The ‘hidden winners’ of AI that the pros are backing

While big US tech firms have attracted attention, there are other ways to profit from AI. David Prosser asks a selection of fund managers to name ‘under the radar’ shares that are poised to benefit, or already benefiting, from this big theme.

18th September 2023 09:00

by David Prosser from interactive investor

“Investing in the growth of generative artificial intelligence (AI) can be a promising opportunity, but it's essential to approach it with caution and thorough research, as the technology landscape can change rapidly.” Those aren’t the words of an investment professional; rather this is what ChatGPT itself tells you if you ask it for advice on exposure to the booming AI market.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

It's a bland and generic statement, but there’s an important truth in there. The technology sector is littered with case studies of boom-and-bust bubbles. Very often, the smart move is not to bet on the technology itself, but on the companies making best use of it. Unless you’re well-versed in the intricacies of large language models (LLMs) and competing semi-conductor technologies, you may struggle to pick AI’s leaders. Instead, look for the “hidden winners” – technology-agnostic AI users ready to harness its benefits.

Look beyond the obvious

Those hidden winners are already starting to emerge. AI technologies have been evolving at speed for the past five to 10 years; generative AI isn’t new either, with OpenAI having launched its GPT-3 LLM in 2020.

Certainly, OpenAI’s release last December of ChatGPT, a chatbot that enables anyone to use its LLM, captured the world’s attention. User numbers rose above 100 million within a month, making ChatGPT the fastest-growing consumer application in history.

So far, however, rather than seeing the bigger picture, investors have flocked to the companies directly exposed to the AI boom, such as NVIDIA Corp (NASDAQ:NVDA), the Californian company that dominates the market for computer chips that power AI machines. In June, it told the market it expected to announce second-quarter revenues of $11 billion (£8.8 billion), up from its previous guidance of $7 billion; the company’s market capitalisation jumped by almost $200 billion in a single day as a result.

By contrast, says Chis Ford, manager of the Sanlam Global Artificial Intelligence fund, the businesses driving demand for Nvidia’s products are flying under the radar.

He says: “The biggest AI opportunity of all is for the economy as a whole – there are use cases in every sector. What we haven’t seen yet is a re-rating of those corporates moving fastest to embrace that opportunity.”

- Artificial intelligence: is the hype real, and how to invest in the winners

- Ian Cowie: why I’m bullish on the hottest tech theme

- The key trends impacting your investments so far in 2023

The numbers are striking. Goldman Sachs thinks generative AI alone could add 7% – a full $7 trillion – to global GDP over the next 10 years courtesy of productivity improvements. Pitchbook says the addressable market for this technology will grow 32% a year from $42.6 billion in 2023 to $98.1 billion by 2026.

Natasha Ebtehadj, co-manager of the Artemis Global Select fund, is one investor on the look out for the early adopters.

She says: “AI will have benefits for lots of non-tech companies, although these wins might take longer to become clear. We’ve seen big increases in the share prices of the AI revolution’s poster children this year; the less obvious beneficiaries may be significantly more attractive for patient investors.”

One good example, suggest Ebtehadi, is the American railways company Union Pacific Corp (NYSE:UNP), which is already deploying AI technology to streamline operations and improve safety.

“AI can help train logistics teams, predict demand, optimise routes and forecast maintenance needs. AI augments human capabilities and helps management make better and smarter decisions,” explains Ebtehadi.

Media sector offers route to AI winners

Elsewhere in the economy, the media sector is a good place to look for hidden AI winners according to several fund managers.

“Universal Music Group NV (EURONEXT:UMG) is a global leader in music rights ownership – it has around 34% of the market share of the digital market in recorded music,” says James McDermottroe, manager of the Invesco Metaverse fund.

He adds: “It gets paid when we download its music from providers such as Spotify Technology SA (NYSE:SPOT) and Apple Music, but it should also be paid if companies use their music for commercial videos on Facebook, Instagram or TikTok. AI allows them to better track when a UMG song is playing, which could boost revenues.”

Sanlam’s Ford is also enthusiastic about the use of AI in media, with Netflix Inc (NASDAQ:NFLX) among his fund’s top 10 holdings.

He explains: “Netflix uses AI in a number of ways to deliver great experiences for its viewers. AI is used to manage the way that digital content is delivered to the user over the internet, but it is also used to help direct viewers to content they are likely to engage with based on their prior preferences. Netflix will also tailor the presentation of content to the individual user dependent on their prior viewing choices.”

