ii Winter Portfolios 2019 rocket in December

After the December election result went the City’s way, there was no stopping our seasonal portfolios.

3rd January 2020 14:16

by Lee Wild from interactive investor

After the December election result went the City’s way, there was no stopping our seasonal portfolios.

Our pair of winter portfolios has shrugged off plenty of colossal events in the six years since launch; the Brexit referendum, Donald Trump’s election victory and one of the worst ever fourth quarters for global stock markets. But never has it had to cope with a full-blown general election.

Despite this year’s interactive investor Consistent and Aggressive Winter Portfolios delivering a record performance for November, most inside the Square Mile feared the worst if Boris Johnson’s Conservative Party did not win a significant majority. Well, they did, and the so-called Boris or Brexit bounce turbocharged returns for our portfolios in December.

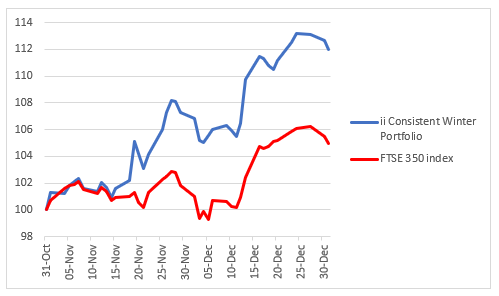

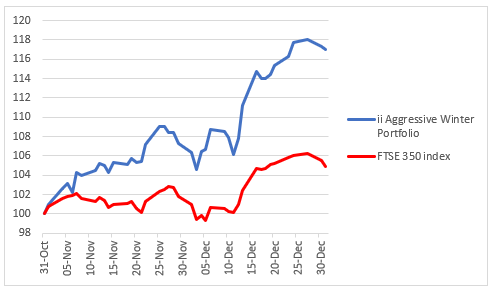

Our seasonal baskets of shares for 2019-2020 outperformed the FTSE 350 benchmark index by a country mile, and the pair of them already boast double-digit percentage returns since launch on 31st October.

The consistent portfolio ended December with a two-month gain of 12% versus a 4.9% return for the FTSE 350 index, against which the success of both portfolios is measured. But our aggressive portfolio is up a stunning 17% already!

The aggressive portfolio surged by an astonishing 9% last month, with all five constituents sharply higher, although two stood out with gains of up to 16%. The consistent portfolio ended December with a one-month profit of 4.4% as all five stocks rose. The FTSE 350, against which the success of both portfolios is measured, made a 3.1% gain.

Demonstrating perfectly the impact of the election result on share price performance, our stats show gains since 12th December were, in many cases, better than the performance for the entire month. The evidence is clear on both charts below.

interactive investor Consistent Winter Portfolio 2019-20

Source: interactive investor Past performance is not a guide to future performance

Companies making most, if not all, of their money in the UK shone last month, benefiting from certainty generated by the election result.

Hill & Smith (LSE:HILS), which makes motorway barriers, rallied 9% in December and is now up 12.4% this winter. Kitchen supplier Howden Joinery (LSE:HWDN) made 6.7% for the month, taking two-month gains to 16.7%.

This pair of UK-focused stocks left the remaining three constituents, all of whom generate massive profits overseas, in the shade. InterContinental Hotels (LSE:IHG), chemicals company Croda (LSE:CRDA) and Halma (LSE:HLMA) all advanced, but by a more modest 4%, 2.8% and 0.5% respectively.

interactive investor Aggressive Winter Portfolio 2019-20

Source: interactive investor Past performance is not a guide to future performance

Our higher risk portfolio was already going great guns, but City analysts leant a hand to one of the lesser known constituents.

Synthomer (LSE:SYNT), without whom hospitals wouldn’t have their latex gloves, rocketed 16.2% in December. The shares are now up 26.8% this winter. In July, it agreed to buy speciality chemicals company OMNOVA for an enterprise value of about £654 million. The acquisition is expected to complete in the first quarter of 2020.

“With an enhanced geographical balance post acquisition and an experienced management team to drive further medium-term growth in higher margin specialty products, we find valuation compelling at 12.6x PE 2020e and 9.6x EV/EBITDA 2020e,” wrote analysts at Deutsche Bank just before Christmas. Rating the shares a “buy”, Deutsche upgraded its price target for Synthomer from 340p to 410p, implying further upside potential.

We had concerns about JD Sports Fashion (LSE:JD.) before the beginning of this year’s winter portfolios, largely because it had risen so far so quickly already and now traded on a full valuation. We needn’t have worried; the shares jumped a further 10% to a record high.

Bodycote (LSE:BOY) had sunk close to multi-year lows when the 2019-2020 portfolios launched. But the heat treatment engineer now ranks as the best performing constituent of either portfolios, with a 33% profit in just two months after a 9% rally last month.

Elsewhere, workspace star IWG (LSE:IWG), formerly Regus, added 6.6%, and US-focused rental firm Ashtead (LSE:AHT), flat at the start of the month, ended winter 2019 up 2.8%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.