Stockwatch: four key reasons this bull market could continue

With all news seemingly good news, analyst Edmond Jackson identifies a number of tailwinds that could continue to fuel the stock market rally.

12th September 2025 11:23

by Edmond Jackson from interactive investor

September is often touted as a tricky month for stock markets, but this week has manifested several props for confidence.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

I remain wary of how US tariffs risk a stagflation scenario, despite tax cuts for rich Americans probably helping avoid recession, and how the UK can dodge a “debt doom loop” as taxes rise again. But consider the following:

US Constitution starting to check Trump influence on monetary policy

Liberal economists moan about how this US president will rig the Federal Reserve Board of Governors so that it cuts interest rates by at least 1-2% and mitigates public debt service costs. Comparisons are made with Turkey’s past financial crises where President Recep Tayyip Erdogan fired central bank presidents and appointed a board compliant with his desire for lower rates despite rising inflation.

Indeed, both countries have run big external current account deficits and external debt, helping explain a circa 10% fall in the dollar this year, while gold has soared 30% or so, as a hedge. US tax cuts will add $3 trillion (£2.2 trillion) to its budget deficit over the next decade, where 2024 public debt to GDP was estimated at 121-124% - well above the 106-112% after the Second World War.

But the US economy has far greater depth, and probably resilience, as wealthier consumers appear to have maintained overall US consumer spending even while middle and lower-income people suffered. Obviously, that could change if the stock market crashed and impacted their confidence - an outlier risk perhaps.

Significantly, last Wednesday a federal judge blocked – if only temporarily – President Donald Trump from removing Fed governor Lisa Cook, who is part of the board responsible for setting US interest rates.

It is hard to lecture the US on a matter of alleged mortgage fraud after the UK deputy prime minister had to resign over stamp duty, and the matter looks set to end up in the US Supreme Court.

Yet it shows that the US Constitution is starting to exert a check on an impulsive president, which is reassuring for independent monetary policy.

Market bias remains towards ‘all news is good news’

If you are old enough to recall Bob Beckman, a high-profile American investment commentator in London during the 1980s, he had a simple but effective litmus test of a bull or bear market. “All news is good news” implies a bull trend, and vice versa.

In this respect, equities were ebullient to this week’s US inflation data, which objectively came out mixed. The consumer price index rose 0.4% for August, which was slightly hotter than the 0.3% rise expected, but the index rose 2.9% over 12 months, as expected. The core measure of inflation excluding food and energy rose 0.3% on July and 3.1% from a year ago, both in line with forecasts.

It is hardly great how US consumer inflation seems anchored around 3% versus a supposed 2% mandate, and the Fed is between a rock and hard place – looking set to cut rates 0.25% next week as it prioritises a weak labour market. Might the effect of tariffs ingrain inflation higher in due course?

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

- Is global bond market sell-off a golden opportunity?

At least the producer price index – reflecting input costs – unexpectedly slipped 0.1% on July but rose 2.6% annually. Tariffs are yet to have the feared mega-effect.

Weaker jobs data should be mildly negative for the US economy overall. There has been the largest-ever revision - 911,000 fewer jobs created from March 2024 to March 2025, half the previous 1.8 million. There was also a surprise 27,000 jump in weekly jobless figures, if only minor in a US economic context.

But “all news is good news” welcomes this as making a rate cut more likely next week when the Fed board convenes.

AI fever remains in grip of market participants

A 42% intraday jump in the shares of Oracle Corp (NYSE:ORCL) to a peak of $345 in response to bullish numbers and guidance for its artificial intelligence (AI) cloud business, seems without historic precedent.

Source: TradingView. Past performance is not a guide to future performance.

The stock price closed up 38% on Wednesday, adding $250 billion to Oracle’s market value, and yesterday eased 6% to $308, but I cannot recall a mega-cap re-rating similarly during the 1999-2000 tech-share boom.

Is AI so much more far-reaching than late 1990s advances in e-commerce, AI’s economic gains offsetting the mooted job losses? What will the net upshot for Oracle be given that it will need more debt in support of capital expenditure?

