Share Sleuth: sustainability is a key ingredient for finding winners

4th November 2021 10:09

by Richard Beddard from interactive investor

Richard Beddard is not scouring the market specifically for clean energy opportunities, but sustainability runs through how he scores shares.

I am hopeful COP26, the UN Climate Change Conference, will result in tougher emission reduction targets, more funds to help vulnerable nations adapt to environmental degradation, and inspire greater global cooperation on climate change.

From an investment perspective though, it is business as usual for the Share Sleuth portfolio.

If COP26 releases a new wave of investment in environmental technology and more regulation, some businesses will benefit disproportionately, and others may suffer.

One of my investment rules, though, is not to bet on any particular scenario. I am not scouring the market specifically for clean-energy opportunities, for example.

There are two reasons for this ambivalence. The first, is the one that always applies; the scenario I am betting on may not come true.

The second is that some people are already rushing to invest in climate-change winners, which makes me uncomfortable.

As veterans of the dot.com era will remember, high demand for fashionable shares drives up prices and drives down returns.

It also encourages entrepreneurs to enter the market. Many have little experience and unproven products or services, but they are thirsty for capital.

- Share Sleuth: a new holding that offers chance to diversify

- Richard Beddard: why this is my number-one stock

- Five pollution stocks: should you buy any of these household names?

The creative destruction that ensues is a good thing in terms of innovation, but picking the winners, the Googles from the Yahoo!s, is much more difficult in real time than in hindsight.

Although I refuse to get carried along with the enthusiasm for trends and industries, that does not mean the Share Sleuth portfolio is riddled with investments that are bad for the environment.

Share Sleuth is invested in shares that I expect to hold for at least a decade from the date they were first purchased, and sustainability is a thread running through the five factors I use to score a share.

The first factor, profitability, is what must be sustained.

The second factor, risks, considers what could stop the company from growing profit. The third factor, strategy, checks that the actions it is taking to achieve profitable growth address the risks.

If a company faces climate risks or could profit from climate opportunities, they are addressed when I score these factors.

The fourth factor, fairness, considers the impact of the company on people. I try to judge whether customers, staff, suppliers and society in general benefit from the actions of the company.

Over the long term, I think companies that do harm are themselves unsustainable, whether they are gouging individuals, other businesses or our common good.

These factors have changed slightly over the years, but factors like them led me to add FW Thorpe (LSE:TFW) to the Share Sleuth portfolio in 2010.

It is a manufacturer of energy-efficient lighting systems that has been offsetting emissions for more than a decade. Gratifyingly, it is planting fewer trees now because, partly by using its own products, its emissions have fallen while the business has grown.

The fairness criterion is also prompting me to reconsider the inclusion of Anpario (LSE:ANP), a manufacturer of natural animal feed additives, in the portfolio.

- Fund managers call for more action and fewer words on climate change

- COP26: five top share picks that are climate leaders

- Hot sector: should investors put down roots in plant-based foods?

While Anpario’s products result in healthier animals that produce less methane (a greenhouse gas) and healthier humans because they take the place of antibiotic growth promoters, they nevertheless enable the farming of meat, a more carbon-intensive food than plants.

Like the politicians meeting in Glasgow, investors must grapple with complex issues but the joy of running a portfolio designed to perform over the long term is that sudden changes are not required.

Most of the time I expect change to come from the companies themselves. I have selected them because they are facing up to risks with strategies that embrace change, and most have demonstrated that they can change in the past.

One example is Goodwin (LSE:GDWN), which until the middle of the last decade made a lot of money making check valves for oil pipelines. One of its best prospects for the future is containers for nuclear fuel, which are already rolling out of its newly enlarged foundry.

Another is PZ Cussons (LSE:PZC). The owner and manufacturer of famous brands such as Carex, Original Source, and St Tropez, plans to become a B-Corporation, certification that it balances purpose and profit.

Logging Share Sleuth’s performance

I have not made any trades in the Share Sleuth portfolio this month.

