Share Sleuth: a rule re-think and a portfolio awash with cash

Richard Beddard explains why he’s introduced tougher scoring for his Decision Engine, and what needs to happen to make replenishing the holdings easier.

10th September 2025 08:38

by Richard Beddard from interactive investor

Since I tweaked the Decision Engine’s scoring system to increase my focus on risks, I have re-scored about half the shares in the Share Sleuth portfolio.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Thinking more about what could stop companies making more money has often resulted in lower scores. It has also precipitated the removal of some shares from the Decision Engine and the Share Sleuth portfolio.

It is counter-intuitive, but lower scores don’t mean the shares that remain are less promising long-term investments. Tougher scoring is recalibrating the Decision Engine so that it is more discriminating.

This has exposed a flaw in the Decision Engine’s design. Let’s call it the “rule of 7”.

Rethinking the ‘rule of 7’

The “rule of 7”, isn’t a rule at all. I introduced it to highlight the shares I had most confidence in, but I have sometimes referred to shares that score more than 7 as the “buy zone”.

Once we fixate on a number, it can become hardcoded in our mindsets, and I don’t think I’ve ever added shares to the portfolio when they have scored seven or less.

With stricter discipline in force, the rule of seven takes out too many good investments. Sticking with it while I score more strictly would make it impossible to fill the portfolio. I could invent a “rule of 6” or a “rule of 5” instead, but these are more arbitrary numbers, and I might need to change them in future.

The Decision Engine has a more flexible method of suggesting trades. It is the relationship between the minimum trade size (2.5% of the portfolio’s total value), the minimum holding size (also 2.5% of the portfolio) and the ideal holding size.

To recap, the ideal holding size (ihs) is based on a share’s score. The higher the score, the bigger the ihs:

Score | Ideal holding size (%) |

10 | 10 |

9 | 8 |

8 | 6 |

7 | 4 |

6 | 2 |

5 | 0 |

There’s no real difference between a score of 6.9 and a score of 7.1, yet if I follow the “rule of 7”, I prevent myself from adding one share but can add a middling-sized holding of the latter.

This cliff edge interferes with my basic goal: to invest in proportion to my degree of confidence.

The creeping recalibration of the Decision Engine has also created another problem. I’m more confident in the scores of shares that have been re-scored than shares that haven’t. Consequently, I’m speeding up the re-calibration of the Decision Engine. Starting with Focusrite (LSE:TUNE).

I chose Focusrite because the portfolio is awash with cash and I need to add to holdings or add new ones. Focusrite was the highest-scoring share available to trade, and I hadn’t scored it since I adopted my more risk-averse stance.

Re-scoring Focusrite

Before the rescoring, Focusrite scored 8 out of 10. Now it scores 7.

Focusrite | TUNE | Designs recording equipment, synthesisers and sound systems | 08/09/2025 | 7/10 |

How capably has Focusrite made money? | 2.0 | |||

Focusrite has achieved double-digit revenue growth and low single-digit profit growth since 2019, a period in which return on capital has halved to still viable levels and cash conversion has deteriorated. Many acquisitions and volatile trading cloud my interpretation of the numbers since the pandemic. | ||||

How big are the risks? | 2.0 | |||

Fraught trade relations are disruptive. Focusrite uses Chinese raw materials and components and manufactures there. It exports to the US. Management was wrong-footed by the pandemic boom and subsequent whiplash and is changing the year end, leading me to question its handling of events. | ||||

How fair and coherent is its strategy? | 2.0 | |||

Focusrite's NPS scores indicate that it is employee and customer-centric. It owns market-leading products but acquisitions may be necessary to grow faster. They have made the business more complex, and Low ROTIC(return on tangible invested capital) may mean the company overpaid for them. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 166p values the enterprise at £121 million, about 5 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

Focusrite has published half-year results since I scored it last December.

The half-year results clarified that about 12% of the company’s revenue is made in China and sold in the US, which sounds modest. The company is working with its Chinese partners to make volume products such as its market-leading audio interfaces outside China as well, a policy it calls dual sourcing. Principally, I believe, it will also source from Malaysia, although it manufactures in Germany, the UK and the US too.

Dual sourcing adds complexity. Focusrite is likely to remain dependent on China for components like magnets, and imports into the US from other territories attract tariffs. Managing this risk adds to costs, already probably enlarged by the growing complexity of the business.

- The Income Investor: an appealing cyclical dividend stock

- Stockwatch: is this FTSE 100 share’s 9% yield worth the risk?

Focusrite’s low Return on Invested Capital (ROTIC) (7%), may partly be explained by temporarily reduced profits. Demand has fallen for the company’s market-leading audio interfaces following a pandemic boom, and as stockists reduce high levels of inventory acquired during years of high demand.

But the cost of Focusrite’s many acquisitions has also added to total invested capital, and low ROTIC may betray the fact that it has paid too much for these businesses.

Management has been wrong-footed by volatile trading in the 2020s, and changing the financial year-end from August to February makes it more difficult for investors to evaluate the company’s performance. Focusrite would normally be preparing its full-year results for the year to August now, but it will report a second set of interim results in October or November. Its next statutory reporting period will end in February.

