Top 10 jobs for pensions

28th January 2022 16:36

by Faith Glasgow from interactive investor

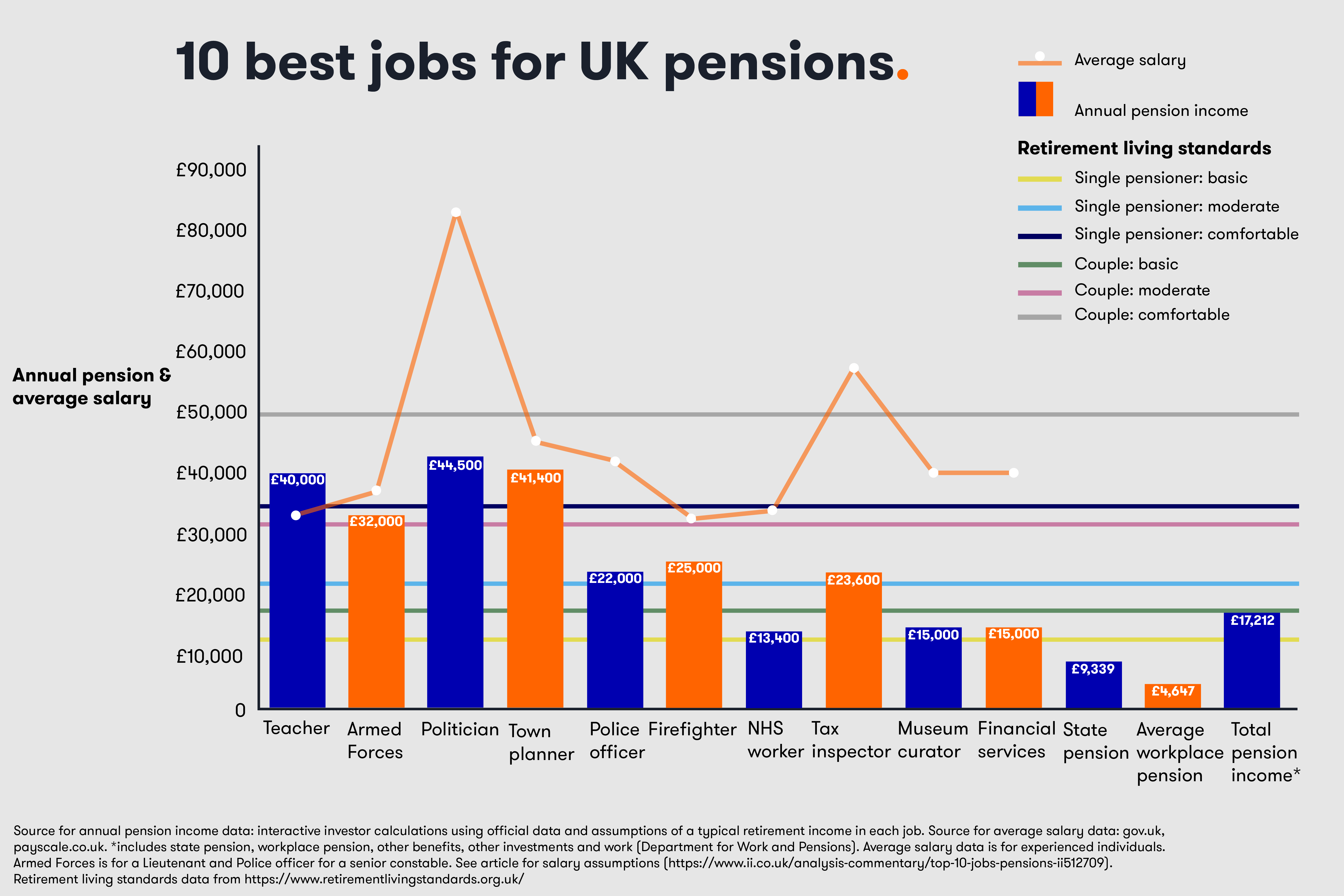

From teachers and NHS workers to firefighters and those in financial services, these are 10 of the top jobs for pension benefits.

