Fund spotlight: UBS MSCI UK IMI Socially Responsible ETF

22nd November 2021 12:16

by Tracy Zhao from interactive investor

Tracy Zhao, a senior fund analyst at interactive investor, examines a recent new entry to our ACE 40 list.

UBS ETF MSCI UK IMI Socially Responsible ETF (LSE:UKSR) tracks the performance of the MSCI UK IMI Extended SRI Low Carbon Select 5% Issuer Capped Index. The index reflects high environmental, social and governance (ESG) specifications and is designed to represent the performance of companies that have lower carbon exposure than that of the broad UK market. Furthermore, the index also aims to avoid concentration by capping issuers within the index to a maximum weight of 5%.

The ETF is managed by UBS’s index equity portfolio management team, which is led by Ian Ashment and supported by 23 portfolio managers. The portfolio management team works closely with eight index and quantitative research analysts, operating in London, Zurich and Sydney. The team is highly experienced, and its leadership has remained unchanged since 2006.

UBS Asset Management has been managing index assets for more than 35 years, with current assets under management (AUM) standing at $480 billion (£403 billion), representing more than 40% of the firm’s total AUM. The firm offers 330 UBS ETFs, in 15 markets. UBS has 19 years of ETF experience.

- Active versus passive: a brief introduction

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

What does it invest in?

The ETF’s aim is to fully replicate the index. It does so through buying the underlying assets physically to replicate the index. If any changes are made to the index, the ETF replicates these changes. The percentage weightings of the companies correspond to their weightings in the index. The ETF is monitored and rebalanced quarterly, aiming to minimise transaction costs, and tracking error.

The companies with a low ESG score are excluded from the index. Furthermore, other companies excluded from the index are those showing involvement in controversial weapons, civilian firearms, nuclear weapons, tobacco, alcohol, adult entertainment, conventional weapons, gambling, genetically modified organisms, thermal coal, oil & gas, nuclear power, and fossil fuel reserves.

- ii COP26 hub: see tips, news, comment and analysis from our experts

- Subscribe to the ii YouTube channel for interviews with popular investors

To select companies with low exposure to carbon emissions, companies are ranked by their carbon emission intensity, and the top 10% largest emitters, by number, are excluded from the index.

