Share Sleuth: a new holding that offers chance to diversify

6th October 2021 11:28

by Richard Beddard from interactive investor

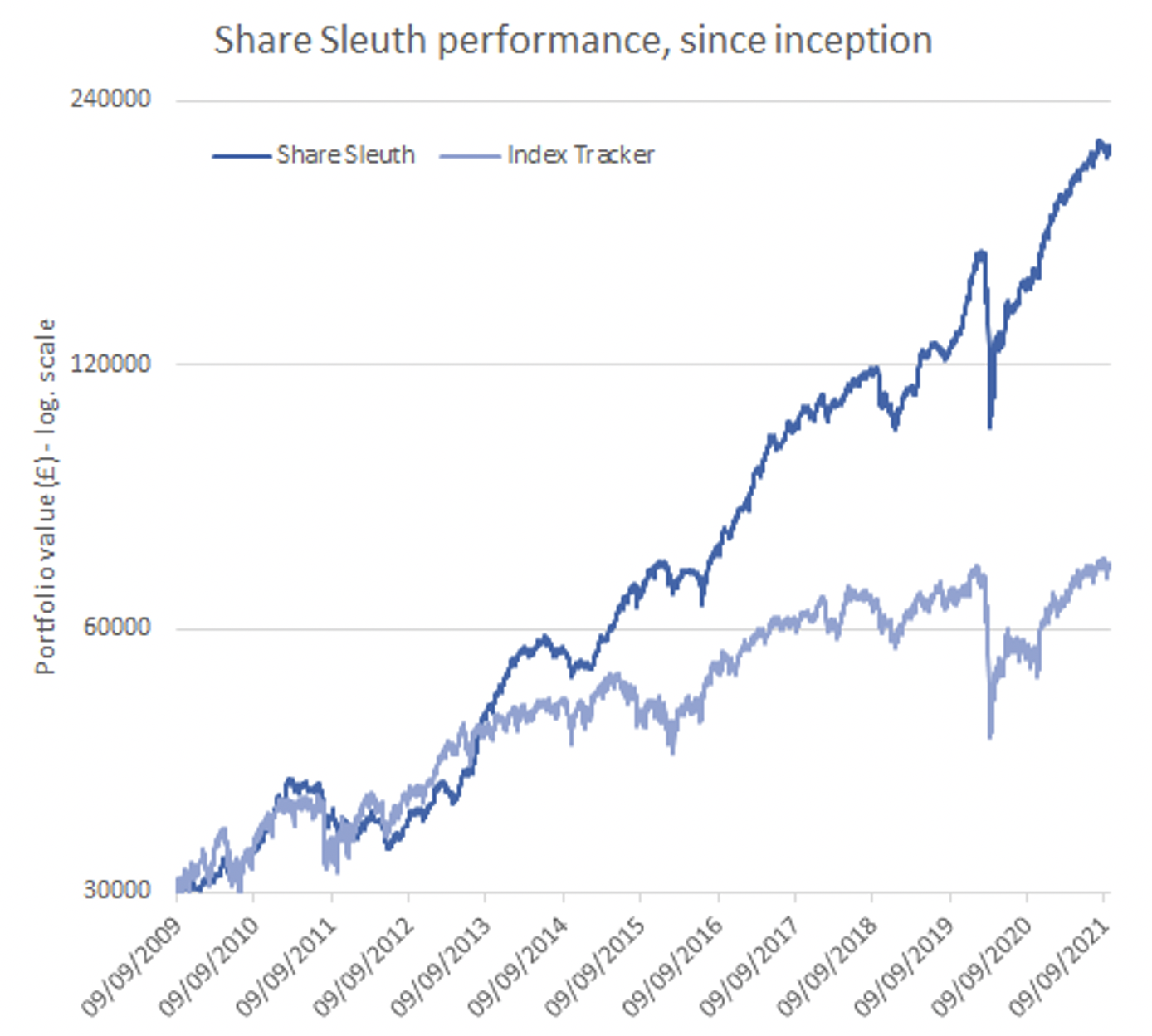

The Share Sleuth portfolio is now worth a notional £208,785, which is 596% more than the £30,000 invested in September 2009.

This month, I added a new share to the Share Sleuth portfolio: James Latham (LSE:LTHM), having awarded the company a score of 7 out of 9 in September.

Buying James Latham

It has taken me some time to warm to the timber importer and distributor. When I scored it a year ago in September 2020, I was surprised by how well it fared, which led me to question my analysis.

The numbers are good, but not great. Typically, it earns a return on capital of about 12%, which puts it at the lower end of profitability for companies in the Share Sleuth portfolio. It has grown revenue at a Compound Annual Growth Rate (CAGR) of 7% over the last 12 years and profit at a CAGR of 12%.

But there is a factor I cannot express in a number, which is my level of confidence that the next 12 years will look a lot like the last 12 years. I think it is very likely that James Latham will continue to earn good, but not great returns, and continue growing.

The reasons for my confidence are explained in my write-up, but in a nutshell it is the market leader with a proven reputation, and it is continuously investing to improve.

On Wednesday 22 September, I added 400 shares at £13.07 per share, a price quoted by my broker. After deducting £10 in lieu of broker fees, the transaction reduced the portfolio’s virtual cash balance by £5,238, close to my minimum trade size of 2.5% of the portfolio’s total value.

If I had acted in September 2020, when I first scored James Latham, I could have bought it at a significant discount to the current price. I am not going to beat myself up about that. I was not confident enough in the company then. And lots of shares have gone up over the last year. Since I only make one trade a month, if I had added James Latham in September 2020 I would not have added 4imprint (LSE:FOUR) which has done just as well so far.

