Kepler’s investment trust tips for 2023

6th January 2023 14:02

The team at Kepler Trust Intelligence review their 2022 tips, and name a trust for the year ahead.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

This quote was first published in 1841 in Scottish author Charles Mackay’s book, Extraordinary Popular Delusions and the Madness of Crowds, and it seems particularly apposite as we come to the end of a year in which we are beginning to see the impact of two years of lockdowns writ large across the world’s log-jammed economies and our own compromised immune systems.

Perhaps more worrying, though, is that 2022 may mark the end of a much longer period of distemper, which began in 2008, and we are only beginning to see the impact of that descent into madness. It comes in the form of sticky inflation, falling house prices, stuck wages and a vast gap between the lives and outcomes of those whose assets have been inflated by government policy since the global financial crisis and those who bring them parcels, nurse their sick and have ‘deplorable’ voting habits.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

It was with this rather bleak hypothesis in mind that I chose Ruffer Investment Company (LSE:RICA) for my top pick for 2022 this time last year, saying: “Even if we ignore ongoing strife caused by the virus we still have the West’s increasingly sour relationship with China, the threat of war in the Ukraine, apparently useless governments in most Western countries, and runaway inflation to contend with as we consider the year ahead.”

Since then, the trust has delivered a share price total return of 7.46% in absolute terms, putting it, by a margin of more than 19%, ahead of its nearest rival in the team’s choices for the year. The smug sense of superiority this provides as I write these words almost makes up for the fact that I decided to sell RICA in February and bought a house instead, just as a multi-decade housing boom went into reverse.

We are all prophets with hindsight, though, and with that in mind it’s time to have another go. My pick for this year is Bellevue Healthcare Ord (LSE:BBH). BBH invests in a highly differentiated portfolio of innovative healthcare companies, hinged upon addressing what the managers view as a ‘broken healthcare system’, which sounds extremely familiar.

Like International Biotechnology (LSE:IBT), which I would also put money on for a good performance in 2023, the trust is exposed to stocks which have taken a hammering along with the rest of the equity market, despite the inelastic nature of demand for healthcare and the demographic support that ageing populations in the West and richer populations in the developing world represent.

Huge war chests built up by large healthcare companies could also spell good news for both trusts, as the pace of M&A picks up again after a hiatus of deals during the lockdown era, when - doesn’t it sound weird now? - it was illegal for those who would’ve made the deals to leave the house.

Both trusts pay an income from capital and both are geared, which has been to their detriment at times in 2022 but will have the opposite effect in an upswing. I settle for BBH for the purposes of this article because it also has the benefit of a discount of 6.3%, as at the time of writing on 30 December 2022, which, if it were to narrow, may add that little extra to put me at the front of the field next year.

PERFORMANCE OF OUR TOP PICKS IN 2022

| TRUST | 01/01/2022 - 22/12/2022 SHARE PRICE TOTAL RETURN | |

| Ruffer Investment Company (LSE:RICA) | Pascal Dowling | 7.46 |

| AVI Global Trust (LSE:AGT) | John Dowie (ret) | -12.26 |

| Hipgnosis Songs (LSE:SONG) | William Heathcoat Amory | -26.79 |

| Miton UK Microcap (LSE:MINI) | David Johnson (ret) | -28.67 |

| BlackRock Throgmorton Trust (LSE:THRG) | Thomas McMahon | -38.62 |

| FTSE All-Share Ex Investment Trust TR GBP Index | 1.78 |

Source: Morningstar.Past performance is not a reliable indicator of future results.

OUR TOP PICKS FOR 2023

| TRUST | ANALYST |

| Bellevue Healthcare (LSE:BBH) | Pascal Dowling |

| Hipgnosis Songs (LSE:SONG) | William Heathcoat Amory |

| AVI Japan Opportunity (LSE:AJOT) | Thomas McMahon |

| abrdn China (LSE:ACIC) | Helal Miah |

| AVI Global Trust (LSE:AGT) | Nicholas Todd |

| European Opportunities Trust (LSE:EOT) | Alan Ray |

| The Global Smaller Companies Trust (LSE:GSCT) | Ryan Lightfoot-Aminoff |

Past performance is not a reliable indicator of future results.

