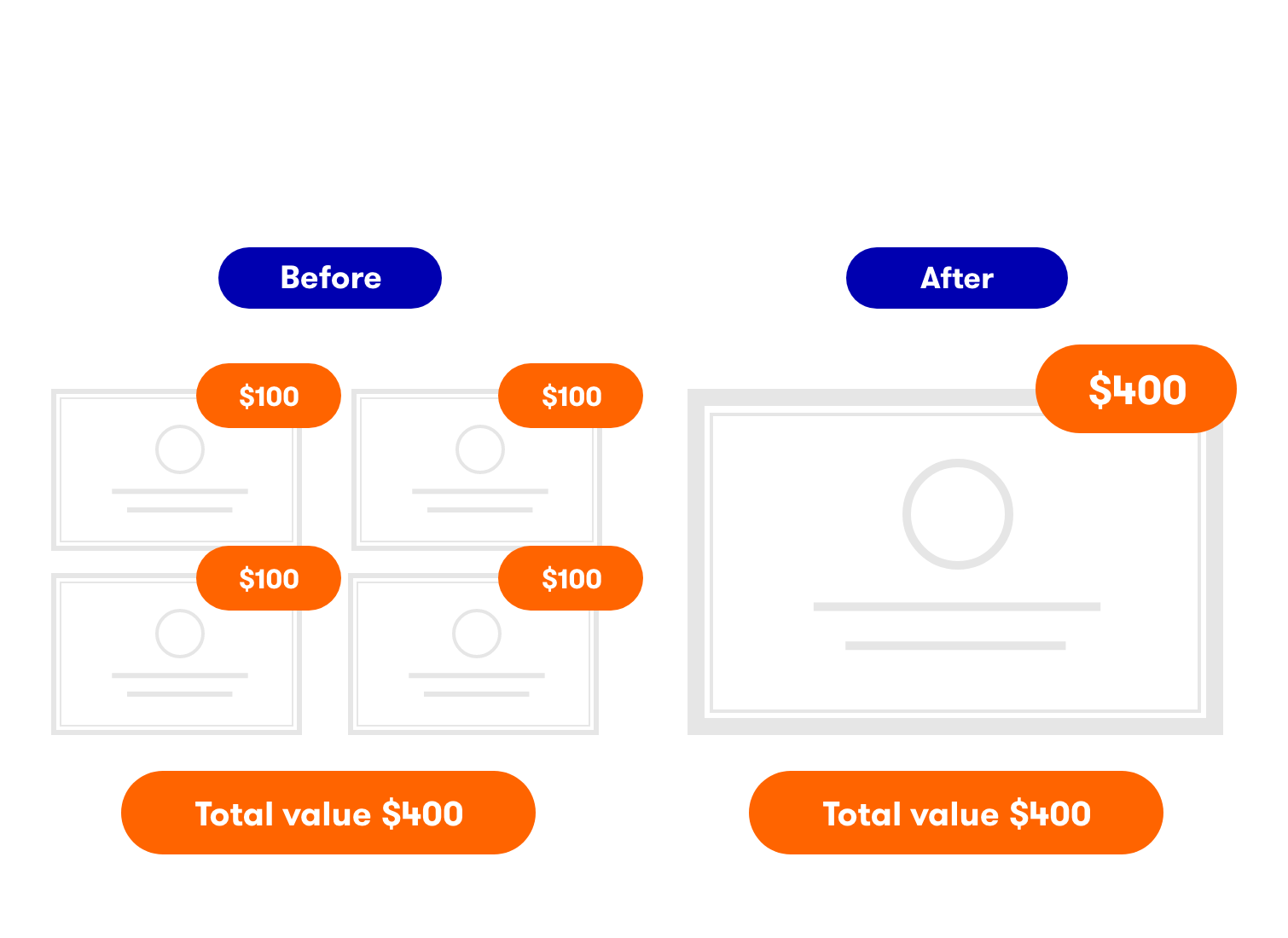

Reverse splits

Reverse splits, also referred to as a share consolidation, work in the opposite way to forward splits. Shares owned by existing investors are replaced with a proportionally smaller number of shares. Generally, but not always, this happens for a negative reason (e.g. after a big decline in a company’s share price).

