Times are a changin': The case for a value resurgence

Amid the longest period of value underperformance since the 1920s, are things about to change?

8th November 2019 15:01

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Amid the longest period of value underperformance since the 1920s, are things about to change?

Times are a changin'? The case for a value resurgence

Callum Stokeld, investment trust research analyst at Kepler Trust Intelligence.

The long view

"Is life always this hard, or just when you're a kid?"

"Always like this" (Leon: The Professional)

In the post-financial crisis world, value investors have found themselves facing a period of structural underperformance relative to growth investors which has been unusual relative to history. In fact, this is the longest period of underperformance since at least the 1920s. This raises the question what, if anything, could cause this to change?

Fama and French have famously identified value as a factor which over the long-term, has led to outperformance in equity markets. In fact, their data shows that value portfolios have consistently outperformed growth portfolios over the long run (from 1926), but with significant periods of underperformance too.

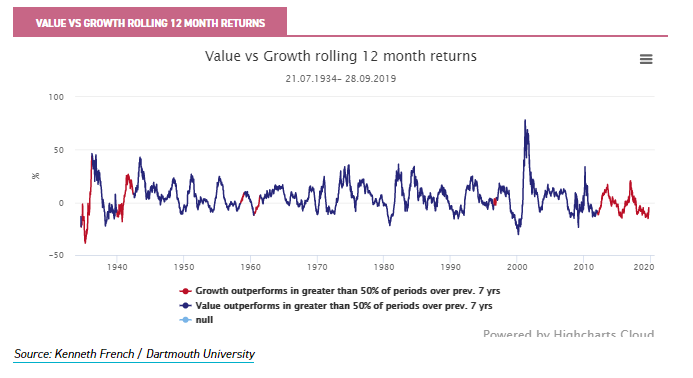

Below we can see the rolling 12-month annual returns of a value factor portfolio relative to a growth portfolio, both equally weighted to small and large caps. Over a twelve-month period, it has been common for value to underperform.

However, we have highlighted in blue where Value has outperformed in over 50% of 12-month periods in the previous 7 years (which we have taken as the average length of the business cycle). The red line represents periods where Growth strategies have outperformed in over 50% of the periods. This shows that the recent outperformance of growth is not unusual, but the sustained outperformance certainly is.

The gambler's fantasy

"Markets can stay irrational longer than you can stay solvent"

(J.M Keynes)

"There is only one side of the market and it is not the bull side or the bear side, but the right side"

(Jesse Livermore)

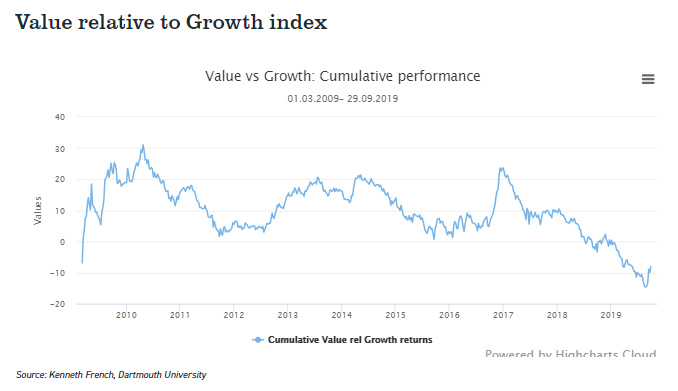

Cycles do not die of old age. That the endurance of growth outperformance in recent years is unusual is not a reason to reject growth strategies for the future. Indeed, there have been many false dawns of short-term periods of value performance since the financial crisis which have come to nothing, as the below graph of the relative performance of value versus growth shows.

Value relative to Growth index

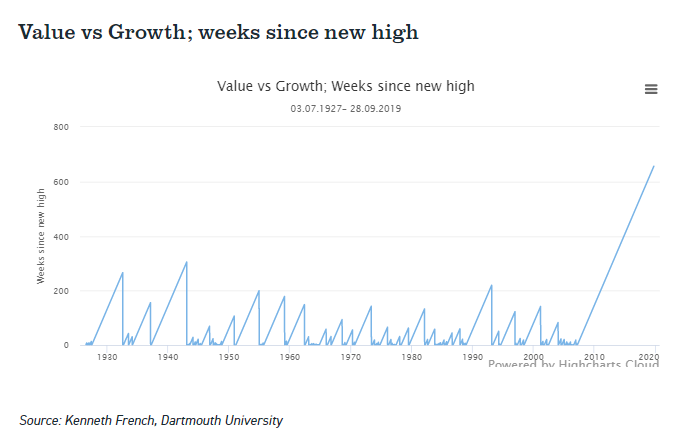

Our calculations show the duration of the current outperformance of growth factor strategies is already unprecedented, with the value relative to growth index having last made a new high in July 2007. However, betting on this streak to end has to be based on more than just the length of time that has expired, as the experience of the past decade shows. The below chart shows the number of weeks since the value versus growth relative index has peaked.

