ii Winter Portfolios: Coronavirus update

With no stock immune from this global health crisis, here’s how the seasonal portfolios have fared.

23rd March 2020 16:08

by Lee Wild from interactive investor

With no stock immune from this global health crisis, here’s how the seasonal portfolios have fared.

The past month has been like no other in social or economic history. Pubs, bars, cafes, schools have shut down, those who can are working from home, building projects are mothballed and social distancing makes life almost impossible for many businesses to function. Government measures threaten to become more draconian and a return to normality could be many months away.

Stock markets have plunged in response to the impact on company profits from the threat of global recession. UK indices are among the worst hit, especially the FTSE 250 which is down 40% in 2020 so far.

The FTSE 100 is down 31% and FTSE All-Share 35%. Hitting record highs less than six weeks ago, the US Dow Jones index is down 33% in 2020 and the tech-heavy Nasdaq 23%. In Europe, many markets are down 35%, and the Japanese Nikkei is off 30%.

It is against this background that we issue this early update on the performance of our two winter portfolios.

Many of the companies that make up the seasonal portfolios have found themselves on the frontline during the coronavirus outbreak, and there’s no sugar coating the performance data. Both portfolios have fallen sharply.

Typically, we analyse the previous month’s achievements at the beginning of each month. That's because these six-month portfolios are designed to be bought either on 31 October or 1 November and sold on 30 April. This ‘winter’ period is historically the most profitable period to own equities.

- Discover how we do it by clicking here

- Find out more about interactive investor’s winter portfolios on our dedicated hub page

But, given the highly exceptional circumstances this year, the drivers that make the portfolios work, including greater flows of money into the market and ISA season buying, have broken down.

Shares look cheap, but many companies are cutting dividends to preserve cash, which is sensible given the circumstances, and it has become incredibly difficult to estimate the impact of Covid-19 on company profits with any accuracy. That makes valuing businesses tricky.

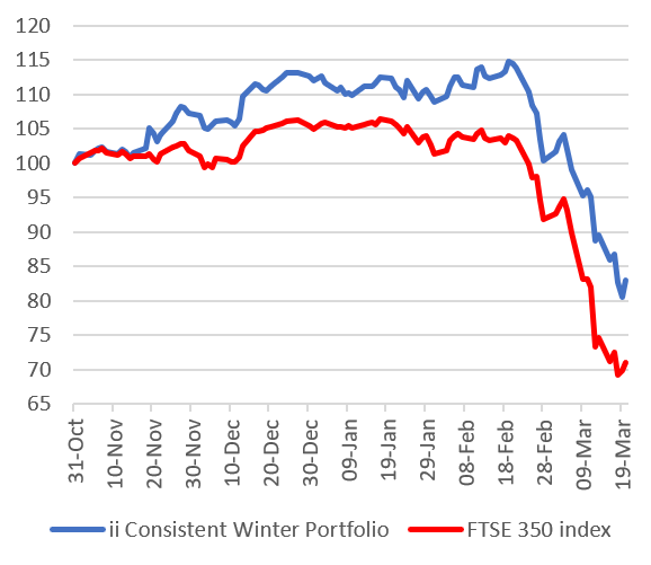

However, the Consistent Winter Portfolio, made up of five FTSE 350 stocks with the most reliable returns over the past 10 years, has fallen much less than the FTSE 350 benchmark index. Between the end of February and 20 March, the portfolio was down 17.3% compared with a 22.6% decline for the FTSE 350.

It now means that the portfolio is currently down 17% since 31 October 2019 versus a 29% decline for the FTSE 350.

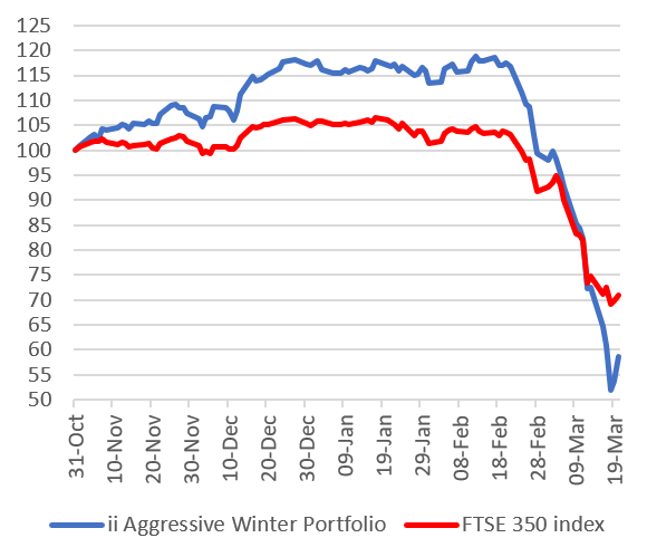

It’s been tougher for the Aggressive Winter Portfolio, which relaxes the entry criteria only very slightly in return for much higher potential returns. Its five constituent stocks are high-growth companies and are priced as such.

If anything disrupts that growth, the shares are punished. And that it precisely what has happened here, and on an unprecedented scale.

In March so far, the portfolio has lost 41% and is down a similar amount for the seasonal portfolio so far. And today – Monday 23 March – has been another bad day at the office for all stocks.

interactive investor Consistent Winter Portfolio 2019-2020

Source: interactive investor, Morningstar data up to close of business 20 March 2020 Past performance is not a guide to future performance

Predictably, Holiday Inn and Crowne Plaza owner InterContinental Hotels (LSE:IHG) was the consistent portfolio’s worst performer, down 36% in March so far. If people can’t travel and take holidays, there’s no revenue. Former high-flyer, kitchen supplier Howden Joinery (LSE:HWDN) slumped by 30.6% and motorway barriers firm Hill & Smith (LSE:HILS) fell 14.6%.

But two FTSE 100 stocks - technology conglomerate Halma (LSE:HLMA) and speciality chemicals firm Croda (LSE:CRDA) – proved more defensive, down just 2.4% and 2.9% respectively. At close of business on Friday 20 March, Halma was actually up 0.5% for this year’s winter portfolio. However, declines today have tipped it into a loss.

interactive investor Aggressive Winter Portfolio 2019-2020

Source: interactive investor, Morningstar data up to close of business 20 March 2020 Past performance is not a guide to future performance

Significant selling of these prime growth stocks was always the risk if disaster struck. It explains why the aggressive portfolio’s constituents were hit so hard this month.

Biggest casualty is serviced offices giant IWG (LSE:IWG), down over 54% in just three weeks. High street retailer JD Sports Fashion (LSE:JD.) also dived, losing 48% as bricks and mortar chains look set to suffer serious hardship whether they have established online operations or not.

US-focused equipment rental giant Ashtead (LSE:AHT) will feel the pain as both existing large-scale building works and new projects are mothballed. Europe-focused heat treatment engineer Bodycote (LSE:BOY) will also struggle as the aircraft and automotive industries scale back production. Chemicals company Synthomer (LSE:SYNT) fared best, with a 27% drop. It’s a sign of the times that this might be referred to as a more “modest” decline.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.