Pros for a reverse split:

- Enhance market perception

- Reduce costs by removing low value or negligible shareholdings

- Reduce share volatility

- Improve trading conditions by narrowing the margin (or spread) between the sell and buy prices

Both things can happen, but as these are typically poor performing companies, it might do neither of these.

What impact will a split have on the company’s value?

Although a stock split won’t change the company’s overall value, the circumstances surrounding the split can positively and negatively affect its share price. For example, for many investors high-priced stocks (e.g. over $1,000 per share) are inaccessible. So, if a company opts for a forward split, to make its shares more affordable to more investors, this may cause a spike in demand and temporarily raise its share price.

The process

Stock splits have three key dates, which happen in the following order:

- Announcement date: This is the date the company publicly announces its plans to split and relevant details for investors, including the split ratio and timings.

- Record date: This is the date a copy of the shareholder register is taken to identify who is entitled to receive shares once the split is carried out. However, for investors it’s immaterial because if you buy or sell shares between the record date and the effective date, the right to the new shares is transferred.

- Effective date: This is the date when the company’s shares begin trading on an adjusted split basis and also the distribution date, when new shares will appear in your account.

The advantage of local custody

We conduct overseas trading through local brokers, unlike platforms such as Hargreaves Lansdown and AJ Bell, who use CREST Depository Interests (CDI’s) to allow their customers to trade international shares.

It’s thanks to local custody that there are no delays for our customers, and we can give you access to stock splits on the effective date. Customers of service providers who offer CDI’s must wait until these are updated within CREST.

Upcoming and previous stock splits

| Company Name | Split ratio | Effective date |

|---|---|---|

| Netflix Inc (NASDAQ:NFLX) | 10-for-1 | 17 November 2025 |

| Super Micro Computer Inc (NASDAQ:SMCI) | 10-for-1 | 1 October 2024 |

| MicroStrategy Inc Class A (NASDAQ:MSTR) | 10-for-1 | 8 August 2024 |

| Broadcom Inc (NASDAQ:AVGO) | 10-for-1 | 15 July 2024 |

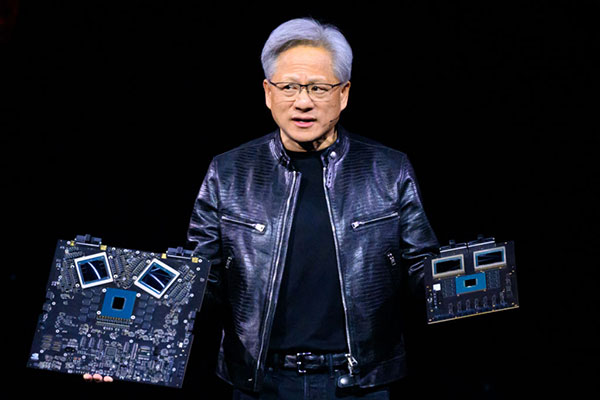

| NVIDIA Corp (NASDAQ:NVDA) | 10-for-1 | 10 June 2024 |

| Walmart Inc (NYSE:WMT) | 3-for-1 | 26 February 2024 |

| Palo Alto Networks Inc (NASDAQ:PANW) | 3-for-1 | 14 September 2022 |

| Tesla Inc (NASDAQ:TSLA) | 3-for-1 | 25 August 2022 |

| GameStop Corp Class A (NYSE:GME) | 4-for-1 | 22 July 2022 |

| Alphabet Inc Class A (NASDAQ:GOOGL) | 20-for-1 | 18 July 2022 |

| Alphabet Inc Class C (NASDAQ:GOOG) | 20-for-1 | 18 July 2022 |

| Shopify Inc Registered Shs -A- Subord Vtg (NYSE:SHOP) | 10-for-1 | 29 June 2022 |

| Amazon.com Inc (NASDAQ:AMZN) | 20-for-1 | 6 June 2022 |

Why we’re the right choice for international trading

- Choice - access one of the widest ranges of investments on the market.

- Value - fair, flat fees and a free trade every month.

- Award-winning - "Best Stockbroker for International Dealing" at the 2023 ADVFN International Financial Awards.

News and insights

Please remember, investment value can go up or down and you could get back less than you invest. The value of international investments may be affected by currency fluctuations which might reduce their value in sterling. We may receive two elements of commission in relation to international dealing - Trading Commission and our FX Charge. Please see our rates and charges for full details of the relevant costs. Foreign markets will involve different risks from the UK markets. In some cases the risks will be greater.