Four little-known funds delivering consistent returns

Saltydog Investor identifies four funds that have made money over the past six six-month periods.

20th November 2023 15:08

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor, we are always on the lookout for funds that are doing consistently well, and recently they have not been easy to find.

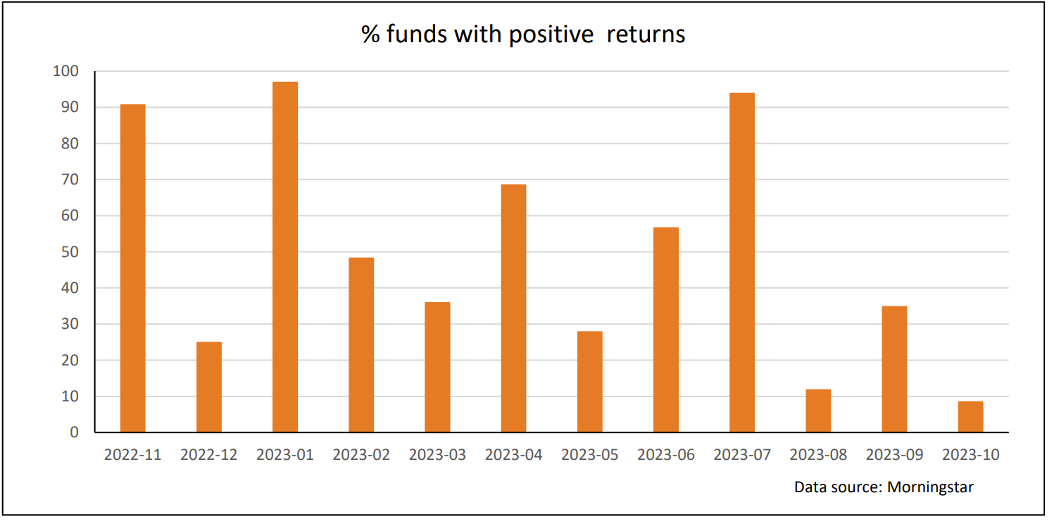

Last month, only 8% of the funds that we analyse rose in value, down from 35% in September. Only 3% of funds have gone up in each of the last three months and less that 1% have gone up in each of the last four months.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

Past performance is not a guide to future performance.

Last week, I highlighted the three funds that had made more than 5% in five out of the last six six-month periods. They were the three “energy” funds, Schroder ISF Global Energy, WS Guinness Global Energy, and BGF World Energy. No funds had made gains of over 5% in all six six-month periods.

That got us thinking: how many funds have actually gone up in each of the last six six-month periods?

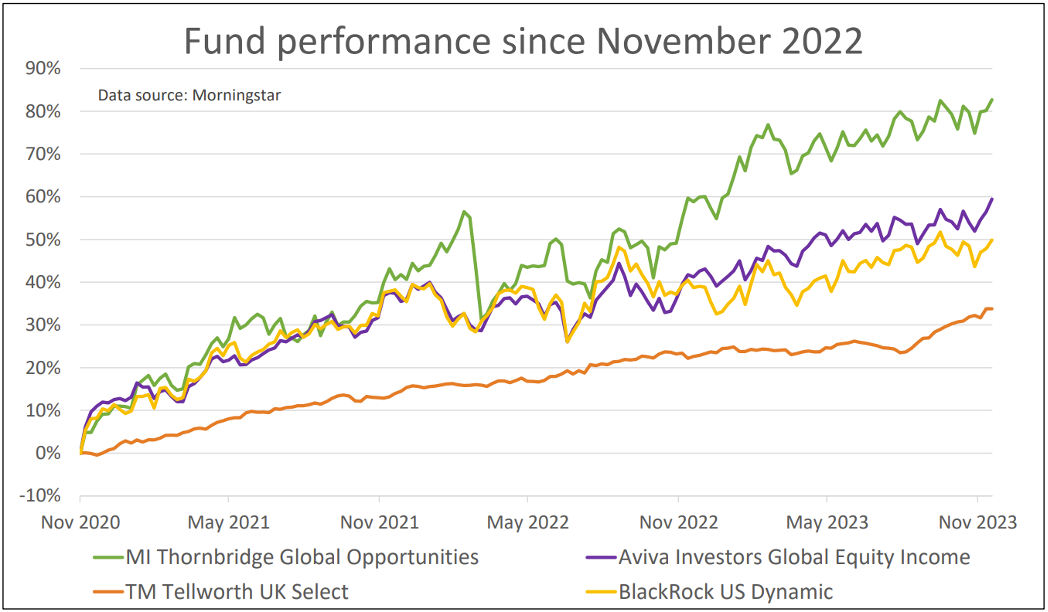

We crunched the numbers again and could find only four funds that satisfied the new criteria. They were MI Thornbridge Global Opps, Aviva Investors Global Equity Income, BlackRock US Dynamic, and TM Tellworth UK Select.

