FTSE 100 nudges 6,000, but Boris Bounce is short-lived

After the PM’s Sunday sermon confused workers and investors, there are winners and losers today.

11th May 2020 13:30

by Graeme Evans from interactive investor

After the PM’s Sunday sermon confused workers and investors, there are winners and losers today.

Boris Johnson's roadmap out of lockdown provided only limited direction for investors today, with banks and builders among UK-based stocks leading an early about-turn for the FTSE 100 index.

The top-flight initially surged 1% to within one point of 6,000, with Lloyds Banking Group (LSE:LLOY) among those on the charge in the opening minutes of trading.

But hopes for a fourth consecutive day of gains for the blue-chip index were dampened by a reversal of almost 100 points, as the reality of restarting the UK economy and others around Europe hit home.

Source: TradingView. Past performance is not a guide to future performance.

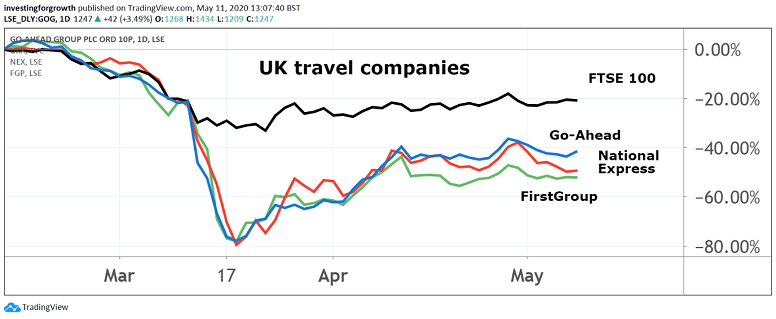

Investors appeared to share the wider public's frustration at the lack of detail in last night's televised address, particularly those wanting more clarity for retail or transport stocks.

Further guidance from the Government on workplaces and public transport is due to follow on Tuesday, although, in the meantime, rail operators have been told to prepare for a significant increase in the number of train services from next week.

That relief will be offset by the prospect of huge operational disruption and the advice to the public that those able to return to work should do so by driving, walking or cycling.

This guidance led to a mixed share price performance for the sector, with rail operator Go-Ahead (LSE:GOG) up 6% but FirstGroup (LSE:FGP) down 1% and coach and bus operator National Express (LSE:NEX) 1% ahead.

Source: TradingView. Past performance is not a guide to future performance.

In contrast, there was no stopping Halfords Group (LSE:HFD) as it continued its spectacular run by accelerating another 22%. The retailer is now up 270% from its March low, having revealed last week that it had benefited from a surge in bicycle-related sales during the Covid-19 lockdown.

Last week's update prompted one City firm to hike its profits forecast by 76%, with another adding that the shares were still “fabulously cheap”. Cycling accounts for 40% of Halfords' sales but motoring-related business now also looks set for a rebound as more vehicles return to the roads.

- How Halfords shares took post-crash rally past 170%

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The same factor helped Auto Trader in the FTSE 100 index, even though car showroom customers remain closed for business for the time being. The digital automotive marketplace rose 3% to 493.1p, compared with 364p in mid-March.

Other FTSE 100 risers included chemicals business Johnson Matthey and commodities giant Glencore (LSE:GLEN) amid hopes they will benefit from improved demand as more economies re-open.

This optimism has sustained world markets in recent days, with the S&P 500 up 1.7% on Friday despite the worst US jobs report in history. The 20.5 million decline in April's non-farm payrolls was better than Deutsche Bank's 22 million projection, as was the 14.7% unemployment rate, which was below its 17.1% estimate.

The fact this figure was the worst since the Great Depression shows just how much of this year's economic collapse is already being factored in by markets, regardless of the continued lack of a vaccine to fight any second spike in Covid-19 cases.

The support of central banks has been the crucial factor, helping technology stocks to drive the Nasdaq 6% higher last week and to a point where it is now stronger across the year-to-date.

The FTSE 100 index, meanwhile, has been one of the global laggards, partly due to the impact of oil prices on Royal Dutch Shell (LSE:RDSB) and BP (LSE:BP.). Today, Brent crude was trading 2% lower at just above $30 a barrel.

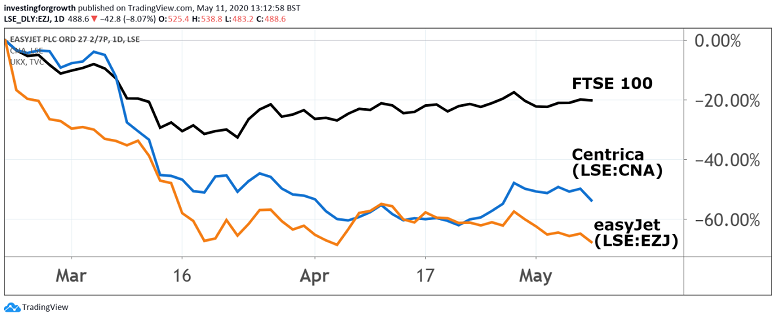

Low-cost airline easyJet was the biggest faller, with the prospect of a two-week period of quarantine for nearly all UK arrivals later this summer the reason for the 8% slump. Shares are below 500p, with the stock returning to the low point for the crisis seen in early April.

Source: TradingView. Past performance is not a guide to future performance.

Centrica (LSE:CNA) slid 5% as the British Gas owner lost last week's gains to stand at 37.8p. Housebuiders Persimmon (LSE:PSN) and Barratt Developments (LSE:BDEV) were also down 3% and 2% lower respectively, while Lloyds Banking Group gave up its promising start to the session to return to near 30p.

Vodafone was closely watched ahead of tomorrow's annual results, with investors hopeful that the mobile phone giant will not follow the lead of BT (LSE:BT.A) by sacrificing its dividend. The signs are positive, particularly given that it only cut its dividend for the first time a year ago.

CEO Nick Read has done a good job restoring shareholder confidence since then, although that has not spared its shares in the current market sell-off. The stock was just under 1% higher at 113.8p today, having fallen as low as 98p in mid-March.

- Chart of the week: is bombed-out BT finally a massive buy?

- The Week Ahead: Vodafone, Morrisons, TUI, US-China friction

Even if Vodafone (LSE:VOD) does not cut, investors should brace themselves for further blows to income streams in the month ahead. Morgan Stanley suggested that dividends in the MSCI Europe index were likely to fall by 40% peak-to-trough, which would leave a dividend yield of just 2.7%.

Royal Dutch Shell delivered one of the most damaging cuts last month, with Morgan Stanley noting that other cuts of such magnitude could reduce the sector's relative yield to below the long-run average of 1.3x. BP, which did not cut its dividend in April, fell by 2% to 309.95p.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.