If you’re in paid employment in the private sector, you probably have a workplace pension these days. Under the auto-enrolment regime phased in from 2012, employers have to provide a pension scheme for their staff and enrol them in it unless they opt out; as a consequence 88% of eligible employees are scheme members, up from just over 40% in 2012.

But while at least 8% of your salary, including at least 3% from your employer, will be going into your pension fund every year under the auto-enrolment rules, that won’t necessarily equate to a comfortable income when you stop working. Nor will it necessarily come with inflation guarantees or income security at retirement.

- Read about: SIPP Portfolio Ideas | How SIPPs Work | SIPP vs Stocks & Shares ISA

If you want a career path where relatively generous and secure pension benefits are part of the package, take a look at the public sector options.

These are defined benefit pensions, very different beasts from the defined contribution or investment-based pensions offered by private companies. You’ll still in most cases be making a contribution, but your employer pays in much more - and your final pension grows year by year, and is secure for life. In addition, you receive a host of related benefits such as widow’s pension and death in service payments.

Your retirement income is calculated on the basis of your salary. Historically this was a proportion of your final salary, but in 2015 public sector final salary schemes were overhauled because rising life expectancy made them unsustainable.

A less generous (but still attractive) ‘career average revalued earnings’ (CARE) system is now in place in most cases, and it is into this that new employees are enrolled. CARE pensions involve a fraction of your annual pensionable earnings - say 1/60th – being paid into your pension pot each year, and the pot value being indexed annually against inflation by an amount set by the government.

Your annual retirement income is directly based on the value of that pot. There is the option to swap up to 25% of your pension income for a tax-free lump sum: the usual exchange rate is £12 of lump sum for every £1 of income given up.

Here are some of the best pension deals around. All the examples use current values, in most cases revalued to take account of inflation, but they are not real-life scenarios and should only be treated as a general indicator.

1) Teachers

Under the 2015 Teachers Pension Scheme, members’ benefits build up each year based on 1/57th of their pensionable earnings for that year. To take account of inflation, for every year they are working as teachers, their accrued pension is revalued (by 2.1% for the year to April 2022).

Employee contributions increase as earnings rise: teachers earning less than £28,000 contribute 7.4% of their salary, while those on the highest pay tiers (over £81,000) contribute 11.7%. However, in addition the employer pays 16.5%.

Retirement age for this scheme is the later of state pension age or 65.

Typical retirement income

A teacher who expects to retire on £60,000 at the age of 66, after 40 years of service, can look forward to an annual pension of £25,700 if they take the maximum tax-free lump sum of around £170,000. If they sacrifice the tax-free lump sum, their pension income will increase to £40,000 a year.

- Pension stories: examine the saving habits and goals of investors at different life stages

- Pensions: is 12% the new 8%?

2) Armed Forces

In contrast to all other public sector pensions, members of the Armed Forces pension scheme make no contributions. Instead, the Ministry of Defence pays in the equivalent of 1/47th of each member’s pensionable earnings each year and the pot increases with inflation.

The normal pension age is 60; if you leave the forces at an earlier age your pension will be deferred until you reach 60, or you can take a reduced pension from age 55.

But given that a full career to age 60 is not available to most forces personnel, the Armed Forces also operates an Early Departure Payment (EDP) scheme for those who remain in service until at least age 40 and have served at least 20 years. This pays a tax-free lump sum plus a monthly income worth a third of the value of your deferred pension.

Typical retirement income:

A 32-year-old sergeant on £39,600 who expects to retire at 60 as a major earning £64,600 could expect a pension income of around £32,000. If they take the maximum tax-free lump sum of £137,000, their income will fall to £20,600.

