10 promising dividend payouts from UK retail

While retail stocks are tricky territory for investors, these 10 offer promise in the hunt for income.

23rd October 2019 14:07

by Ben Hobson from Stockopedia

While retail stocks are tricky territory for investors, these 10 offer promise in the hunt for income.

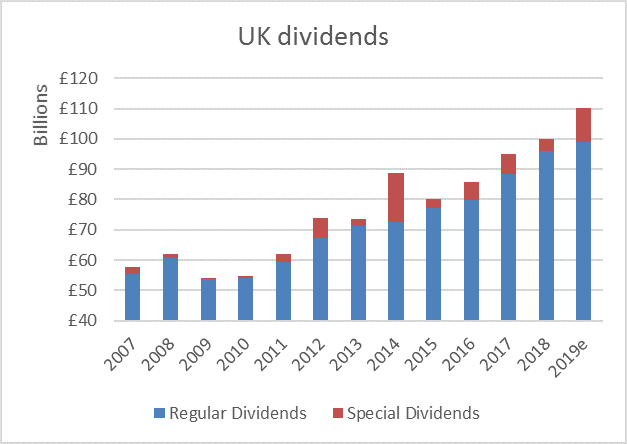

UK companies paid out £35.5 billion in dividends between July and September this year. With the total up by £2.3 billion versus 2018, it was a new record for third-quarter payouts. Even so, there are signs that after several fast-paced years, dividend growth is slowing down.

As ever when it comes to dividends, there are various moving parts that impact on what shareholders really feel in their wallets. At a headline level, dividend growth of 6.9 percent in the third quarter was still above the long-run average of 5 percent.

But what we’ve seen in recent months - according to stats from Link Asset Services - is a heavy skew caused by very large special dividends. When you strip all that away, payouts actually fell in those three months by 0.2 percent.

And even then, foreign exchange rates between the pound and the euro and the dollar flattered the numbers. The weak pound added around £850 million to the total. Strip that out and dividends fell by 3 percent in Q3.

Dividends in detail

Vodafone (LSE:VOD) - once one of the UK's most popular dividend stocks - has seen its business change a great deal in recent years. This year, a big cut to its dividend was a major drag on the overall FTSE 100 payout in the third quarter. Vodafone slashed its dividend by nearly 40 percent to €0.09 for the year. Even then, the dividend cover was negative.

Source: Link Asset Services

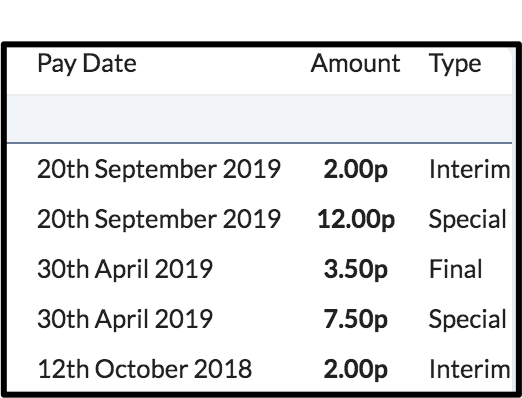

In terms of sectors, banking dividends jumped by two-fifths between July and September, with The Royal Bank of Scotland (LSE:RBS) being a major contributor. RBS will have paid out a total of £3 billion in 2019.

Last year, the bank initiated dividends after a 10 year hiatus following the financial crisis. An interim and final payment totalling 5.5p was supplemented by a special of 7.5p, making 13p for the year. In this financial year, the bank has already committed to 14p, with an additional final payout due next spring.

Stockopedia: Royal Bank of Scotland dividends since 2018

Elsewhere, mining dividends rose by almost a third, again thanks to special payouts from the two giants, Rio Tinto (LSE:RIO) and BHP Group (LSE:BHP). Both companies have seen profits soar in recent years and are currently on forecast yields of 7.2 percent and 6.4 percent respectively.

That contrasts with the oil sector, where foreign exchange was the largest factor in dividend growth of 2.8 percent in Q3. Meanwhile, the media, leisure, and food retail sectors all saw double-digit underlying increases, but most sectors delivered single-digit growth, according to Link.

Shopping for high street payouts

Problems on the high street mean that retail stocks remain tricky territory for investors. Third quarter dividends fell by a fifth, with cuts from Marks & Spencer (LSE:MKS), Superdry (LSE:SDRY), and Dixons Carphone (LSE:DC.). But more broadly, retail has seen some very mixed fortunes in the recent past.