- ii view: Oracle shares soar on huge customer demand

- Share Sleuth: a rule re-think and a portfolio awash with cash

As “all news is good news” the market blew such concerns aside, at least in its initial reaction, and was also less concerned about a weaker-than-consensus 12% increase in Oracle’s first-quarter revenue to $14.9 billion year-on-year and normalised earnings per share (EPS) up 6%. Declines elsewhere in the group are implied by the cloud business - up 28% to $7.2 billion driven by cloud infrastructure up 55% to $3.3 billion.

True, Oracle’s cloud business is growing fast and accounts for near the majority of group revenue. The business backlog has soared an incredible 359% to $455 billion year-on-year, helped by multiple AI cloud contract wins and comments such as this; “over the next few months we expect to sign up additional multi-billion-dollar customers taking the backlog over $500 billion”.

Hopefully management knows what it is doing, talking up prospects like this, and can raise the extra finance to boost its $35 billion annual capex budget. Amid the challenge to discern earnings and net present value, and looking at the chart, I would be wary if capital protection is a first priority for you.

The crux seems to be whether a parallel exists with the 24% jump in NVIDIA Corp (NASDAQ:NVDA) after an early 2023 release cited acceleration in data-centre sales. Nvidia proceeded to more than triple revenues over the next 12 months based on demand for its AI chips, and the shares have nearly quadrupled since end-2023:

Source: TradingView. Past performance is not a guide to future performance.

AI adoption has a long way to go for generating upbeat stories, hence any bubble valuations could continue to expand.

While supportive of a wider bull market, mind how the 1999 euphoria led to the 2000 bust, despite e-commerce taking over like AI seems to be now.

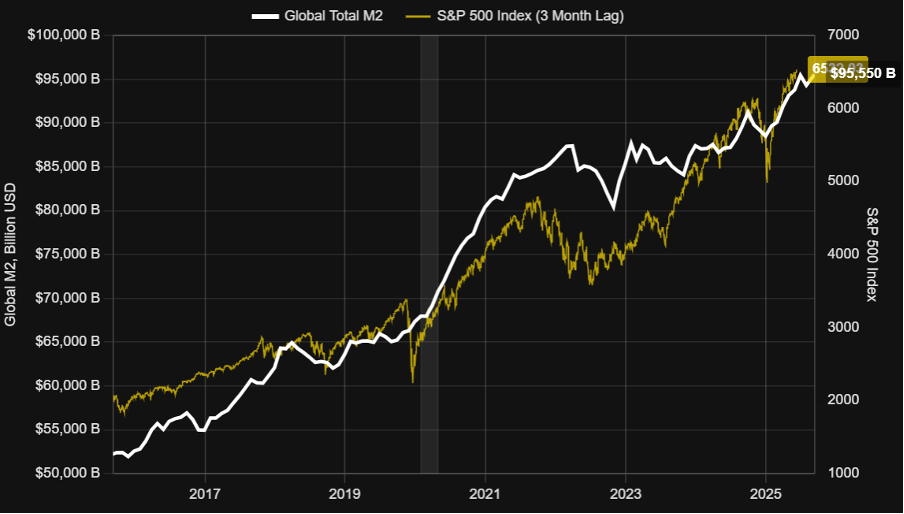

Is it all a function of rising money supply?

There are reminiscences of 1999 in tech, where equities are soaring despite unprecedented US tariffs and heightened political risks, which seem at odds with shares marching onwards and upwards.

Perhaps a monetarist explanation is key and implies no real slowing yet.

Global money supply as measured by M2 – liquid assets covering cash and various short-term deposits – has been in a firm overall uptrend, even preceding Covid.

Despite a downturn from end-March 2022 to end-October 2022, M2 has increased strongly and especially in 2025, up from $88,520 billion to $95,500 billion.

Global M2 Money Supply

Source: StreetStats (Board of Governors of the Federal Reserve System Release H.6, Money Stock Measures; European Central Bank Data Portal; People's Bank of China Financial Statistics Report; Bank of Japan Money Stock Statistics)

It is a cynical view, about how money creation during Covid has lingered, but it squares with classic monetarism where inflation (here, in relatively liquid asset prices) links to “broader money”.

Without upsets on producer/consumer inflation and corporate profit warnings this autumn, bulls seem set to stay in control, happy to buy into any market drops.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.