- Pensions versus ISAs: a beginner’s guide

- Dinah Wolf: what a 21-year-old really thinks of pension saving

3) Politicians

Politicians may like to consider themselves ‘representatives of the people’, but they certainly aren’t when it comes to pay and pensions. As well as earning a basic annual salary of £81,932 since April 2020, MPs also benefit from one of the most generous pension schemes, in the shape of the Parliamentary Contributory Pension Fund (PCPF).

Under the CARE scheme introduced in 2015, when they join, members choose what level of contribution to make – from 7.75% up to 13.75% of their salary. Larger contributions mean benefits build up at different levels. For example, an MP who pays in 13.75% of pensionable earnings will accrue pension at 1/40th of his earnings - which for a starting MP on the basic salary amounts to around £2,000 for each year of membership.

MPs can take their pension from state pension age, but only once they have stopped being paid as an MP or minister. However, there are also special rules governing those who continue in office beyond retirement age and even beyond age 75.

Typical retirement income

An MP appointed on the current basic salary, who remained in post for 20 years until they retired at age 66, and who had made contributions at the middle rate of 9.75% of their salary (which meant they accrued pension benefits at a rate of 1/50th of salary) would be entitled to a pension of around £44,500, based on annual salary increases of 1% and inflation increases of 2%.

4) Town planner

Local government employees also do pretty well in pension terms. From town planners to school caterers to recycling operatives, they can all join the Local Government Pension Scheme (LGPS), with contributions worth 1/49th of their pensionable earnings added to their pension pot and revalued each year in line with the consumer price index (CPI).

Employees earning less than £14,600 pay 5.5% of their salary each year, while those earning more than £165,000 contribute 12.5%. The employer’s contribution typically amounts to around two-thirds of the total scheme costs.

Typical retirement income

A town planner on a £30,000 salary at the age of 30, who joins the scheme and works until state pension age at 68, will contribute 6.5% of their salary (though this may change if the pay bands and contribution rates are changed) and retire on a pension of £41,400. This assumes an annual 1% pay rise and inflation revaluations at 2% each year.

If the employee wants to take a tax-free lump sum, their pension income will be reduced.

- Don’t be shy, ask ii…how do I value my final salary pension schemes?

- Watch our share, fund and trust tips, plus outlook videos for 2022

5) Police officers

Under the Police Pension Scheme, contributions of 1/55.3th of members’ pensionable earnings are added to their pension pot each year. In other words, if you earned £55,300 one year, £1,000 would be added to your pension for that year. Your pot is indexed at CPI plus 1.25%.

Member contribution rates stand at between 12.4% and 13.8% of pensionable earnings, depending on salary; the police force as employer puts in typically about twice as much as the employee.

Unlike many other public sector occupations, retirement age in the police is 60, though (as with other CARE pensions) police officers can retire any time after age 55 and take immediate payment of a reduced pension (to reflect the fact that it will be paid for longer).

Typical retirement income

Take a 30-year-old officer earning £21,000 in their first year of active scheme membership and receiving a pay increase of 1% a year, with CPI inflation at 2%. Assuming no promotion or changes in the inflation rate, if they continue to work as a police officer for 30 years until retirement at age 60, they will have built up a pension income of around £22,000 per year.

They could take up to 25% of this as a tax-free lump sum of up to £64,000, though their pension income would fall to around £16,000 a year.

- Low-cost investments to help get you started – all chosen by our experts

- Check out our award-winning stocks and shares ISA

6) Firefighters

Firefighters have had a pension scheme since 1926 but the current CARE scheme was introduced in 2015. This provides an annual benefit of 1/59.7th of earnings, revalued every year to keep pace with inflation.

Contributions depend on salary. For instance, in the 2021/22 tax year, anyone earning less than £27,818 pays in 11% of their earnings, with this contribution rate rising to 14.5% for those with salaries of £142,501 plus.

Normal retirement age is 60, but if you opt to remain in work as an active scheme member beyond that age you’ll continue to build up pension, with an ‘age addition’ to reflect the fact that you’ve postponed taking benefits.

Typical retirement income:

A 25-year-old firefighter joining the service on £30,000 can expect an annual pension in the region of £20,000 to £29,000 when they retire at age 60, depending on inflation-linked increases.