Is it different this time?

Recent research from O'Shaughnessy Asset Management (OSAM) has highlighted how important the sector weighting issue is to value's underperformance. OSAM estimates that the financials sector has accounted for 75% of value's underperformance in recent years, whilst technology has been the main driver of growth's outperformance. Indeed, it is worth highlighting that since the start of March 2007, when the value/growth index peaked, the iShares Global Financials ETF has provided a total return of 5.4% in USD. This pales in comparison to the 92% of the iShares Core MSCI World ETF (LSE:SWDA), and the 283% of the iShares Global Technology ETF.

In part this was because the 'value' in banks, in particular, in 2007 was illusory, a result of overstated asset values and profit margins driven by excess leverage. Meanwhile, the disruption of the existing socio-economic model by technology companies was entirely unappreciated by the wider market; many of these companies appeared optically expensive on the assumption that the structure of the economy was static.

So a key consideration will be whether these things still hold true going forward, with relative exposure to technology and financials remaining a significant difference between a value and momentum (a proxy for growth) ETF.

The rich get richer

"Price is what you pay. Value is what you get"

(Warren Buffett)

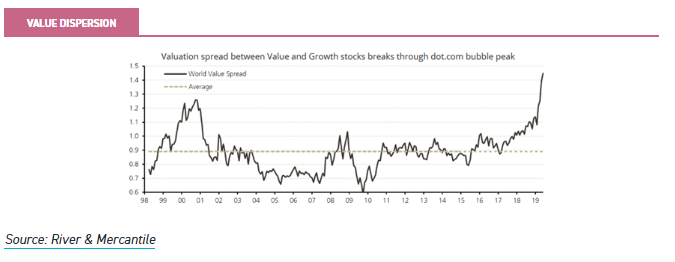

It is axiomatic that 'value' should trade at a discount to other parts of the market. However, as highlighted by River and Mercantile (LSE:RIV) with the below graph, value dispersions have reached elevated levels.

In the context of our comments on technological shifts and disruption to the socio-economic cycle, this brings us to the heart of the near-term consideration for investors considering a shift to value strategies. Value investing at the company level is undertaken on the assumption that the future earnings stream relative to trailing earnings has been over-discounted by the market. Have we now, with the extreme divergences seen above, reached the point where the market has discounted too great a reduction or evisceration of existing companies and business models?

If we have, then all we need to see is a catalyst. I have noted above the sensitivity to moves higher in interest rates and bond yields of value stocks; could we finally be approaching the point, with c. $14 trillion of debt globally providing negative nominal yields, where rates move up? Central bankers around the world have started to increasingly comment that they may be at or approaching the reversal rate, at which the costs of rate cuts outweighs the benefits. Sweden's Riksbank has recently announced they will raise rates for precisely this concern; could this be the moment which sparks a change?

Trusts to access Value Factors

Should investors believe we are about to see a sea-change in environment, there remain a few stalwarts continuing to plough the lonely furrow of value investing in most major markets.

UK

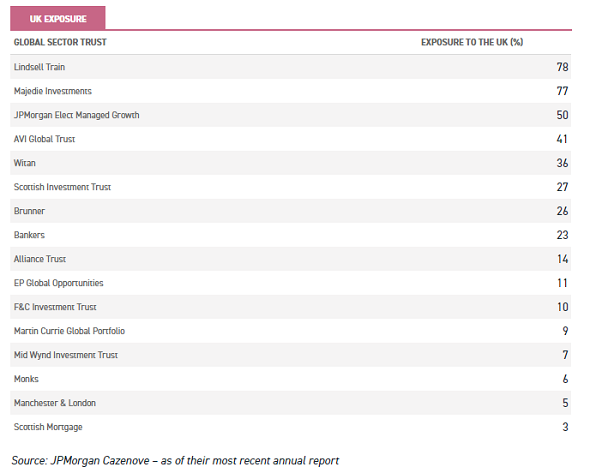

The UK, a high dividend market, has a stauncher professional value investor base than many other markets. Across all UK investment trusts, median R-squared (R2, a method of measuring correlation) to value indices remains higher than to growth indices. UK investors looking to access growth strategies often look abroad, or use the small-cap sector.

