FTSE 100 slumps to a very important level

A 390-point rally since mid-June is unravelling. We explain why and name shares leading to decline.

24th June 2020 12:57

by Graeme Evans from interactive investor

A 390-point rally since mid-June is unravelling. We explain why and name shares leading to decline.

The back-to-business message from pub chains, cinemas and retailers was being viewed a little more cautiously by investors today after a worrying dip in global stock market confidence.

The FTSE 100 index slid 2.5% to 6,159 and other European markets were also sharply lower after a surge in the number of Covid-19 cases in many US states fuelled fears about a second wave of the pandemic.

Fears that this trend could lead to restrictions on Americans travelling to Europe dealt a fresh blow to BA owner International Consolidated Airlines Group (LSE:IAG), which fell 5% to 238.9p. Other top-flight casualties included catering group Compass (LSE:CPG), which has seen about 50% of its business temporarily shut due to various country lockdowns.

The prospect of a setback to the re-opening of its sites caused shares to retreat almost 6% to 1,110p, leaving the well-regarded company not far from its March low of 1,002p.

- Chart of the week: is FTSE 100 on a cliff edge?

- The winners of lockdown and the firms fit for a post-Covid world

The mood has deteriorated dramatically since yesterday's session, when risk appetite was buoyed by signs of a faster-than-expected rebound in European business activity, and after reassurance from Washington about the first phase of a US-China trade deal.

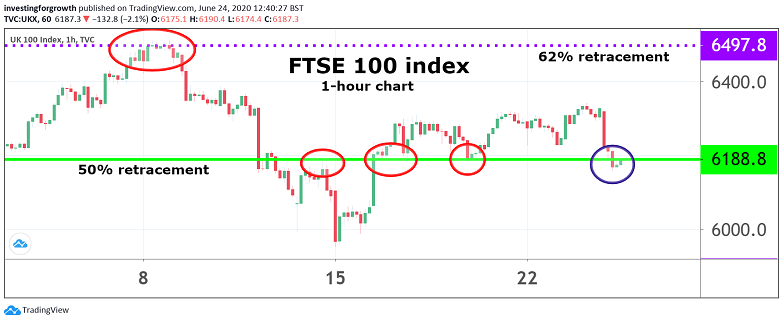

For chart watchers, today's slump means the FTSE 100 is back below the key 50% Fibonacci retracement of the crash from February’s pre-crash level to March low. It's a level where the blue-chip index has shown a good deal of support, and possibly now resistance, so far this month (see circled touch points on the chart below).

Source: TradingView. Past performance is not a guide to future performance.

The reality check for investors also came from some of today's corporate updates, with Crest Nicholson (LSE:CRST) sending a shiver through housebuilding stocks by warning that its profits will be as much as 70% lower this year. It remains wary about medium-term prospects despite a recent pick-up in reservations as building sites re-open.

Crest shares were down 10% in the FTSE 250 index, while blue-chip rival Persimmon (LSE:PSN) fell 3% after also announcing National Express (LSE:NEX) boss Dean Finch as its new CEO from later this year. Barratt Developments (LSE:BDEV) and Berkeley Group (LSE:BKG) also dropped 3%.

The domestic-focused FTSE 250 was almost 2% lower, with National Express down 6% in the wake of Finch's surprise departure. He's been at the helm of the bus and coach operator for a decade, having revived its fortunes following the loss of the East Coast mainline franchise.

Other fallers included shopping centre owner Hammerson (LSE:HMSO) and FTSE 100-listed British Land (LSE:BLND) and Land Securities (LSE:LAND), with the trio down 3% on quarter rent day for retail tenants. Lockdown closures meant LandSec only collected 63% of its quarterly invoiced rent in March, before warning last month that it expects this quarter will be even worse.

In contrast to the struggles felt by retail landlords, shares in warehouse owner Segro (LSE:SGRO) were little changed at 892.8p and remain close to the level seen prior to the market sell-off. The dividend-paying stock has become a firm investor favourite due to its e-commerce exposure.

- Five most-held dividend stocks among the biggest income funds

- Apple: how the world’s biggest company can get much bigger

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Leisure stocks have also been attracting plenty of interest from value investors in recent sessions, although any relief at yesterday's Boris Johnson's “end of hibernation” announcement quickly evaporated in today's market sell-off.

Mitchells & Butlers (LSE:MAB) was 5% lower at 209.5p, albeit still more than double the level seen in mid-March. Marston's (LSE:MARS), whose recovery has been aided by its recent brewing joint venture deal with Carlsberg, fell 6% to 63.25p.

While JD Wetherspoon (LSE:JDW) confirmed to investors today that it would reopen its pubs from 4 July, its shares still fell 5% to 1,064p. The chain also reported the results of a survey in which 35,616 members of staff said they intend to return to work, with another 4,090 not able to return immediately due to maternity leave, caring responsibilities, or health issues.

Cineworld (LSE:CINE) lost hold of recent gains achieved yesterday, when it outlined plans to reopen its sites in the UK and the United States from 10 July. Cinemas in the Czech Republic and Slovakia are due to re-open this weekend.

The shares fell 3% to 76.6p, having earlier doubled from the 36p low in early April. Smaller rival Everyman Media Group (LSE:EMAN) plans to have all its 33 venues open by 24 July, when the company also expects to cut the ribbon on its new cinema on Chelsea's King's Road. Shares fell 3p to 132p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.