Stockopedia: the AIM dividends making a comeback

The case for looking beyond momentum investing in bullish markets.

23rd September 2020 14:34

by Ben Hobson from Stockopedia

Many stocks on the smaller market suspended their payments, but Ben Hobson highlights companies where the tide could be turning.

After a record year in 2019, dividend payouts from companies on the Alternative Investment Market (AIM) have tumbled in 2020. Like much of the main market, Covid-19 has triggered a wholesale slashing of cash returns from AIM stocks. But look a bit closer and there are signs that dividends could already be making a comeback.

Traditionally, dividends have not really been a hallmark of AIM. As a growth market, many of its companies are not mature enough to settle into a confident rhythm of making shareholder payouts. Indeed, many of their investors wouldn’t expect them to.

Even so, there has been a marked increase in the number of AIM companies delivering payouts. The proportion rose from 26% to 35% between 2012 and 2019, according to Link Asset Services.

As a result, last year AIM dividends grew by 16.7% to a record £1.33 billion. In the context of the whole market - where payouts hit a record £110.5 billion - that’s undoubtedly small. But this improving trend has been a useful new way for investors to weigh up where quality really lies on AIM. After all, dividend payouts can be a signal of both confidence and competence on the part of company managers.

With Covid-19, the dividend story has changed dramatically. Faced with operational disruption and the likelihood of ongoing economic uncertainty, companies have cut or cancelled payouts right across the market.

On AIM this meant that after a flat first quarter, Q2 payouts fell by a third, even after allowing for one-off dividends, takeovers, and promotions to the main market. The latest statistics show that two fifths of Q2 payers cancelled dividends outright and another tenth cut them. And while those reductions were not all related to the pandemic, many of them were.

In a best-case scenario, Link Asset Services now thinks that the overall 2020 payout from AIM will fall by 34% to £873 million. In turn, a recovery to the previous highs is not expected until 2022 to 2023.

What this means for investors

For investors, this means that dividends may play a bigger role than normal as a barometer of the outlook for many firms. Without doubt it’s a given that many of them have cut these payments. But as things start to settle we’re starting to see those that have managed to keep their payouts intact , as well as those that look like they might be re-introducing or growing them in the year ahead.