William Heathcoat Amory | Hipgnosis Songs (again…)

Last year, I observed that the years 2019 to 2021 inclusive had been exceptional for global equity investors and significantly ahead of long-term averages. Whilst recognising that over the long-term equities are hard to beat, making a one-year prediction is sometimes very different. I reasoned that equity markets could not continue to power ahead, so we could expect a period of consolidation at the very least during 2022.

As such, I picked Hipgnosis Songs (LSE:SONG), believing that it offered the prospect of relatively steady income, being uncorrelated to equity markets and potentially having a link to inflation, and the prospect of capital growth. It traded at a small discount to NAV, i. e. 0.6%, at the time of writing. I reckoned that on a NAV total return basis, SONG was unlikely to keep up with global equities if 2022 saw another strong year. However, if returns were more muted or negative, then I thought there was a strong chance that it would outperform equity strategies on a total return basis.

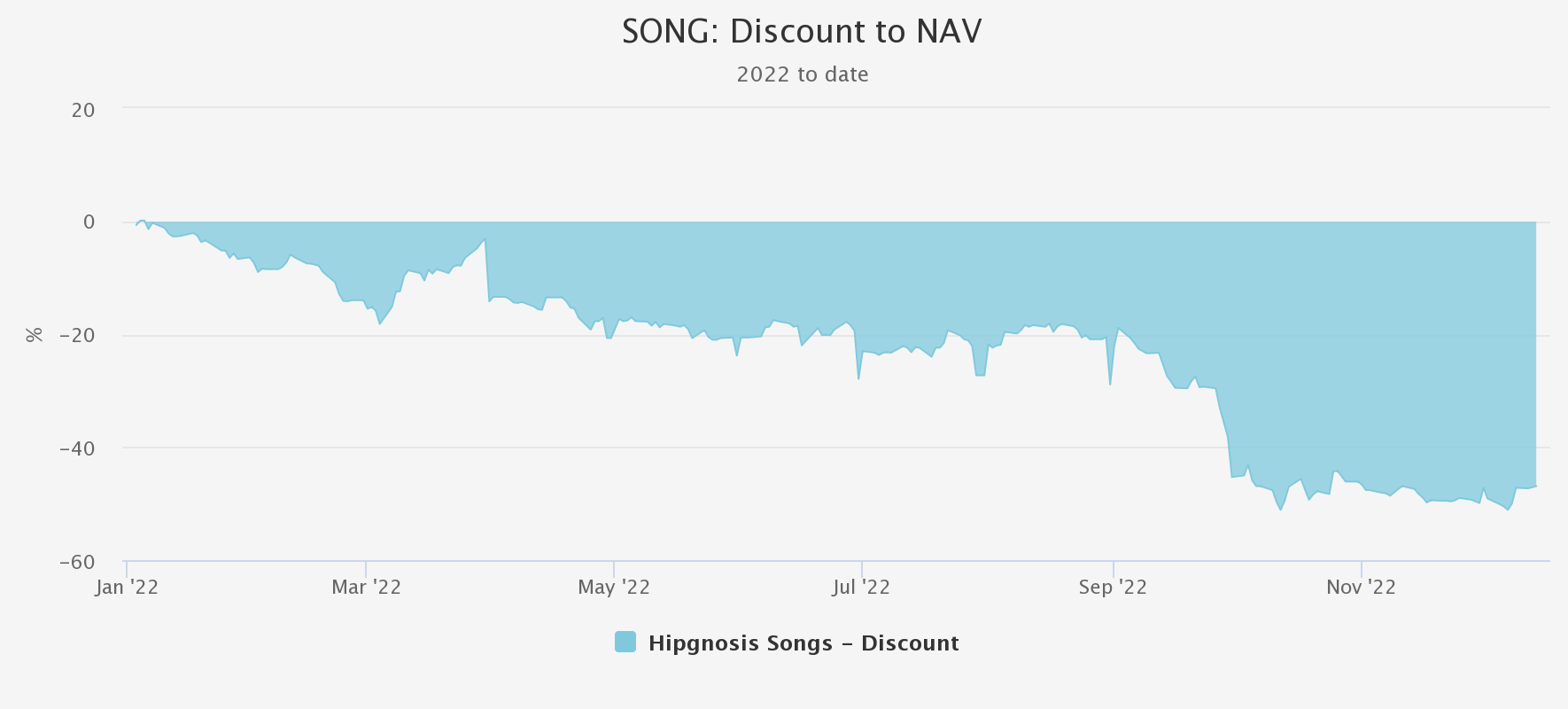

While I couldn’t have been more right on 2022 being a challenging year for equities, and SONG outperforming on a NAV basis, I couldn’t have been more wrong in terms of the market’s interest in the shares. As the graph below shows, the discount widened and continued to widen all year. As a result, share price total returns have been rather less impressive. As it turns out, relatively highly geared trusts investing into illiquid assets were those hit hardest by the change in investor sentiment which we have seen in 2022, as we discussed in this article. On a NAV basis, my pick did well but, sadly, given we are measured on share prices, my run of form from last year seems to have deserted me.

SONG DISCOUNT

Source: Morningstar

When considering ideas for 2023, I’m maintaining my conviction in SONG. In an environment where private equity buyers continue to fall over themselves to buy song royalties, it seems, in my view, highly unlikely that SONG will still be on such a wide discount this time next year. SONG has a broad portfolio amounting to over 65,000 songs but much of the value lies in, perhaps, a few hundred or so. Many of these are iconic and will likely be popular for many years and decades into the future.

The team at SONG tell us that they own 13 of the top 30 most-played music videos on YouTube, as well as 78 out of the 324 songs which have hit one billion streams on Spotify. Rolling Stone magazine’s music experts rank the 500 greatest songs of all time, of which SONG owns 52. But what do they know anyway?

