How my share tips performed in 2020

Our overseas investing analyst Rodney Hobson looks back at some great stock ideas of the past year.

23rd December 2020 13:01

by Rodney Hobson from interactive investor

Our overseas investing analyst Rodney Hobson looks back at some great stock ideas of the past year.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It was a year of three distinct phases: any shares bought in the first six weeks of 2020 were doomed to plunge in the Covid-19 panic, irrespective of the merits of the company; then there were two months of glorious opportunity to buy on the cheap; from June onwards investors were left scrabbling to spot worthy companies with unappreciated recovery potential.

Few years have been as exciting in investment terms, or presented such opportunities, as 2020. Also, even the most experienced pundits were left guessing what would come next. On balance, though, investors should be ending the year ahead overall, especially those who invest in American stocks.

With Covid-19 the main global talking point, let us look first at pharmaceutical companies that stood a chance of benefiting from the search for a vaccine.

- Will 2021 be a year of RECOVERY for global stock markets?

- The best and worst-performing stock markets of 2020

- Want to buy and sell international shares? It’s easy to do. Here’s how

At the start of February, with the full scale of the crisis still unrealised, American biotechnology company Gilead Sciences (NASDAQ:GILD), which specialises in antiviral drugs, seemed best placed to win the race to produce a cure. Its experimental antiviral drug remdesivir looked promising.

Its shares did rise from $68 to $84 but, as it dropped out of the reckoning for a Covid-19 vaccine, they fell back below $60. They are unlikely to pick up again any time soon.

Among smaller rivals, I reckoned Inovio (NASDAQ:INO) looked a good bet for longer term investors with an appetite for risk. Don’t pay more than $4, I said. They have since reached $11, a great return over 10 months. They have eased back but, if you want to make up for a missed opportunity, I suggest you wait to see if they slip further.

Source: TradingView as at 22 December 2020. Past performance is not a guide to future performance

I feared that Moderna (NASDAQ:MRNA) at $23.24 and Novavax (NASDAQ:NVAX) at $6.31 had further to slip back. Moderna did, but only briefly; Novavax was soon moving upwards. I hope readers did not wait too long to take the plunge. Both have been above $170.

At around $141, I would be inclined to hang on to Moderna, one of the great winners in the race to produce a vaccine, but Novavax has fallen back to around $130. Take profits if you have not already done so.

Source: TradingView as at 22 December 2020. Past performance is not a guide to future performance

April proved a good time to show faith in the American housing market. Taylor Morrison (NYSE:TMHC), tipped while still below $11, has more than doubled to $28. My fears that the stock could run into resistance at $15.50 proved too pessimistic. Instead they have broken through previous resistance at $27.

Lennar (NYSE:LEN) was available below $45 and is now topside of $80. I said not to chase KB Home (NYSE:KBH) past $22.50 and it did prove a less profitable buy, though it has still reached $35.

My view that D.R. Horton (NYSE:DHI) looked the best in the sector at $38 was justified, with an increase to $73. Again, I was a little overcautious in suggesting that it would not reach a previous peak of $62 any time soon.

- What Bill Ackman thinks will happen to stocks in 2021

- Why the S&P 500 was not the best way to track the US market this year

Sometimes you can pick up the stocks that have been unfairly left behind. Corteva (NYSE:CTVA), spun out of the agriculture division DowDuPont as the largest purely agricultural group in the world, had hit a low of $22.50 in March. It had recovered only to $23.50 by June, still only three-quarters of its pre-crisis level.

Most American stocks had already fully recovered by this time and, with some of the best-known brands in the sector, Corteva should have done so. I suggested buying up to the $29 level at which the company was floated in May 2019. The shares now stand at $39. I wouldn’t take profits below $40, the level that many analysts feel is fair value for now.

Source: TradingView as at 22 December 2020. Past performance is not a guide to future performance

I rather jumped the gun by recommending Volkswagen (XETRA:VOW), one of my star tips of 2019, at €171 in January. The coronavirus crisis sent the shares plunging but, undaunted, I recommended them again in June at €140.50 and they have since recovered lost ground. At the current €169 they are still worth buying.

Daimler (XETRA:DAI) had recovered to around €36 after dipping to a low of €22 in mid-March, and I said buy up to €40. At the current €58.50 the shares are at their 12-month peak, so the case for buying is no longer as compelling, though I would not take profits at this stage.

I was cautious on Peugeot (EURONEXT:UG), which had had a particularly rough time of it. Readers were warned not to pay more than €15. In the event, that was overcautious. Peugeot made up lost ground to reach €22.

Tipping luxury brands in mid-February, just as the crisis was biting, soon looked foolhardy, but in the event it was right to suggest that people with money were merely delaying purchases rather than abandoning them altogether.

- Read more great articles by Rodney Hobson here

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

I said buy Remy Cointreau (EURONEXT:RCO) below €95, LVMH Moet Hennessy Louis Vuitton (EURONEXT:MC) below €375 and Estee Lauder (NYSE:EL) below $195, although it was possible to beat these limits comfortably - and by quite a margin in March. They have reached €150, €503 and $262 since. Remy and LVMH are a little below their recent best, but I see no reason to bail out in a hurry. Lauder is still going from strength to strength so enjoy the ride.

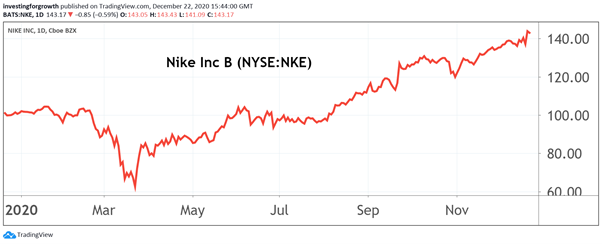

I argued in November 2019 that sportswear manufacturers Nike (NYSE:NKE) and Adidas (XETRA:ADS) both had further to run. They then stood at $82 and €270 respectively, and I said to hold on in August this year with Nike at $106 and Adidas just below €270.

Nike is now at an all-time high of $137 and I can’t see it falling back far, if at all. Adidas has continued to underperform, having edged up only as far as €289. Online sales have not offset the impact of Covid-19 on in-store sales but as the trend towards taking more exercise continues the stock should come good next year.

Source: TradingView as at 22 December 2020. Past performance is not a guide to future performance

The wooden spoon goes to American private security and protection company The Brink’s Co (NYSE:BCO). The shares were just below $79 when I wrote about them at the beginning of March, and I hoped for $85. Instead we got $35 as consumers stopped using the cash that Brink’s carts around for banks, and large companies and turned to credit cards.

Brink’s is mercifully back to $71 but, with the use of ATMs possibly going into decline in the wake of the Covid-19 scare, I can no longer recommend a purchase. Look for a chance to get out.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.