- The funds and investment trusts profiting from AI excitement

- Be cautious of ‘AI tech hype’ as seven US stocks dominate returns

- Top tech investor on how to profit from artificial intelligence

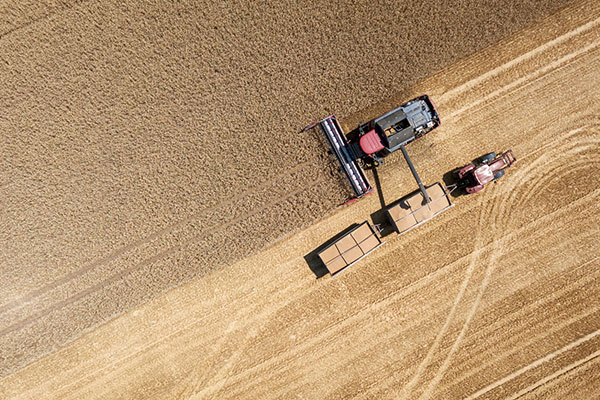

Elsewhere, Ford picks out two other hidden winners to consider. First, in the industrials space, he highlights the agricultural machinery giant Deere & Co (NYSE:DE) as “a great example of what was once regarded by some as an old economy firm using AI to transform its business”.

Ford points out: “Deere has already developed fully autonomous tractors and tillage machines, which are always ready to work, no matter how early or late. Labour recruitment and labour shortages are major issues in rural communities across the world and autonomous precision agriculture equipment can fill the gap.

“Deere has also developed intelligent crop sprayers that calculate the precise amount of water and nutrients individual plants need – this means water and fertiliser use is kept to a minimum, an absolutely essential innovation if we are to do anything to reduce waste and mitigate environmental damage.”

Ford’s second suggestion is in the healthcare space. “UnitedHealth Group Inc (NYSE:UNH)’s technology-focused subsidiary, Optum, has a platform that uses data analytics, natural language processing, machine and deep learning models to improve patient outcomes by predicting conditions and thereby decreasing the overall cost of care over a lifetime,” says Ford.

He adds: “UNH also utilises what is known as Agent Virtual Assistant or AVA. The service includes a chatbot that helps to direct calls more quickly and a full-scale service that helps doctors, patients, carers and family members get more information more quickly.”

Biotech boost

In a related field, a number of managers see biotechnology as offering rich rewards for AI adoption. “AI has enabled innovation in the biotech sector for some time, particularly in early stage drug discovery,” say Ailsa Craig and Marek Poszepczynski, the portfolio managers of International Biotechnology (LSE:IBT) Trust.

The duo adds: “As computational power has increased, biotech companies have become increasingly effective at processing large amounts of biological data and screening out bad drugs earlier on in the process than was previously possible.”

One UK company leading the global field in this regard is Benevolent AI (EURONEXT:BAI). The Cambridge-based company listed on Amsterdam’s Euronext market last year, although bumps in the road since then underline the difficulties of pioneering new technologies. A strategic revie in May saw it cut half its staff. ChatGPT’s warning about rapid changes to the landscape looks prescient.

Outsourcing the AI decision

If you’re not sure about the best way to profit from the AI revolution, investing through a collective fund may be a good option. There are a number of generalist funds with increasing AI exposures, as well as technology funds and other specialists.

Popular investment trust Scottish Mortgage (LSE:SMT) is a good example of the former, says Dzmitry Lipski, head of funds research at interactive investor. “Scottish Mortgage, which appears on interactive investor’s Super 60 list of investment ideas, has a heavy weighting towards technology stocks,” he points out. Nvidia is the trust’s fourth-largest holding.

For those looking for a more dedicated exposure, Lipski likes the Sanlam fund run by Chris Ford, although he warns investors to be careful about being too narrowly exposed to one sector or investment theme.

- Stockwatch: why I’ve tweaked my rating on microchip star Nvidia

- Artificial Intelligence: four UK shares to watch

“Sanlam’s Global Artificial Intelligence Fund has a dedicated approach; the managers use AI itself to pick stocks that are benefiting from AI technology,” Lipsky says.

He adds: “It therefore has unique exposure to companies that both develop and incorporate AI technology.”

Alternatively, research published earlier this year by the investment trust team at Winterflood pointed to several funds with potential to benefit from AI. These included Allianz Technology Trust (LSE:ATT). Winerflood said it “is particularly suitable for investors that seek mid-market exposure to cloud, cyber, semiconductors and enterprise software”.

The research also highlighted HgCapital Trust (LSE:HGT) as potentially “attractive to investors that believe generative AI will benefit or be implemented by smaller and medium-sized enterprise software companies”.

Finally, for investors looking for passive exposure, rather than an actively managed fund, the First Trust Nasdaq Artificial Intelligence and Robotics ETF could be an option. It tracks the Nasdaq CTA Artificial and Robotics Index, comprised of companies engaged in AI and robotics in technology, industrials and other sectors.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.