The highest forward yields in the diversified retail sector are in stocks that have, unsurprisingly, largely seen their prices slump over the past year. Companies like Shoe Zone (LSE:SHOE) and Ted Baker (LSE:TED) have issued profit warnings, while Halfords (LSE:HFD) is also now expected to cut its payout because of challenging trading conditions.

| Name | Yield % Rolling 1y | Relative Price Strength % 1y |

|---|---|---|

| Shoe Zone (LSE:SHOE) | 10 | -35.8 |

| United Carpets Group (LSE:UCG) | 9.5 | -35.9 |

| Halfords Group (LSE:HFD) | 9 | -45.2 |

| Card Factory (LSE:CARD) | 7.9 | -5.71 |

| Ted Baker (LSE:TED) | 7.8 | -74.5 |

Source: Stockopedia

Yet, other retailers have managed to hold firm. In the current climate, where the outlook for shares may well depend on how Brexit is finally resolved, there is added uncertainty. But if equities do eventually bounce, cyclical, consumer-facing stocks could benefit - but there are no certainties.

This list looks for retailers with positive price performance against the market over the past year - so they enjoy investor support. Included in the table is the number of dividend increases over the past 10 years, dividend cover (all positive) and dividend growth forecasts, which vary a lot.

Motor retailers are regulars here, so to are stocks like Next (LSE:NXT), Dunelm (LSE:DNLM) and WH Smith (LSE:SMWH), which have been solid dividend growth stocks in recent years.

| Name | Yield % Rolling 1y | Div Cover Rolling 1y | DPS Growth % Forecast 1y | DPS Increases | Relative Price Strength % 1y |

|---|---|---|---|---|---|

| ScS Group (LSE:SCS) | 7.2 | 1.4 | 0.6 | 4 | 3.8 |

| Marshall Motor (LSE:MMH) | 6.1 | 2.6 | 0.08 | 3 | 8.7 |

| Vertu Motors (LSE:VTU) | 4.3 | 3.1 | 43.48 | 7 | 4.3 |

| Inchcape (LSE:INCH) | 4.2 | 2.3 | 0 | 7 | 25.4 |

| Dunelm (LSE:DNLM) | 4.2 | 1.4 | 33.72 | 9 | 50 |

| Motorpoint Group (LSE:MOTR) | 3.6 | 2.5 | 3.05 | 2 | 0.23 |

| Pets at Home (LSE:PETS) | 3.3 | 1.9 | 0 | 2 | 85 |

| Travis Perkins (LSE:TPK) | 3.3 | 2.3 | -0.71 | 8 | 46 |

| WH Smith (LSE:SMWH) | 2.9 | 2 | 9.64 | 9 | 21.1 |

| Next (LSE:NXT) | 2.6 | 2.7 | 4.06 | 7 | 29.7 |

Source: Stockopedia

A mixed outlook for income hunters

Overall, the dividend picture for UK shares has been strong this year but the growth outlook is perhaps starting to weaken. UK shares are set to yield 4.4% (excluding any special dividends) over the next twelve months, according to Link, with the FTSE 100 yielding 4.5% and the mid-caps 3.3%. Expectations are that 2019 will see the headline dividend total rise by 10.4 percent to £110.3 billion.

Michael Kempe, chief operating officer of Link Market Services said:

"The predicted economic slowdown is beginning to show as UK plc payouts falter after years of solid growth despite the gloss of huge special dividends and eye-catching FX effects. As the world economy falters and the UK remains mired in its political crisis, we are witnessing a significant slowdown in UK plc’s dividend growth rate. This is inevitable given the increasingly lacklustre performance companies are putting in on earnings. Unlike 2016 it is not due to problems in just one sector; it is a more generalised slowdown.

"2019 will almost certainly prove a temporary high-water mark for UK dividends. Volatile specials are likely to revert towards the mean, and sterling is already partially pricing in a disorderly exit from the EU, so these more superficial factors will provide less cover for a more sluggish underlying performance in the year ahead.

"Having said that, the yield on equities is extremely attractive. Dividends would have to fall far more even than during the severe recession a decade ago to bring the yield back into line with historic averages. A decline of that size is extremely unlikely."

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.