Deciding by sleep

Despite my newfound confidence in James Latham, the decision was not an easy one.

This time, it was Goodwin (LSE:GDWN), a diversified engineering and materials company, that put me in a conundrum. I had given it a score of 8 out of 9 a week before I scored Latham 7 out of 9. Scores change all the time, though, due to fluctuating share prices, and when I made this month’s trade decision, both companies scored 7.

In other words, the Decision Engine had produced a tie and when there is no clear daylight between two company’s scores I have to make a judgement.

Since I keep a diary, I can share my flips and flops with you. On Monday 14 September, I identified Goodwin as an obvious addition. It was the highest ranked share that day and since the holding was only 4% of the portfolio there was scope to add more.

According to my formula, which bases the ideal holding size of a share on its score (the higher the score, the bigger the holding), I could have increased the size of Share Sleuth’s Goodwin holding (£8,512 at the time) by up to £6,785.

As usual, I slept on the decision.

On Tuesday 15 September, I considered adding shares in Portmeirion (LSE:PMP), which scored 7. Having lost faith in the manufacturer of tableware brands and home fragrances, I am beginning to regain it.

Old fears resurfaced though. Specifically, I wondered about the quality of some of Portmeirion’s more recent acquisitions and the waning strength of consumer brands in an era of seemingly endless choice.

So I slept on the decision again.

On Wednesday 16 September, a series of messages with a private investor and shareholder in Goodwin returned my attention to the company again. By then I had finalised my score for James Latham, elevating it into buy territory.

Did I want to concentrate the portfolio (Goodwin) or diversify it (James Latham)?

I felt a bit thick-headed towards the end of the week, and I never take decisions unless I am in the right mood. A number of sleeps took me to Monday 20 September.

On Monday, I almost went for Goodwin. Both companies have earned similar returns on capital in recent years but there may be a greater chance profitability will improve at Goodwin. It has been repositioning its business for major new contracts that have recently entered production.

But on Tuesday 22 September, I thought better of it. At Goodwin, the potential reward may be higher, but I do not know how high, and the risk may be higher too. Goodwin is a complex multifaceted business in comparison to James Latham.

The portfolio already has shares in Goodwin. James Latham is a chance to diversify.

The urge to own half as much of two good businesses rather than twice as much of one is one I find difficult to resist and on Wednesday, after one more night’s sleep, I made the trade.

Share Sleuth performance

On Thursday 30 September, the Share Sleuth portfolio was worth a notional £208,785, 596% more than the £30,000 invested during the year following the first investments in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would have appreciated to £71,209 over the same period.

The cash balance has fallen to £3,181 due to the purchase of James Latham, offset somewhat by dividends from Quartix (LSE:QTX), Games Workshop (LSE:GAW), D4t4 (LSE:D4T4), 4Imprint, Solid State (LSE:SOLI) and Cohort (LSE:CHRT).

Share Sleuth has insufficient funds to add a new share, or more of an existing constituent, at the minimum trade size of 2.5% of the portfolio’s total value (about £5,220).

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 3,181 | ||||

| Shares | 205,604 | ||||

| Since 9 September 2009 | 30,000 | 208,785 | 596 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,124 | 4,057 | 6,688 | 65 |

| BMY | Bloomsbury | 2,676 | 8,509 | 8,911 | 5 |

| BNZL | Bunzl | 201 | 4,714 | 4,935 | 5 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,916 | 8 |

| CHH | Churchill China | 341 | 3,751 | 6,309 | 68 |

| CHRT | Cohort | 1,600 | 3,747 | 8,896 | 137 |

| D4T4 | D4t4 | 1,528 | 3,509 | 5,195 | 48 |

| DWHT | Dewhurst | 532 | 1,754 | 10,108 | 476 |

| FOUR | 4Imprint | 190 | 3,688 | 5,719 | 55 |

| GAW | Games Workshop | 76 | 218 | 7,805 | 3,481 |

| GDWN | Goodwin | 266 | 6,646 | 9,443 | 42 |

| HWDN | Howden Joinery | 1,368 | 8,223 | 12,255 | 49 |

| JDG | Judges Scientific | 159 | 3,825 | 12,100 | 216 |

| JET2 | Jet2 | 456 | 250 | 5,837 | 2,235 |

| LTHM | James Latham | 400 | 5,238 | 4,680 | -11 |

| NXT | Next | 106 | 6,071 | 8,705 | 43 |

| PRV | Porvair | 906 | 4,999 | 6,270 | 25 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,217 | 9 |

| QTX | Quartix | 1,085 | 2,798 | 5,208 | 86 |

| RM. | RM | 1,275 | 3,038 | 2,996 | -1 |

| RSW | Renishaw | 92 | 1,739 | 4,368 | 151 |

| SOLI | Solid State | 986 | 2,847 | 11,536 | 305 |

| TET | Treatt | 763 | 1,082 | 7,744 | 615 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 8,960 | 306 |

| TRI | Trifast | 2,261 | 3,357 | 3,211 | -4 |

| TSTL | Tristel | 750 | 268 | 4,538 | 1,591 |

| VCT | Victrex | 534 | 10,812 | 12,720 | 18 |

| XPP | XP Power | 240 | 4,589 | 12,336 | 169 |

Table notes:

Added holding in James Latham.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £215,202 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £71,209 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 30 September 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all of the shares in the Share Sleuth portfolio except James Latham. That will probably change.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.