Stockwatch: time to buy WPP shares or steer clear?

Times are tough at this ad agency whose share price just plunged to levels not seen since 1998. Analyst Edmond Jackson discusses if they’re a bargain or a falling knife.

31st October 2025 12:40

by Edmond Jackson from interactive investor

Cindy Rose, Group CEO of WPP. Source: WPP.

In my last piece I engaged the mid-cap specialist media group Future (LSE:FUTR) and by way of comparison it’s interesting to consider WPP (LSE:WPP) - similarly geared to advertising - after it published third-quarter results on Thursday.

Weaker than expected progress from WPP would normally be interpreted as a tell-tale sign about the wider economy, especially given that WPP is a global business.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Equity bulls generally must therefore satisfy themselves that it isn’t a macro issue for WPP but structural; and whether the growth of artificial intelligence (AI) means advertising agencies are struggling for work and WPP is not best positioned.

On a forward price/earnings (PE) ratio around 5x and dividend yield near 8%, assuming a current share price of 293p, existing holders of WPP shares, and those eyeing it for recovery, must also consider how the shares sit relative to two adages.

First, how a new CEO in a well-established business can have a far-reaching effect. Cindy Rose, who took the top job in September, was the lauded UK boss of Microsoft and knows WPP well from six years as a non-executive director. Second, to quote Warren Buffett “when a manager with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact”.

The share price chart is certainly intriguing for a contrarian “buy”, even if it may be yet to form a base:

Source: TradingView. Past performance is not a guide to future performance.

Yesterday’s 16% fall to 302p at the close is lower than prices suffered in 2008 amid the Great Financial Crisis, after which WPP rose to over 1,900p early in 2017.

But from a decade-long chart, see how net profit has broadly halved from 2014-18 with weakening pre-Covid:

WPP - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Turnover (£ million) | 14,389 | 15,804 | 13,047 | 13,234 | 12,003 | 12,801 |

| Operating margin (%) | 14.2 | 12.1 | 9.2 | 9.4 | -20.2 | 9.1 |

| Operating profit (£m) | 2,048 | 1,909 | 1,204 | 1,248 | -2,424 | 1,167 |

| Net profit (£m) | 1,400 | 1,817 | 825 | 844 | -2,967 | 638 |

| EPS - reported (p) | 108 | 126 | 55.0 | 67.3 | -243 | 52.5 |

| EPS - normalised (p) | 103 | 140 | 95.2 | 81.3 | -50.5 | 69.3 |

| Operating cashflow/share (p) | 137 | 110 | 134 | 147 | 168 | 167 |

| Capital expenditure/share (p) | 22.0 | 25.6 | 29.7 | 31.3 | 22.3 | 24.1 |

| Free cashflow/share (p) | 115 | 84.8 | 105 | 116 | 146 | 143 |

| Dividends per share (p) | 56.6 | 60.0 | 60.0 | 22.7 | 24.0 | 31.2 |

| Covered by earnings (x) | 1.9 | 2.1 | 0.9 | 3.0 | -10.1 | 1.7 |

| Return on total capital (%) | 11.5 | 10.5 | 7.0 | 8.0 | -18.7 | 10.2 |

| Cash (£m) | 2,437 | 2,391 | 11,066 | 11,306 | 12,899 | 3,883 |

| Net debt (£m) | 4,131 | 4,483 | 4,017 | 3,789 | 2,852 | 2,943 |

| Net assets (£m) | 9,325 | 9,487 | 9,360 | 7,926 | 4,732 | 3,616 |

| Net assets per share (p) | 728 | 747 | 742 | 630 | 386 | 313 |

Source: historic company REFS and company accounts.

Forecasts like shooting fish in a barrel

When I last examined WPP at 420p in July, I noted a prospective price/sales ratio around 0.4 implying scope for turnaround. However, a chief risk looked to be weakening economic data conspiring with the group’s structural dilemmas to generate another profit warning. A “buy” stance appeared too speculative, hence I compromised at “hold”, but this is now shown as complacent.

Consensus actually appears more bearish on revenue than 2025 annual revenue guidance, which was downgraded from a -3% to -5% fall to -6% in yesterday’s update. The market expectation appears to be a 20% fall to £11.8 billion, with a 22% fall in normalised earnings per share (EPS) to around 65p.