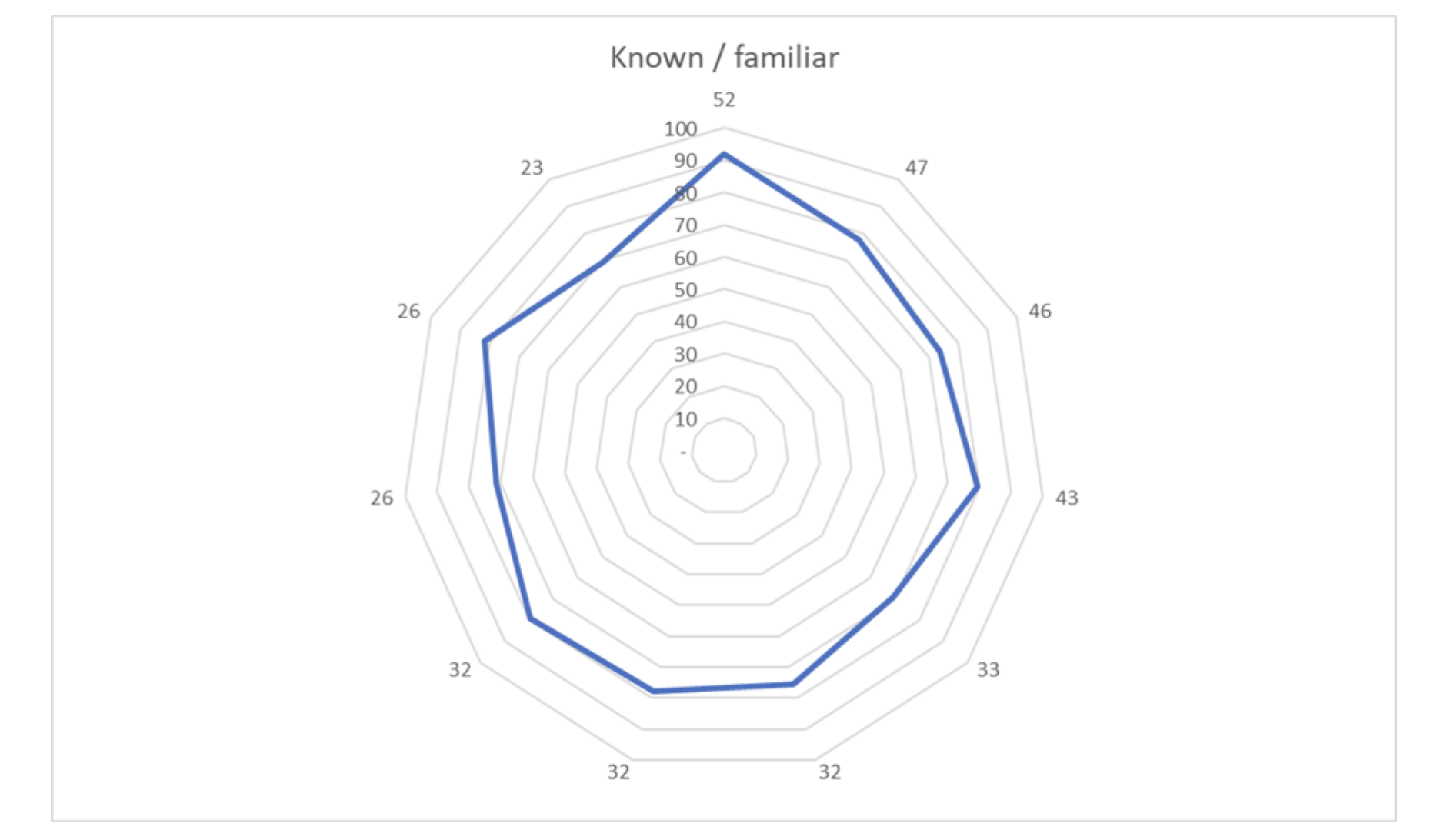

We put the SONG portfolio popularity to the test by asking the KTI team, consisting of 11 souls, to watch the opening 10-minute sequence of the SONG capital markets day (available here) which consisted of the 49 of the 500 greatest songs of all time that are owned by SONG. In the graph below, we show the age of each team member against the percentage of the songs in this montage that they knew well or were familiar with. On average, we knew 77% of them which, in my mind, shows that these are not just oddities that SONG owns, but legitimate high-quality hits. Streaming has led to a transformation in the way that music is consumed and paid for, such that it might now be considered a utility rather than a discretionary purchase. The looming global recession will be a test of this theory but with live music making a significant comeback and the Hipgnosis team working hard on commercialising their catalogue of songs, we think that the tailwinds for revenues will continue. SONG has now fixed a significant proportion of its gearing and hedged dollar income for next year at an advantageous rate. The current dividend, which yields 6% at the current price, was covered over the first half of the year and cover should improve as time goes on. As such, we believe that the discount to NAV of c. 45% is anomalous and should close, providing strong shareholder total returns over 2023.

Source: Kepler Partners

Thomas McMahon | AVI Japan Opportunity

I’ve been betting on Britain for the past three years, as readers can find out by digging through our archive. It hasn’t really worked out. The majority government we saw elected in December 2019 saw a brief honeymoon period but this was brought to a swift halt by the pandemic. Since then, foreign investors have generally steered clear of the UK, with political squabbles seeming to be a constant reason for uncertainty and mistrust. In late 2021, I thought that UK smaller companies were set to do well, as the Omicron variant was to be a damp squib and 2022 was to be a year of recovery. Sadly, Omicron saw another hit to the economy and, once the Russian invasion of Ukraine gave extra impetus to inflation, any post-pandemic optimism deflated pretty quickly. I thought small and mid-cap company-focused trusts, like BlackRock Throgmorton and Henderson Opportunities (LSE:HOT), might do well in the year of recovery which I had expected, but a couple of months into the year it became pretty clear this was not to be.