| Saltydog Investor 6x6 Report - November 2023 | Nov 20 | May 21 | Nov 21 | May 22 | Nov 22 | May 23 | 3 year |

| to | to | to | to | to | to | return | |

| Apr 21 | Oct 21 | Apr 22 | Oct 22 | Apr 23 | Oct 23 | ||

| Funds that have risen in 6 out of 6 periods | |||||||

| MI Thornbridge Global Opportunities | 26.8% | 6.7% | 6.1% | 4.7% | 14.2% | 2.6% | 76% |

| Aviva Inv Global Equity Income | 21.8% | 8.1% | 3.8% | 1.0% | 9.4% | 0.8% | 52% |

| BlackRock US Dynamic | 25.2% | 5.5% | 5.0% | 1.3% | 0.7% | 1.6% | 44% |

| TM Tellworth UK Select | 8.0% | 4.6% | 3.4% | 5.5% | 1.2% | 6.0% | 32% |

It is interesting that they come from four different Investment Association (IA) sectors. The MI Thornbridge Global Opportunities fund is from the Global sector, the Aviva Investors Global Equity Income fund is from the Global Equity Income sector, the BlackRock US Dynamic fund is from the North America sector, and the TM Tellworth UK Select fund is from the Targeted Absolute Return sector.

Over the three-year period, the Thornbridge fund has made the greatest return, gaining 76%, but it has also been the most volatile. It has had some fairly dramatic corrections along the way, but usually recovered relatively quickly.

- The fund sector delivering consistent returns despite choppy markets

- Funds suffer biggest outflow this year, but bonds remain in favour

The TM Tellworth UK Select fund has been much less volatile and has not suffered any significant falls in the last three years. However, that does not mean that it always goes up. During June and July this year, it dropped by around 2%, but it has been rising ever since.

Past performance is not a guide to future performance.

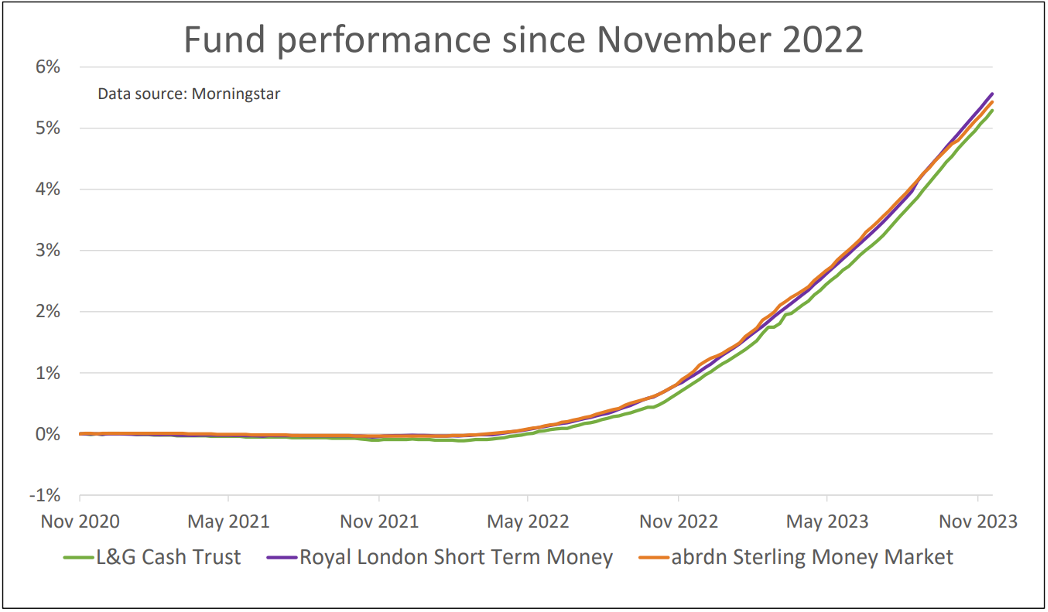

I was slightly surprised that none of the funds from the money markets sectors made the shortlist, especially when you think how well they have been doing over the last year. The problem is that if you go back a bit further to when interest rates were almost zero, the funds were sometimes unable to make enough to cover their costs. They never lost much, but there were some six-month periods when they went down rather than up.

However, over the last year their performance has improved dramatically as interest rates have been rising. We currently hold three funds from the money market sectors in our demonstration portfolios. They are the L&G Cash Trust fund, Royal London Short Term Money Mkt and abrdn Sterling Money Market. They have all gone up by around 2.5% in the last six months.

Past performance is not a guide to future performance.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.