An avowed 'value' manager, who has remained committed to his process despite the challenges of recent years, is Alastair Mundy, manager of the Temple Bar Investment Trust (LSE:TMPL). This retains amongst the highest R2 to the UK value index amongst the various trusts investing in UK equities over both the recent and slightly longer term. Whilst there is one trust with a higher reading, it is notable that the difference is reasonably marginal, and the other trust exhibits a higher R2 towards the FTSE All-Share. This likely means some of its apparent Value correlation is a result of exposure to large-cap stocks.

Alastair has identified the likelihood that central bankers will be prepared to risk higher inflation in the coming years to deal with debt overhangs. Cognisant of this, but having identified them as attractive value opportunities on a bottom-up basis, he holds exposure to select UK banks, such as Lloyds Banking Group (LSE:LLOY) and Barclays (LSE:BARC), with financials and industrials the two biggest sectors in TMPL.

Another option in the UK is Aberforth Smaller Companies (LSE:ASL). ASL is a rare value-focused small-cap trust. According to Morningstar data it has the highest weighting to "value" stocks in the small cap peer group, by a considerable margin. The management team uses EV to EBITA as their main valuation metric, believing it allows them to better isolate the cash generation of a business and view companies with different capital structures on a level playing field. The share price saw a significant rally after the mini-rebound in value in August, with the discount coming in from 15% to 7%, and share price total return in 2019 has been 20% compared to 9% for the growth-dominated sector average.

In recent years, the value discipline has led ASL to be tilted more towards UK domestic earnings which have been out of favour after the Brexit vote led to weakness in sterling and doubts about growth in the UK economy. Political clarity on the next steps in the Brexit vote and diminishing chances of a no-deal exit could therefore also be helping sentiment towards the trust. The current top holdings are all UK-focused: transport operator FirstGroup (LSE:FGP), pub owner Mitchells & Butlers (LSE:MAB) and property developer Urban & Civic (LSE:UANC).

US & North America

Trying to identify intrinsic value and a catalyst for value realisation, Gabelli Value Plus (LSE:GVP) has, since launch, displayed a consistently high R2 to US value indices. The managers of this trust seek to invest across the market cap spectrum to generate a highly differentiated portfolio to the wider US market. Valuation is primarily undertaken on an individual stock level, trying to determine if companies are trading at significant discounts to the strategic value they would offer a private investor.

Communications and Industrials are overweight sector exposures in GVP, similar to that seen in broad style indices, whilst technology is a significant underweight.

Emerging Markets

There is a diverse array of countries, strategies, and trusts available in emerging markets, including generalist trusts, country specialists, and regional specialists. Value outperformance in individual markets may not be replicated in others, and, indeed, is unlikely to be; one of the most common drivers of relative economic (and often market) fortunes in emerging markets is the performance of commodities, driving divergence between emerging economies which import or export certain commodities and energy sources.

Explicitly value strategies are not, in any case, well represented in the emerging markets universe, with few 'pure' value investors. However, this does not preclude opportunities; investors looking to access value opportunities can focus instead on accessing lowly valued markets. On any of Price/Cash Flow, Price/ Sales, Price/ Earnings, or Price/ Book, emerging Europe consistently appears at a lower valuation other regions, with its constituent countries all individually screening attractively on this basis as well, and on a Cyclically Adjusted Price/Earnings basis.

Baring Emerging Europe (LSE:BEE), whilst not a value-investor itself, invests in this region, and generally outperforms wider emerging markets in global value rallies (this is, of course, subject to variance arising from regional issues). BEE invests across emerging Europe, including investments in Russia, Poland, Turkey, Greece, Romania, Hungary and Czech Republic. The managers have noted the depressed valuations in the region, and look to take advantage of pricing inefficiencies caused by low broker and analyst coverage of much of the region. As an illustration of the extreme valuations in its market, BEE's major holding Gazprom (LSE:OGZD) is trading on a PE of just 3.5 times, compared to 15.9 times and 15 times for US peers Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX).

Multi-Asset

An alternate way to look to benefit from any value resurgence would be to hold a broad-exposure to assets discounted to their intrinsic value. The Miton Global Opportunities (LSE:MIGO) looks to construct a portfolio of just such opportunities, diversifying risks across different themes but buying other investment trusts which offer substantial upside if their intrinsic value becomes more widely appreciated by the market. At present, there are various themes held within the trust where the manager believes there are substantial opportunities for portfolio uplift from narrowing discounts; these include in UK micro-caps, German residential property, and alternative assets.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.