The company says reporting the August year-end is onerous because it is busy, shipments for the pre-Christmas peak trading period are around the same time. But the timing of the change may allow it to gloss over a bad year. I have always felt Focusrite’s communications with shareholders were good, but belatedly I’ve been wondering.

This is not a glowing mid-term report, and by focusing on the risks, you may wonder why I would entertain the 4% holding determined by a score of 7.

- Why investors shouldn’t worry about weak stocks in September

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Focusrite is still profitable and cash generative. It does not have a dangerously high level of debt. I believe it makes market-leading products. Demand for the most important of them, the Scarlett audio interface, should recover. The shares are very cheap in comparison to historic profits and my version of normalised profit may be conservative. I have excluded the extraordinary returns of 2020 to 2022 in the calculation.

It’s a tough one, but not tough enough for me to eject Focusrite from the Decision Engine. I will not be adding more shares to Share Sleuth for now though. The portfolio already holds nearly 2% of its value in Focusrite. Trading at the minimum trade size, would take the holding size over the ideal 4%. I’m not confident enough to do that.

Reducing Goodwin

Even after I raised Goodwin (LSE:GDWN)’s score last week, the Decision Engine indicated I should reduce the size of the holding by 3.6% of the portfolio’s total value, from 6.6% to 3.0% of its total value. This is mainly because of the extraordinary rise in its share price.

Reluctant to add even more to the portfolio’s cash balance, on Wednesday 27 August I complied only partially. I reduced Share Sleuth’s Goodwin holding by 52 shares, roughly the minimum trade size (2.5% of the portfolio’s total value).

The actual price, quoted by a broker, was £94.00 per share, which raised £4,878.00 after deducting £10.00 in lieu of fees.

Dewhurst Group (LSE:DWHT) also exited the portfolio in August, because the company is delisting.

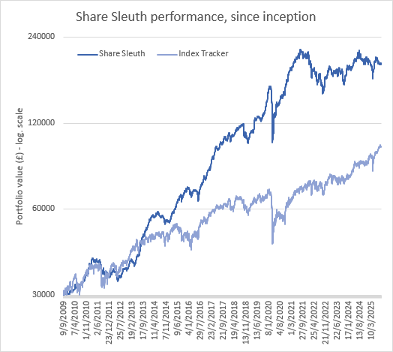

Share Sleuth performance

At the close on Friday 5 September, Share Sleuth was worth £193,675, 546% more than the £30,000 of pretend money we started with in September 2009.

My objective is to remain fully invested, but the portfolio is nearly 16% cash. Hopefully, as I gain full confidence in my scores again, replenishing the portfolio will become easier.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £99,732, an increase of 232%.

Past performance is not a guide to future performance.

After dividends paid during the month from Bloomsbury Publishing (LSE:BMY), ex-holding Dewhurst, Games Workshop Group (LSE:GAW), Latham (James) (LSE:LTHM), Porvair (LSE:PRV), Oxford Instruments (LSE:OXIG), and ex-holding Treatt (LSE:TET), Share Sleuth’s cash pile is £30,490.

The minimum trade size, 2.5% of the portfolio’s value, is £4,842.

Share Sleuth, 07 Sep 2025 | Cost (£) | Value (£) | Return (%) | ||

Cash (16% of portfolio) | 30,690 | ||||

Current holdings (22 shares) | 162,985 | ||||

Performance since 9 September 2009 | 30,000 | 193,675 | 546 | ||

Benchmark: FTSE All-Share index tracker (acc) | 30,000 | 99,732 | 232 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,107 | -9 |

ANP | Anpario | 1,124 | 4,057 | 4,608 | 14 |

BMY | Bloomsbury | 845 | 3,203 | 4,225 | 32 |

BNZL | Bunzl | 417 | 9,798 | 10,792 | 10 |

CHH | Churchill China | 1,495 | 17,228 | 6,429 | -63 |

CHRT | Cohort | 326 | 1,118 | 4,049 | 262 |

FOUR | 4Imprint | 116 | 2,251 | 3,950 | 75 |

GAW | Games Workshop | 66 | 4,116 | 10,124 | 146 |

GDWN | Goodwin | 81 | 1,959 | 8,003 | 308 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,347 | 19 |

JET2 | Jet2 | 456 | 250 | 6,639 | 2,556 |

LTHM | James Latham | 1,150 | 14,437 | 12,880 | -11 |

MACF | Macfarlane | 7,689 | 10,011 | 7,212 | -28 |

OXIG | Oxford Instruments | 505 | 10,044 | 9,262 | -8 |

PRV | Porvair | 906 | 4,999 | 6,559 | 31 |

QTX | Quartix | 3,285 | 7,296 | 9,329 | 28 |

RNWH | Renew Holdings | 689 | 4,902 | 5,602 | 14 |

RSW | Renishaw | 234 | 6,227 | 7,593 | 22 |

SCT | Softcat | 326 | 4,992 | 5,213 | 4 |

SOLI | Solid State | 5,009 | 6,033 | 7,514 | 25 |

TFW | Thorpe (F W) | 4,362 | 9,711 | 13,195 | 36 |

TUNE | Focusrite | 2,020 | 14,128 | 3,353 | -76 |

Notes

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

Objective: To beat the index tracker handsomely over five-year periods

Source: ShareScope.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Share Sleuth portfolio, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.