Greed vs fear: two fund sectors winning in 2025

Saltydog Investor looks at two very different fund groups coming out on top this year.

9th December 2025 09:35

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There have been two recurring themes this year: the dominance of large US technology stocks driven by the rise of artificial intelligence (AI), and the increase in demand for gold.

Funds investing in either of these trends have been volatile, but for very different reasons. One is driven by greed and the other by fear.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

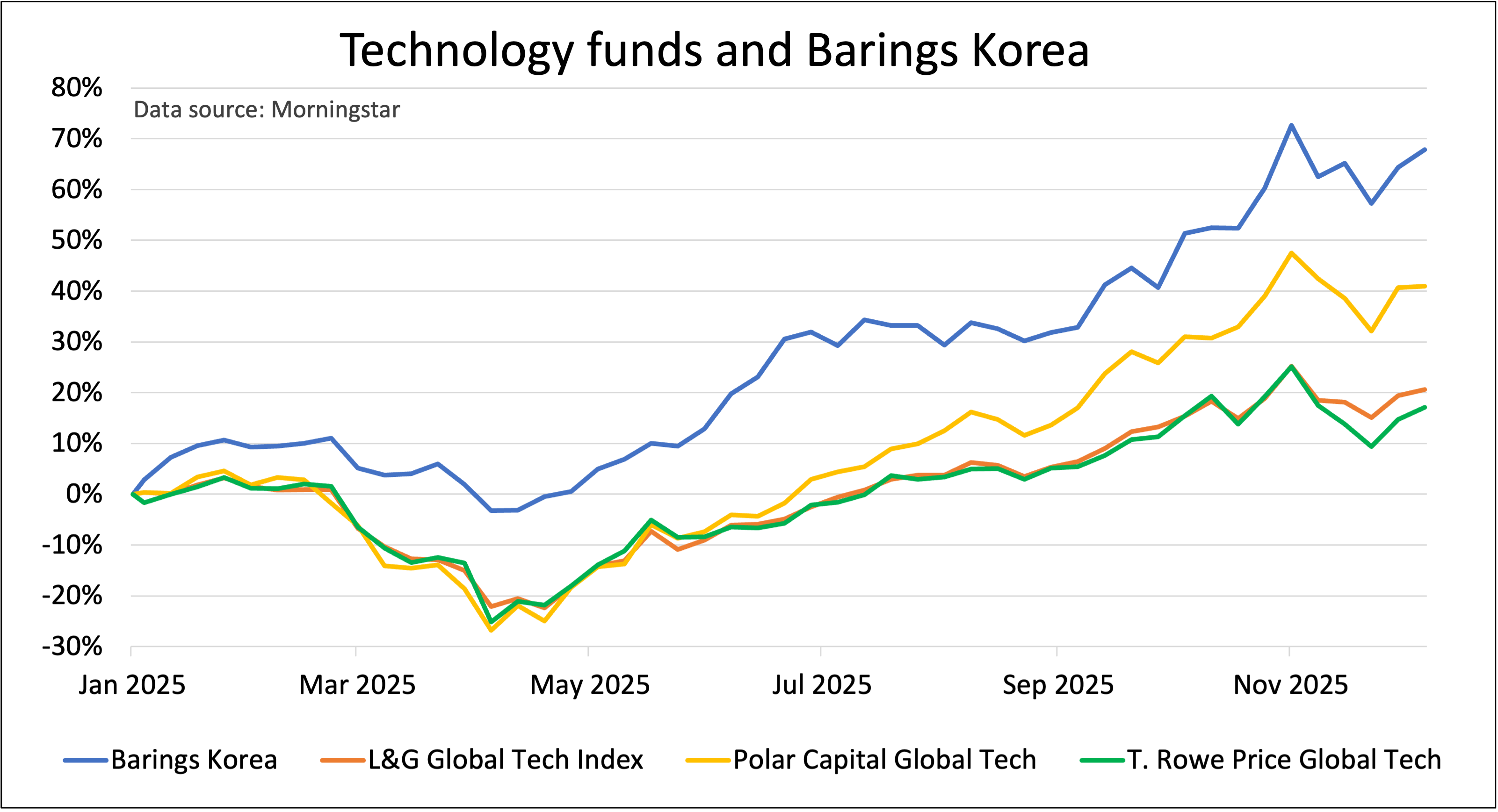

The Technology & Technology Innovation sector had a reasonable start to the year, rising 5% in January, but those gains were wiped out in February, and March was even worse. By the end of the first quarter, the sector was showing a loss of 11.3%.

In contrast, gold funds got off to a flying start. Up 15.1% in January, but they dipped slightly in February (down 1.5%). They then rebounded strongly in March with a gain of 12.5%, ending the quarter up 27.6%. The best-performing fund in our analysis was Ninety One Global Gold I Acc £, returning 31.3% over the three months.

The technology sector continued to struggle in April, losing a further 0.8%, but strengthened throughout May and June to finish the second quarter up 15.1%. The leading fund over that period was Barings Korea I GBP Acc, up 35.9%, followed by Polar Capital Global Tech I Inc GBP (up 29.6%) and Liontrust Global Technology (up 27.3%).

During this time, gold funds rose more modestly but still gained almost 10% in the second quarter.

In the third quarter, technology funds performed well again, adding another 11.5%. However, they were eclipsed by the gold funds, which gained 3% in July, 17% in August, and 26.1% in September, a remarkable rise of more than 50% in just three months.

Since then, the pendulum has swung once more. In October, the gold funds gained 0.7%, while the technology sector climbed 8.3%. Barings Korea topped the tables again with a one-month return of 20.5%. Although it is not classified in the Technology & Technology Innovation sector, the fund has a strong technology bias, holding substantial positions in SK Hynix and Samsung Electronics Co Ltd DR (LSE:SMSN). The Polar Capital Global Technology fund came in second with a gain of 15.3%.

In November, the gold funds returned to favour, rising 12.6%, while the technology sector fell 5.4%.

The market’s swings this year have highlighted the effect of investor psychology. When optimism about AI and corporate earnings takes hold, greed dominates and technology funds tend to climb.

The rise of NVIDIA Corp (NASDAQ:NVDA) to become the world’s first $5 trillion (£3.8 trillion) company symbolised this exuberance. Investors piled into AI-related stocks, pushing valuations to levels that many now believe are difficult to justify.

In contrast, periods of political tension and economic uncertainty have strengthened the appeal of safer assets. Concerns over trade realignments under US President Donald Trump’s new agreements, the ongoing war in Ukraine, and conflict in the Middle East have all reminded investors of the fragility of global stability. Central banks have continued to buy gold at near record levels, seeking to diversify reserves and protect against currency and geopolitical risks.

- ii Tech Focus: crypto, Intel, Anthropic, Snowflake, Strategy, Oracle

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This tug of war between fear and greed has defined 2025. When optimism dominates, technology funds climb. When anxiety returns, gold shines. As the year draws to a close, investors are still caught between the promise of the next wave of innovation and the desire for safety in uncertain times.

After gold’s strong run in November, the technology funds have started to recover, gaining 4.7% in the last couple of weeks. Perhaps it will be their turn to top the tables in December.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.