7) NHS employees

The National Health Service has provided a CARE scheme since 2015 (though those in the NHS scheme before then will have accrued earlier pension benefits). However, though it’s been trimmed back, it still remains one of the UK’s most generous schemes.

To qualify, you’ll need to contribute a percentage of your pensionable pay, starting at 5% for anyone earning less than a full-time salary equivalent of £15,500 and rising in stages to 14.5% for those on more than £111,000 a year.

This entitles you to a pension based on 1/54th of your pensionable pay for each year you have contributed to the scheme. This is increased at the beginning of each scheme year by CPI plus 1.5% while you are still an active member of the scheme.

Typical retirement income:

Take someone earning £18,000 as a junior member of the NHS workforce and receiving a 4% pay rise and 3.5% revaluation each year. After 20 years of service, they would be on a salary of £37,923 and could expect a pension worth over £13,400 a year.

- Top 10 things you need to know about your state pension

- Read the Great British Retirement Survey 2021 report

8) Tax inspector

Whether you’re a tax inspector, prison officer or IT operator, there is a huge spectrum of civil servant roles, and they all qualify for an attractive Civil Service pension. There are five different variations on the scheme theme, and which one you’re in will generally depend on when you started working as a civil servant; but members joining since 2015 will be enrolled into the Alpha career average-based scheme.

The Civil Service scheme has much lower member contribution rates than many of the others. So someone on the Alpha scheme who earns less than £23,100 pays just 4.6% of their salary, while those earning over £150,000 contribute 8%. The employer contributes between 26% and 30% of salary. The amount your pension accrues by each year is 2.32% of earnings.

For Alpha scheme members, the retirement age is 65 or your state pension age, whichever is the later.

Typical retirement income

Assuming pay rises of 1% a year and inflation revaluations of 2.5% each year, a 46-year-old tax inspector who earns £36,100 and plans to work for another 20 years until retirement can look forward to a pension worth around £23,600 a year. If they take the maximum tax-free cash lump sum of £101,000, their pension will fall to £15,100.

- Your pension: think about it earlier and more often

- State pension shock: how you can make up the shortfall

9) Museum curator

Get a job with one of the UK's publicly funded museums, such as the British Museum, the Tate Gallery or the National Museums of Scotland, and you'll be entitled to an Alpha civil service pension.

In exchange for a contribution of between 4.6% and 8.05% of your earnings, your annual pension will grow each year by 2.32% of your income, with an uplift in line with inflation.

Typical retirement income:

A museum curator earning £30,000 a year can expect to build up a pension worth around £15,000 after 30 years' service. On £30,000, they'll need to pay in 5.45% of their earnings.

- ‘No one wants to work til 70’, a student’s view of pensions

- Have you visited our Knowledge Centre? Learn more about the world of investing

10) Financial services

In the private sector, salary-based pensions are fast becoming a blessed memory. According to the Office for National Statistics, almost 1.5 million private sector employees (7.7%) are still paying into one, compared with 5.4 million or 80% of the public sector workforce.

Instead, private sector pension schemes are investment-based, whereby employer and employee together contribute to build up a pot of money which is invested to provide an income in retirement.

However, some industries in the private sector do offer much better pension contributions than others. Although the average employer contribution for the UK is only around 4.5% of the employee’s salary, Profile Pensions research using 2018 data found that employers in financial service paid an average 9.5%.

For someone on the current average UK salary of £31,285 (according to Statista), this amounts to contributions worth £2,972 a year. That figure is not comparable to those for salary-based schemes, however, as it’s simply a contribution to a total pot of investments.

To put it into some context, if you accumulated a pot worth £300,000 by the time you retired, you would be able to buy an annuity worth roughly £15,000, or generate sustainable investment income of around 4%, or £12,000.

- Be frugal at 40 and prioritise your pension

- Don't be shy, ask ii…am I saving enough for a decent retirement?

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.