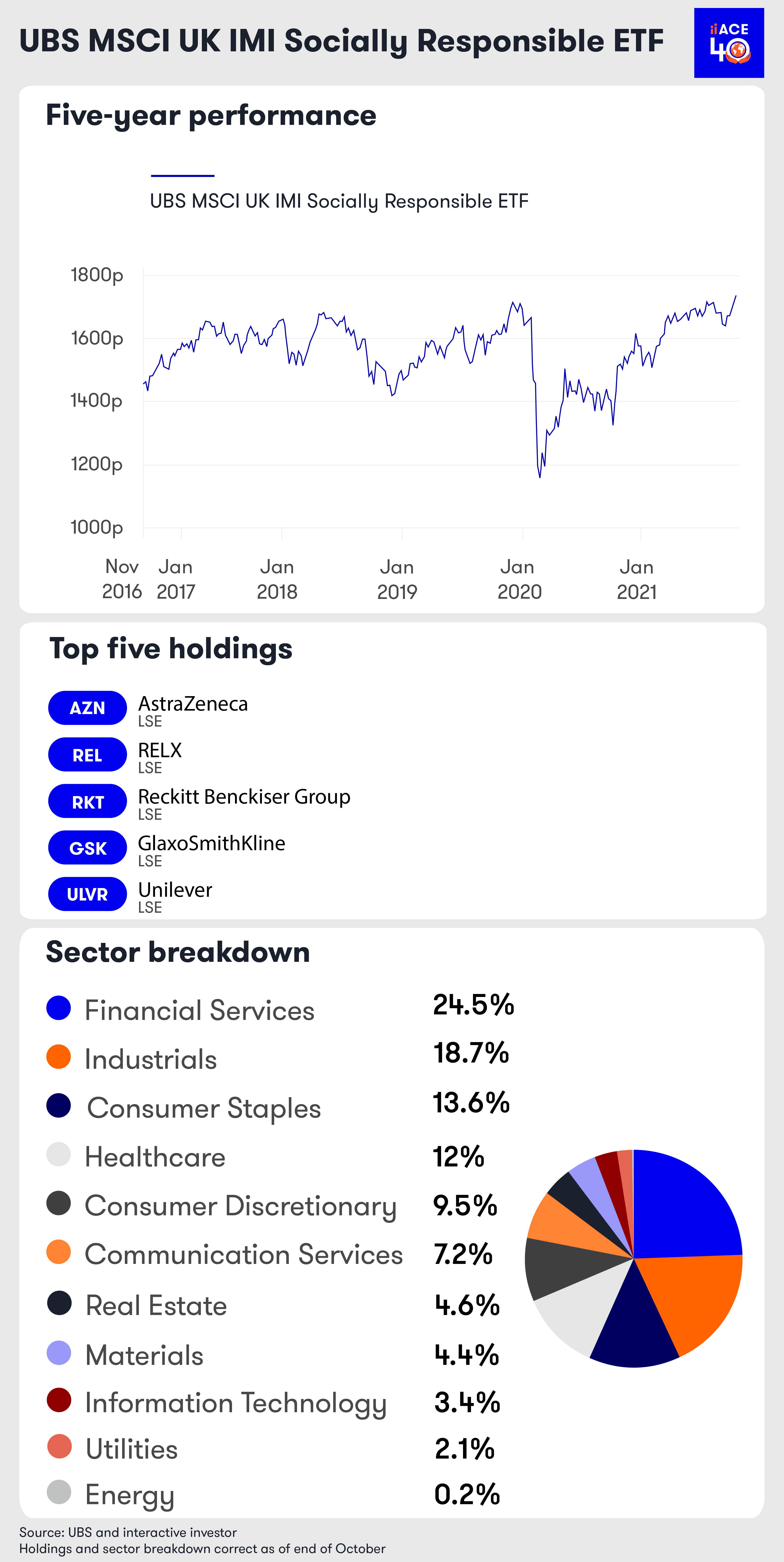

Currently, the index has 123 constituents, and its three largest sector allocations are financials (24%), industrials (19%) and consumer staples (14%). The top 10 holdings are AstraZeneca (LSE:AZN), RELX (LSE:REL), Reckitt Benckiser (LSE:RKT), GlaxoSmithKline (LSE:GSK), Unilever (LSE:ULVR), Lloyds Banking Group (LSE:LLOY), Barclays (LSE:BARC), Vodafone (LSE:VOD), Ashtead (LSE:AHT) and Ferguson (LSE:FERG), with a total weighting of 44% of the ETF.

Performance

The ETF has delivered a return of 33.6% over a period of five years, compared to 35.5% of the MSCI UK IMI Extended SRI Low Carbon Select 5% Issuer Capped Index and 29.4% for the Morningstar UK Large-Cap Equity sector.

| ETF/Index/Sector | 01/11/2020 - 31/10/2021 | 01/11/2019 - 31/10/2020 | 01/11/2018 - 31/10/2019 | 01/11/2017 - 31/10/2018 | 01/11/2016 - 31/10/2017 |

| UBS MSCI UK IMI SRI ETF | 31.24 | -14.73 | 11.03 | -3.57 | 11.54 |

| MSCI UK IMI Extend SRI 5% Issuer Capped Index | 30.62 | -14.34 | 11.46 | -3.19 | 12.25 |

| Morningstar UK Large-Cap Equity Sector | 35.94 | -18.54 | 6.61 | -2.64 | 12.61 |

Source: Morningstar as of 31 October 2021. Past performance is not a guide to future performance

How does the ETF stand out from the crowd?

The ETF has been newly selected for the ACE 40 rated list of ethical investments following our recent annual review. It sits in the Low-Cost, UK Equity category and the ‘ACE’, ‘Avoids’ category. The product is managed by UBS, which has great expertise in index products. The strategy is supported by a large and stable team, drawing expertise from global resource. The index is well-defined, custom-made, and focuses on companies that produce lower carbon emissions.

The ETF is suitable for investors who are seeking exposure to best-in-class ESG UK companies. It has been attracting large inflows, reflecting the demand for low-cost products that have a strong ESG mandate.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.