C-19 updates: Centrica, Next, National Express, Mitchells & Butlers

Some big names report today, among them National Express whose shares have quadrupled since March.

14th April 2020 13:38

by Graeme Evans from interactive investor

Some big names report today, among them National Express whose shares have quadrupled since March.

A much-needed long weekend for battle-scarred investors was soon forgotten today as the likes of Centrica (LSE:CNA), Mitchells & Butlers (LSE:MAB) and National Express (LSE:NEX) triggered more big moves in share prices.

The overall impact of the day's latest Covid-19 related announcements was neutral for the FTSE 100 index, although the FTSE 250 index shed more than 1.5% after enjoying its best week for more than two decades in the run-up to the Easter weekend.

Cineworld (LSE:CINE) and Carnival (LSE:CCL) were among those still showing extreme levels of volatility, with the pair down by 13% and 6% on the frontline of the coronavirus crisis.

Speciality chemicals company Elementis (LSE:ELM) was the biggest riser in the FTSE 350 index, with its shares continuing their record of fluctuation after an 8% rise today.

Shares in retail giant Next (LSE:NXT) also got an initial 3% boost after reopening its website in a “very limited way” following the introduction of additional social distancing measures at its warehouses.

British Gas owner Centrica, which is heading out of the FTSE 100 index after tumbling in value to just £2 billion during the current crisis, fell as much as 4% after announcing the immediate appointment of finance chief Chris O'Shea as its CEO.

- Richard Beddard: Two companies to prosper through the pandemic

- The Ian Cowie interview: profile of a top financial journalist

- Stock market optimists vs pessimists and the trusts to own

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

O'Shea impressed new chairman Scott Wheway during a month in temporary charge, but shareholders will be entitled to ask why it has taken since July to name a permanent successor to Iain Conn. He now faces one of the toughest jobs in the City, with shares at 34p and close to their lowest level since the company was created out of British Gas in 1997.

Centrica dealt a fresh blow to its army of “Tell Sid” shareholders last month when it pulled the 5p dividend payment that Conn had only rebased from 12p back in August.

The dividend pain for investors continued today when Hochschild Mining (LSE:HOC) and Ultra Electronics (LSE:ULE) withdrew recommendations to make payments relating to 2019 trading. It's been reported that about 50% of London-listed companies have suspended dividends in the past month.

National Express is also pulling its dividend, although there was better news for investors after the coach operator completed another leg in a journey that has seen the stock rally to 268p from a post-crisis low of 90p in mid-March.

Source: TradingView Past performance is not a guide to future performance

NatEx said the current lockdown had not stopped it from continuing to generate positive earnings and cashflow. Liquidity has also improved with over £200 million of cash on deposit alongside more than £1 billion in undrawn committed facilities.

The big surprise was that revenues for the first three months of 2020 were still 8.9% higher, helped by a significant growth of 17% in January and February. Even though the group is withdrawing its 2019 dividend, investors appear to be supportive of chief executive Dean Finch after he predicted that the company will emerge out of the crisis in a strong position.

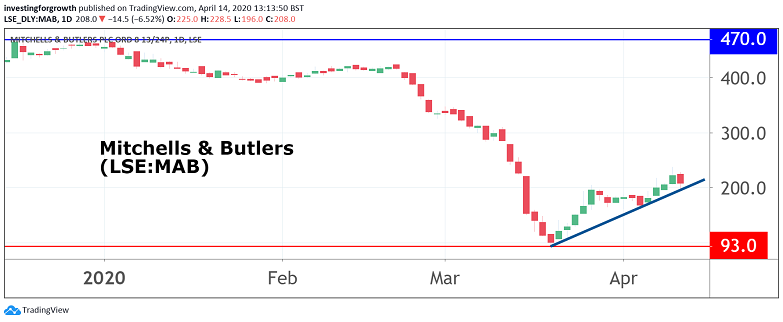

The uncertain outlook is clearly being felt by investors in pubs chain Mitchells & Butlers, where 99% of staff are furloughed during the third week of the government's lockdown. The company, whose brands include O'Neill's, Miller & Carter and Nicholson's, warned today that these pub closures could amount to a technical breach of its financing arrangements.

Even though a temporary waiver has been granted until 15 May pending further discussions, shares fell back 7% to 206p. That compares with 450p at the end of 2019 but double the 100p recorded in mid-March. In another twist, rival Marston's LSE:MARS moved 9% higher to 45p.

Source: TradingView Past performance is not a guide to future performance

Elsewhere in the hospitality sector, Restaurant Group (LSE:RTN) fell more than 10% to 53p as investors got their first chance to react to Thursday's £57 million share placing, which the Frankie & Benny's owner priced at 58p for 20% of the existing share capital.

Shares in pavings specialist Marshalls (LSE:MSLH), which last month withdrew its 2019 dividend, fell back 2% to 634p after its latest update on the measures it is taking in response to Covid-19. It said lenders were supportive, with the group having access to total bank facilities of £255 million.

The stock had been one of the star performers during last week's surge for the FTSE 250 index, rallying 25% over the period.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.