ii Winter Portfolios 2019: Best start ever!

Now in their sixth year, and despite odds stacked against them, our seasonal portfolios are flying.

6th December 2019 16:03

by Lee Wild from interactive investor

Now in their sixth year, and despite odds stacked against them, our seasonal portfolios are flying.

It’s been a whole month since we launched a pair of Winter Portfolios for a sixth year. Started in 2014, the interactive investor consistent and aggressive portfolios have beaten the market and been profitable every year. But a confluence of events coinciding with the new 2019-2020 Winter Portfolios at the end of October was a concern. We needn’t have worried.

Brexit didn’t happen on 31 October as planned. Once again, the UK’s exit from the European Union was kicked down the road. Instead, we got a General Election on 12th December. As a result, investors have preferred to keep their powder dry until the election outcome is known.

Anticipation of a Conservative Party majority, which, whatever your personal politics, is accepted as a market-friendly result, has already been a boost both to sterling and UK domestic stocks. But, while the Tories are streets ahead in most polls, this has been billed as one of the most unpredictable general elections ever, and there are still enough days to go for things to change.

- Winter Portfolio success - Discover how we do it

- Find out more about interactive investor’s winter portfolios on our dedicated hub page

There’s another significant and equally unpredictable influence on financial markets, though – Donald Trump. The US president’s trade spat with China shifts with the wind, from a cordial relationship on the brink of a deal, to more threats of further sanctions. Even Europe is in the firing line this time.

Despite significant threats, the past month was a positive one for UK smaller companies and mid-cap stocks, outperforming even the super-charged S&P 500 index. The FTSE 350 index, the benchmark against which our seasonal portfolios are measured, rose 1.8%.

But our seasonal portfolios had a spectacular month, both rocketing 7.3% in just four weeks. A few days before month-end, the consistent portfolio was up over 8% and the higher-risk aggressive portfolio almost 10% higher. That’s four times greater than the benchmark index! This is the best start to our seasonal portfolios since launch.

| Historic Winter Portfolio Performance each November | |||

|---|---|---|---|

| Year | ii Consistent Portfolio (%) | ii Aggressive Portfolio (%) | FTSE 350 benchmark index (%) |

| 2019-20 | 7.25 | 7.34 | 1.79 |

| 2018-19 | 6.48 | -4.44 | -2.11 |

| 2017-18 | -3.97 | -2.9 | -2.06 |

| 2016-17 | 4.97 | 4.49 | -2.06 |

| 2015-16 | 6.42 | 1.31 | 0.23 |

| 2014-15 | -1.69 | 5.04 | 3.98 |

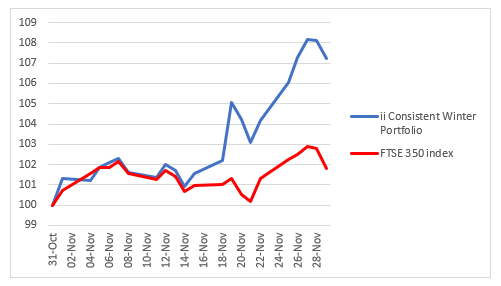

interactive investor Consistent Winter Portfolio 2019-2020

Stocks in this historically reliable basket of shares tracked the wider stock market for half the month before pulling away sharply in week three.

Halma (LSE:HLMA), our winter portfolio debutant, repaid investors in spades, the shares surging as much 15%. During the month we heard how its broad spread of businesses across the safety sector generated forecast-busting profits in its first half.

Kitchen supplier Howden Joinery (LSE:HWDN) finished the period up 9.3%, despite little reaction to a decent trading update published early in the month. InterContinental Hotels Group (LSE:IHG) jumped 7.4%, although the hotelier left its rally late, moving out of the red into profit with just one week of November to go.

Motorway barriers firm Hill & Smith (LSE:HILS) will hit full-year profit targets, but it was enthusiasm for British stocks that meant the shares ended the month up 3.7%.

It had looked bad for Croda (LSE:CRDA), the FTSE 100 speciality chemicals company that has risen every winter for at least the past 15 years. However, with days to go the shares perked up and finished November with a 3.4% gain.

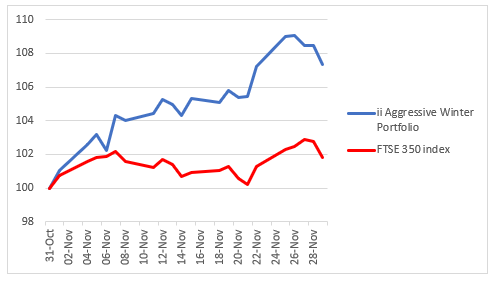

interactive investor Aggressive Winter Portfolio 2019-2020

Unlike the consistent portfolio, the interactive investor Aggressive Winter Portfolio wasted no time putting distance between itself and the FTSE 350 index.

Bodycote (LSE:BOY) had been trading near multi-year lows just before the winter began, but within a week of launch they were up 14%. Market conditions are tough for the heat treatment engineer, but investors are looking beyond 2019 and to an uptick in earnings in 2020. A reassuring update later in the month provided further momentum and the shares ended the period up 21.8%.

Chemicals firm Synthomer (LSE:SYNT) has also struggled, but its shares were up 8% by the end of week one, finishing the first month of winter up 9.1%. Feeling is that the bombed-out share price already reflected enough bad news and difficult trading conditions.

We had concerns about a couple of very highly rated stocks at the beginning of this year’s winter season. Both workspace provider IWG (LSE:IWG) and high street sports fashion chain JD Sports (LSE:JD.) had already done incredibly well, and share price valuations looked stretched. But we don’t tinker with the data, so the pair made it into the aggressive portfolio.

Incredibly, IWG ended the month up 6.7%, although JD fell 1%, making it the only stock of the 10 in this year’s portfolios to trade in negative territory at month-end. It’s a great company though, and there’s excitement about turnaround potential at 2018 acquisition, US shoe store chain The Finish Line.

Despite a brief glimmer of hope at equipment rental giant Ashtead (LSE:AHT), the shares ended November flat, although it could have been worse. The business has significant exposure to the US, and consensus remains that President Trump will not let the American economy slide into recession in 2020, a US presidential election year. That underpins optimism in this regular winter star.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.