Yet it expects net profit to rise 35% to £733 million, an improvement on performance since 2019. When I last wrote, the consensus was for just over £800 million 2025 net profit on £11.7 billion revenue, hence an 8% downgrade versus the shares down 28% since July.

- Wild’s Winter Portfolios 2025: winning stocks revealed

- Budget 2025 preview: weighing up the cost of income tax hikes

However, the 7 August interims showed a near 8% revenue fall to below £6.7 billion, with net profit whittled down from £246 million to £70 million like-for-like. £129 million net finance costs ate into £238 million overall operating profit and the net cash outflow from operations nearly doubled to over £1 billion.

So, with the new CEO declaring recent third-quarter performance “unacceptable” even if triggering only a modest revenue downgrade, it does not help market confidence. Expecting a flat 2026 could simply be analysts suspending forecasts, with which I can empathise. With talk of job cuts and a new CEO saying “there is a lot to do”, exceptional charges seem likely.

Consensus is for a circa 24p dividend amply covered by normalised earnings, hence an 8% yield that normally would be supportive.

The key question seems to be whether economies do turn down, making the CEO’s challenges harder. But on a possible two-year view, WPP could be in an interesting valuation range unless AI is permanently displacing its services.

Rose does look a very good fit for this job, but mind you, when Mark Read took over as CEO in 2018, he was heralded similarly and was attuned to client needs at a time when digital transformation was required. Early reported remarks from Rose, having met key clients, could imply that WPP is out of synch with clients.

Her declaring a strategic review effectively concedes that the group is behind the curve. It aims to simplify and integrate the client offering, “harnessing our AI advantage to deliver growth and business outcomes for our clients”, improve execution and expand the market, and also strengthens financial foundations through operational efficiency.

The role of short sellers

Disclosed shorts above 0.5% of the issued share capital spiked from 1.6% in August to 5.8% just lately, with five trading firms raising such positions during October. It shows how tracking shorts can be useful and, indeed, the overall disclosed short is now close to 7%, with probably more under the 0.5% threshold. That makes WPP the third most-shorted share on the LSE.

In particular, I note the largest trade is from hedge fund Marshall Wace, which on 28 October raised its short 0.09% to 1.20% just before the bad news. I have followed the hedge fund for years and, while it can make mistakes, I respect that one needs very good reasons to take the opposite trade.

Six of 10 disclosed institutions raised their short positions this October, none have trimmed. So, it is possible the shares are over-weak in the near term as shorting becomes a crowded trade, yet those with a longer-term short such as Marshall Wace have raised their bets just prior to this fall.

A maximum 2% was disclosed shorted in early 2013, then throughout 2018-19 and occasionally 1% or so from 2022 to 2025.

I suspect their rationale is three-fold: WPP underperforming its sector; marketing services remain pressured whether by AI or sluggish demand; and the extent of debt that this group carries.

