10 high flying mid-caps that are leading the market

Quality and momentum can propel stocks for long periods, but high flyers won't fly high forever.

15th January 2020 13:55

by Ben Hobson from Stockopedia

Quality and momentum can propel stocks for long periods, but high flyers won't fly high forever.

In the eyes of many investors, the valuation of a share is a key factor when it comes to deciding whether or not to buy it. After all, some of the biggest names in finance - from Buffett to Klarman to Greenblatt - insist that the way to make money in shares is to buy them when they’re marked down, mispriced and out of favour.

Sure enough, there’s no argument that value investing is a well-proven strategy. But it ignores a section of the market that almost always looks pricey - and in some cases looks terribly expensive. So does that mean that highly-rated, richly-priced shares are worth avoiding? The answer is not if you switch up some conventional investing rules and look for factors, other than value, that can generate the outperformance you want.

Two other factors that have been shown to be predictors of stock market profits are ‘quality’ and ‘momentum’. And when you mix strong quality and momentum in shares that appear expensively-priced, you enter the territory of High Flyers.

Why do High Flyers soar?

High Flyers are the shares that many of us would love to own. They’re the shares that always looked appealing but rarely looked cheap. They’re found among the market’s most successful multi-year compounders, ranging from big household names to little-heard-of specialist corporations. Often, they come with well defended business models.

Despite their expensive prices, High Flyers soar because of a blend of quality and momentum that drives them forward. They’re not infallible - and they can fall sharply if and when they slow down - but until that happens the returns can be eye-catching.

Company quality - which covers solid profitability, efficiency and strong and improving finances - is highly desirable for many investors. It can be a byword for resilience and dependability, and the market pays up for it.

In turn, momentum - both in terms of price and earnings acceleration - is one of the most powerful return drivers in the market. When quality interacts with momentum, more and more investors buy in and bid up prices. Success begets success, and as momentum builds in high quality stocks, they can soar.

Over the past decade we’ve seen this High Flyer process play out right across the market. For instance, drinks giant Diageo (LSE:DGE), which has tripled in price over ten years, has almost always ranked in the most expensive quarter of the market - and it still does. The same goes for the fashion brand Burberry (LSE:BRBY), which has quadrupled in price over a decade. It’s another high quality stock that has, often, benefited from persistent momentum despite a rich valuation. Among many others are names like Rightmove (LSE:RMV), Fevertree Drinks (LSE:FEVR), Dart (LSE:DTG), Next (LSE:NXT), RELX (LSE:REL)...

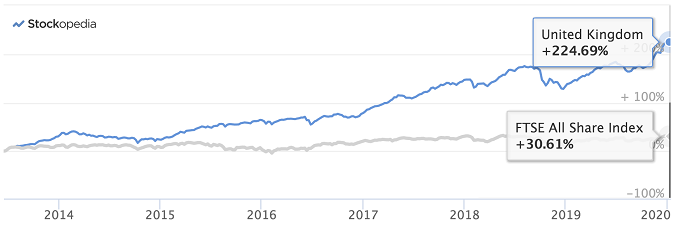

Tracking at Stockopedia shows that the High Flyer strategy has paid off over the past six years. A regularly refreshed portfolio of high quality and momentum (and expensively priced) shares handily outperformed - albeit in generally benign market conditions.

Top QM Rank shares (portfolio rebalanced quarterly), minimum market cap: £10 million, June 2013 - January 2020

With this in mind, this week’s screen picks up on the High Flyer theme by taking a look at high quality and momentum (but apparently expensive) mid-caps that are leading the market. In terms of volatility, it excludes the most conservative and most highly speculative shares - focusing on Balanced, Adventurous and Speculative levels of historic volatility.

This list is sorted by their proximity to hitting new 52-week highs. It gives a flavour of which shares the market is favouring during the early weeks of 2020. Industrials and Technology stocks have been some of the biggest recent movers, with Kainos (LSE:KNOS), Chemring (LSE:CHG) and XP Power (LSE:XPP) all currently trading at new highs.

| Name | Mkt Cap m GBP | StockRank Style | Risk Rating | Forward P/E Ratio | Price vs 52w High % | Sector |

|---|---|---|---|---|---|---|

| Kainos (LSE:KNOS) | 979.9 | High Flyer | Adventurous | 42.2 | 0 | Technology |

| Chemring (LSE:CHG) | 751 | High Flyer | Adventurous | 19.8 | 0 | Industrials |

| XP Power (LSE:XPP) | 692.5 | High Flyer | Adventurous | 21.4 | 0 | Industrials |

| Team17 (LSE:TM17) | 615 | High Flyer | Speculative | 37.9 | -0.426 | Technology |

| Ultra Electronics (LSE:ULE) | 1,625.50 | High Flyer | Adventurous | 18.5 | -0.434 | Industrials |

| Ascential (LSE:ASCL) | 1,663.10 | High Flyer | Balanced | 21.3 | -0.531 | Industrials |

| Hollywood Bowl (LSE:BOWL) | 468 | High Flyer | Adventurous | 20.3 | -0.637 | Consumer Cyclicals |

| Softcat (LSE:SCT) | 2,423.30 | High Flyer | Adventurous | 31.8 | -0.732 | Technology |

| Focusrite (LSE:TUNE) | 391.1 | High Flyer | Adventurous | 30 | -1.19 | Technology |

| Games Workshop (LSE:GAW) | 2,274.20 | High Flyer | Adventurous | 29.2 | -1.72 | Consumer Cyclicals |

Lessons from High Flyers

While valuation is a key consideration for many investors, it’s certainly possible to find outperformance in more expensive-looking shares. High exposure to a blend of quality and momentum can propel some stocks for extended periods - delivering stunning profits despite their apparently high prices.

The risk of course is that momentum can fade, and when it does the prices of high flying shares can fall sharply. So this is a strategy that needs careful attention. Paying a higher price for better quality shares on the move is a proven strategy of playing two very powerful drivers of returns in the stock market. High Flyers won’t fly high forever, but they can deliver stunning returns over long periods.

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.