Looking ahead, it seems to me that we probably still have some pain to come in equity markets. A recession has been expected for many months but is only really getting going now and we are yet to see the full impact in company earnings. Once this happens, it may be that we see a further leg down in prices, on top of the valuation compression we have seen so far. I would, however, expect a recovery to begin by the end of the year, which makes picking a trust to outperform over the whole year pretty tough. However, if I had to pick somewhere to outperform next year, I think it would be Japan. Japanese markets are known for being cyclically geared to the global economy. A lot of this comes through sensitivity to China and, since the MSCI China Index sold off in February 2021, the Topix Index is down circa 20%, compared to 7.5% for the MSCI Europe ex UK Index, a flat return for the FTSE 100 index and a marginally positive return for the S&P 500 index, all in dollar terms. The Topix Index’s sell-off began earlier than its developed world peers, which masks how much it has sold off when looking back over only 2022.

PERFORMANCE OF INDICES SINCE FEBRUARY 2021

Source: FE Analytics. Past performance is not a reliable indicator of future results.

A lot of the pressure has come through the currency, which the central bank has been loath to defend as it would counteract its attempt to keep bond yields capped. Well, Japanese inflation has just hit 3.6%, so the willingness of the central bank to raise rates and let yields rise can only be growing. Even if it doesn’t, the boost to Japanese exporters from China opening up is surely likely to contribute to the strengthening of the currency. China is the largest destination for Japanese exports, at 23%, before Hong Kong is considered. Asia, generally seeing more modest inflation than the West, is more important to Japan than Europe and the US. Additionally, I would expect the US Federal Reserve to at least reach the end of the rate-hiking cycle next year, if not go into reverse.

While I am wary of picking a trust that has outperformed this year to do so again, I think AVI Japan Opportunity (LSE:AJOT) looks well placed to do well next year too, hopefully in a rising market this time. The strategy of picking cash-generative businesses with inefficient balance sheets and engaging with management to unlock value has borne fruit this year and is supported by government policies that originally formed one of the three arrows of ‘Abenomics’ and continue to be emphasised by the current leadership.

Alan Ray | European Opportunities Trust

This year, about $100 billion of outflows from European equity strategies have been matched by approximately the same inflows into US equity strategies. It’s not hard to see why investors have taken money out of Europe: a war has exposed Europe’s seemingly inextricable and uncomfortable dependency on Russian hydrocarbons, bolstered by decades of avoiding tough decisions. Energy prices and security really matter. Did we really just learn that this year?

But complex systems can adjust surprisingly quickly when there’s a crisis, as we learned during the pandemic, and there are signs that European energy markets are doing the same. Europe isn’t going to build a series of new nuclear power stations next year, nor bring online an extra couple of gigawatts of offshore wind in the North Sea. That will come in time. In the short term, Europe is already finding new suppliers of gas and finding energy efficiencies it didn’t know it had. Not easy, comfortable or a return to how things were before, but perhaps ahead of expectations and, as we know, stock markets are all about expectations. Unlike the World Cup, you don’t have to be the best, just better than expected.

Investing in equities, of course, involves accepting risk and there are obvious risks to this. Wars are unpredictable and European markets could be derailed once again. But perhaps the same is true of all developed equity markets.

Ironically, my pick for 2023 is European Opportunities Trust (LSE:EOT), which is a portfolio of high-quality global companies that, by the manager’s own admission, just happen to be listed in Europe. This gives us exposure to companies that will, potentially, do well even if Europe does not, but the trust could also benefit if some of that investor negativity towards European equities starts to reverse. EOT’s discount is also a little bit wider than it arguably should be, which is helpful, although not a reason in itself to invest. Finally, I think that growth investing, which has been so successful for so many years, is going to be more nuanced in the years to come. Low interest rates and inflation can help a lot of companies grow fast but when both are higher, it’s the quality growth companies that will shine.