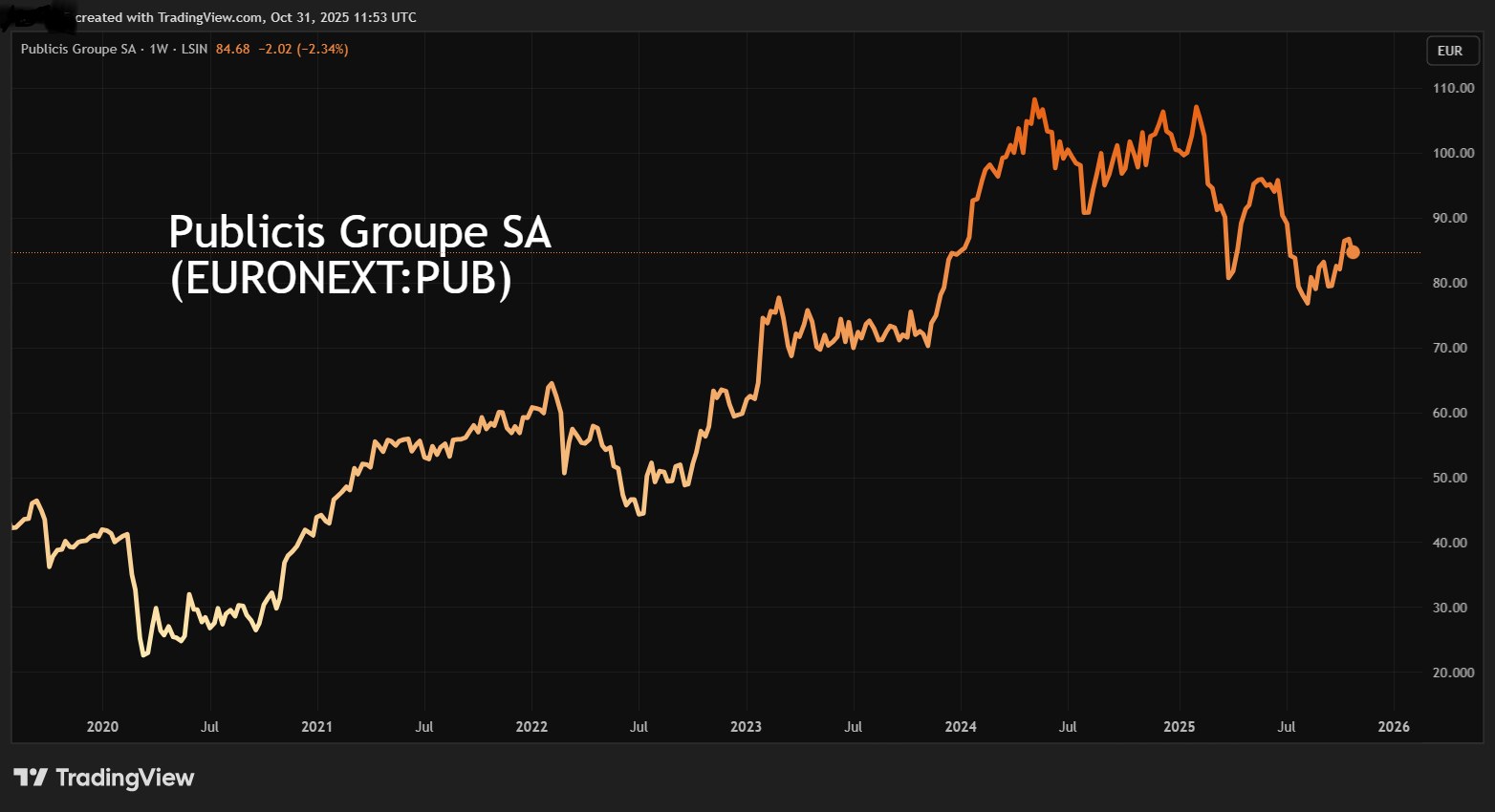

Last year, WPP lost its position as the world’s leading ad agency to France’s Publicis Groupe SA (EURONEXT:PUB), whose five-year chart is pretty much the opposite to WPP despite overall decline this year:

Source: TradingView. Past performance is not a guide to future performance.

Also, by contrast, its third-quarter results showed a 5.7% organic growth rate that beat expectations, hence full-year guidance slightly upgraded to near 5.5%. This was driven by high demand for AI products and services, plus strong performance across the US with 7.1% growth, plus plenty of new business wins.

This scotches the idea that WPP’s weak performance can be blamed on macro events, although it does underline how AI-related parts of the economy are booming while others are soft.

- Gold: buy the dip, or mind the drop?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

For example, in its third quarter, Global Integrated Agencies fell 6.2% and WPP Media by 5.7%, with a sequential deterioration on the second quarter. Public relations was down 5.9%. Geographically, the US fell 6.0% and the UK by 8.9% versus Europe down 4.4%. Rest-of-world “improved” to a 5.0% decline, with variance such as 6.7% growth in India offset by a 10.6% fall in China. Revenue from WPP’s top 25 clients eased 2.0% year to date versus 4.8% for the group, with healthcare the chief outperformer.

Poor balance sheet with hefty debt costs

This is blood to short-selling sharks when a company’s performance is deteriorating.

WPP’s £3.34 billion net debt is slightly ahead of a £3.20 billion market capitalisation, in context of £8.1 billion goodwill/intangibles comprising 237% of net assets.

S&P downgraded its credit rating from BBB investment grade to negative in July, although Moody’s still rates it as Baa2 investment grade. It’s unclear whether this shows these agencies as behind the curve or whether the situation is not as bad as shorters imply.

On a market technical basis, I think some near-term recovery is possible, as we’ve seen with B&M European Value Retail SA (LSE:BME) lately.

On an investment view, however, the variables are too tricky to grasp, especially when the new CEO talks of pricing services “more efficiently”, which implies some level of cost to margin.

I am inclined to let the situation evolve further rather than change my stance. It can go either way but the news could be worse before it improves.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.