Third of parents keep Junior ISA a secret until child turns 18

Such a step is underpinned by a fear of lack of financial maturity, writes Myron Jobson.

19th March 2024 16:26

by Myron Jobson from interactive investor

- ‘They’re too young’ was the most popular reason for not informing children about their Junior ISA, cited by over two-fifths of respondents

- Some 13% said they fear their child would spend it all at 18

- interactive investor also reveals key Junior ISA trends and bestselling investments in 2024.

Almost a third of parents (30%) say they haven’t told, or plan to tell, their child that they have a Junior ISA (JISA) before they’re 18, according to a new poll by interactive investor.

- Invest with ii: Open a Junior ISA | Transfer a CTF to Junior ISA | Junior ISA Allowance

‘They’re too young’ was the most popular reason for not informing children about their JISA, cited by over two-fifths (44%) of the sample from a poll of 500 parents who visited the interactive investor website between 4-7 March 2024.

Some 13% said they fear their child would spend it all when they are able to withdraw funds from the account at the age of 18. Another 12% thought doing so would be inappropriate and 5% said they think their child finds matters related to money and finance boring.

There also appears to be a case of inertia among parents, with over one in four (26%) stating they don’t know why they haven’t told their child about their JISA.

When it comes to the appropriate age to tell a child they have a JISA, the largest percentage of the sample (36%), said 10-15. However, one in four (25%) said children shouldn’t know about them until they turn 18 and the same number cited 16-17.

14% of respondents believe it is inappropriate to inform children under 10 about their JISA.

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Building up an investment pot to give your child a financial leg up when the reach adulthood is half the battle. Ensuring that the money is used in a responsible way is also challenging.

“Underpinning a nervousness among a significant portion of parents surveyed around informing their child of their JISA is a worry that they are simply too young to know. Doing so could potentially lead to expectation about finances, an early sense of entitlement, or misunderstanding about the value of money.

“Before breaking the JISA news to children, it is important for parents to consider their child’s age, their savvy in finance matters, including the importance of budgeting, saving and investing.

“It is important to introduce financial concepts gradually and age-appropriately to help child develop heathy money habits. Make it a learning opportunity, explaining the purpose of the ISA, the perks of saving and investing for the future, and consider getting them involved in the decision-making.

“Parents and carers also have a crucial role to play in helping their children develop a healthy relationship with money – especially as financial education simply doesn’t get the attention it deserves at many schools. Fostering positive attitudes towards budgeting and saving from an early age will help them make the right financial decisions in later life.”

interactive investor JISA trends

- The average pot size of a JISA on interactive investor is £14,128.

- The average age of a JISA accountholder on ii is 10 years old.

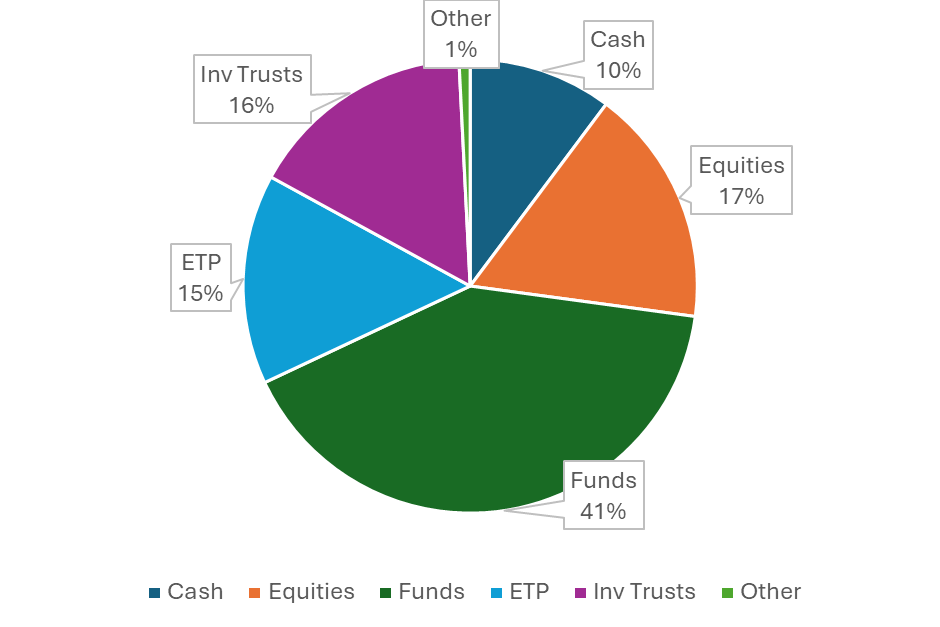

Average JISA portfolio composition on ii

Asset type | Female | Male | All |

Cash | 10.1% | 10.3% | 10.2% |

Equities | 16.9% | 17.1% | 16.9% |

Funds | 41.0% | 40.8% | 40.9% |

ETP | 15.4% | 14.5% | 15.0% |

Investment trusts | 15.9% | 16.4% | 16.2% |

Other | 0.8% | 0.8% | 0.8% |

- There are no significant differences between genders in how parents invest for their children.

Bestselling investments among ii’s JISA and adult ISA customers so far this year (January-18 March 2024)

Position | Most-bought investments among JISA customers | Investment type | Most-bought investments among adult ISA customers | Investment type |

1 | ETF | EQUITY | ||

2 | FUND | EQUITY | ||

3 | FUND | EQUITY | ||

4 | FUND | EQUITY | ||

5 | INVESTMENT TRUST | EQUITY | ||

6 | EQUITY | EQUITY | ||

7 | ETF | EQUITY | ||

8 | FUND | EQUITY | ||

9 | FUND | ETF | ||

10 | FUND | EQUITY |

Myron Jobson says: “Passive funds dominate the list of bestselling investments within JISAs with ii so far this year, accounting for seven of the top 10, with only one stock and investment trust, Tesla Inc (NASDAQ:TSLA) and Scottish Mortgage Ord (LSE:SMT), respectively, making the cut. In contrast, all but one of the top 10 most-bought investments among our adult ISA customers is a stock, with the usual FTSE 100 heavyweights – the likes of Lloyds Banking Group (LSE:LLOY), Rolls-Royce Holdings (LSE:RR.), and Legal & General Group (LSE:LGEN) – ranking highly as well as Helium One Global Ltd Ordinary Shares (LSE:HE1) and NVIDIA Corp (NASDAQ:NVDA), which have surged in popularity in recent times following an uptick in valuation.

“Funds within JISAs are a popular choice because they offer the potential for growth over the long term, while reducing the risk of loss through diversification. Stocks, on the other hand, are typically more volatile and may carry higher risks, which adults might be more willing to take on themselves for the potential of higher returns.”

Cash ISAs won’t cut it long term

Myron Jobson explains: “Cash JISAs are frankly pointless other than as an option for teenagers approaching adulthood who might shortly need to use their pot and therefore want to remove the short-term risk of a sudden loss of value. Most JISAs are going to be inherently very long term, because they cannot be accessed until the child is 18, there is ample time for short-term bumps in stock markets to be ironed out.

“The JISA allowance stands at a generous £9,000 for each tax year but, in reality, few are fortunate enough to maximise the allowance, with the average parent saving £1,229 into these accounts in the 2021-22 tax year, according to the latest HMRC figures available. But even modest investments that are given ample time to grow and benefit from compounding can yield impressive returns that could give your child a financial leg-up and then some when they reach adulthood. While stock markets can be volatile on a day-to-day basis, a glance at history shows that they have a knack of delivering inflation-beating returns over long periods of time. There are no guarantees in life – and that is something long-term investors need to be comfortable with.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.