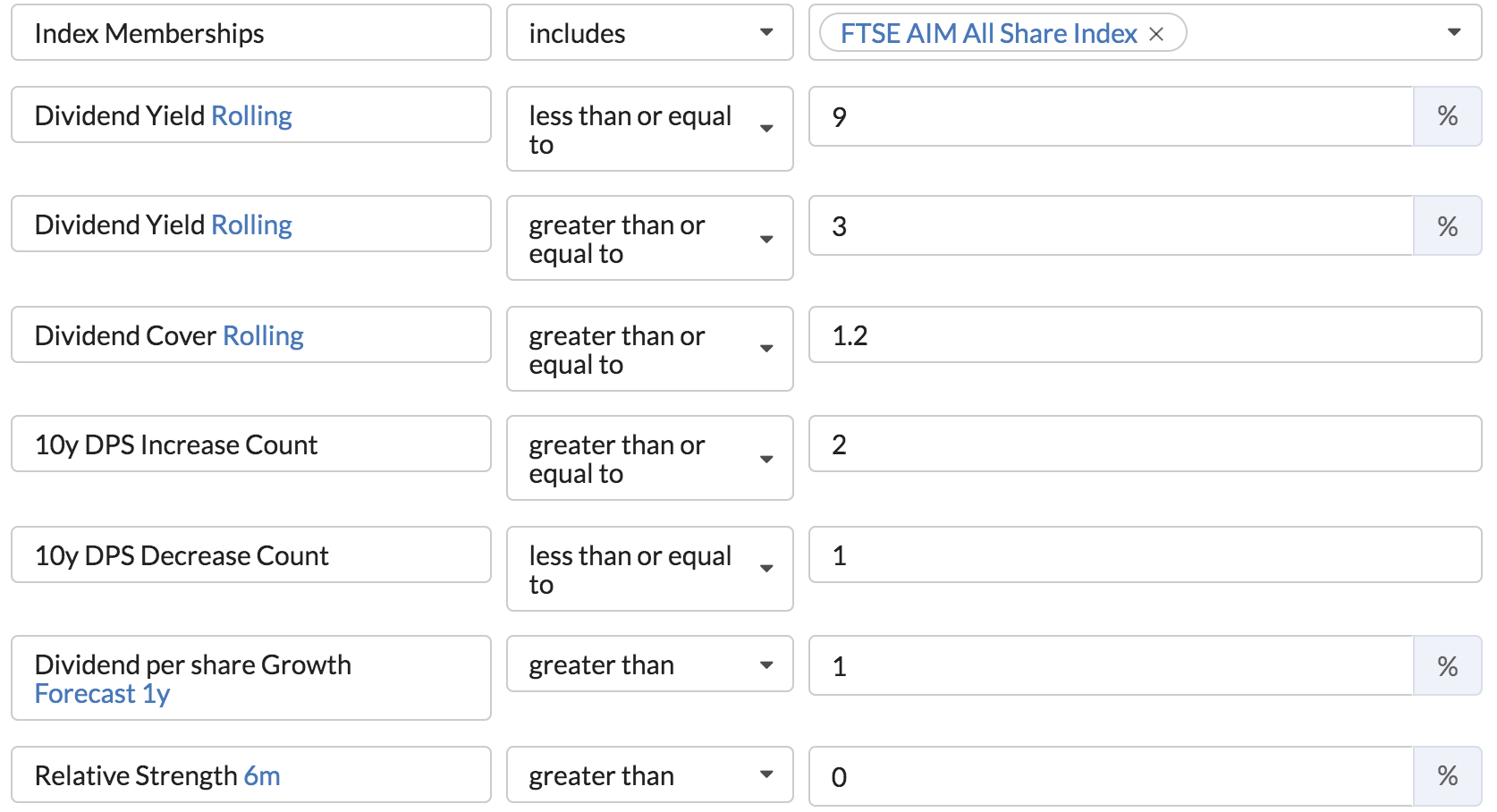

Dividend checklists typically look for three things: yield, growth and safety. High yield, a payout growth record and solid finances are desirable. Using these ideas, this screen looks for companies on a yield of more than 3%, with payouts more than covered by earnings.

It looks for evidence of dividend increases in the past 10 years and forecasts that the dividend will grow in the year ahead. It also looks for relative price strength ahead of the market over the past six months.

The results find companies across a range of sectors, led by Portmeirion (LSE:PMP), the housewares manufacturer, and Sylvania Platinum (LSE:SLP), the precious metals processing business (which has announced an expected special dividend payout this year).

- What happens if AIM stocks lose IHT tax break status?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Some of the others include the agricultural supplies firm Wynnstay (LSE:WYN), concrete levelling specialist Somero (LSE:SOM) and leisure and vending data-monitoring group Vianet (LSE:VNET).

| Name | Mkt Cap £m | Yield % | Dividend Cover | Dividend Increases | DPS Gwth % Forecast 1y | Industry Group |

|---|---|---|---|---|---|---|

| Portmeirion (LSE:PMP) | 51.4 | 8.4 | 1.8 | 8 | 392.2 | Household Goods |

| Sylvania Platinum (LSE:SLP) | 184.8 | 4.6 | 4.6 | 2 | 439.3 | Metals & Mining |

| Wynnstay (LSE:WYN) | 62 | 46 | 2 | 9 | 1.79 | Food & Tobacco |

| Somero Enterprises (LSE:SOM) | 150.7 | 4.1 | 2 | 6 | 195.7 | Machinery, Equipment |

| Vianet (LSE:VNET) | 26.2 | 4 | 1.3 | 2 | 235.3 | Software & IT |

| Robinson (LSE:RBN) | 20.4 | 3.8 | 2.4 | 5 | 120 | Containers & Packaging |

| NWF (LSE:NWF) | 92.9 | 3.7 | 2.6 | 8 | 3.23 | Oil & Gas |

| Strix (LSE:KETL) | 472.3 | 3.3 | 1.8 | 2 | 1.56 | Machinery, Equipment |

| Begbies Traynor (LSE:BEG) | 112.5 | 3.3 | 1.3 | 3 | 7.14 | Professional Services |

An uncertain outlook

It’s important to consider that in times of economic turmoil dividends are one of the first costs that companies cut. And for smaller, potentially more financially vulnerable firms on AIM this is particularly the case. Unlike many main market stocks, which may feel pressure from institutional shareholders to pay dividends, smaller AIM stocks won’t be as concerned.

That said, it’s encouraging to see signs that some firms are keen to reinstate their payouts, which can be seen in triple-digit forecast increases. This suggests that at least some companies are finding confidence despite the unsettled conditions. For investors, a careful look at dividend payouts could be a useful check on those that are feeling the most optimistic.

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.