Insider: directors join gold rush as yellow metal leaps again

Ocado and Scottish Mortgage are the only blue-chips to have beaten this share in the first half of 2020.

27th July 2020 09:52

by Graeme Evans from interactive investor

Ocado and Scottish Mortgage are the only blue-chips to have beaten this share in the first half of 2020.

Top-performing FTSE 100 stock Polymetal International (LSE:POLY) has seen further boardroom buying of its shares after the miner's fortunes were boosted by a near-record gold price.

This month's £80,700 purchase by the family trust of senior independent director Ollie Oliveira was at a price of 1,615p, which at the time was a record for the Russian company's shares. They've since spiked above 1,800p after gold traded at nine-year highs near to $1,900 an ounce.

Polymetal has increased output at just the right time, with its recent quarterly trading update showing that gold equivalent production rose 2% thanks to its “world-class” Kyzyl mine in north-eastern Kazakhstan. Revenues increased by 30% to reach $641 million US dollars.

Depreciation of the Russian rouble and Kazakh tenge has also helped to offset Covid-19-related costs, although the pandemic has so far had no material impact on its operations.

Its costs last year were the equivalent of $866 an ounce, comparing favourably with 2019's average realised gold price of $1,411. Its earnings rose to a record $483 million, with significant cash generation enabling shareholders to receive $385 million in dividends from 2019 trading.

- Gold investing: Is it too late to join the party?

- 10 speculative mining stocks for gold bugs

- Gold boom: $2,000 gold and two hot miners in demand

- Gold boom: prices and prospects by Petropavlovsk

The strong performance has made Polymetal a top pick for London investors during the pandemic, leading to a 35% rise for its shares in the first half of 2020. Only Ocado (LSE:OCDO) and Tesla (NASDAQ:TSLA) backer Scottish Mortgage (LSE:SMT) performed better over the period.

Polymetal first joined the FTSE 100 index in 2011, when the gold price also traded at record levels. It returned to the top flight in September, replacing Marks & Spencer (LSE:MKS).

The company's portfolio of nine producing mines makes it a top-10 global gold firm and the second largest in Russia, while it is a top-five global silver producer. Kyzyl was acquired in 2014 for $618.5 million, with its large high-grade reserves and low capital intensity making the facility the main source of medium-term growth and significant shareholder returns.

Oliveira, who is also on the board of Antofagasta (LSE:ANTO) and held senior positions at Anglo American (LSE:AAL) during 40 years in the mining industry and corporate finance, was not the only Polymetal (LSE:POLY) board member buying shares in July. At the start of this month, non-executive director Italia Boninelli bought £23,000 worth of stock through the Zambetti International Trust.

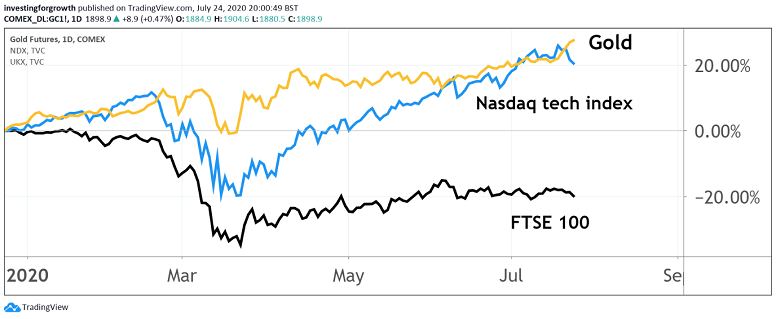

Their purchases are already benefiting from the favourable price environment, with the value of gold up roughly 25% since March and showing every sign of breaking the $2,000 barrier amid strong demand from private investors as well as central banks.

The upward momentum started last year, after the US Federal Reserve cut interest rates for the first time since the financial crisis, and has continued as a safe haven asset during the pandemic.

Source: TradingView. Past performance is not a guide to future performance.

A number of other London-listed stocks have soared in value on the back of the gold price, including a 190% rise for Petropavlovsk shares so far this year.

The company, which used to be known as Peter Hambro Mining, operates in Russia's far east through three active gold mines. Its production improved 22% in 2019, leading to a 45% surge in underlying earnings to US$264 million.

Smaller stocks include AIM-listed Chaarat Gold (LSE:CGH), which owns the Kapan operating mine in Armenia as well as the Tulkubash and the Kyzyltash gold projects in the Kyrgyz Republic. Its shares have now risen 10p since April's placing of new stock at 26p, when the company raised $13.8 million towards strengthening its balance sheet and progressing strategic plans.

Executive chairman Martin Andersson, who is the company's largest shareholder, participated along with other management in the share placing.

- Stockwatch: Ugly duckling gold miner becoming a swan

- Greatland Gold: another AIM success story up 330%

- Gold rush: why Altus Strategies rose 164% in one day

At Greatland Gold (LSE:GGP), shares have surged 700% this year as investors continue to see the potential of its Paterson exploration licences in north-western Australia. Last year, the company entered into a farm-in agreement with Newcrest Mining to explore and develop the Havieron gold-copper discovery. The site is close to Newcrest's Telfer mine, which has produced millions of ounces of gold but is nearing the end of its life.

On Friday, it emerged that Greatland chief executive Gervaise Heddle's stake in the company had increased to 2% after he exercised £100,000 worth of options on five million shares at a price of 2p. At the same time, the former Merrill Lynch fund manager raised £511,000 by selling 3.5 million of stock at 14.6p.

The past few days has also seen buying by directors at Goldplat (LSE:GDP), which is a profitable gold recovery services company. Its operations process the by-products of gold mining for blue-chip clients including Anglogold (NYSE:AU), Harmony (NYSE:HMY) and Goldfields.

- Two gold stocks as an alternative to US tech sector

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

As well as generating robust cash flows from its gold recovery operations in South Africa and Ghana, it has a small gold mining and exploration portfolio in Kenya, Burkina Faso and Ghana. Shares dipped from 7p in February to as low as 3p in April after its operations were temporarily curtailed due to various government lockdown restrictions to combat Covid-19.

Shares have subsequently recovered to 6p, with the company disclosing this month that four directors including CEO Werner Klingenberg and non-executive chairman Matthew Robinson had bought shares at a price of 5.5p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.