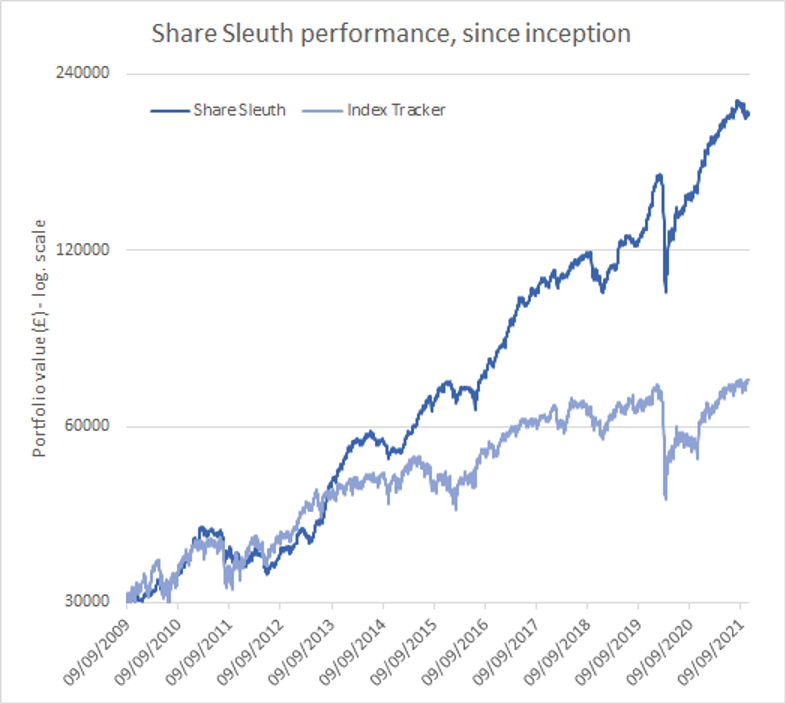

One of the reasons the performance chart (below) uses a log scale is that it focuses our attention on the long term.

A log scale plots the same distance on the vertical (value) axis for the same percentage change in value.

For example, a 10% fall in the value of the portfolio now, when the portfolio is worth more than £200,000, looks as severe as a 10% fall in value would have in 2010, when it was worth little more than £30,000.

The arithmetic scales that we are more used to plot the same distance for each of the absolute values so a loss of £20,000 (10%) now would appear to be much more dramatic than a loss of £3,000 (10%) then.

- Don't be shy, ask ii...will I make more money investing ethically?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

As it happens, the value of the portfolio has declined by nearly £12,000 since its summer high, which sounds like a lot of money. It is a fall of about 5.5%.

But as you can see from the chart, the kink in recent months is unremarkable compared to other kinks in the long history of the Share Sleuth portfolio.

I would say that is nothing to worry about, and not just, or even mainly, because falls of greater magnitude have often happened.

My confidence in the portfolio comes from the quality of the businesses in it, and how I think they will perform in terms of profitability and revenue growth, over the next decade.

Short-term movements in prices do not tell us about that, although they may tell us what other traders think, mostly much less patient traders.

On Friday 29 October, the Share Sleuth portfolio was worth £204,920, which is 583% more than the notional £30,000 invested during the year following the first portfolio additions in September 2009.

The same amount invested in accumulation units of a FTSE All-Share Index tracking fund would have appreciated to £71,909 over the same period.

The portfolio’s cash balance has swelled to £3,535 thanks to dividends from Goodwin, XP Power (LSE:XPP) and Trifast (LSE:TRI).

There are insufficient funds to add a new share, or more shares in an existing member of the portfolio because my minimum trade size of 2.5% of the portfolio’s total value is about £5,100.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 3,535 | ||||

Shares | 201,386 | ||||

Since 9 September 2009 | 30,000 | 204,920 | 583 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,800 | 68 |

BMY | Bloomsbury | 2,676 | 8,509 | 9,687 | 14 |

BNZL | Bunzl | 201 | 4,714 | 5,431 | 15 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,836 | 6 |

CHH | Churchill China | 341 | 3,751 | 5,754 | 53 |

CHRT | Cohort | 1,600 | 3,747 | 9,184 | 145 |

D4T4 | D4t4 | 1,528 | 3,509 | 5,806 | 65 |

DWHT | Dewhurst | 532 | 1,754 | 8,379 | 378 |

FOUR | 4Imprint | 190 | 3,688 | 5,434 | 47 |

GAW | Games Workshop | 76 | 218 | 7,330 | 3,263 |

GDWN | Goodwin | 266 | 6,646 | 9,762 | 47 |

HWDN | Howden Joinery | 1,368 | 8,223 | 12,583 | 53 |

JDG | Judges Scientific | 159 | 3,825 | 11,766 | 208 |

JET2 | Jet2 | 456 | 250 | 5,561 | 2,124 |

LTHM | James Latham | 400 | 5,238 | 4,760 | -9 |

NXT | Next | 106 | 6,071 | 8,444 | 39 |

PRV | Porvair | 906 | 4,999 | 6,251 | 25 |

PZC | PZ Cussons | 1,870 | 3,878 | 4,021 | 4 |

QTX | Quartix | 1,085 | 2,798 | 4,394 | 57 |

RM. | RM | 1,275 | 3,038 | 2,652 | -13 |

RSW | Renishaw | 92 | 1,739 | 4,623 | 166 |

SOLI | Solid State | 986 | 2,847 | 10,698 | 276 |

TET | Treatt | 763 | 1,082 | 8,431 | 679 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,300 | 276 |

TRI | Trifast | 2,261 | 3,357 | 3,052 | -9 |

TSTL | Tristel | 750 | 268 | 3,675 | 1,270 |

VCT | Victrex | 534 | 10,812 | 12,218 | 13 |

XPP | XP Power | 240 | 4,589 | 12,552 | 174 |

- No additions or disposals since the last update

- Costs include £10 broker fee, and 0.5% stamp duty where appropriate

- Cash earns no interest

- Dividends and sale proceeds are credited to the cash balance

- £30,000 invested on 9 September 2009 would be worth £204,920 today

- £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,909 today

- Objective: to beat the index tracker handsomely over five-year periods

- Source: SharePad, 29 October 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all of the Shares in the Share Sleuth portfolio.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.