Helal Miah | abrdn China

I am leaning towards China as the market that can lead the rest of the world out of the current economic slump. Valuations amongst Chinese stocks are low compared to world markets after a difficult few years due to Covid and internal matters, such a real estate crisis. The recent relaxation of lockdown measures and the abandonment of zero-Covid should, in theory, begin to kickstart the economy. The team at abrdn China (LSE:ACIC) have revamped the portfolio since they started running the fund just over a year ago and are taking a high-conviction approach to the long-term growth potential the country offers. China is still developing and opportunities are arising from rising wealth levels and the increasing level of consumerism that follows, while an ageing society is expected to lead to increased healthcare spending. Meanwhile, the transition to renewable energy and the electrification of transport is another area the team are focussing on, with many Chinese companies at the forefront of this revolution.

Nicholas Todd | AVI Global

It has been my privilege to be a member of the Kepler Trust Intelligence team since May of this year. Luckily for me, this meant I didn’t have to provide what had every chance of being a woeful prediction, considering the highly uncertain environment we entered in 2022. That being said, I’d like to think I could have pulled it out the bag with a tactical bet on an alternative or capital preservation strategy, as in the July article Ready Player One, during a period that had all the hallmarks of a bumpy ride.

The year ahead will be dogged by elevated levels of inflation, a continuation of the rate-hiking cycle and the stalemate scenario that is the Russia-Ukraine conflict, these being similar challenges to those faced in 2021. However, I believe that as much of the reaction and selling pressure from investors in now largely priced in, as the higher base effects begin to impact headline inflation figures, interest rates’ hikes begin to slow, as they have done in the US at the time of writing. As the initial impact of the war begins to wane, dipping your toe in the water seems a little more attractive compared to the start of 2022.

With this in mind, I would still advocate a broader-based strategy that offers a genuinely diversified exposure to different corners of the global markets not commonly found in global equity portfolios and with the potential to rally, should markets see signs of positivity, such as AVI Global Trust (LSE:AGT). The strategy may be able to benefit from the widened discounts that have occurred over the course of this year through the impact of the ‘double discount’ that includes the trust’s own discount, which stands currently at 8.7%, and the discount of the underlying investments, including allocations to holdings’ companies and closed-ended investment funds. These include listed private equity and venture capital. As at the end of Q3 2022, this ‘look through’ discount stood at 45%, the widest level since the financial crisis in 2008. The recent pullback in valuations has also led to high-quality opportunities surfacing in Europe and North America and a cleverly timed reintroduction of gearing. Another focus is Japanese small caps, through which they hope to influence through effective engagement activities and hope to benefit from improving corporate governance and capital allocation. This region is unlikely to face the pressures of significant interest rates’ rises anytime soon.

Ryan Lightfoot-Aminoff | Global Smaller Companies Trust

I’m writing this the day after the World Cup final and the football analogy ‘it’s a game of two halves’ has never felt more appropriate, when making predictions for 2023. I believe the first few months of the year are going to look and feel considerably different to those later on. In my opinion, the narrative for the beginning of next year is going to centre around recession and whether central banks can bring inflation under control without crushing demand so much that they cause a severe slowdown. This target outcome is known as a ‘soft landing’. As markets worry about this uncertainty, I fear we will see some significant sell-offs. However, it is worth remembering that markets are forward-looking and that after recessions come recoveries. Hence, I believe later in the year we are going to see a significant bounce back in equities’ markets. As such, I have chosen Global Smaller Companies Trust (LSE:GSCT) as my stock for 2023. Smaller companies often do best in market recoveries and the managers of this trust have the ability to flex their portfolio across a number of different geographies, meaning they should be able to take advantage of any opportunities that arise. This includes a structural overweight to the UK, which I think also has a good opportunity to recover in 2023 following a number of difficult years. The trust is currently trading on a wide discount against its history and has attractive gearing levels locked in. For all these reasons, GSCT is my pick for 2023.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.