Stepping back into markets – slowly

28th March 2022 14:45

by Douglas Chadwick from ii contributor

Saltydog Investor is becoming more optimistic about stocks but is not committing all its giant cash pile yet.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

For the past couple of months, both our portfolios have been holding significant amounts of cash as a buffer against the market uncertainty surrounding rising inflation and the war in Ukraine. When we reviewed them last Wednesday our most cautious portfolio, Tugboat, had 87% in cash and, in the slightly more adventurous Ocean Liner, it was 69%.

Since the previous Wednesday, the few funds that we were holding had all made reasonable gains. Even though they only account for a small part of our overall investment, Tugboat still went up by 0.9% and Ocean Liner made 1.9%.

- Shares, funds and trusts for your ISA in 2022

- How and where to invest £50k to £250k for income

- War, what war? The stock markets that behave like Ukraine conflict never happened

Our latest reports showed that nearly all of the Investment Association (IA) sectors had also made gains in the previous week. We were tempted, after such a good week, to dive straight back in and reduce the cash as quickly as possible – but that would have been greedy. There is still a war going on, energy and food prices are soaring, and interest rates are going up. Sometimes it pays to be patient.

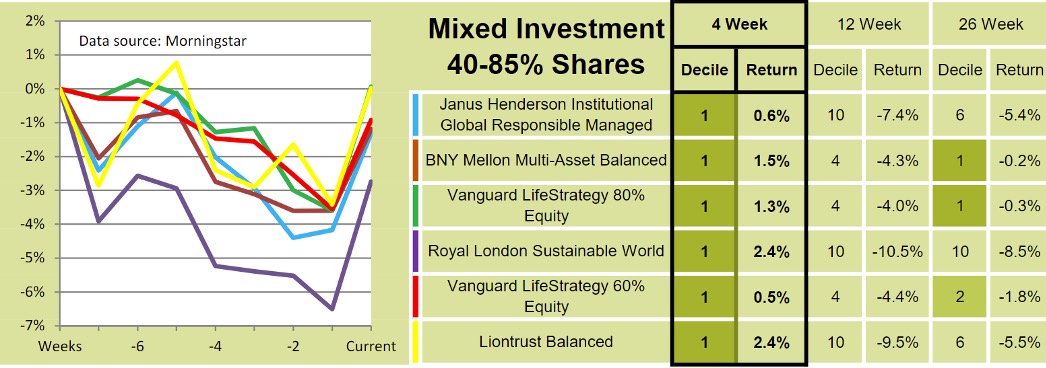

We are desperate to see some of the funds from our low volatility, “Slow Ahead”, group coming through in our numbers, but they are not quite there yet. A couple of our old favourites, Janus Henderson Global Responsible Managed and Royal London Sustainable World, reappeared in our tables last week, but only because they had a strong rebound the previous week.

Past performance is not a guide to future performance.

We also had to take into consideration that at the time all the sectors in the “Slow Ahead” group were still showing losses over four, 12 and 26 weeks.

If, when we crunch the numbers for last week, we find that these funds have kept on going up, we may be tempted to make a small initial investment.

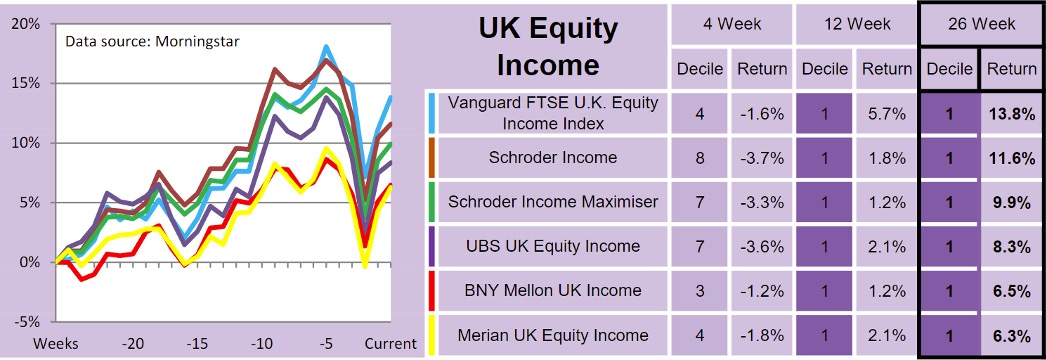

In the more volatile “Steady as She Goes” group, the UK Equity Income, UK All Companies and UK Smaller Companies sectors were already reporting two good weeks in a row. They could be showing four-week gains in this week’s reports.

Ocean Liner is invested in two funds from the UK Equity Income sector, the Vanguard FTSE UK Equity Income Index and Schroder Income.

Past performance is not a guide to future performance.

As you can see from the graph, they fell sharply a few weeks ago but have shown signs of recovery. If they have another good week then we will consider adding to our position.

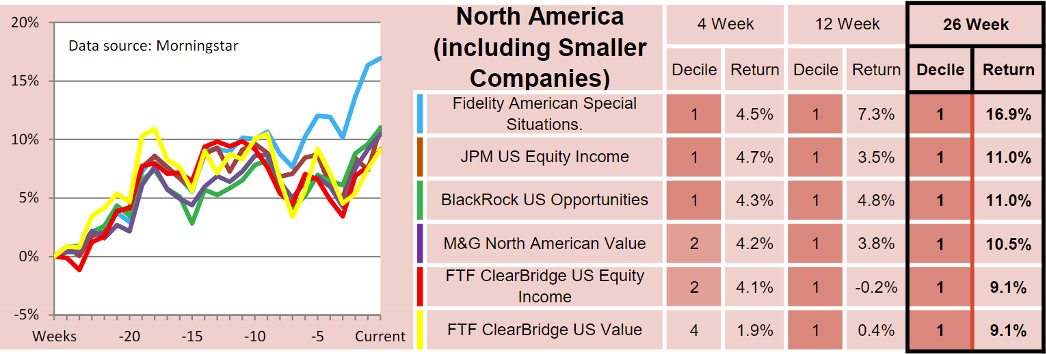

There are two sectors in the “Full Steam Ahead Developed” group that are already showing gains over four weeks: North America (including North American Smaller Companies) and Global.

Last week, Ocean Liner invested in the Fidelity American Special Situations fund. It was at the top of our 26-week table and in decile one over four, 12 and 26 weeks.

Past performance is not a guide to future performance.

The best-performing funds in our portfolios have been the ones investing in energy or natural resources. We have held the JPM Natural Resources, TB Guinness Global Energy and Schroder ISF Global Energy funds for some time.

Last week, we added the VT Gravis Clean Energy Income fund. As the world tries to wean itself off Russian energy, it would be nice to think that the clean energy sector gets another boost. I acknowledge that is probably a little naive, but we are willing to give it a go.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.